-

Details surrounding the tariffs — which could be anything from reciprocal tariffs to finally implementing delayed tariffs on Canada and Mexico and on pharmaceuticals — have remained unclear, but uncertainty has plagued the market for weeks.

April 2 -

Moody's Ratings upgraded Nebraska's issuer rating to Aaa from Aa1 on Monday. It also upgraded the state's $24 million certificates of participation to Aa1 from Aa2.

April 2 -

Nebraska Rep. Don Bacon, a Republican, has penned a "Dear Colleague" letter asking lawmakers to publicly support tax-exempt municipal bonds.

April 1 -

Legislation addressed expanding water supply, paying for flood damage, financing for capital projects, as well as a fiscal 2026 spending plan.

April 1 -

What's happening to the muni market is the "confluence of modest selling (via fund outflows and retail perhaps pausing during tax season); a heavy new issue calendar; and very thin near-term reinvestment expectations," said Matt Fabian, a partner at Municipal Market Analytics.

March 25 -

Goldman Sachs was tapped to lead a sales tax revenue bond issue to finance an arena to replace Paycom Center, home of the NBA's Thunder.

March 25 -

The governor is calling for a freeze on planned cuts to individual and corporate tax rates.

March 20 -

Mesirow's George Barbar said the group's top legislative focus is preserving the municipal bond tax exemption.

March 20 -

The U.S. Congress is considering eliminating the federal tax exemption for municipal bonds, the single most important financing tool for cities and towns across America. If they do, the cost of building and maintaining infrastructure — roads, bridges, schools, water systems, and even broadband networks — will skyrocket.

March 13

-

The Southeast has many of the largest ports and cargo airports in the country along with extensive foreign investment that creates exposure to trade turmoil.

March 13 -

A city-created corporation plans to issue bonds for the mass transit project, paid off with a voter-approved hike in the maintenance and operations property tax.

March 12 -

The BDA met last week ahead of the House Ways and Means launching talks on what the reconciliation tax package may include.

March 11 -

Muni advocates are stepping up pressure on Congress to take the elimination of municipal bond tax exemption off the menu by exploring alternatives and providing numbers showing how short term gains will become long term losses.

March 11 -

The Lone Star state, the nation's largest exporter of goods, could be hit economically by a tariff war, particularly with Mexico, its biggest trading partner.

March 11 -

Missouri lawmakers have opened a new salvo in the battle with Kansas over who gets to fund new stadiums for the Kansas City Royals and the Kansas City Chiefs.

March 5 -

The House Committee on Transportation and Infrastructure is in the early stages of hammering out a surface transportation bill designed to prop up the Highway Trust Fund while House Ways and Means tinkers with a tax deal.

March 5 -

Senate GOP leaders also aim to make the TCJA tax cuts permanent, which would raise the costs of tax reform unless a new scoring method is adopted.

March 5 -

The Bond Buyer's Caitlin Devitt and Kyle Glazier discuss the outlook for tax and infrastructure legislation.

March 4 -

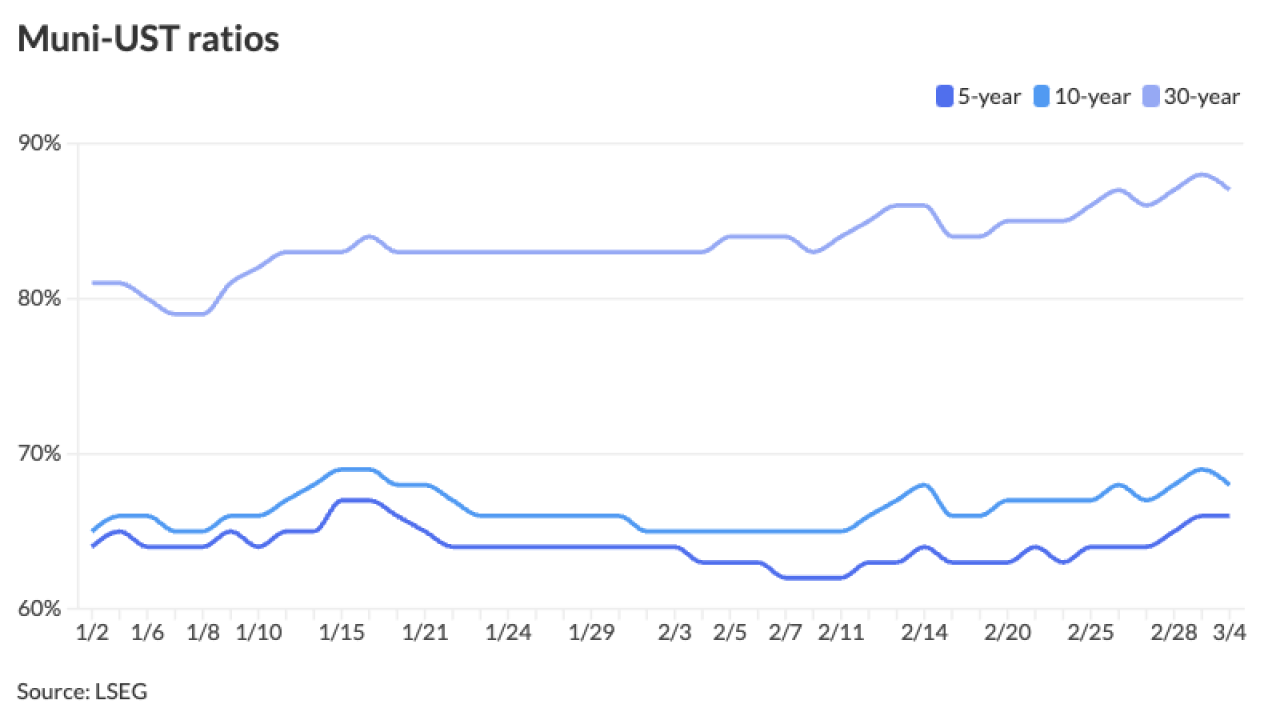

Short-end U.S. Treasuries rallied mid-morning, while UST yields were little changed out long, but ended the day weaker across most of the curve with the greatest losses out long. Munis were steady throughout the day.

March 4 -

Lobbying efforts to keep the muni tax exemption in place is boiling down to convincing select members of the House Ways and Means Committee about the value of munis in financing local infrastructure projects.

February 28