-

The BDA met last week ahead of the House Ways and Means launching talks on what the reconciliation tax package may include.

March 11 -

Muni advocates are stepping up pressure on Congress to take the elimination of municipal bond tax exemption off the menu by exploring alternatives and providing numbers showing how short term gains will become long term losses.

March 11 -

The Lone Star state, the nation's largest exporter of goods, could be hit economically by a tariff war, particularly with Mexico, its biggest trading partner.

March 11 -

Missouri lawmakers have opened a new salvo in the battle with Kansas over who gets to fund new stadiums for the Kansas City Royals and the Kansas City Chiefs.

March 5 -

The House Committee on Transportation and Infrastructure is in the early stages of hammering out a surface transportation bill designed to prop up the Highway Trust Fund while House Ways and Means tinkers with a tax deal.

March 5 -

Senate GOP leaders also aim to make the TCJA tax cuts permanent, which would raise the costs of tax reform unless a new scoring method is adopted.

March 5 -

The Bond Buyer's Caitlin Devitt and Kyle Glazier discuss the outlook for tax and infrastructure legislation.

March 4 -

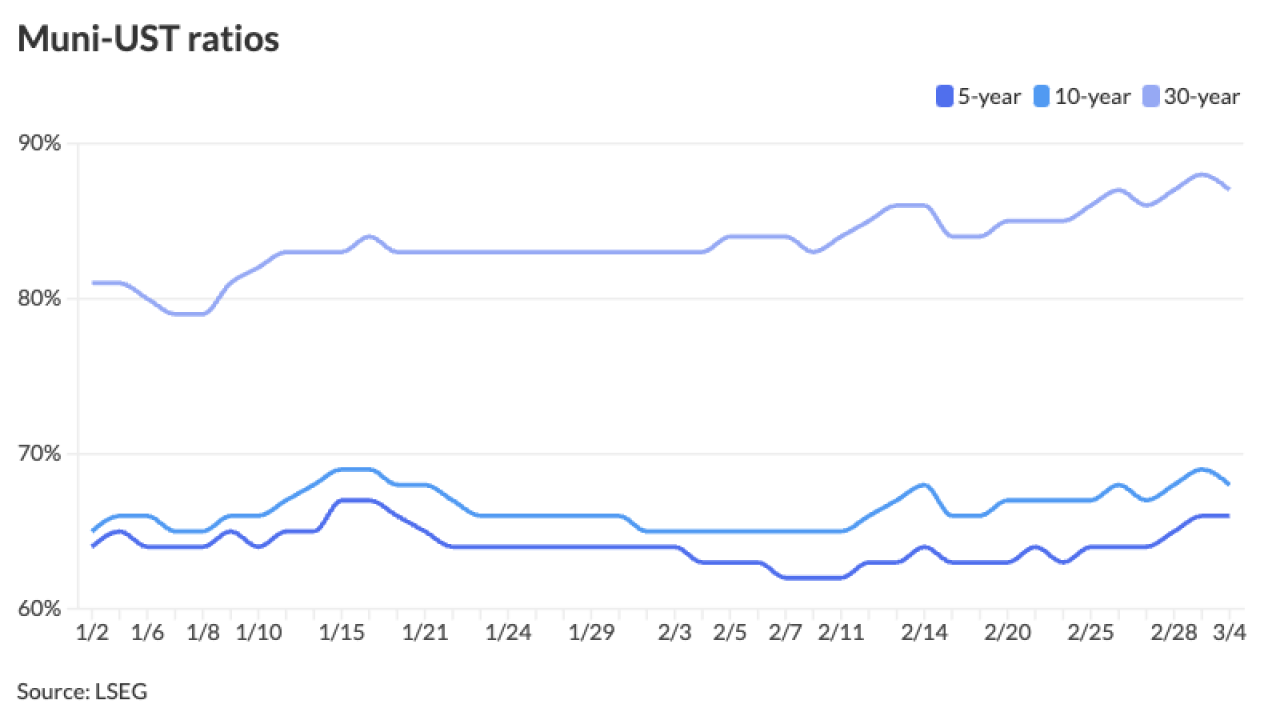

Short-end U.S. Treasuries rallied mid-morning, while UST yields were little changed out long, but ended the day weaker across most of the curve with the greatest losses out long. Munis were steady throughout the day.

March 4 -

Lobbying efforts to keep the muni tax exemption in place is boiling down to convincing select members of the House Ways and Means Committee about the value of munis in financing local infrastructure projects.

February 28 -

Legislation to continue a sales tax and revenue bond program until July 1, 2028, and allow its use for mall redevelopment projects, passed the Senate.

February 26