-

Four states in the eastern U.S. lost a legal challenge to a provision of the 2017 law that limited write-offs for state and local taxe

September 30 -

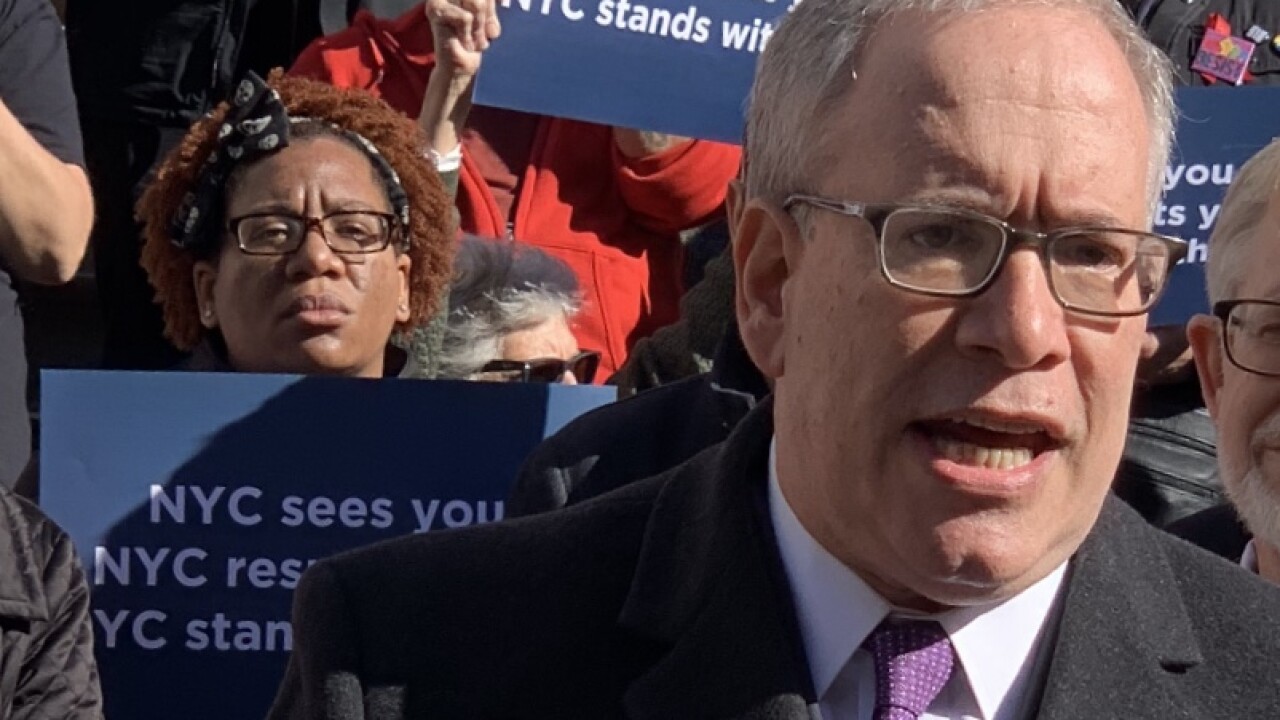

Mismanagement of real-property related taxes may be shortchanging an MTA revenue stream, said city Comptroller Scott Stringer.

September 30 -

Only Florida and Louisiana remain among the sales tax states that have not enacted laws to require remote collection to reap the benefit of the June 2018 Supreme Court ruling in Wayfair v. South Dakota.

September 26 -

Bank holdings in municipal securities continue to decline, as retail investors and mutual funds increase their holdings.

September 20 -

The Greater Orlando Aviation Authority will issue senior-lien bonds with a Green Evaluation from S&P Global Ratings.

September 18 -

Two incentive programs expired on July 1, and Gov. Phil Murphy vetoed a bill to extend them unchanged.

September 13 -

Oklahoma’s economic expansion appears to be slowing, state Treasurer Randy McDaniel said.

September 10 -

Thirty seven states and the District of Columbia now have laws requiring remote sales tax collection, according to the National Conference of State Legislatures.

August 30 -

Close proximity and presence in small states allows Josh Larson to "kick the tires" when analyzing new and existing credits

August 29 -

As health risks associated with e-cigarettes have gained attention, some states are trying to deter minors from the product through taxation.

August 26 -

The evolution of muni advocacy has been in progression for years, though it was further galvanized by the shock and dismay at the 2017 tax reform.

August 13 -

The latest report from the state comptroller says $876.8 million was distributed to cities, counties, transit systems and special purpose taxing districts.

August 8 -

U.S. stocks dropped like a stone in response as Treasuries strengthened in a flight-to-quality bid.

August 5 -

With its population and economy growing, Texas marked its 21st straight monthly record for sales tax collection.

August 5 -

It is time for more creative thinking about finding more solutions to fund improvements for the city instead of political squabbles.

August 5John Hallacy Consulting LLC -

The ruling on tax assessments orders Philadelphia to repay $48 million, with $34 million coming from the school district.

July 22 -

Fitch Ratings has developed two indices tracking LGIPs.

July 18 -

The lawsuits were filed a day after 11 Democrats in the Senate and a bipartisan group of 47 House lawmakers announced a long-shot effort to repeal the regulation using the Congressional Review Act.

July 17 -

The IRS regulation is targeted at ending workarounds by state and local governments that have been enacted since the cap was included in the 2017 Tax Cuts and Jobs Act.

July 16 -

Austin is telling investors that a $319 million airport bond sale is critical to meeting growing demand for service.

July 15