-

The Hawaii Supreme Court will hear arguments that the state is taking too much of Oahu's rail transit tax.

July 6 -

New York lawmakers approved a three-year extension of counties' authority to levy local sales tax.

June 29 -

Mayors and governors are concerned about potential strains on their finances from legislation being drafted without input from Democrats.

June 29 -

Illinois House Democrats laid out a $36.5 billion fiscal 2018 spending plan.

June 28 -

Rep. Dan Donovan of Staten Island initiated a letter to Treasury Secretary Steven Mnuchin.

June 27 -

Cities and states are embracing growth in the sharing economy by reaching agreements on collection of occupancy taxes.

June 27 -

New York municipalities may see a lapse in tax collections absent new legislation, according to Fitch Ratings.

June 26 -

When Placer County, Calif., tried to raise sales taxes last fall for freeway expansions in the booming suburbs of Roseville and Rocklin, voters in the more rural parts of the county defeated the measure.

June 21 -

Ryan’s speech is his first major public effort to keep tax reform on track for enactment by year-end.

June 20 -

Chicago enters the market with $825 million of new money and refunding O'Hare airport revenue bonds.

June 19 -

Some Republican lawmakers advocate a shorter August recess for Congress.

June 19 -

Senate Finance Committee wants tax reform ideas by July 17.

June 16 -

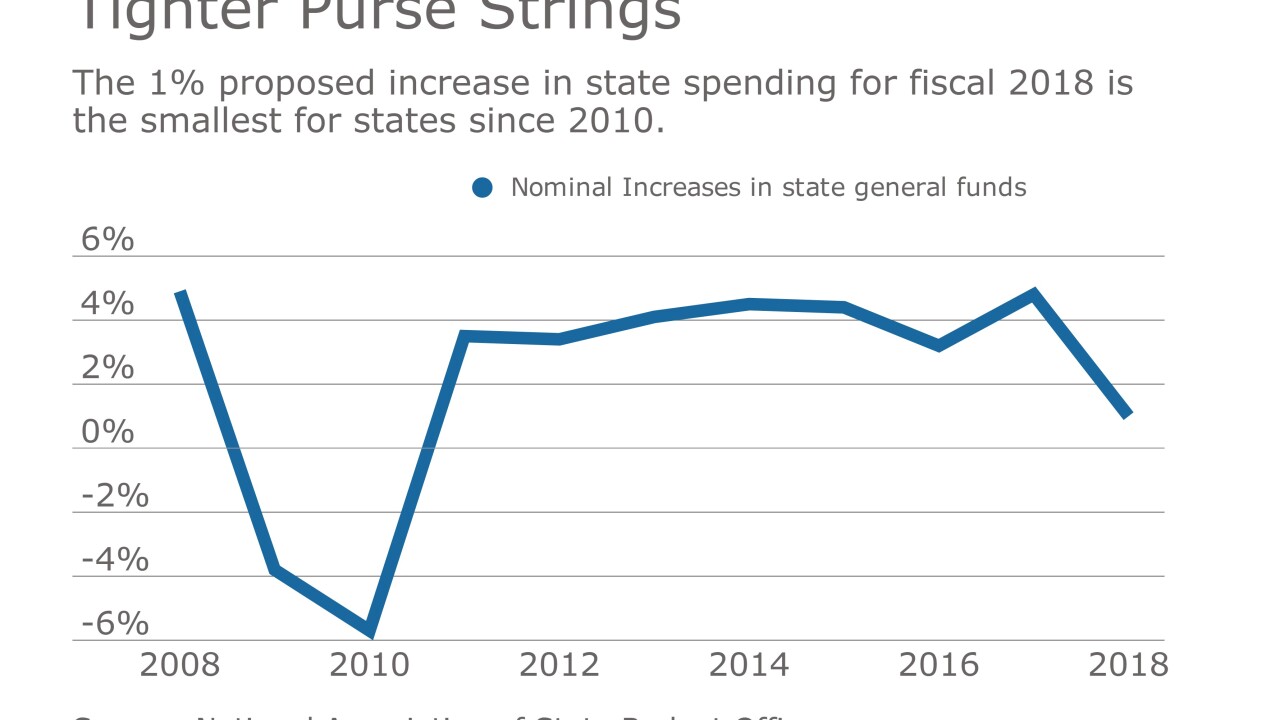

NASBO survey finds states have proposed the smallest increase in spending since fiscal 2010.

June 15 -

San Diego's mayor vetoed changes the City Council made to the budget that cut funding for two special elections.

June 12 -

A California hearing contemplated major changes to a tax board's structure.

June 8 -

Kansas lawmakers defied Gov. Sam Brownback by overriding his veto of a tax increase bill.

June 7 -

Kansas Gov. Sam Brownback vowed to veto a tax increase.

June 6 -

National Economic Council Director Gary Cohn announced the target date for releasing a tax reform plan

June 5 -

Municipal market participants should not make the mistake of focusing only on the muni exemption in tax reform plans.

June 1 -

Increasing military funding at the expense of domestic programs is likely to have a profound impact on our sovereign nation.

May 26John Hallacy Consulting LLC