-

A rule change allowing non-profits to cash in green energy credits presents both opportunities and challenges.

November 4 -

Detroit, which has several climate-friendly projects in the pipeline, is seeking a tax advisor to help navigate snag tax credits in the Inflation Reduction Act.

March 7 -

There are a variety of reasons more finance officers aren't talking about potntially game-changing tax credits.

February 16 City of Detroit

City of Detroit -

Cities and states are eligible to apply for the program, which gives eligible solar and wind facilities in low-income areas increased investment tax credits of 10% or 20%.

December 5 -

Changes to the direct-pay system provides opportunities for nonprofits to cash in tax credits

June 28 -

The IRS has published its final regulations on e-filing of Form 8038-CP and will require electronic filings beginning with returns filed after Dec. 31, 2023.

February 27 -

If the IRA's tax credits prove popular for building clean energy projects, they may be expanded into basic infrastructure financing, said University of Chicago professor Justin Marlowe.

October 20 -

Fitch said it expects the law will spur more public power borrowing for clean energy facilities.

August 30 -

Lawmakers and advocates of U.S. tax credits like tax-exempt debt aren't getting many answers from Treasury about an impending global tax regime that diminishes the value of the tax tools.

May 6 -

The city has received a notice from the IRS seeking evidence bond proceeds were used on the construction, rehabilitation or repair of public school buildings.

April 28 -

KeyBanc Capital Markets priced tax-exempt bonds that will fund more than 300 units in Clayton County, Georgia, with the help of a Fannie Mae finance program.

September 29 -

The agreement over middle-class tax relief could set the stage for passage of the fiscal 2022 budget.

June 22 -

Advance refunding, direct-pay bonds, and increased limits on bank-qualified bonds would be among the muni-friendly tax provisions that have a good chance of becoming law if Democrats control both chambers of Congress.

October 8 -

A new tax credit, a grand jury report, national election-year politics and regional bickering have revived debate over natural gas drilling.

July 31 -

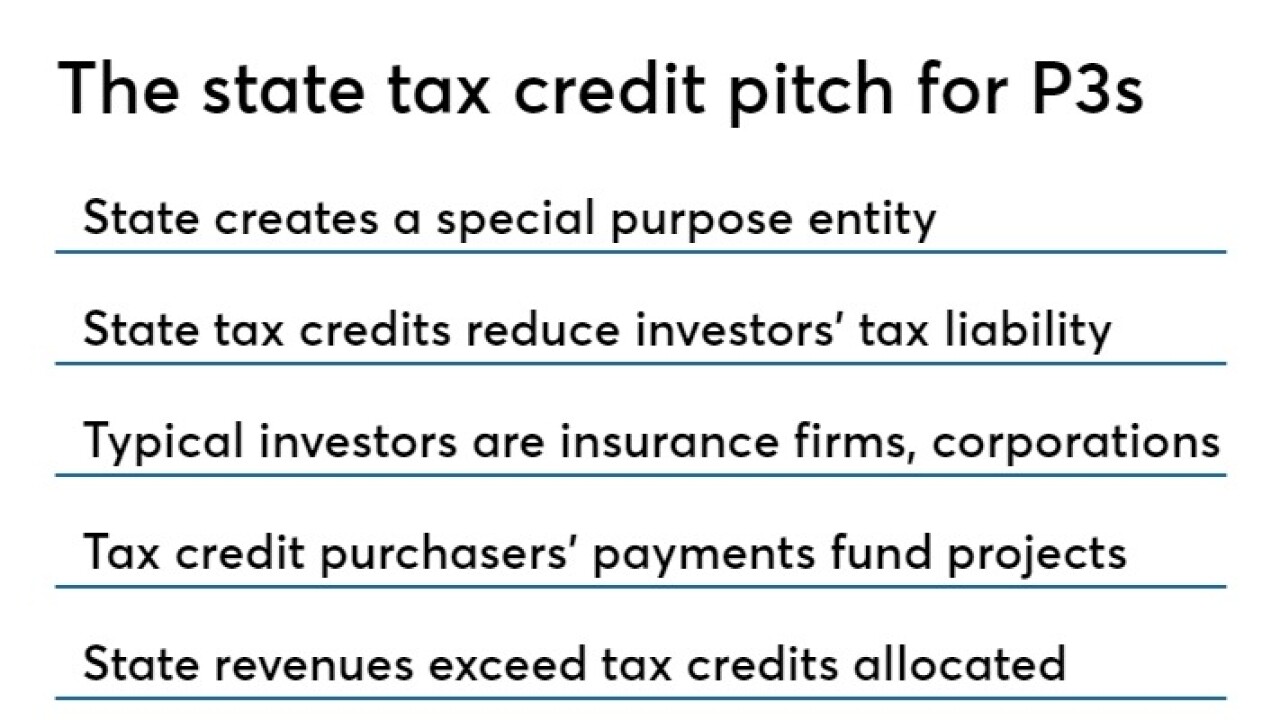

NDH founder Scott Haber told Louisiana officials that state tax credits can provide seed funding for public-private partnership projects.

November 13 -

It is time for more creative thinking about finding more solutions to fund improvements for the city instead of political squabbles.

August 5John Hallacy Consulting LLC -

The lawsuits were filed a day after 11 Democrats in the Senate and a bipartisan group of 47 House lawmakers announced a long-shot effort to repeal the regulation using the Congressional Review Act.

July 17 -

Issuers of the Clean Energy Bonds would have the option of offering the bond as a tax credit bond, or as a direct-pay bond, where the Treasury Department reimburses the bond issuer at a rate of up to 70% of the interest cost, according to a summary of the bill.

May 3 -

The firm is expanding its bond counsel practice in Virginia and the Southeast.

July 10 -

Historic redevelopment projects that were on life-support are moving forward after historic tax credits were retained in a rewrite of the federal tax code.

March 26