-

Build America Mutual insured the majority of the maturities in the West Contra Costa Unified School District GO deal.

October 25 -

More project finance deals are part of FHN Financial's plans to grow its municipal finance business.

October 23 -

As technology options grow, firms are looking for ways to streamline and scale workflows.

October 22 -

Christopher Roberts joins the firm as a managing director, Joey Dierker as an associate director, Soledad Mancias as a municipal underwriter, and Steve Basset as a director.

October 21 -

Conference sponsorships targeting bond firms led Mayor John Whitmire to call for a probe into actions by Controller Chris Hollins, who denied any wrongdoing.

October 18 -

Supply ramps up this week to an estimated $13.361 billion, with several billion-dollar pricings on tap.

October 15 -

Florida will use its own cash, not from a refunding bond, to buy up to $500 million of bonds tendered.

October 15 -

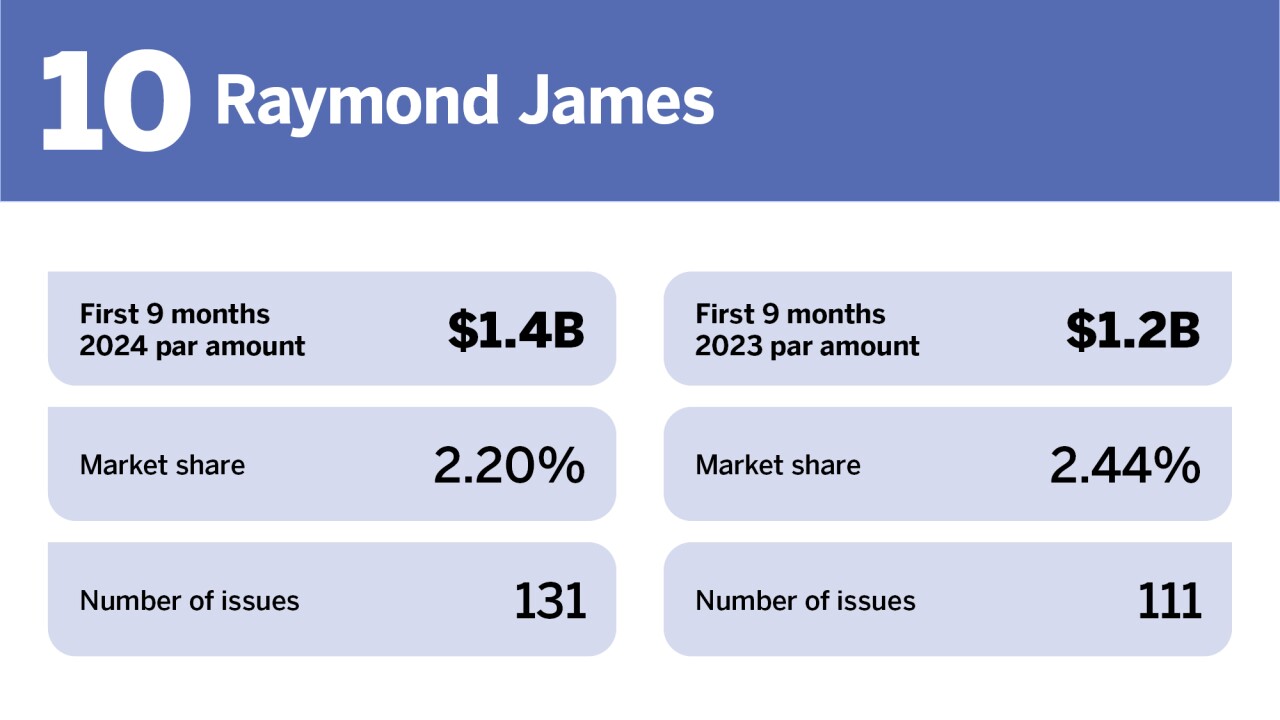

As the underwriter landscape changes, so does the competitive market.

October 15 -

City Comptroller Brad Lander said he's optimistic about the deal, congestion pricing lawsuits and his mayoral campaign.

October 7 -

Enright's passion for infrastructure and complicated deals led him to the cutting edge of municipal financing strategies.

October 4 -

As managing director at Crews & Associates, Susan Reed aims to bring creative ideas and a deep well of experience to bear on challenges facing Indiana issuers.

October 1 -

With supply ballooning, reinvestment dollars at lows of the year, J.P. Morgan's Peter DeGroot argues the next few weeks could offer the best opportunity to buy bonds of the year – and possibly the rate cycle. DeGroot talks about this, plus potential impacts of shifting investor behavior on market liquidity, and what the upcoming election might mean for tax policy and the muni market. Lynne Funk hosts.

October 1 -

Disruption was on the minds of those gathered in Chicago last week for MuniTech, a conference billed as a magnet for the "tech-forward" in public finance.

October 1 -

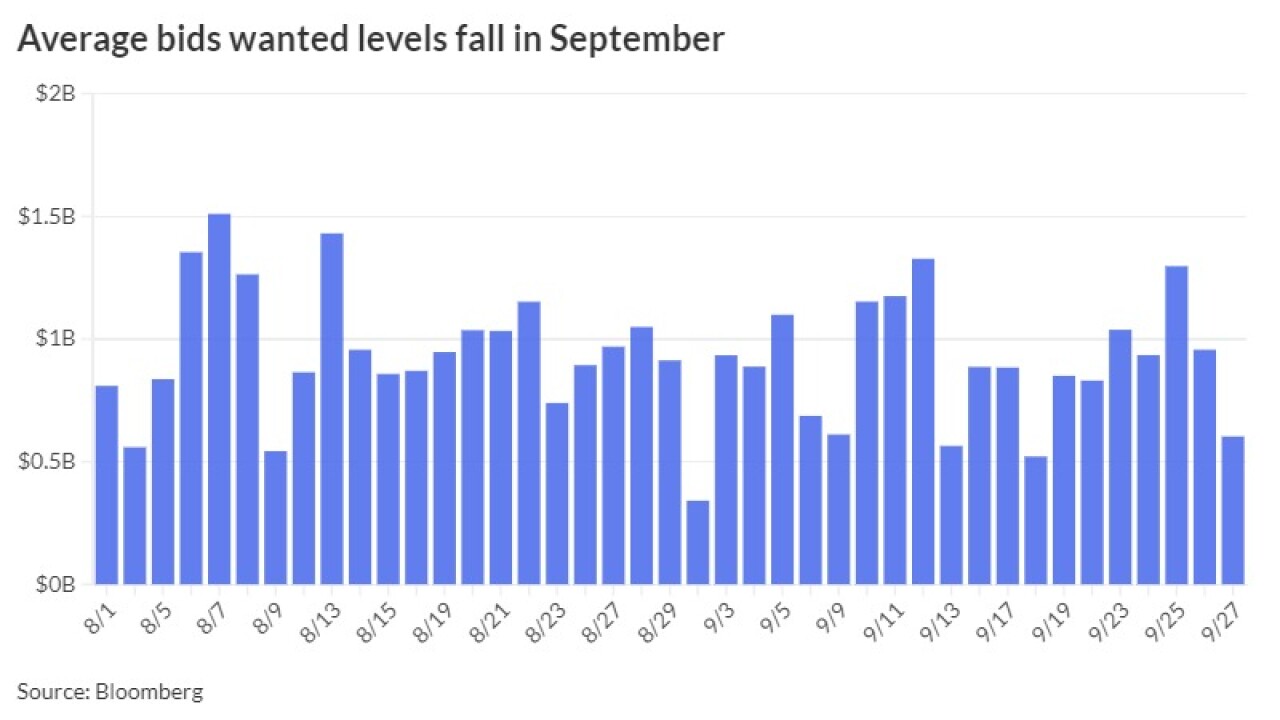

"As September draws to a close, some dynamics may prevail in October but others could undergo a shift," said NewSquare Capital's Kim Olsan. "One aspect that will continue is the level of supply coming to market."

September 30 -

Municipal triple-A yield curves closed out the week with few changes, valuations were little changed, but at attractive levels, and the forward calendar climbs to more than $10 billion to open the fourth quarter.

September 27 -

Ramirez & Co. continues growth plans with the addition of bankers in Texas, Florida and New York.

September 27 -

Matthew McQueen, Head of Municipal Banking and Markets and Global Mortgages within the Global Markets business at Bank of America, sits down with Bond Buyer Executive Editor Lynne Funk to talk about getting deals done amid an uncertain global macroeconomic landscape.

-

The Investment Company Institute reported $1.329 billion of inflows into municipal bond mutual funds for the week ending Sept. 18 after $1.402 billion of inflows the week prior. Exchange-traded funds saw $55 million of inflows after $1.048 billion of inflows the previous week.

September 25 -

This collaboration allows users with a DPC Data subscription to access content directly within BondWave's Effi, providing Effi users with more information for all municipal bond positions in their portfolio.

September 24 -

NYPA's green designation and two credit upgrades are drawing lots of attention in a crowded market.

September 24