-

The deal comes amid market inflows and a dearth of high-yield supply, but demand will depend, as always, on the price, investors said.

April 9 -

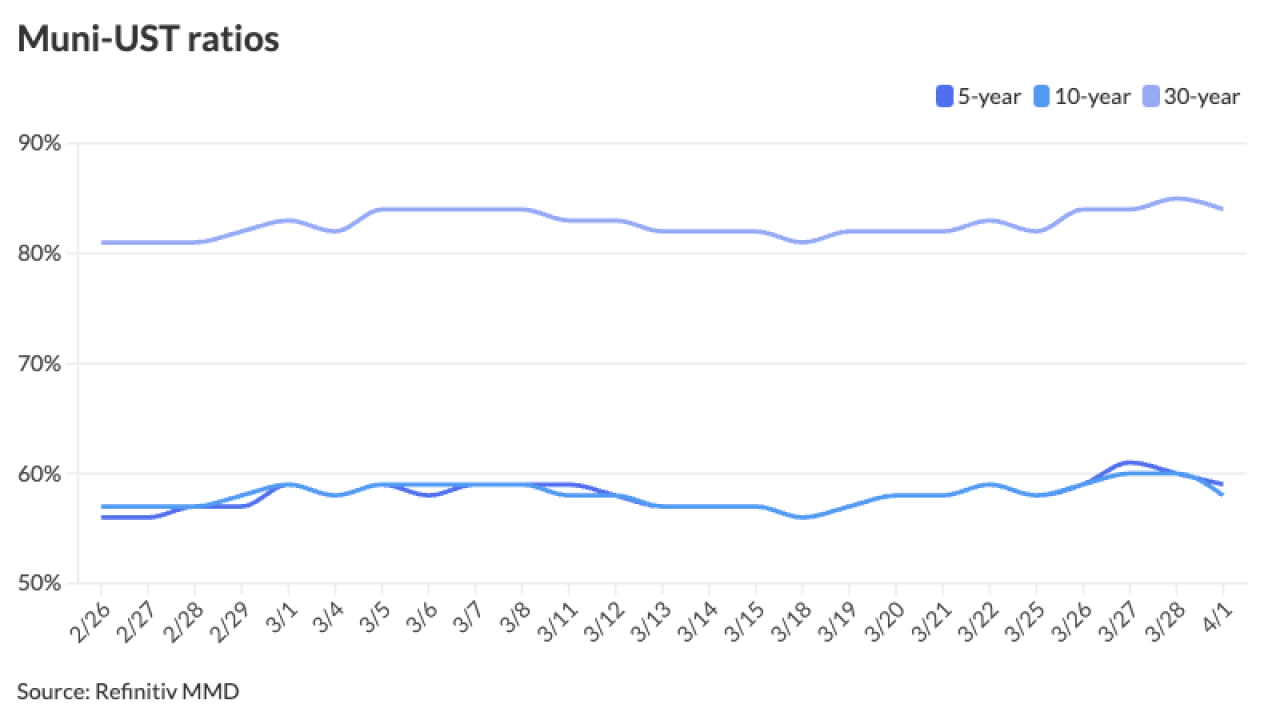

Muni to UST ratios also continue to rise across the curve, inching closer to more normal averages.

April 8 -

As another economic indicator pushed investors closer toward the assumption that rate cuts are farther away, the relationship between munis, USTs and the vast amount of capital sitting on the sidelines becomes more challenging to navigate, particularly ahead of the tax-filing deadline and growing new-issue calendar.

April 5 -

Some buying returned to the market Thursday from the buy-side and asset managers as dealers attempted to sell bonds, said Chris Brigati, senior vice president and director of strategic planning and fixed income research at SWBC.

April 4 -

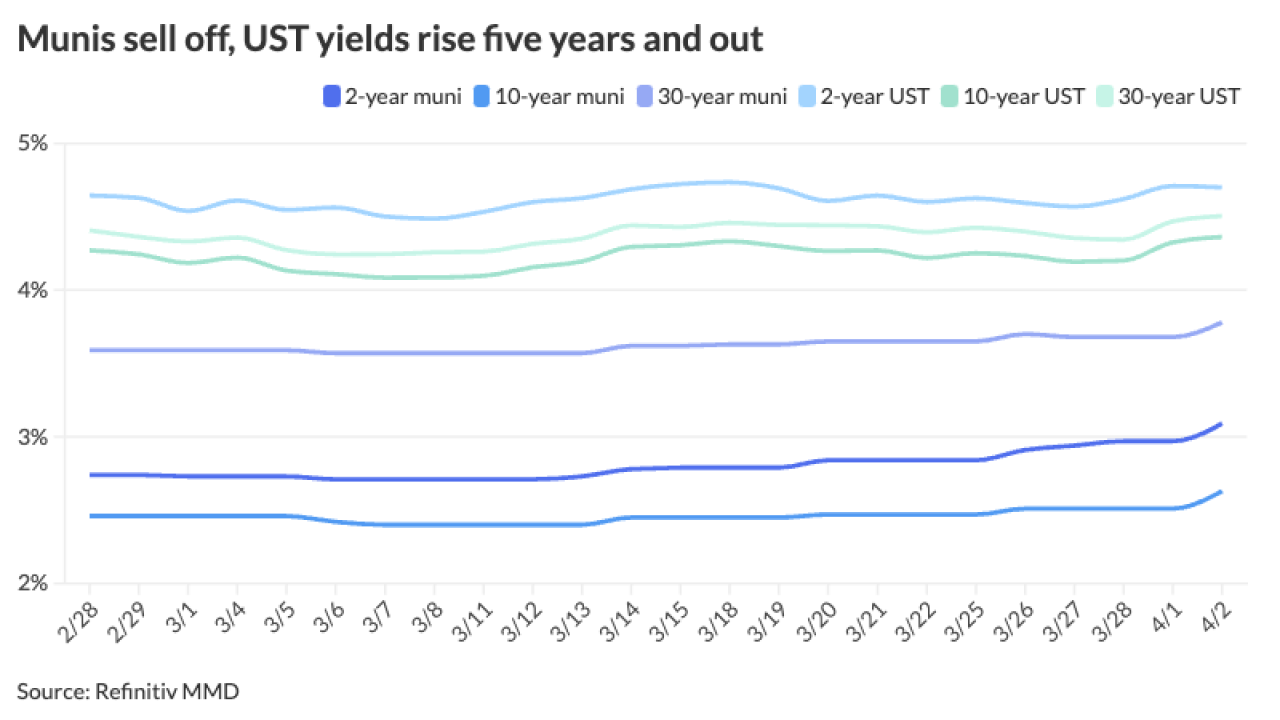

"Most spots on the muni AAA HG curve are at or near year-to-date highs, and the muni HG curve showed significant underperformance across the curve in March, relative to the broader fixed income market, after sizable muni outperformance in February," said J.P. Morgan strategists.

April 3 -

Before Tuesday's selloff, muni yields have been rising over the last several weeks due to "outsized" new-issue supply, said Anders S. Persson, Nuveen's chief investment officer for global fixed income, and Daniel J. Close, Nuveen's head of municipals.

April 2 -

John Hallacy of John Hallacy Consulting and Rich Ciccarone, president emeritus of Merritt Research Services, talk with Chip Barnett about the municipal bond business over the past 40 years. They take a look back at where the industry has been, where it is and where it will be going.

April 2 -

The uptick in supply amid tax season has led to a short-end correction and higher muni to UST short ratios, but the levels are still rather rich from a historical perspective.

April 1 -

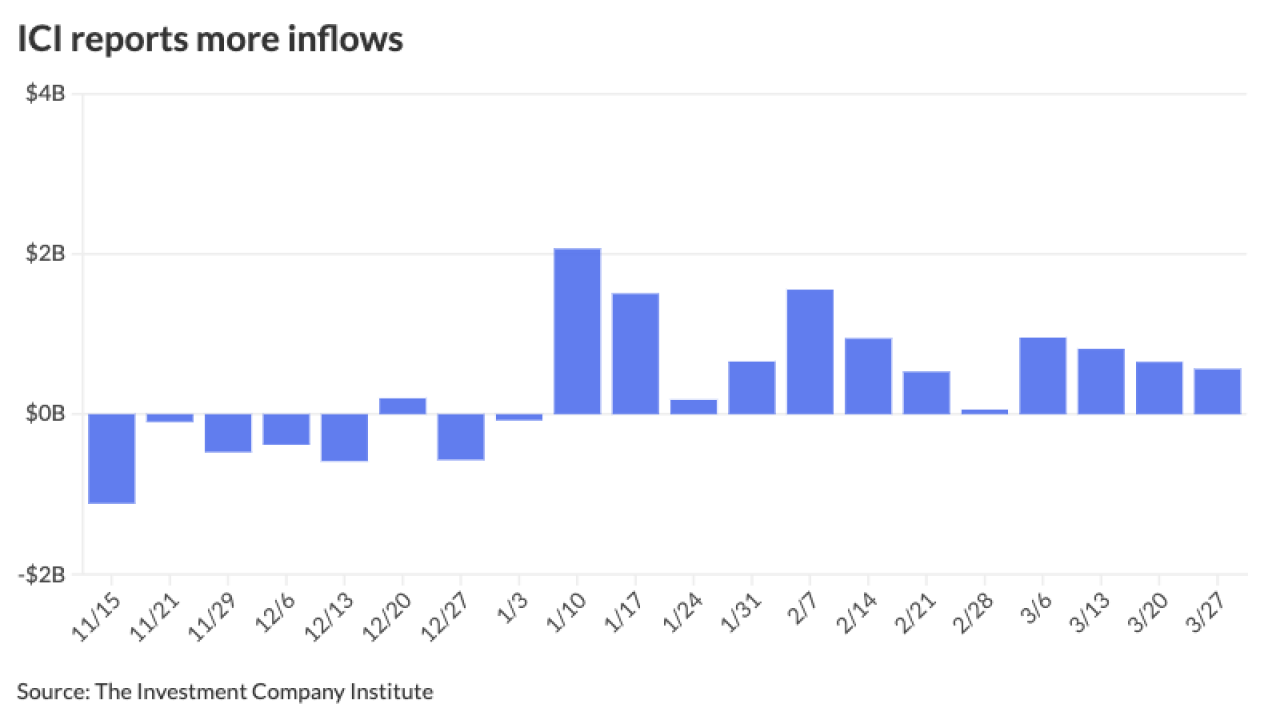

LSEG Lipper reported fund inflows of $447 million while high-yield muni bond funds saw another round of inflows at $246 million, marking the 12th consecutive week of positive flows in that space.

March 28 -

Most of the selling during tax season happens on the front end of the curve, said Wesly Pate, senior portfolio manager at Income Research + Management.

March 28 -

Absolute yields "remain attractive in the context of the trading range over the past three years and our longer-term projections for lower rates this year," according to J.P. Morgan strategists.

March 27 -

The onslaught of new-issuance and approaching month- and quarter-end led triple-A yields to rise up to seven basis points on the short end and as much as three to five elsewhere along the curve, despite stronger U.S. Treasuries. Short ratios rose as a result.

March 26 -

This week's new-issue calendar grows and includes some "common benchmark names like CA GO, NYC GO, and WA GO," Birch Creek strategists said.

March 25 -

The calendar is led by several high-profile deals, including $2.7 billion of GOs from California, $1.5 billion from New York City and $1.1 billion from Washington. High-yield gets another dose of unrated project finance debt from Miami Worldcenter Project tax increment revenue bonds. The Bond Buyer 30-day visible supply sits at $12.06 billion.

March 22 -

Hallam will handle high-yield muni sales and trading, focusing on large institutional accounts at the firm.

March 22 -

LSEG Lipper reported fund inflows of $63.8 million for the week ending Wednesday following $300.5 million of inflows the prior week. High-yield saw its 11th consecutive week of inflows at $180.4 million, down from $278.6 million the week prior.

March 21 -

The extraordinary redemptions being used to call Build America Bonds "are based on a creative but flawed legal argument driven by the current change in interest rates," said Kramer Levin partner Amy Caton.

March 21 -

Citi's exit comes amid the larger trend of broker-dealers downsizing balance sheets, which can hurt secondary market liquidity, particularly in times of stress. Other market players are coming into the fold.

March 21 -

"The balance of March may continue to be better-than-expected, particularly given existing demand and decent reinvestment needs over the next 30 days," according to Oppenheimer's Jeff Lipton.

March 20 -

Despite several larger deals entering the primary, the vast amount of cash on hand has not allowed munis to cheapen amid UST volatility and ultra-rich ratios

March 19