-

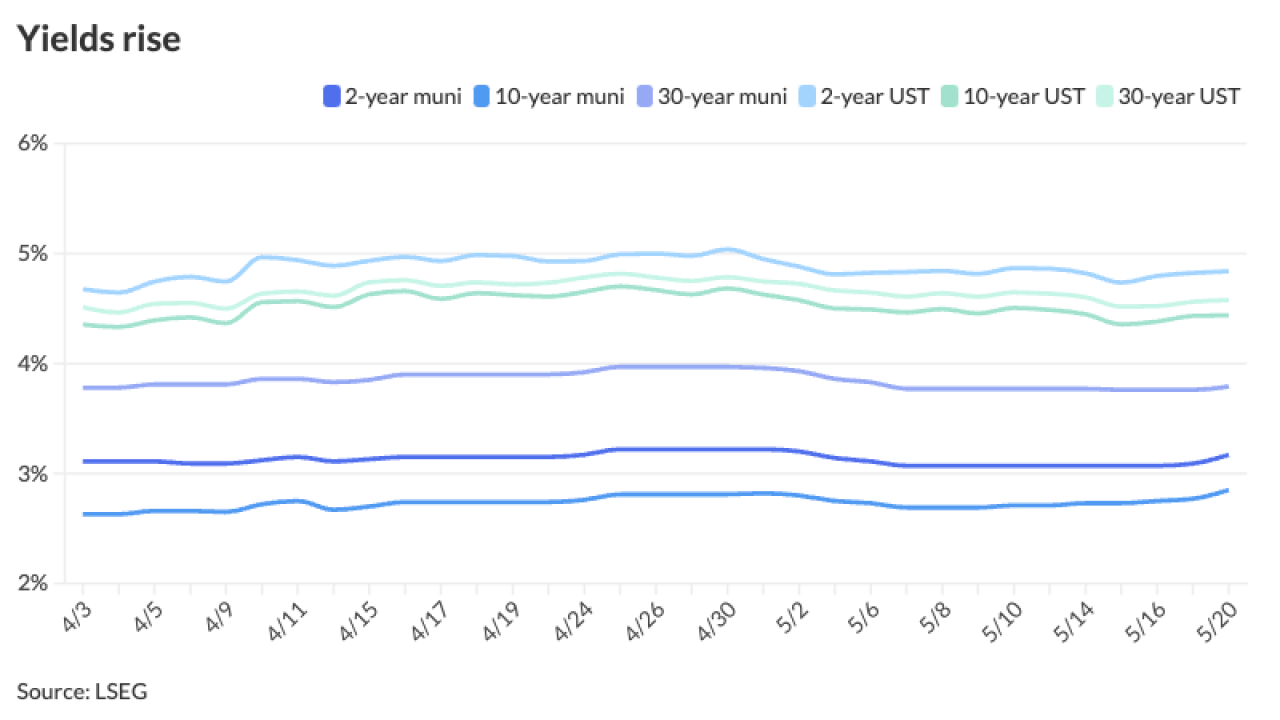

"For each May dating to 2021, the average 30-year MMD was 2.74% — or 122 basis points below the current yield," FHN Financial's Kim Olsan said. "The recent adjustment offers better investor value."

May 24 -

Municipal bond mutual funds saw the second week of outflows as investors pulled $217.6 million from the funds after $546.2 million of outflows the week prior, according to LSEG Lipper. High-yield saw inflows again.

May 23 -

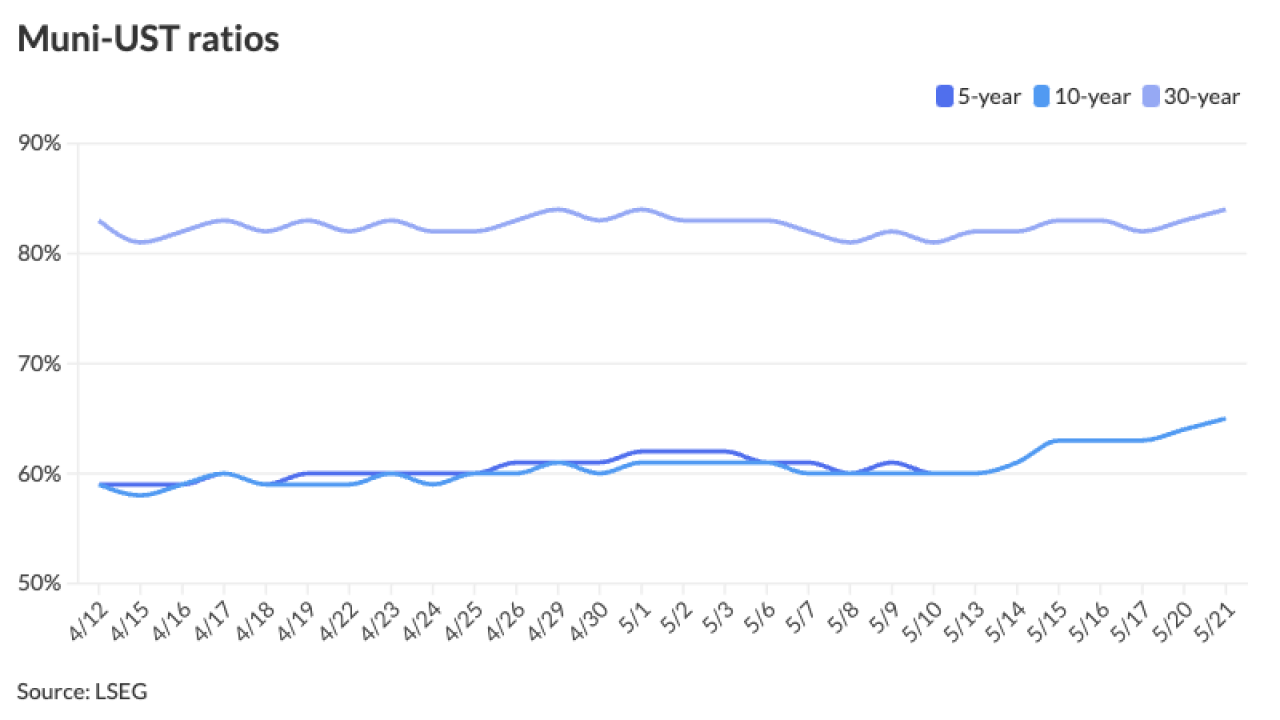

The ongoing influx of new-issue supply has pushed muni-UST ratios to at or near year-to-date highs, J.P. Morgan strategists said.

May 22 -

Several weeks of elevated supply should theoretically be "weighing more on performance, but the market is now just ahead of its largest reinvestment season, which so far in 2024 has become even more pronounced, with an additional $19.5 billion scheduled for call/redemption between [June 1 and August 30]," said Matt Fabian, a partner at Municipal Market Analytics.

May 21 -

"While we acknowledge that the market tone is weaker [Monday], we are generally constructive regarding valuations and expect this week's supply to be absorbed fairly well after last week's giveback of the richening witnessed over prior weeks," said Vikram Rai, head of municipal markets strategy at Wells Fargo.

May 20 -

"The industry is built on relationships, and it's powered by technology," said Josh Rosenblum, head of algorithmic trading at Brownstone.

May 20 -

There are nearly 30 new-issues over $100 million on tap across the credit spectrum, led by the week's largest negotiated deal from Harris County, Texas, with $950 million of toll road first lien revenue and refunding bonds. The competitive calendar ticks up with several high-grade names.

May 17 -

"In terms of credit quality, high-yield funds proved resilient" while investment-grade funds saw outflows of $673 million, noted J.P. Morgan's Peter DeGroot in a market note.

May 16 -

The CPI print keeps the possibility of the Fed cutting rates at least once this year, potentially at least two rate cuts if the data continues to point to a trend of inflation falling further, said Jeff Lipton, a research analyst and market strategist.

May 15 -

This week's issuance is above the 2024's year-to-date weekly average of $7.6 billion, said Chris Brigati, senior vice president and director of strategic planning and fixed income research at SWBC.

May 14