-

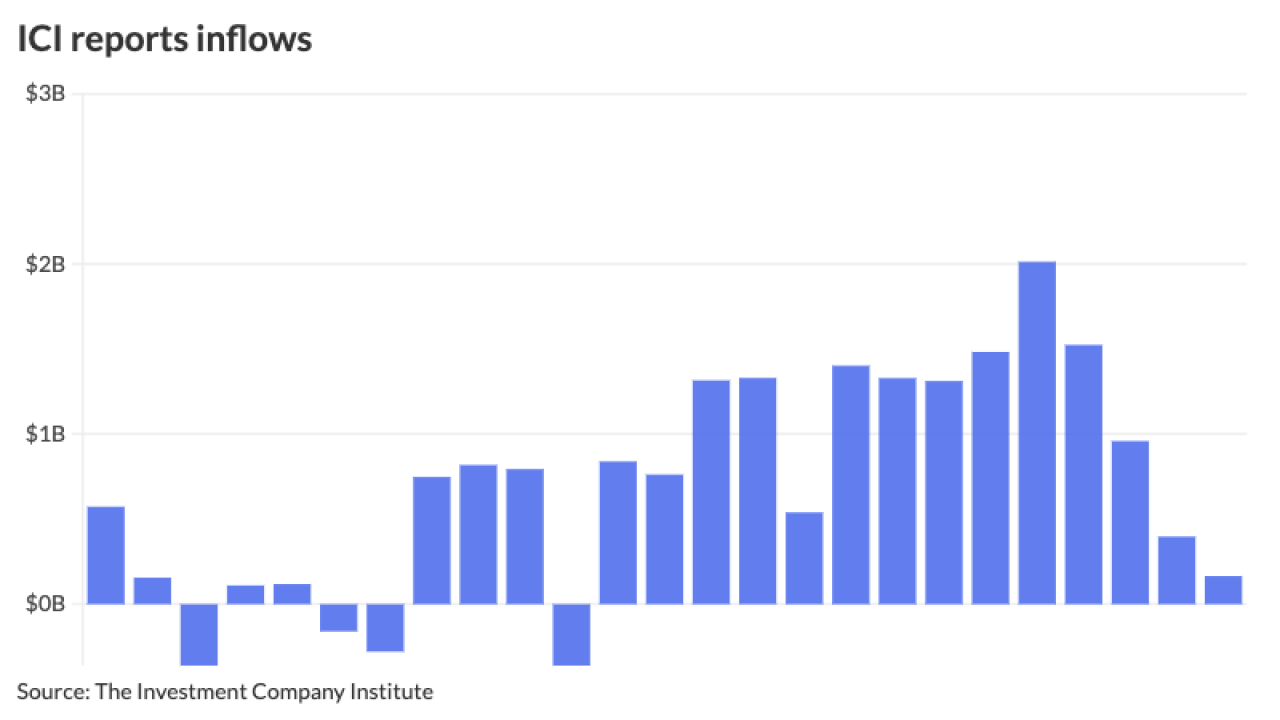

The Investment Company Institute reported $1.221 billion of inflows into municipal bond mutual funds for the week ending Nov. 20. Exchange-traded funds saw inflows of $836 million.

November 27 -

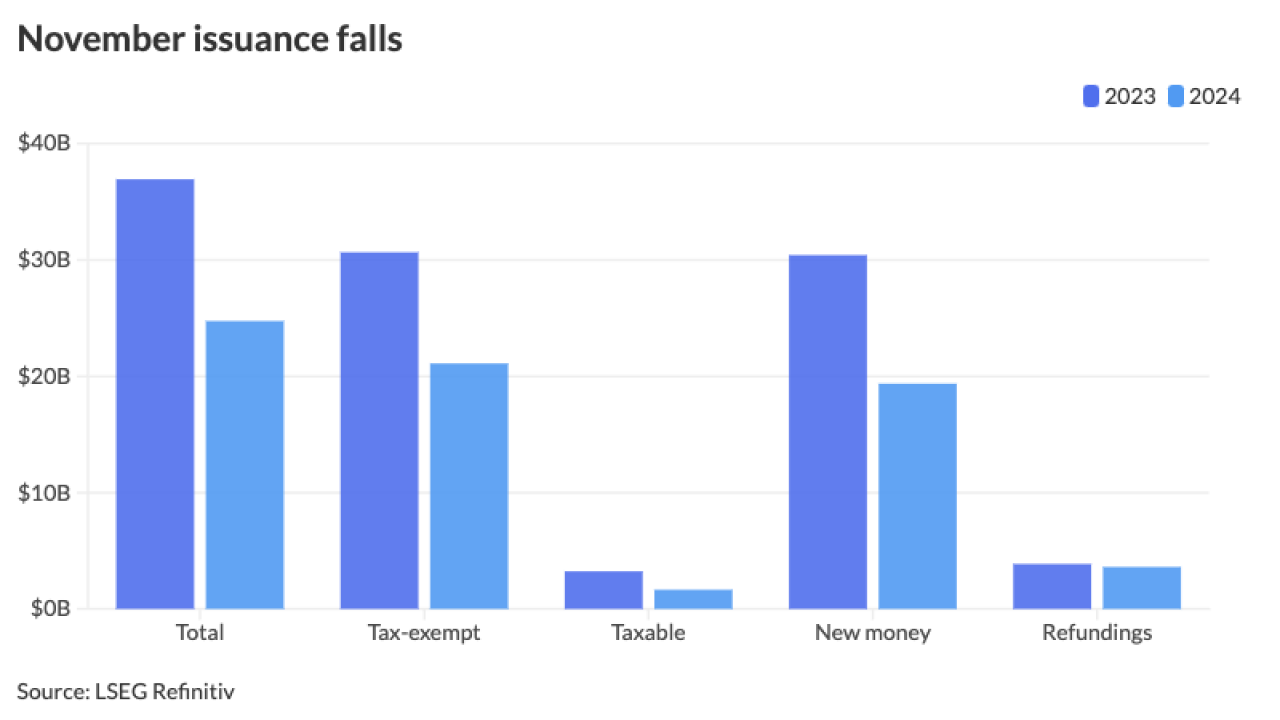

November's total is below the 10-year average of $32.278 billion and is the lowest monthly total this year. The year's total is about $25 billion short of $500 billion.

November 27 -

"Earlier this month, Chair [Jerome] Powell noted that there was no 'hurry' to cut rates," noted BMO Senior Economist Priscilla Thiagamoorthy. The minutes, she noted, "confirm a broad support for taking a more cautious approach in easing monetary policy."

November 26 -

Markets could see that "the risks of higher inflation and interest rates are implicit constraints on the Trump policy agenda, with the eventual policy outcomes potentially less inflationary than some investors previously feared," UBS strategists noted.

November 25 -

Supply has "declined materially, allowing dealers to take a breather, with their inventories dropping significantly, while retail investors do not seem to be spooked by rate volatility, lower taxes and possible threats to the tax-exempts, and continued putting money into tax-exempts at a brisk pace," said Mikhail Foux, managing director and head municipal research and strategy at Barclays.

November 22 -

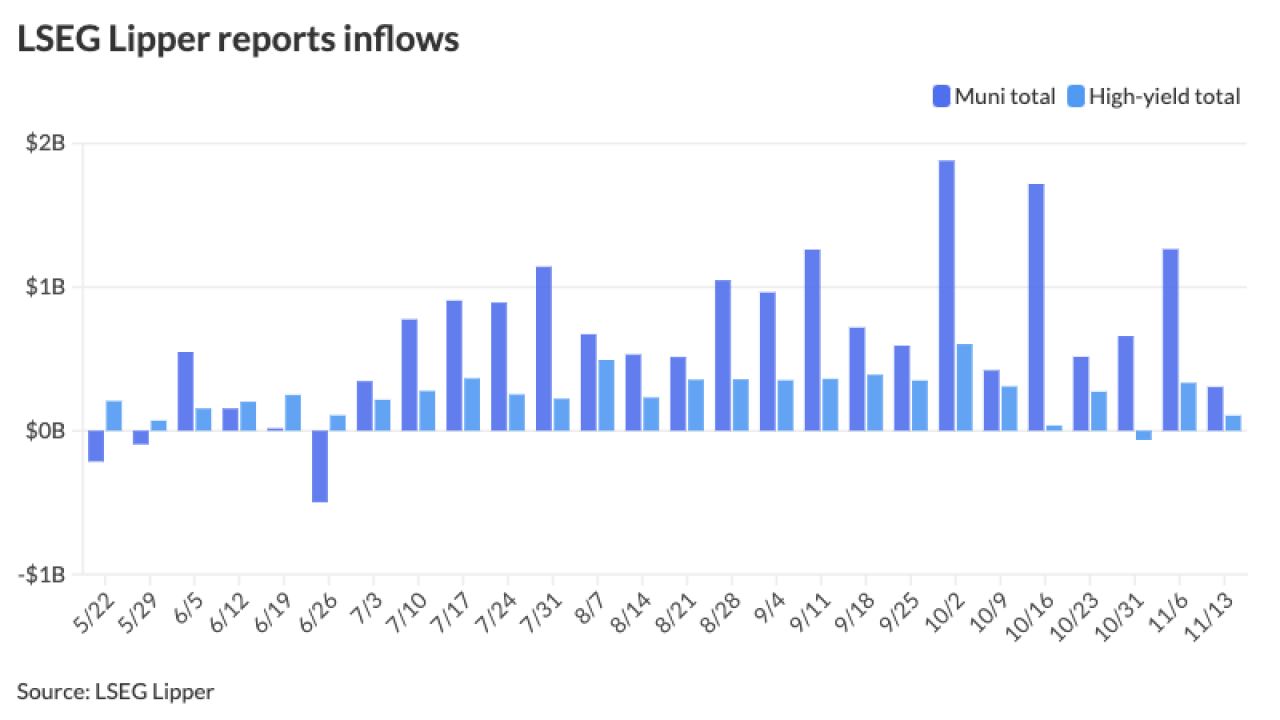

High-yield funds saw $608.9 million of inflows compared with inflows of $150.3 million the week prior.

November 21 -

"Volatility creates all kinds of opportunities in the municipal space, not just for tax-loss harvesting, but for positioning and parts of the yield curve that might be undervalued or certain sectors or states that are poised to perform well going into yearend," said Tim McGregor, a managing partner at Riverbend Capital Advisors.

November 21 -

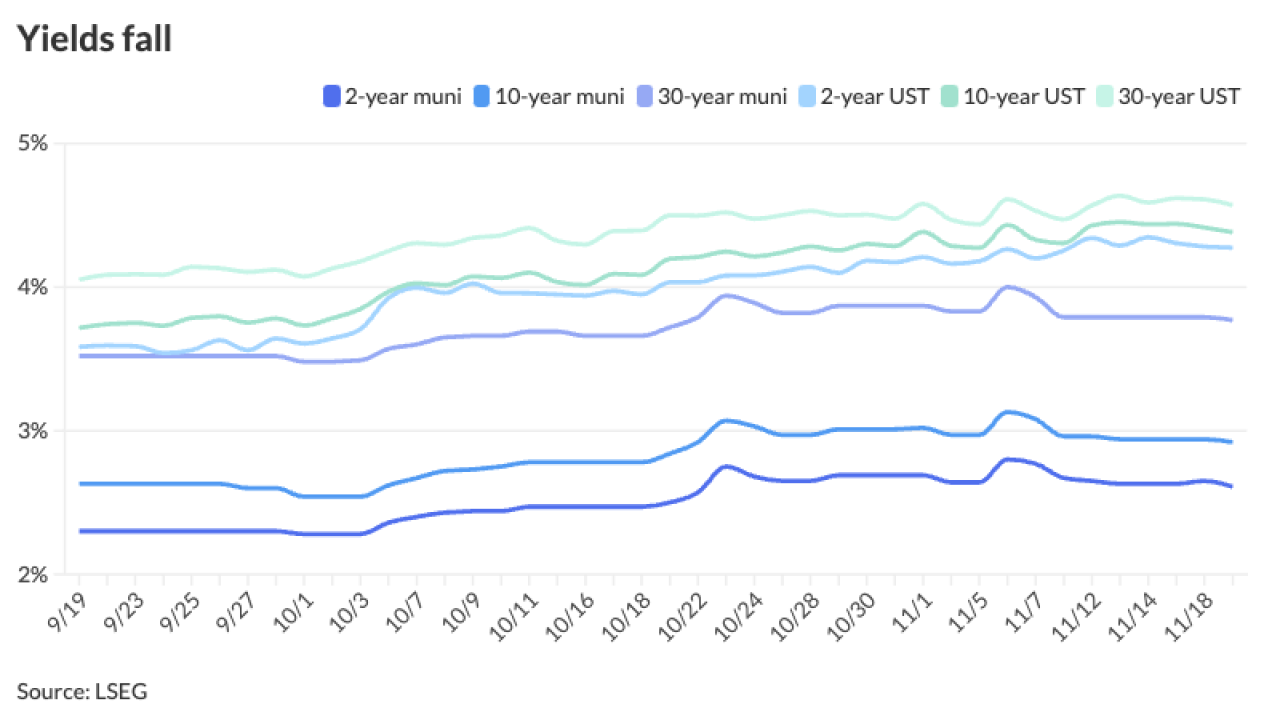

Municipals are outperforming USTs to a large degree this month, with investment grade munis seeing positive 0.81% returns in November and 1.63% year-to-date. USTs are in the red at -0.40% in November with only 0.96% positive returns in 2024.

November 20 -

"This year, with the tax-exemption clearly threatened, primary calendars should (although, of course, might not) be larger, putting a $500 billion full-year supply total in range, with $451 billion already in the books through 46 weeks," said MMA's Matt Fabian.

November 19 -

Houston is set to price Tuesday $1 billion of United Airlines Terminal Improvement Projects AMT revenue bonds while the Public Finance Authority will bring $125 million of non-rated Million Air Three General Aviation Facilities Project revenue bonds.

November 18 -

As headline risk swirls around the Fed and the transition to the Trump administration, municipals have largely stayed in their own lane. November finds the municipal market "in far better technical shape, with an attractive backdrop through at least year-end," J.P. Morgan's Peter DeGroot said.

November 15 -

This month is experiencing similar volatility as 2016 when generic yields traded higher by 50 to 70 basis points during November of that year, said Kim Olsan, a senior fixed income portfolio manager at NewSquare Capital.

November 14 -

Market reaction to inflation numbers was "tempered," said Richard Flax, chief investment officer at Moneyfarm. But should inflationary pressures hold in 2025, "markets may anticipate that further rate cuts could be limited in scope, suggesting a more cautious investment outlook."

November 13 -

Municipals ignored USTs losses, leading to lower muni to UST ratios and adding to the better performance across the curve and credit spectrum.

November 12 -

The focus: municipal advisors — part of your regulatory responsibilities and duties (if you don't agree to evaluate pricing and/or structure, you must expressly disclose it to the client) and broker-dealers (fair dealing).

November 11 SOLVE

SOLVE -

Tax-exempt money market funds reached a 2024 high of assets under management at $136.84 billion for the week ending Wednesday, according to the Investment Company Institute.

November 11 -

"A sharply lower new-issuance calendar, peak yields, large redemption money and mutual funds inflows are all positive performance factors for the market," BofA strategists said.

November 8 -

Despite the post-election selloff, inflows continued this week as LSEG Lipper reported investors added $1.263 billion to municipal bond mutual funds for the week ending Wednesday, compared to $658.5 million of inflows the prior week. High-yield inflows returned.

November 7 -

The red wave that took the presidency and the Senate — along with increased odds of a Republican victory in the House — was hanging heavily over fixed income markets Wednesday, with munis and UST yields rising up to 17 basis points, with the largest losses out long.

November 6 -

"If the GOP wins the House, the specter of risk to the municipal bond tax-exemption will increase," said Edwin Oswald, a tax partner at Orrick Herrington & Sutcliffe in Washington D.C.

November 6