-

The FOMC held rates steady at the conclusion of its meeting Wednesday and offered no hints regarding a September move.

July 30 -

The muni market has "cheapened and steepened," which is a great opportunity for people still on the sidelines to get into the market again, said Jennifer Johnston, director of municipal bonds research at Franklin Templeton.

July 29 -

The asset class got a "much-needed boost" from inflows into muni mutual funds last week, said Birch Creek strategists.

July 28 -

Issuance for the week of July 28 is estimated at $11.035 billion, with $9.018 billion of negotiated deals and $2.017 billion of competitive deals on tap, according to LSEG.

July 25 -

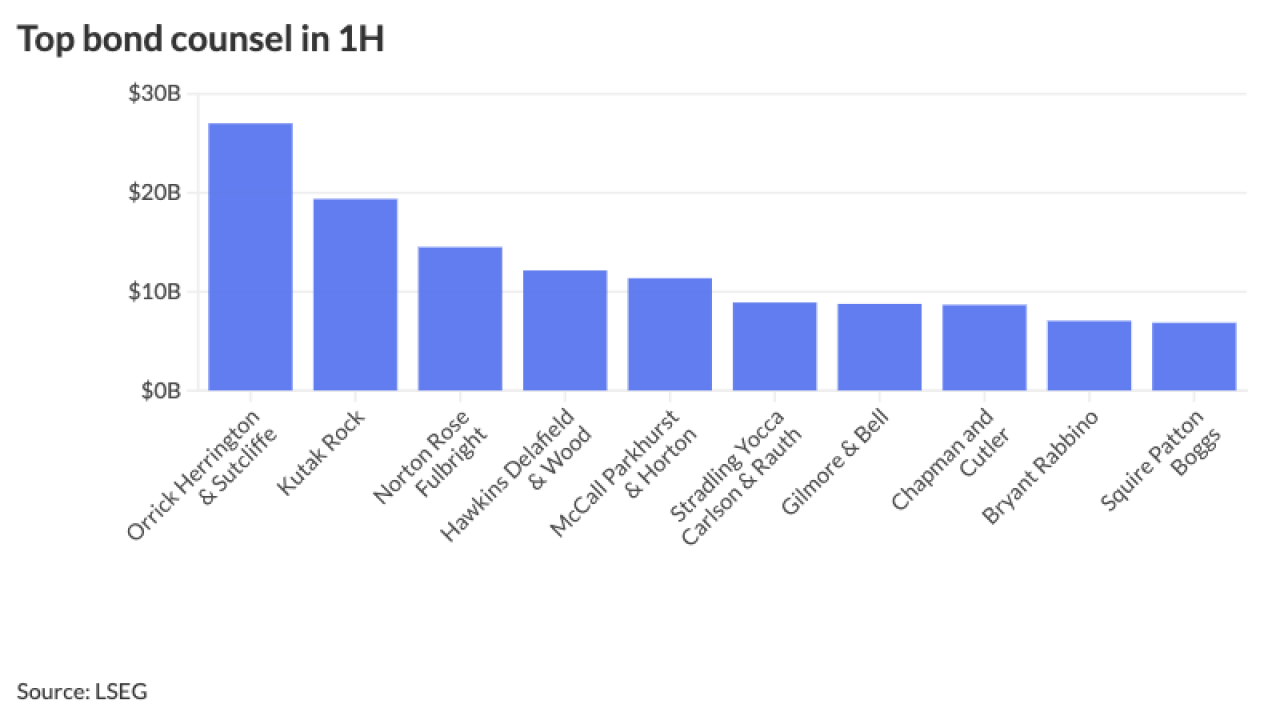

The top five featured in the ranking handled deals totalling more than $84 billion in par value.

July 25 -

Investors added $571.5 million from municipal bond mutual funds in the week ended Wednesday, following $224.6 million of outflows the prior week, according to LSEG Lipper data.

July 24 -

The fund's sell-off in June shows the challenges of accurate pricing in the high-yield muni market.

July 24 -

Larger dealer networks lead to lower markups, but smaller networks show evidence of potential collusion and market manipulation, the paper said.

July 24 -

Longer-term munis have become more attractive, said Cooper Howard, a fixed income strategist at Charles Schwab.

July 23 -

There is a buyer base that is a little bit "skeptical" of longer maturities, but it's more of a retail response, said Adam Congdon, a director at Payden & Rygel.

July 22