-

Market reaction to inflation numbers was "tempered," said Richard Flax, chief investment officer at Moneyfarm. But should inflationary pressures hold in 2025, "markets may anticipate that further rate cuts could be limited in scope, suggesting a more cautious investment outlook."

November 13 -

Municipals ignored USTs losses, leading to lower muni to UST ratios and adding to the better performance across the curve and credit spectrum.

November 12 -

The focus: municipal advisors — part of your regulatory responsibilities and duties (if you don't agree to evaluate pricing and/or structure, you must expressly disclose it to the client) and broker-dealers (fair dealing).

November 11 SOLVE

SOLVE -

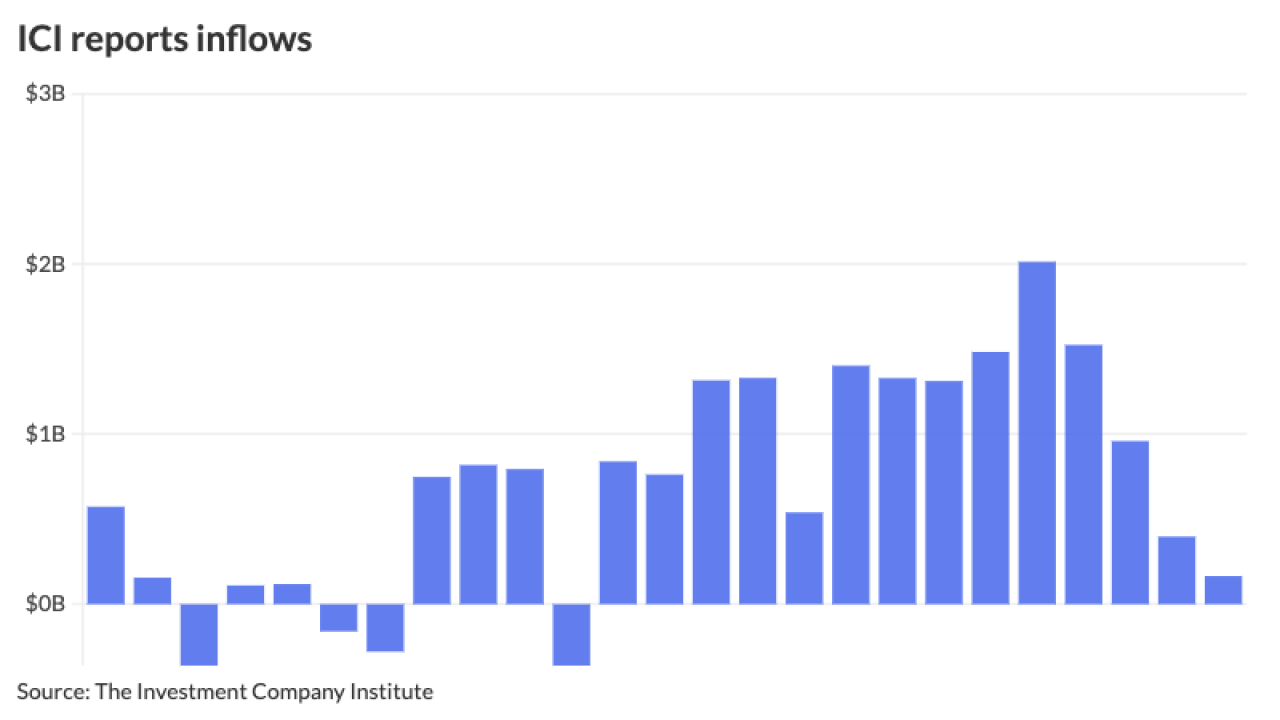

Tax-exempt money market funds reached a 2024 high of assets under management at $136.84 billion for the week ending Wednesday, according to the Investment Company Institute.

November 11 -

"A sharply lower new-issuance calendar, peak yields, large redemption money and mutual funds inflows are all positive performance factors for the market," BofA strategists said.

November 8 -

Despite the post-election selloff, inflows continued this week as LSEG Lipper reported investors added $1.263 billion to municipal bond mutual funds for the week ending Wednesday, compared to $658.5 million of inflows the prior week. High-yield inflows returned.

November 7 -

The red wave that took the presidency and the Senate — along with increased odds of a Republican victory in the House — was hanging heavily over fixed income markets Wednesday, with munis and UST yields rising up to 17 basis points, with the largest losses out long.

November 6 -

"If the GOP wins the House, the specter of risk to the municipal bond tax-exemption will increase," said Edwin Oswald, a tax partner at Orrick Herrington & Sutcliffe in Washington D.C.

November 6 -

"A victory for former President Trump is likely to be viewed as ushering in a more inflationary environment, whereas a win for Vice President Harris will probably be seen as closer to the status quo," said Erik Weisman, chief economist and portfolio manager at MFS Investment Management."

November 5 -

Investors should "brace themselves" for further volatility, as uncertainty is likely to remain, said Tom Kozlik, managing director and head of public policy and municipal strategy at HilltopSecurities.

November 4