-

"We expect subdued activity again [this] week heading into the Labor Day holiday," Birch Creek strategists said.

August 25 -

Munis underperformed a UST rally, which had everything to do with Powell's speech at the Jackson Hole symposium and future Fed action, said Cooper Howard, a fixed income strategist at Charles Schwab.

August 22 -

A possible explanation is that the massive inflows into mutual funds are a parallel move to large inflows into the Capital Group Municipal High-Income ETF, which saw the biggest inflow of a ETF on Friday at $1.5 billion, said Pat Luby, head of municipal strategy at CreditSights.

August 21 -

FOMC meeting minutes "clearly show why they didn't cut rates," said Northlight Asset Management Chief Investment Officer Chris Zaccarelli.

August 20 -

The muni bond market remains strong, supported by Treasury market strength, said Anders S. Persson, Nuveen's chief investment officer for global fixed income, and Daniel J. Close, Nuveen's head of municipals.

August 19 -

"If unfavorable economic numbers ... are released next month, we should expect a hold on any rate cuts and a possible rate hike to follow, putting a damper on any positive returns for the rest of the year," said Jason Wong, vice president of municipals at AmeriVet Securities.

August 18 -

Issuance for the week of Aug. 18 remains elevated at an estimated at $6.166 billion, with $5.065 billion of negotiated deals and $1.101 billion of competitive deals on tap, according to LSEG.

August 15 -

The latest inflation report — the producer price index — threw a monkey wrench into expectations for a big rate cut next month, according to some economists, may put into question any easing in September.

August 14 -

Muni performance is likely to recover during the second half of the year, said Cooper Howard, a fixed income strategist at Charles Schwab.

August 13 -

Through June 30, BAM insured 11 transactions with par of $100 million or more, with four more deals coming since then, the company said.

August 13 -

"The combination of stronger core and softer headline readings has left some traders struggling for direction," said Daniela Sabin Hathorn, senior market analyst at Capital.com. "There is a reason to be both bullish and bearish depending on which CPI reading you wish to focus on."

August 12 -

Returns for the month currently stand at 0.64%, which have "pushed muni returns back into the green with year-to-date returns of 0.09%," said Jason Wong, vice president of municipals at AmeriVet Securities.

August 11 -

Issuance for the week of Aug. 11 remains elevated at an estimated at $10.713 billion, with $8.857 billion of negotiated deals and $1.857 billion of competitive deals on tap, according to LSEG.

August 8 -

"Nothing could delay a restructuring or a consensual deal [more] than the existing board was doing," said Assured Guaranty CEO Dominic Frederico of the Trump administration's removal of Puerto Rico oversight board members.

August 8 -

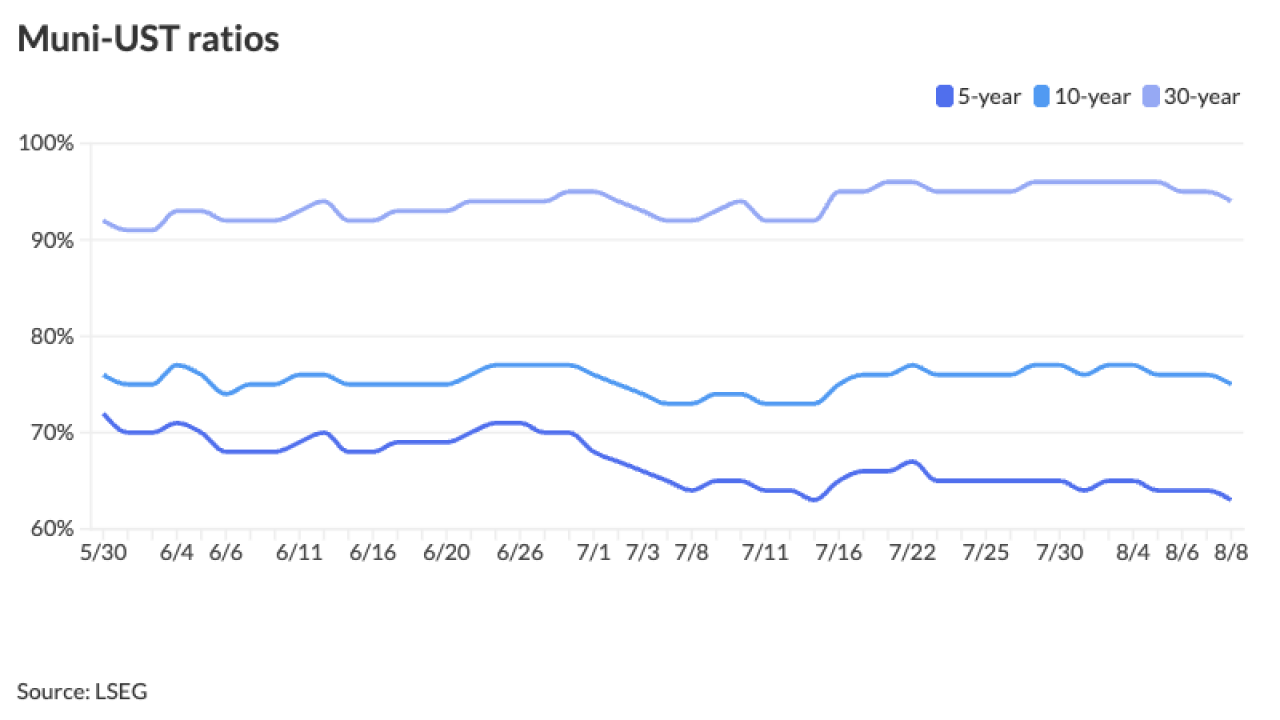

While UST yields "consolidate" following Friday's massive rally after the July jobs report, muni yields remain resilient, according to Kim Olsan, senior fixed income portfolio manager at NewSquare Capital.

August 7 -

The municipal bond market is "doing pretty good for the moment," said Jeff Timlin, a managing partner at Sage Advisory.

August 6 -

The risk Brightline Florida poses to the rest of the high-yield market may manifest in fund flows, investors said.

August 6 -

Over the past three trading sessions, MMD yields have been bumped nine to 12 basis points, while UST yields have fallen over 20 basis points on the front of the curve.

August 5 -

Some bondholders have retained legal counsel while others are in the dark about the company's plans.

August 5 -

"If the narrative takes hold that the Fed is behind the eight ball and will need to cut rates several times in the coming months to catch up to the realities of a weaker economy, we expect muni yields will drift lower alongside treasuries," Birch Creek strategists said.

August 4