-

Investors will be greeted Monday with decreased supply with the new-issue calendar estimated at $5.882 billion, down from total sales of $6.134 billion in the week of Aug. 22.

August 26 -

Outflows from municipal bond mutual funds continued as investors pulled $1.180 billion out of funds in the latest week, according to Refinitiv Lipper data.

August 25 -

The Investment Company Institute reported $230 million of inflows into muni bond mutual funds in the week ending August 17. ETFs see second week of outflows.

August 24 -

Join Peter O'Neill, Director and Senior Fixed Income Portfolio Manager, at Bank of America, and Blake Lynch, Head of Business Development, IMTC, as they discuss the role of separately managed accounts in the muni market with The Bond Buyer's Lynne Funk.

-

Don't expect much new information to come from Jackson Hole this year analysts say, as the data-dependent FOMC will rely on incoming economic numbers in September to decide the proper size rate hike.

August 23 -

Losses for August climbed last week, with month-to-date returns in the red at negative 1.40% on the Bloomberg muni index, high-yield seeing 0.99% losses, taxables at 2.01% losses and the impact index losing 1.70%.

August 22 -

Investors will be greeted Monday with a decrease in supply with the new-issue calendar estimated at $6.711 billion, down from total sales of $10.318 billion.

August 19 -

Investors pulled $229.263 million out of muni bond mutual funds in the latest week, versus the $635.177 million of outflows the prior week, according to Refinitiv Lipper. High-yield continues to see inflows.

August 18 -

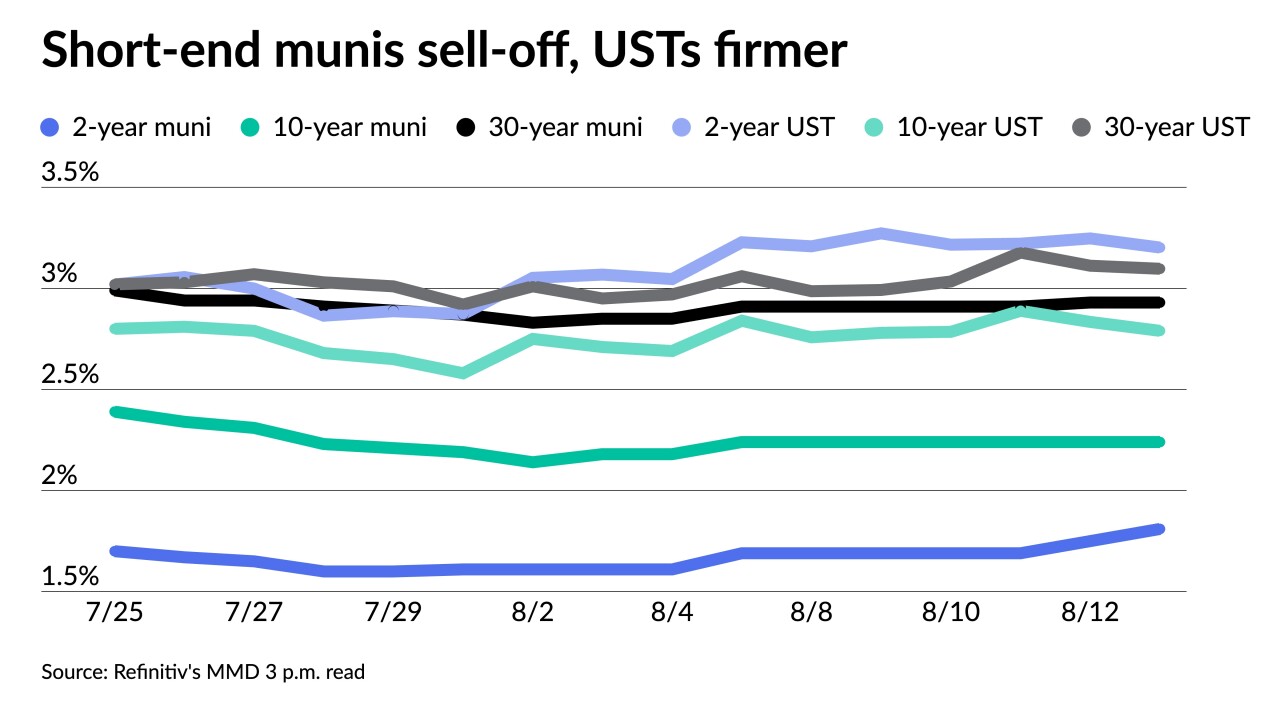

The short end was hammered in the secondary with large blocks of high-grades showing big swings to higher yields while the rest of the curve wasn't spared the damage and triple-A yields rose by seven to 16 basis points.

August 17 -

It was a busy day in the primary Tuesday, with New York City pricing $950 million of GOs for retail and Miami-Dade County, Florida, and Mecklenburg County, North Carolina, selling in the competitive market.

August 16 -

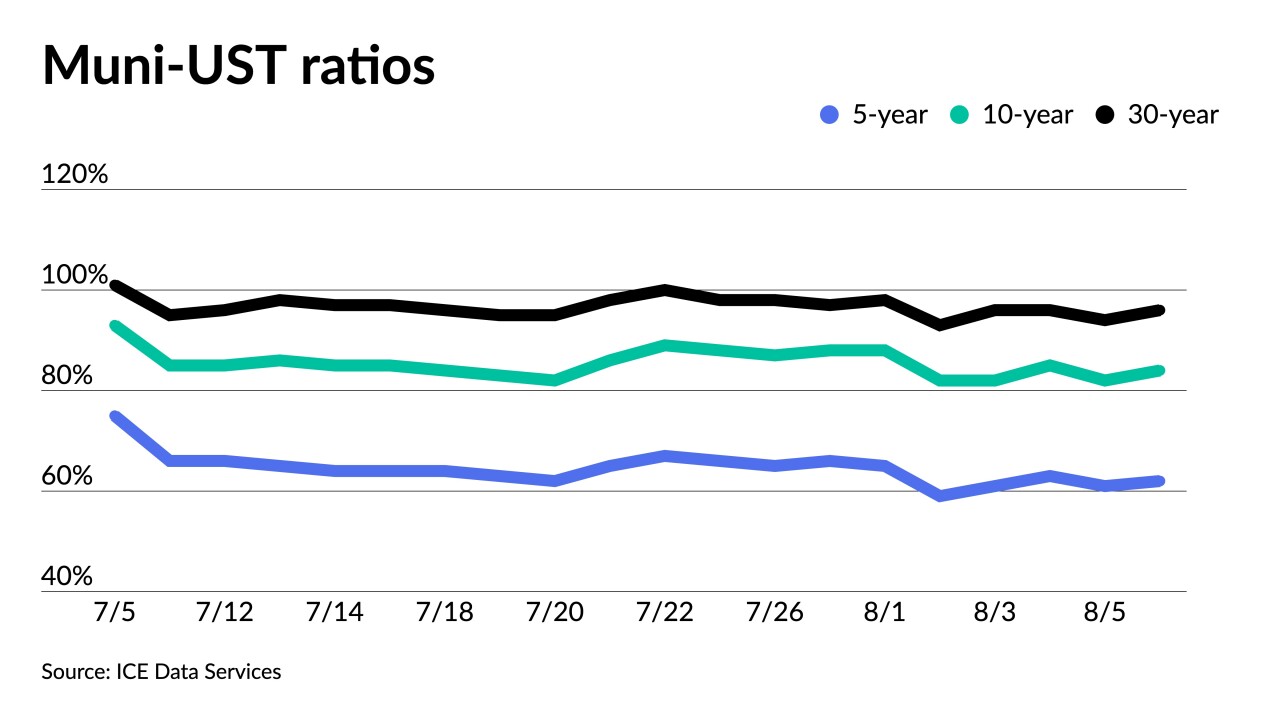

"Demand for low-duration tax-exempts has been so strong that short maturity benchmark yields are now lower than the after-tax yields for comparably rated benchmark taxable muni and corporate bonds," said CreditSights strategists Pat Luby and John Ceffalio.

August 15 -

New-issue volume grows to $10.7 billion led by a $2.7 billion taxable Massachusetts ESG deal, $1.35 billion of Oklahoma natural gas taxables, $1.25 billion from the Regents of the University of California and $1.1 billion from New York City.

August 12 -

Pressure on the short end of the muni curve is being exacerbated by a 3.24% two-year Treasury note, from a correction to floating rate notes and dealer positions.

August 11 -

The Investment Company Institute reported investors poured in $1.589 billion into muni bond mutual funds in the week ending August 3, the highest level since November.

August 10 -

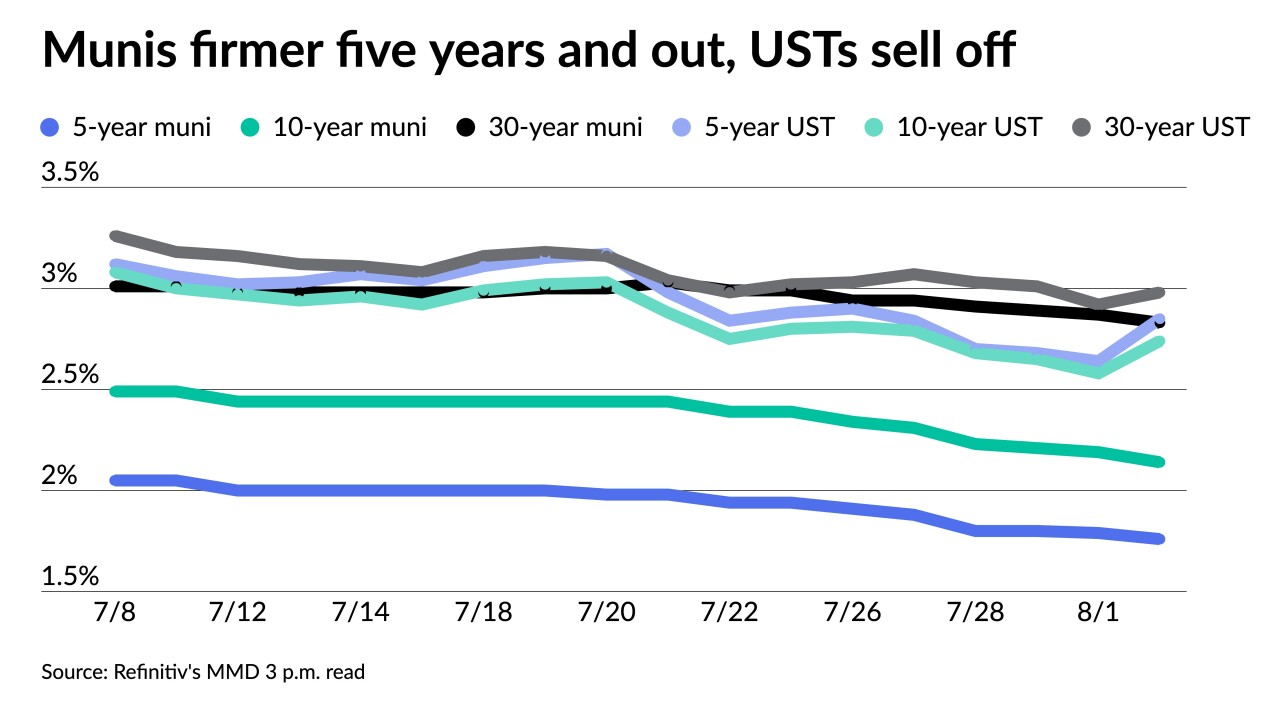

Several large new issues priced. Municipal yields were little changed, U.S. Treasuries were weaker on the short end and stocks ended in the red ahead of the much-anticipated July inflation figure.

August 9 -

Weekly supply is holding below $5 billion, reinvestment needs are still in effect from large redemptions and fund flows are leaning more positive, noted FHN Financial's Kim Olsan.

August 8 -

Investors will be greeted Monday with an increase in supply with the new-issue calendar estimated at $5.941 billion, up from total sales of $1.700 billion.

August 5 -

Investors poured $1.094 billion into municipal bond mutual funds in the latest week, versus the $236.491 million of inflows the week prior. It marks only the second time this year inflows eclipsed $1 billion.

August 4 -

The Investment Company Institute reported investors pulled $246 million out of muni bond mutual funds in the week ending July 27 compared to the $602 million of outflows in the previous week.

August 3 -

The large primary was led by two $700-plus million of revenue bonds from the Port of Seattle and the Georgia Ports Authority.

August 2