-

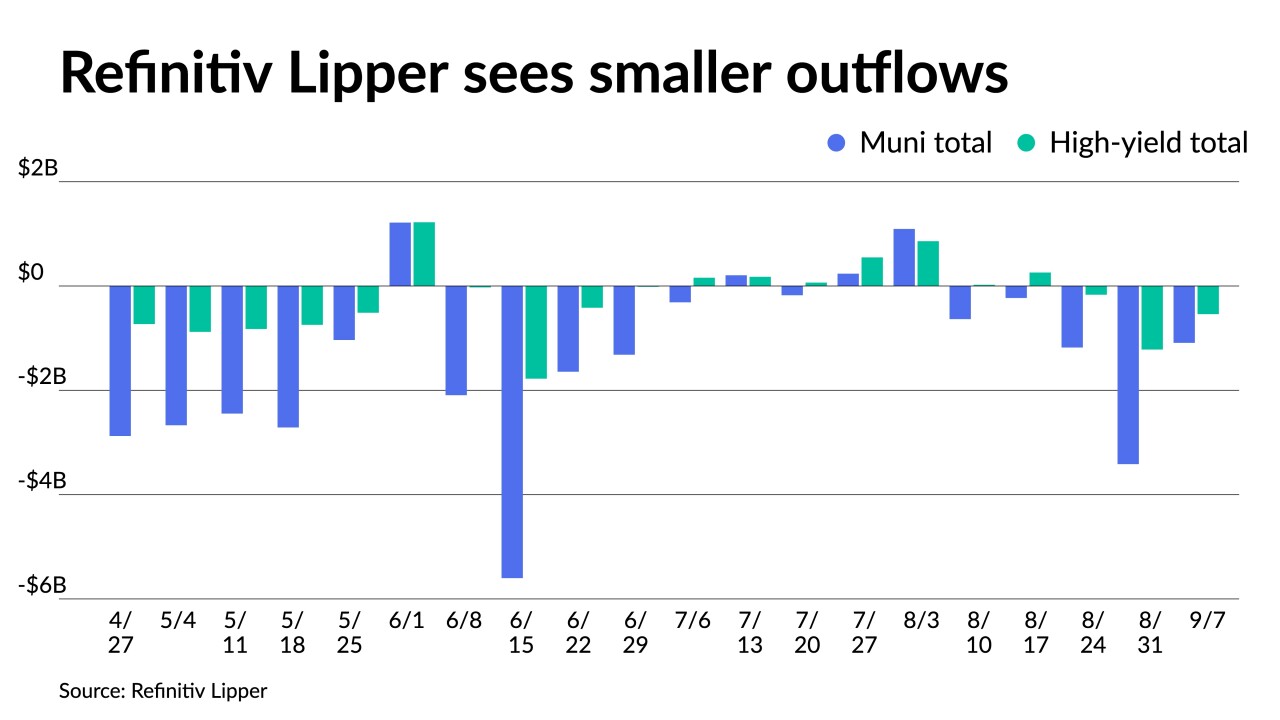

The market has seen outflows for 13 straight weeks, per Refinitiv Lipper, but Nuveen strategists Anders S. Persson and John V. Miller said "selling is due primarily to investors harvesting tax losses."

November 8 -

Voters will decide on more than $60 billion of bond ballot measures Tuesday with New York voters faced with the largest amount at $4.2 billion.

November 7 -

ICE TMC, part of ICE Bonds, provides market participants access to an all-to-all market for trading munis and other bonds.

November 7 -

Investors will be greeted Monday with a new-issue calendar estimated at $5.268 billion.

November 4 -

High-yield saw outflows of $867.067 million after $594.497 million of outflows the week prior while exchange-traded funds saw inflows of $736.967 million after $444.544 million of inflows the previous week.

November 3 -

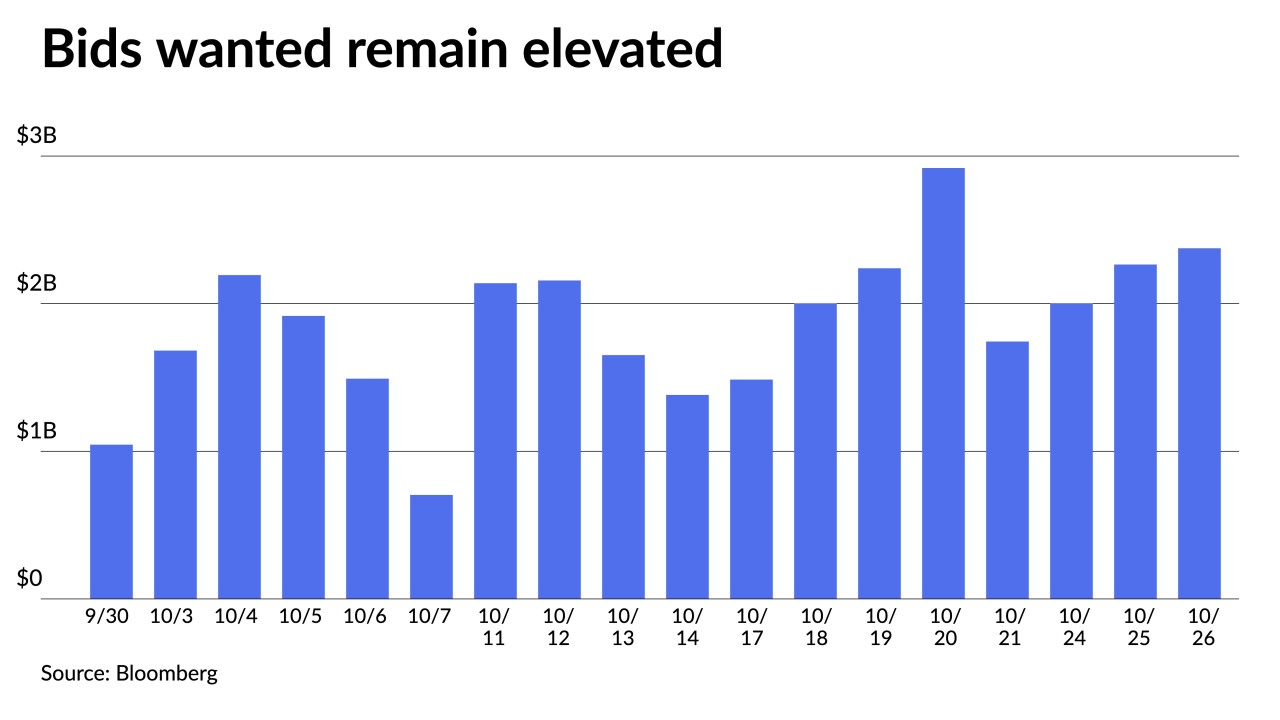

Investors pulled $3.843 billion from mutual funds in the week ending Oct. 26 after $3.876 billion of outflows the previous week, according to ICI.

November 2 -

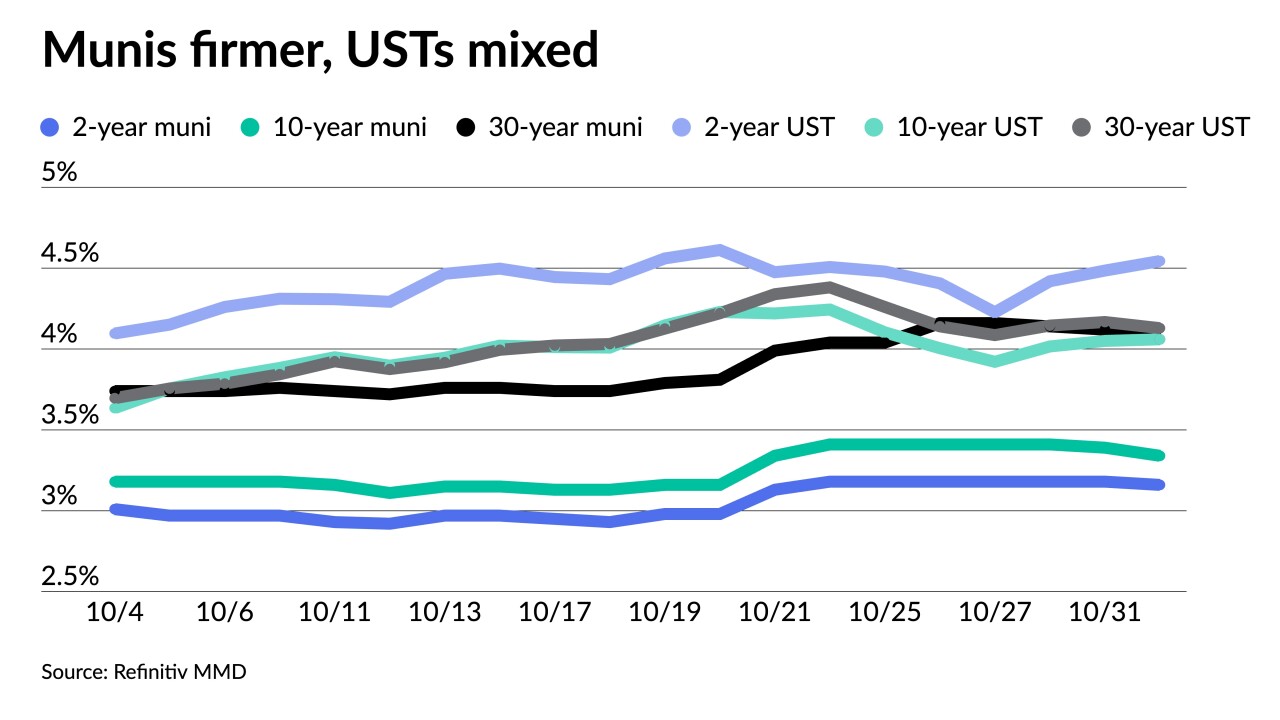

October returns were in the red with the Bloomberg Municipal Index showing a loss of 0.83% for the month, bringing total losses in 2022 to 12.86%. Only May and July saw positive returns for the asset class.

November 1 -

With the Federal Open Market Committee meeting this week and the next week shortened by the bond market observance of Veterans Day, CreditSights strategists said "investors should be prepared for two weeks of subdued new issuance."

October 31 -

The upcoming Federal Open Market Committee meeting on Tuesday and Wednesday has led to a lighter new-issue calendar with $2.72 billion on tap.

October 28 -

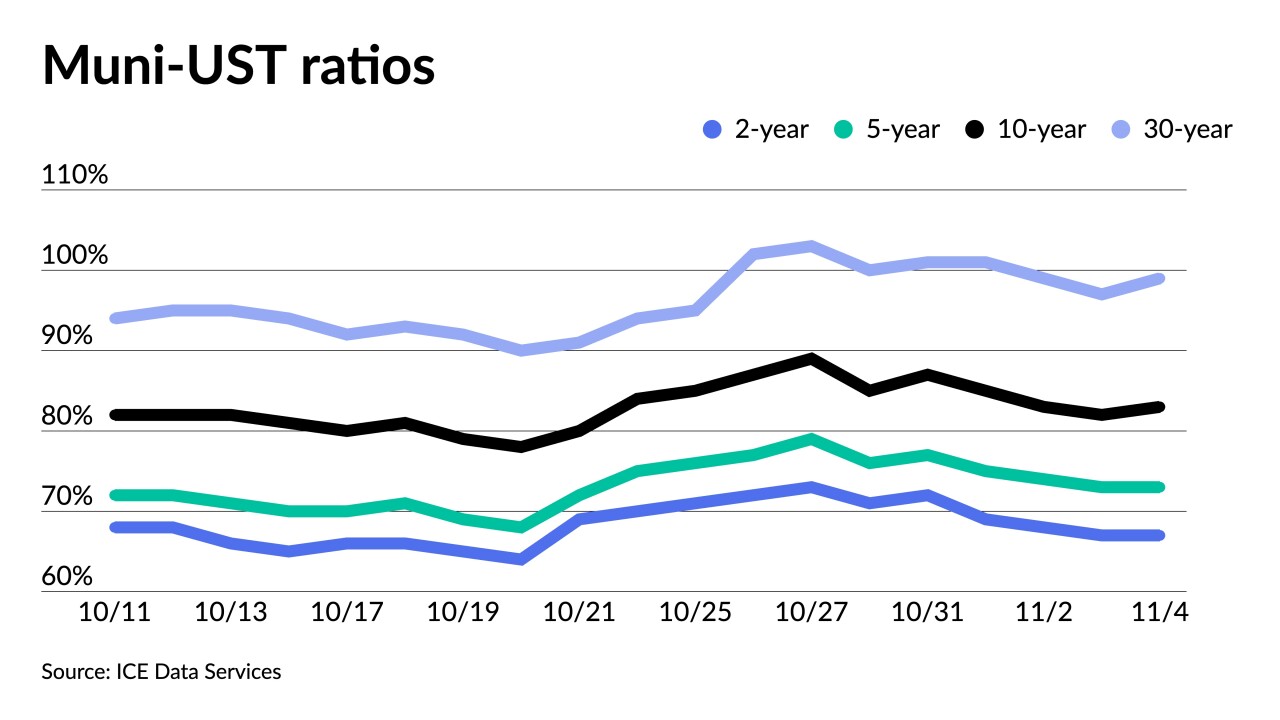

Municipal to UST ratios have risen this week with the 10-year approaching 90% and the 30-year topping 100%.

October 27