-

Issuance shrinks to $722 million while Bond Buyer 30-day visible supply sits at little more than $7 billion.

November 18 -

Municipals improved again Thursday, pushing the 10-year yield firmly below 3%, while Refinitiv Lipper reported $604.704 million of inflows into municipal bond mutual funds for the week ending Wednesday.

November 17 -

Investment bank expands with three former Citigroup muni veterans at the helm.

November 17 -

As market participants navigate through the remaining weeks of 2022, Jeff Lipton, managing director of credit research at Oppenheimer Inc., expects munis to maintain their outperformance over USTs

November 16 -

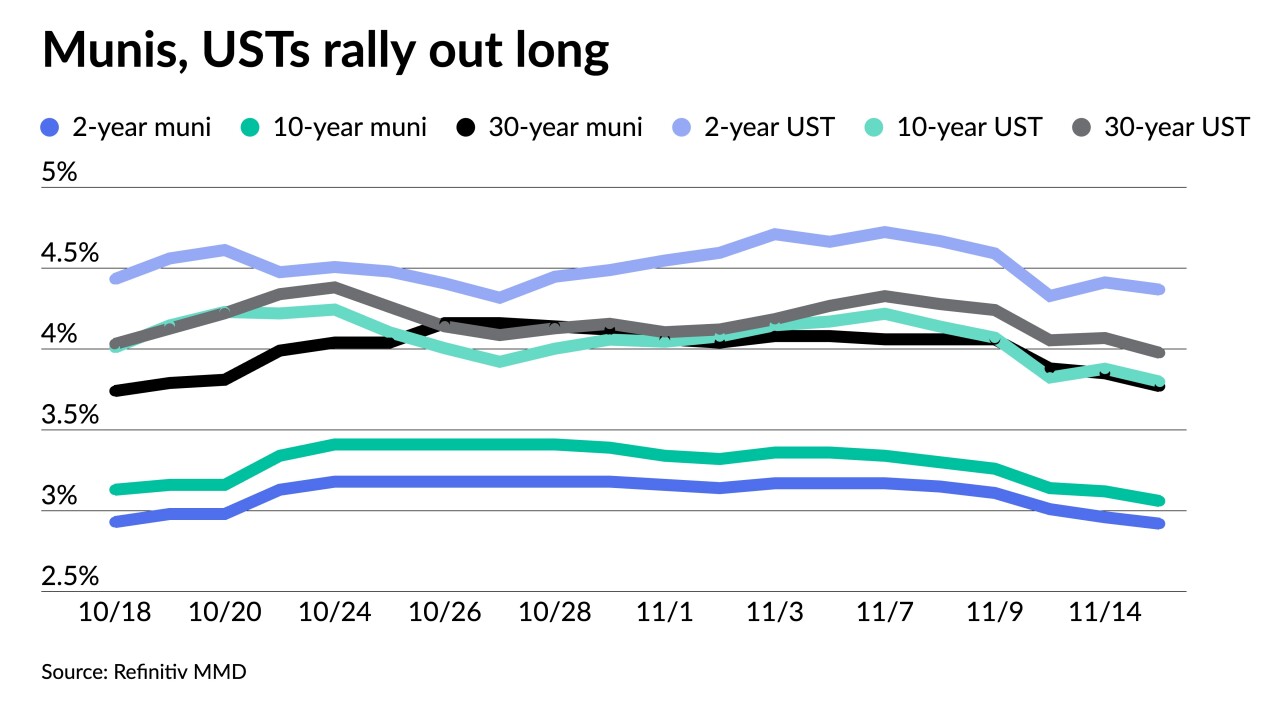

Triple-A yields fell five to eight basis points while UST saw yields fall up to nine out long, moving the 30-year UST below 4% for the first time since mid-October.

November 15 -

Illinois raised its fiscal 2023 revenue estimates by $3.69 billion, giving Gov. J.B. Pritzker enough to propose doubling the state's $1 billion rainy day fund.

November 15 -

Munis were in their own lane while broader markets were mixed Monday as participants digested various Fed officials' comments on inflation and rate hike schedules.

November 14 -

Refinitiv Lipper reported $2.537 billion of outflows from municipal bond mutual funds for the week ending Wednesday after $2.389 billion the week prior.

November 10 -

Municipal bond mutual funds saw more losses on Wednesday with the Investment Company Institute reporting another week of multi-billion-dollar outflows, bringing year-to-date losses to $123.3 billion.

November 9 -

The market has seen outflows for 13 straight weeks, per Refinitiv Lipper, but Nuveen strategists Anders S. Persson and John V. Miller said "selling is due primarily to investors harvesting tax losses."

November 8