-

The bond markets are witnessing a rare situation that could hinder spending on infrastructure projects around the country, said Amanda Hindlian, president of fixed income and data services at ICE.

February 28 -

The availability of higher yields has brought some investors into the market — even though volume in the primary and secondary markets are on the thin side and the municipal market is a bit of a mixed bag right now.

February 27 -

Investors will be greeted Monday with a new-issue calendar estimated at $4.098 billion.

February 24 -

An improving tone was apparent in the municipal market midweek — after a topsy-turvy ride last week when the market saw a close to 50-basis point adjustment to the front end of the triple-A municipal yield curve.

February 23 -

Earlier in the pandemic, bond values showed a greater divergence among local government issuers tracked, but that has reverted to pre-pandemic levels, although work-from-home and other uncertainties still take a toll.

February 23 -

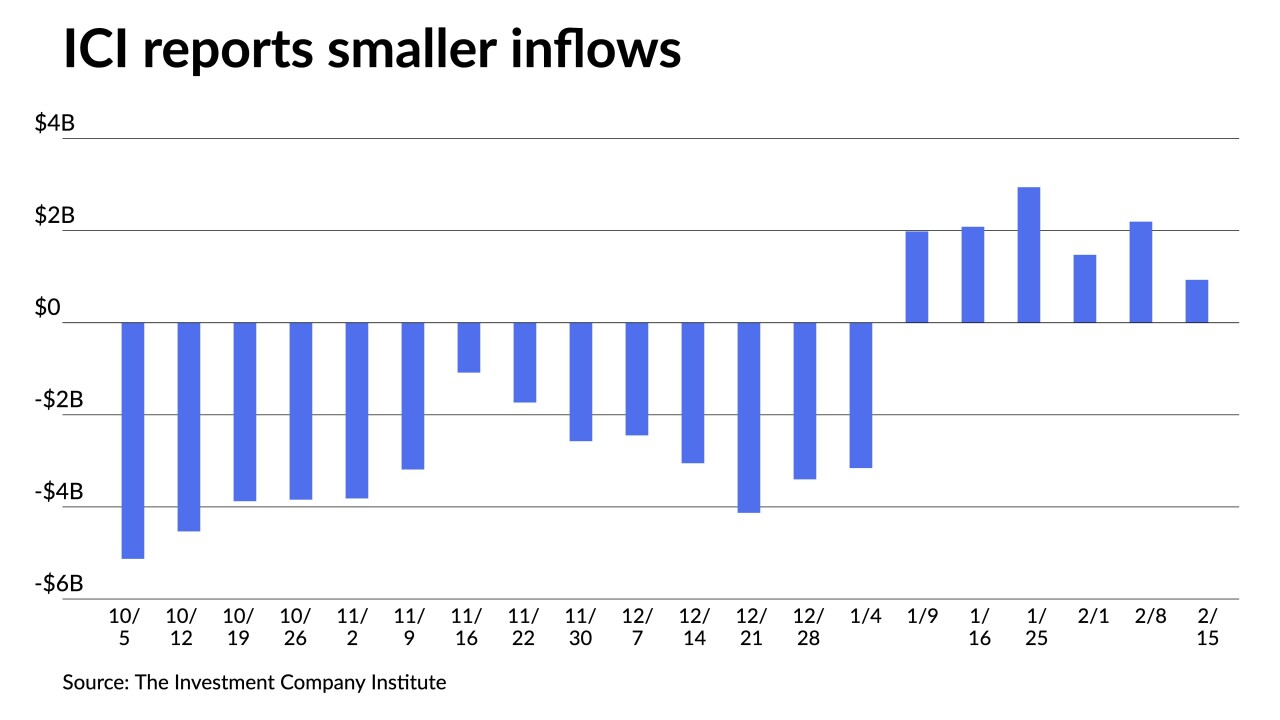

Inflows continued with the Investment Company Institute reporting investors added $931 million to mutual funds in the week ending Feb. 15, after $2.194 billion of inflows the previous week.

February 22 -

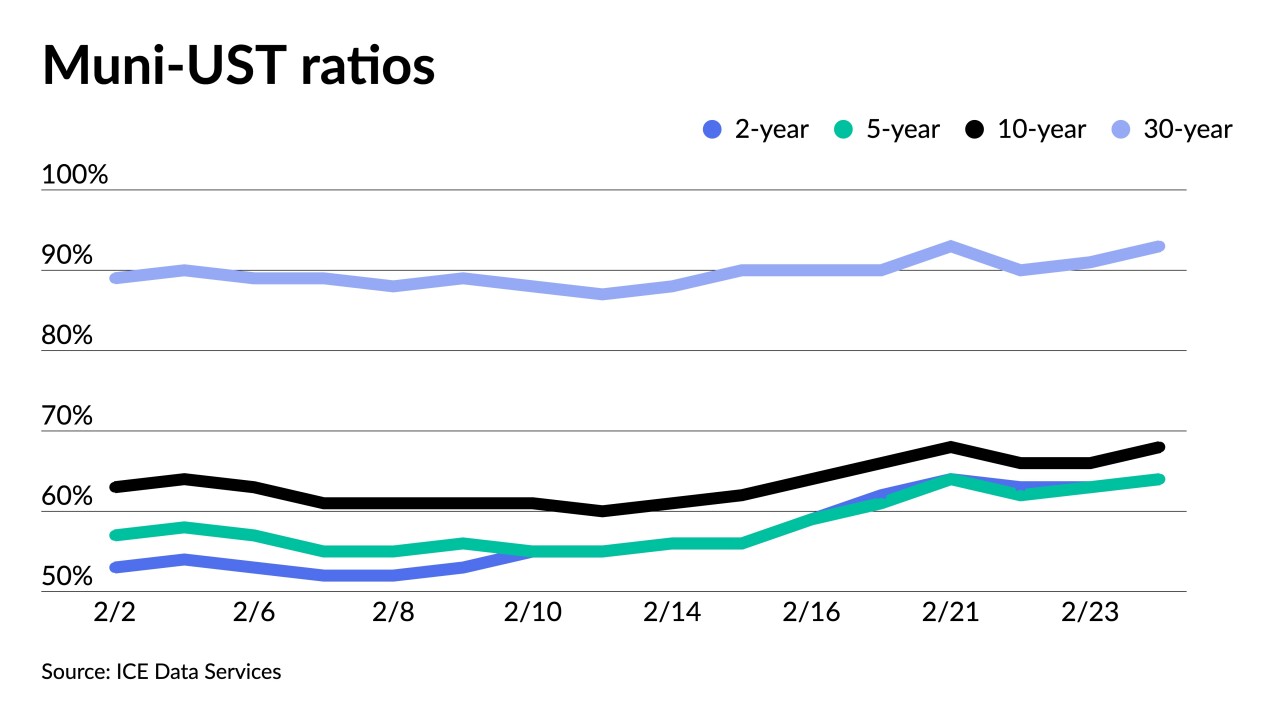

"The close to 50 bp adjustment to the front end of the AAA municipal curve, taken at face value, appears to be a huge step toward pricing normalization for tax-exempts," said Eric Kazatsky, head of municipal strategy at Bloomberg Intelligence.

February 21 -

Investors will be greeted Monday with a new-issue calendar estimated at $3.603 billion.

February 17 -

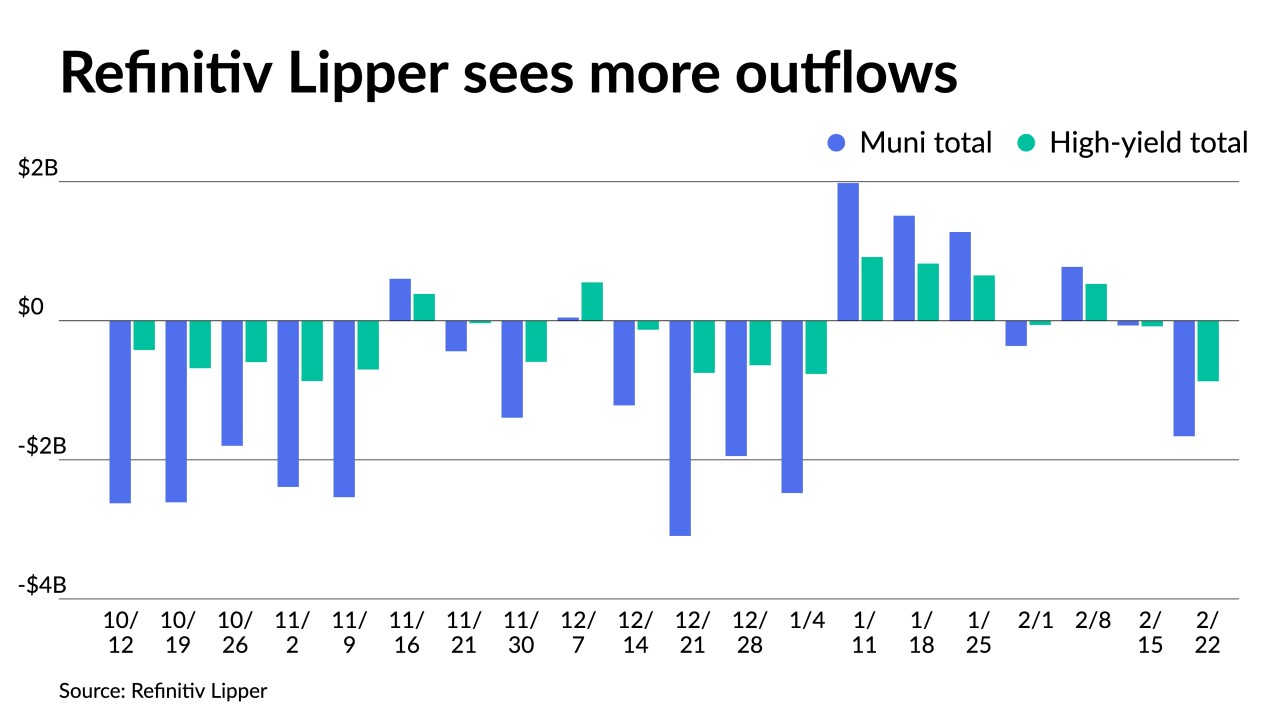

Refinitiv Lipper reported $68.054 million was pulled from municipal bond mutual funds in the week that ended Wednesday after $775.006 million of inflows the week prior.

February 16 -

Inflows continued with the Investment Company Institute reporting investors added $2.194 billion to mutual funds in the week ending Feb. 8, after $1.471 billion of inflows the previous week.

February 15