-

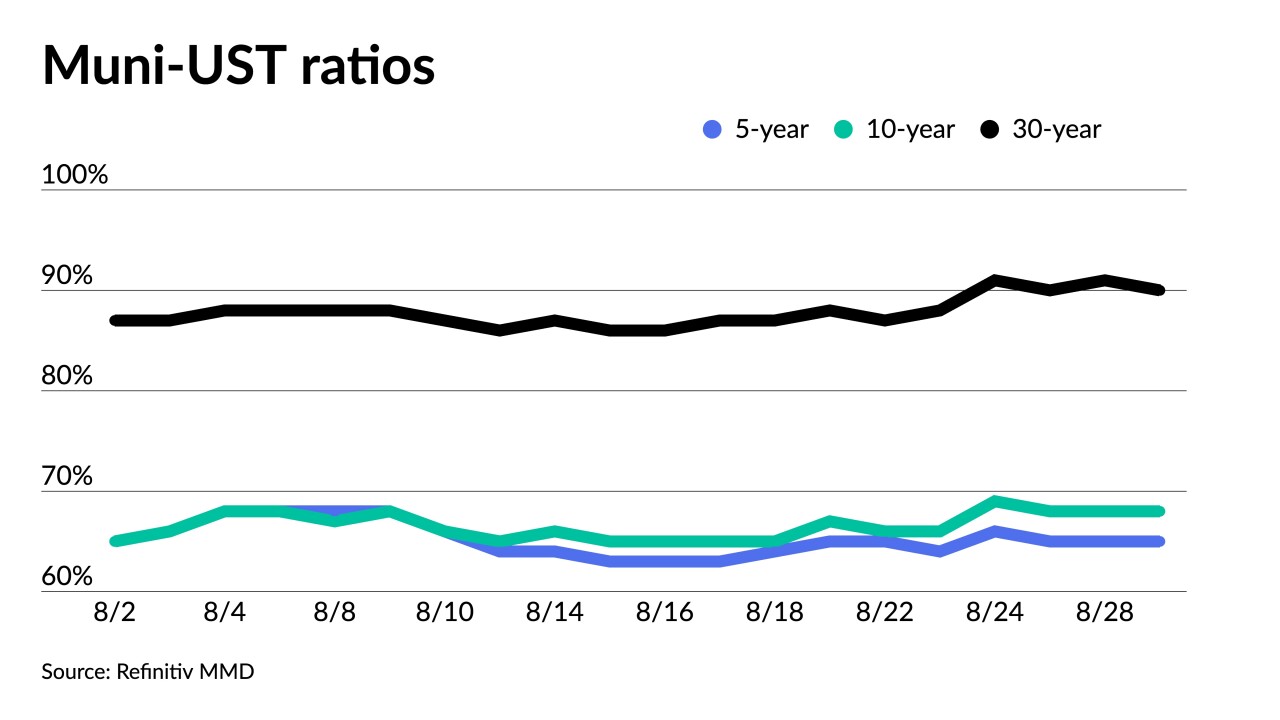

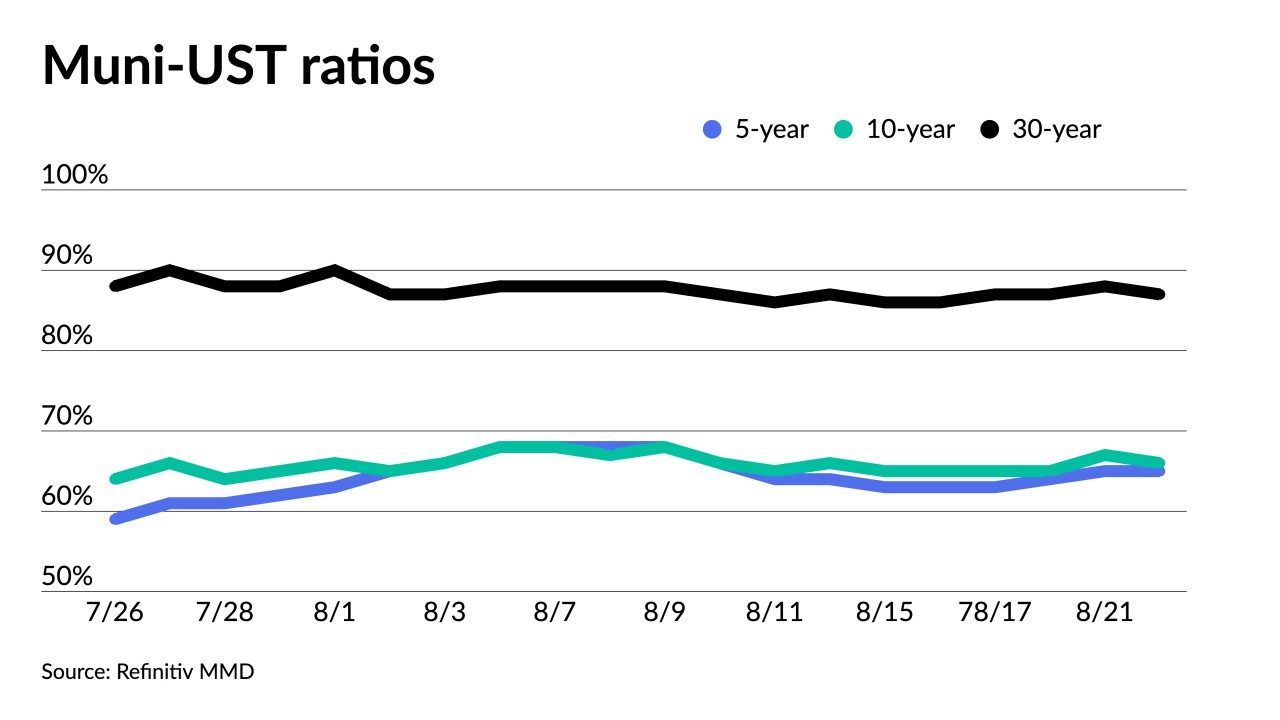

Investors remain hesitant about "jumping back into munis even as rates are nearing multi-year highs as tax-exempts are still not cheap enough with the front-end ratios still yielding under 70% while the historical averages are around 90%," AmeriVet Securities' Jason Wong noted.

September 5 -

The calendar will rebound with an estimated $7.141 billion next week with $6.323 billion of negotiated deals on tap and $817.6 million on the competitive calendar.

September 1 -

Refinitiv Lipper reported $407.976 million of inflows from municipal bond mutual funds for the week ending Wednesday after $534.428 million of outflows into the funds the previous week.

August 31 -

"We've seen more buyer attention at this time of the year versus what we generally would experience as we approach the beginning of September," said Morgan Stanley's Matthew Gastall.

August 30 -

Over the last month or so there's been some volatility in the muni market driven by the Treasury side, said Daryl Clements, municipal portfolio manager at AllianceBernstein.

August 29 -

Andy DeVries of CreditSights is fairly optimistic about the eventual outcome for bondholders, though its tax-exempt paper has been trading at a discount.

August 29 -

The muni market "finally succumbed to the month-long rate selloff that had seen valuations test historically rich levels," said Birch Creek Capital strategists in a weekly report.

August 28 -

The new-issue calendar for the final week of August is estimated at a meager $2.979 billion. Bond Buyer 30-day visible supply sits at $5.76 billion.

August 25 -

Refinitiv Lipper reported $534.428 million of outflows from municipal bond mutual funds for the week ending Wednesday after $264.046 million of outflows into the funds the previous week.

August 24 -

Supply scarcity is helping the market through the Treasury volatility. Bond Buyer 30-day visible supply currently sits at $4.72 billion.

August 23 -

This week's new-issue supply needs to be "priced to sell to pique investor interest," said noted Nuveen's Daniel Close and Anders S. Persson.

August 22 -

Tracey Manzi, senior investment strategist at Raymond James, talks with Chip Barnett about the fixed income markets today and how munis and Treasuries are doing. She says the number one issue clients are asking about is inflation. (20 minutes)

August 22 -

Continued pressure on the UST market coupled with the end of the summer reinvest may begin to test new issues as investors are able to be more selective.

August 21 -

"Bearish Treasury moves have kept some pressure on the muni market and prevented an attempt to rally during the summer season when large redemptions trump issuance," BofA Global Research said in a report.

August 18 -

Refinitiv Lipper reported $264.046 million of outflows from municipal bond mutual funds for the week ending Wednesday after $278.559 million of inflows the previous week.

August 17 -

Municipal CUSIP request volume decreased in July on a year-over-year basis, following an increase in June, according to CUSIP Global Services.

August 16 -

Summer redemption season ends Tuesday when issuers return $9 billion of matured or called bond principal, said CreditSights strategists Pat Luby and Sam Berzok.

August 15 -

The investor-owned utility issues tax-exempt bonds through the Hawaii Department of Budget and Finance.

August 15 -

"The recent outperformance has valuations nearing stretched levels again," Birch Creek Capital said in a weekly report. "If USTs reverse the recent trend higher, we would not be surprised to see munis lag during the rally."

August 14 -

Another day of mixed inflation data led Treasury yields to rise but munis mostly stayed put after underperforming a UST rally earlier in the week. The market is also focused on the $9 billion of redemption flows coming on Tuesday.

August 11