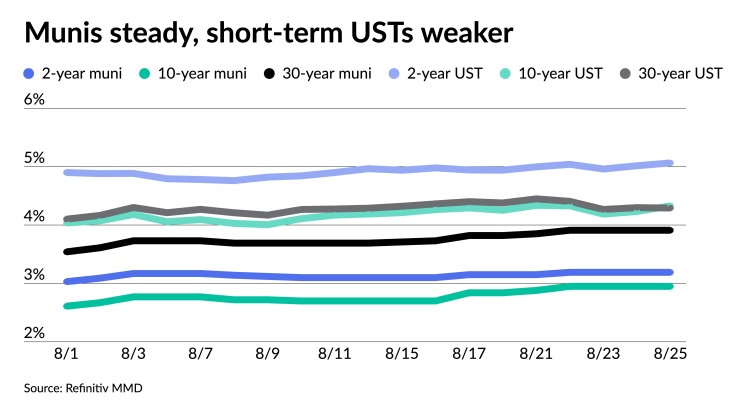

Municipals were steady Friday ahead of a smaller new-issue calendar, while short-term Treasuries were weaker and equities rallied.

The two-year muni-to-Treasury ratio Friday was at 63%, the three-year at 65%, the five-year at 66%, the 10-year at 70% and the 30-year at 91%, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the two-year at 64%, the three-year at 66%, the five-year at 65%, the 10-year at 68% and the 30-year at 90% at 4 p.m.

There were "no real surprises" from Fed Chairman Jerome Powell's Jackson Hole speech, said Gary Pzegeo, head of fixed income at CIBC Private Wealth US.

"It is a very different environment than a year ago when Powell saw a much larger disconnect between the Fed's expectations and the bond markets' pricing," he said. "Powell didn't add much in the way of new information, but he did reiterate that the Fed will 'keep at it until the job is done.'"

The bond market was "fairly stable" in the wake of the speech and short-term indicators of Fed expectations are few changes, he said.

While Powell "left open the issue of additional tightening to arrest inflation," Pzegeo said the bond market is "not very convinced of another move, particularly at the September meeting."

Little was said by Powell to change market expectations in the short term, he noted.

Beyond September, he said "markets may have to adjust the rate outlook higher, particularly if the recent run of faster-than-expected growth continues to play out."

"Markets currently discount a 38% chance of another tightening at the November meeting," he said.

Over this past week, muni rates moved higher, "breaking more cleanly above their January-July 2023 ranges," according to a BofA Global Research weekly report.

One- and two-year AAA benchmark yields topped their highs from late October 2022, the BofA strategists noted.

For most of the maturities five years and out, "current AAA rates levels are around the maximum retracement (76%) for a bull market," they said.

"Even for the most bullish spots around the 10-year, retracements are around 65%," BofA strategists said.

If AAA muni yields climb higher and pass the 76% retracement, they said there's a high probability of matching last October's peak yields.

On this basis, they said "the market should either rally from here, or in the alternative, investors should prepare for double peaks of yields in a continued selloff."

Whatever happens next depends on the Treasury market, they noted.

The muni market would "likely turn the corner" if the Treasury market's rally from Wednesday continued to Friday, but "if the Treasury market resumes its bearish track … yields for 10+ year munis likely will move higher as we head into September when large redemptions will be much lighter," they said.

Principal redemptions in September are estimated to decrease 41% from August, falling at $26.5 billion, while coupon payments are estimated to be $10 billion. Issuance for September is expected to be at $34 billion, they said.

"So, supply and demand is nearly balanced, in contrast to the May through August period when redemptions and coupon payments far exceeded issuance," they said.

New-issue calendar

The calendar is estimated at $2.979 billion next week with $2.415 billion of negotiated deals on tap and $563.8 million on the competitive calendar. Bond Buyer 30-day visible supply sits at $5.76 billion.

Main Street Natural Gas leads the negotiated calendar with $665 million of gas supply revenue bonds, followed by $290 million of special revenue refunding bonds from Jacksonville, Florida.

The competitive calendar is led by the South Carolina Association of Government Organizations with $230 million of certificates of participation.

Secondary trading

North Carolina 5s of 2024 at 3.35%. Ohio 5s of 2025 at 3.25%-3.23%. NYC 5s of 2026 at 3.22%-3.19%.

Massachusetts 5s of 2028 at 2.91% versus 2.94% Wednesday. New Mexico 5s of 2029 at 3.03%. California 5s of 2029 at 2.91% versus 2.89% Wednesday and 2.78% on 8/17.

Washington 5s of 2032 at 3.04%. Maryland 5s of 2032 at 3.02% versus 3.01% Thursday and 2.75% on 8/15. Concord, North Carolina, 5s of 2034 at 3.06%.

Triborough Bridge and Tunnel Authority 5s of 2048 at 4.29%-4.30% versus 4.34% Tuesday and 4.12%-4.14% on 8/14. NYC TFA 5.25s of 2050 at 4.30% versus 4.37%-4.34% original on Thursday.

AAA scales

Refinitiv MMD's scale was unchanged: The one-year was at 3.27% and 3.19% in two years. The five-year was at 2.93%, the 10-year at 2.95% and the 30-year at 3.91% at 3 p.m.

The ICE AAA yield curve was cut up to one basis point: 3.29% (unch) in 2024 and 3.24% (unch) in 2025. The five-year was at 2.91% (unch), the 10-year was at 2.88% (+1) and the 30-year was at 3.89% (+1) at 4 p.m.

The S&P Global Market Intelligence (formerly IHS Markit) municipal curve was unchanged: 3.28% in 2024 and 3.19% in 2025. The five-year was at 2.94%, the 10-year was at 2.96% and the 30-year yield was at 3.90%, according to a 4 p.m. read.

Bloomberg BVAL was cut up to one basis point: 3.27% (unch) in 2024 and 3.19% (+1) in 2025. The five-year at 2.90% (unch), the 10-year at 2.89% (+1) and the 30-year at 3.87% (unch) at 4 p.m.

Treasuries were weaker 10 years and in.

The two-year UST was yielding 5.066% (+5), the three-year was at 4.733% (+4), the five-year at 4.439% (+4), the 10-year at 4.237% (+1), the 20-year at 4.499% (flat) and the 30-year Treasury was yielding 4.289% (-1) near the close.

Powell's Jackson Hole speech

"Jerome Powell has spoken, and I don't think we can be too surprised at what has been said but we have had some volatility in markets and interest rate expectations on the back of it," said Craig Erlam, senior market analyst for UK and EMEA at OANDA.

"After a Volcker-esque hawkish speech at last year's Jackson Hole Symposium the tone was less stern this year, but still had a hawkish tilt to it as the job is not done on inflation and it is too early to declare victory," said Jason England, global bonds portfolio manager at Janus Henderson Investors.

There are no new messages following Powell's speech, said Christian Chan, senior vice president and chief investment officer of Investment Solutions at AssetMark, who concurred that the Fed chairman maintained his hawkish tone.

Powell emphasized Friday "that the labor market and economic growth have not weakened enough to reach the Fed's 2% inflation target," said José Torres, senior economist at Interactive Brokers.

While inflation has "declined sharply since last year's nosebleed levels, it remains well above the objective," he said.

While June and July results have been encouraging, Torres said "two months of lower inflation are not enough for the Fed to be confident that price gains have normalized."

To achieve progress, restrictive monetary policy is needed, and England said the Fed intends "to hold it there until they are confident inflation is moving sustainably down to their 2% target."

Powell said "2% is and will remain their target silencing any chatter from economists to increase the target," according to England.

The Fed chairman also "commented on the challenge with policy going forward as they near the end game and the uncertainty of identifying the neutral rate of interest; however, he stated they are prepared to raise rates further if appropriate," he said.

"This continues with Powell's risk management strategy of moving more slowly, relying on the data from meeting to meeting, and weighing the totality of the data as the Fed nears the end of this aggressive tightening campaign," England said.

"Fed funds futures have responded to the Powell speech by raising the odds of another rate hike from the Fed to around 61% up from a lower 50% prior to Powell speech and a far lower 36% just a week ago," said Scott Anderson, chief economist at Bank of the West Economics.

Given the risk management and uncertainty language in the speech, he said "the market still believe the Fed will more likely pause in September, placing about a 21% probability on a September hike verses a 40% probability of a November hike."

Erlam believes the Fed's rate hiking cycle is down but said "traders are increasingly accepting that they will likely stay there longer than they've expected at any point in the tightening cycle."

"That message was clear from Powell's comments, as was his insistence that if necessary they would hike again," he said. "And in referencing the strength of the labor market and the economy, I suspect he currently believes another will be needed."

Altogether, Chan said Powell's speech reinforces the "higher for longer" theme.

While this has caused some volatility in the markets, Erlam does not believe this diverges from what has already been said.

Primary to come:

Main Street Natural Gas Inc. (A3///) is set to price $665.28 million of gas supply revenue bonds, Series 2023D, serials 2024-2030, term 2054. Citigroup Global Markets Inc.

Jacksonville, Florida (/AA/AA-/AA) is set to price $290.345 million of special revenue and refunding bonds, Series 2023A, and special revenue refunding bonds, Series 2023B, consisting of $259.495 million Series 2023A, serials 2024-2043, term 2048, 2053, and $30.85 million Series 2023B, serials 2024-2026. Raymond James & Associates, Inc.

The Healthcare Authority of the City of Huntsville, Alabama (A1///) is set to price Tuesday $175 million of Series 2023A refunding revenue bonds. Wells Fargo Bank

Lakeland, Florida (/AA/AA/), is set to price Tuesday $154.675 million of Energy System Revenue and Refunding Bonds, Series 2023, serials 2029-2048. Wells Fargo Bank.

The Housing Authority of King County, Washington (/AA//), is set to price $114.405 million of Kirkland Heights Project affordable housing revenue bonds, consisting of $40.9 million Series A1, serials 2028, $23.145 million Series A2, serials 2028, $50.360 million, Series A3, serials 2028-2033, 2041, term 2040. KeyBanc Capital Markets.

The South Carolina State Housing Finance and Development Authority (Aaa///) is set to price $100 million of non-AMT mortgage revenue bonds Tuesday, serials 2025-2035, term 2038, 2043, 2048, 2053, 2054. Citigroup Global Markets Inc.

Competitive:

The South Carolina Association of Government Organization (MIG-1///) is set to sell $230.191 million of certificates of participation (South Carolina School District Credit Enhancement Program) at 11 a.m. eastern Thursday.