-

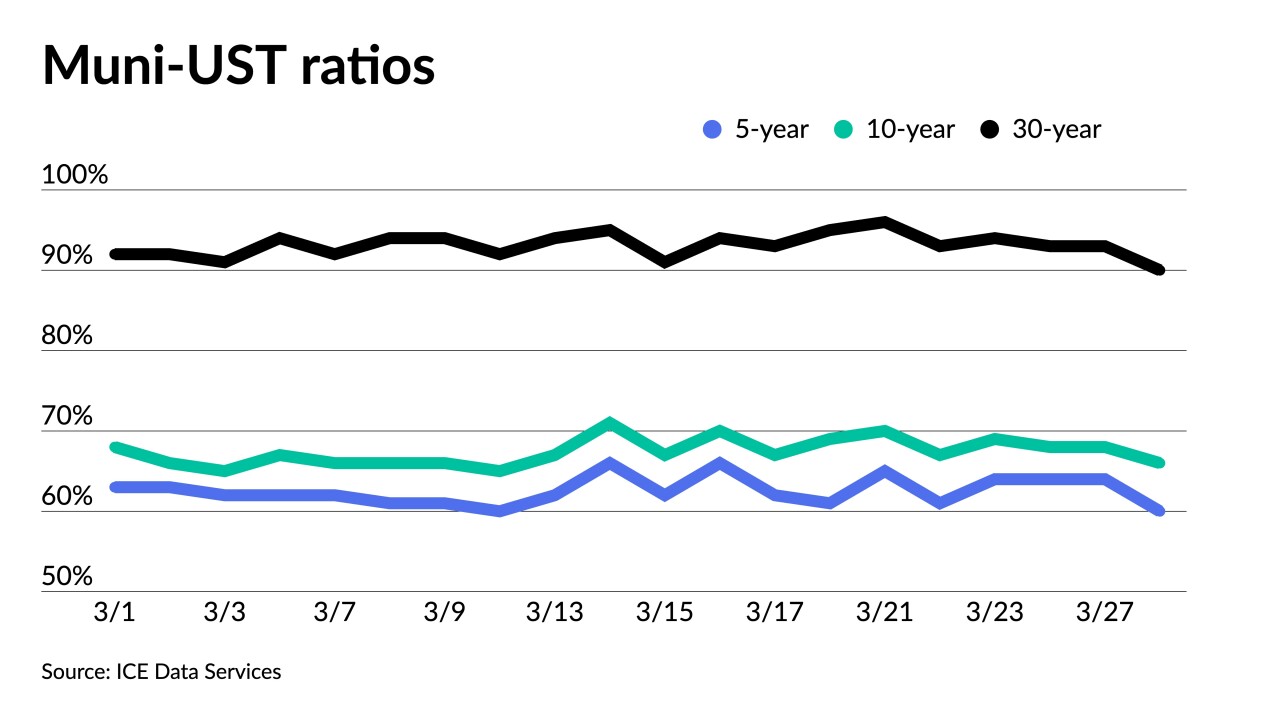

Munis are directionally trading with USTs but underperforming in days where USTs rally and outperforming in days where USTs sell-off, said Greg Gizzi, head of U.S. fixed income and head of municipal bonds at Macquarie Asset Management.

March 28 -

Munis held "their firmer tone as Treasuries continued to rally once more this past week," said Jason Wong, vice president of municipals at AmeriVet Securities.

March 27 -

Yields on top-rated municipal bonds fell as much as nine basis points on Friday as bank contagion fears resurfaced and investors looked to safe-haven securities. The primary calendar is rebounding, with volume rising to an estimated $5.4 billion in the week ahead.

March 24 -

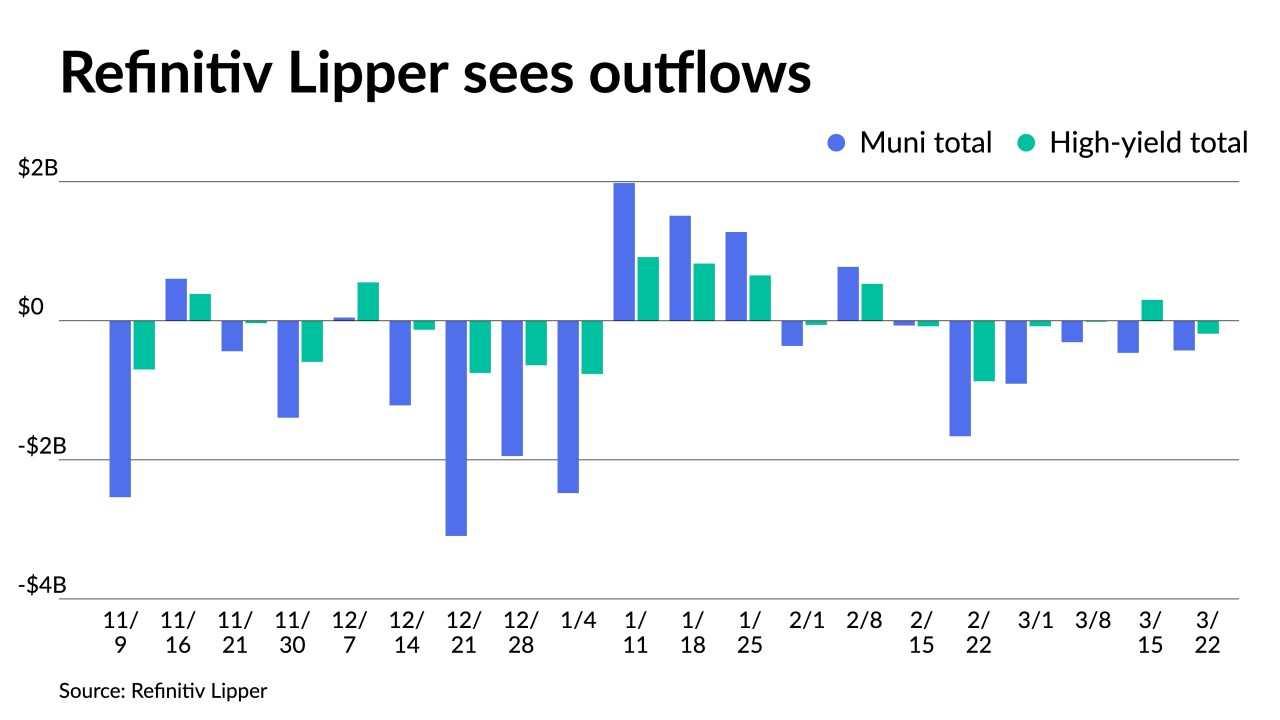

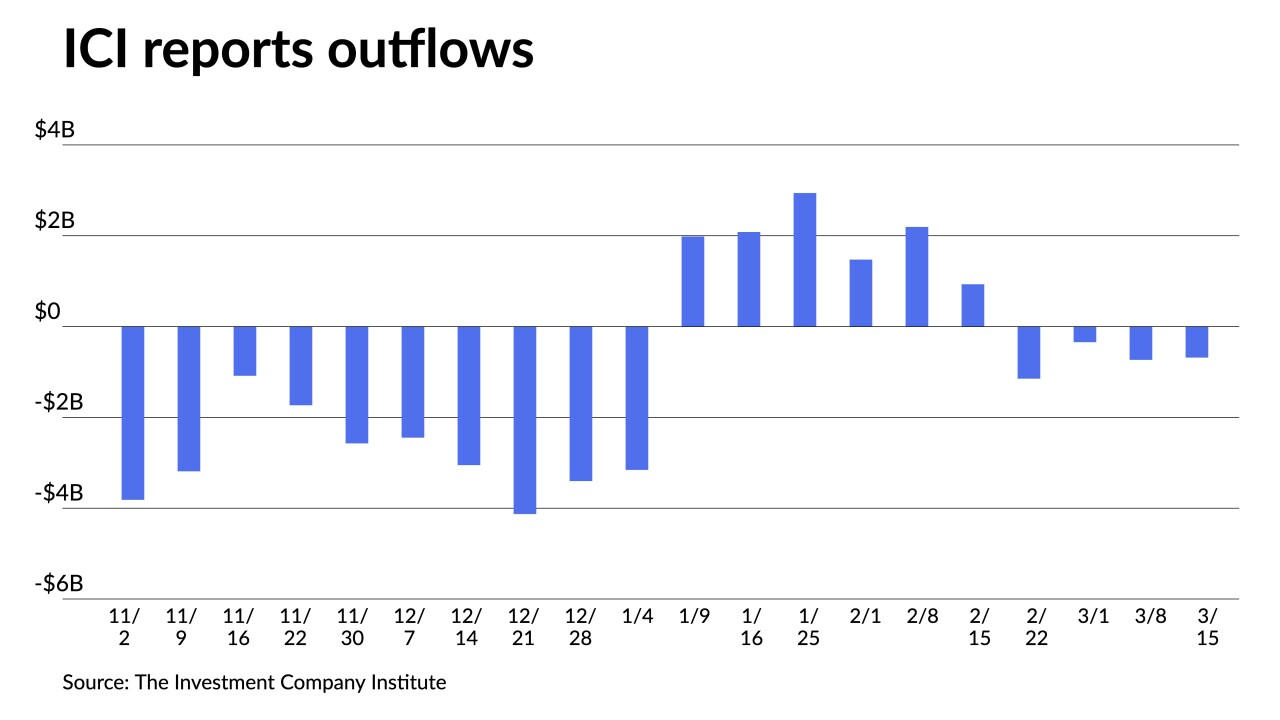

Outflows continued as Refinitiv Lipper reported $427.082 million was pulled from municipal bond mutual funds in the week that ended Wednesday after $461.123 million of outflows the week prior.

March 23 -

"In short, it appears that the end of the current tightening cycle is coming into view," said Wells Fargo Securities Chief Economist Jay Bryson.

March 22 -

After a tumultuous week, expect another ahead, said Matt Fabian, a partner at Municipal Market Analytics.

March 21 -

The banking sector crisis caused a flight-to-quality bid in USTs last week.

March 20 -

Investors will be greeted Monday with a new-issue calendar estimated at $4.064 billion.

March 17 -

Outflows continued as Refinitiv Lipper reported $461.123 million was pulled from municipal bond mutual funds in the week that ended Wednesday after $307.815 million of outflows the week prior.

March 16 -

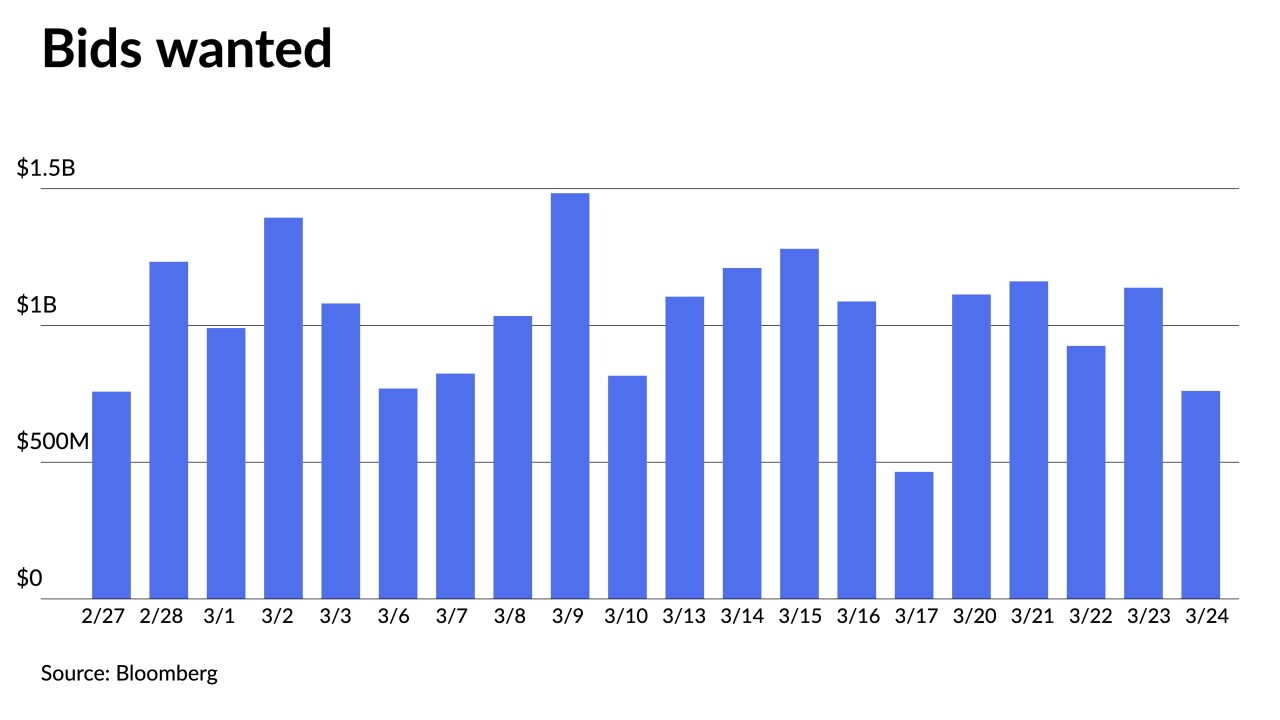

"The main question for investors recently has been: will we see bank selling of municipals that exerts pressure on the market, and what kind of market effects could occur," Barclays strategists said.

March 15