-

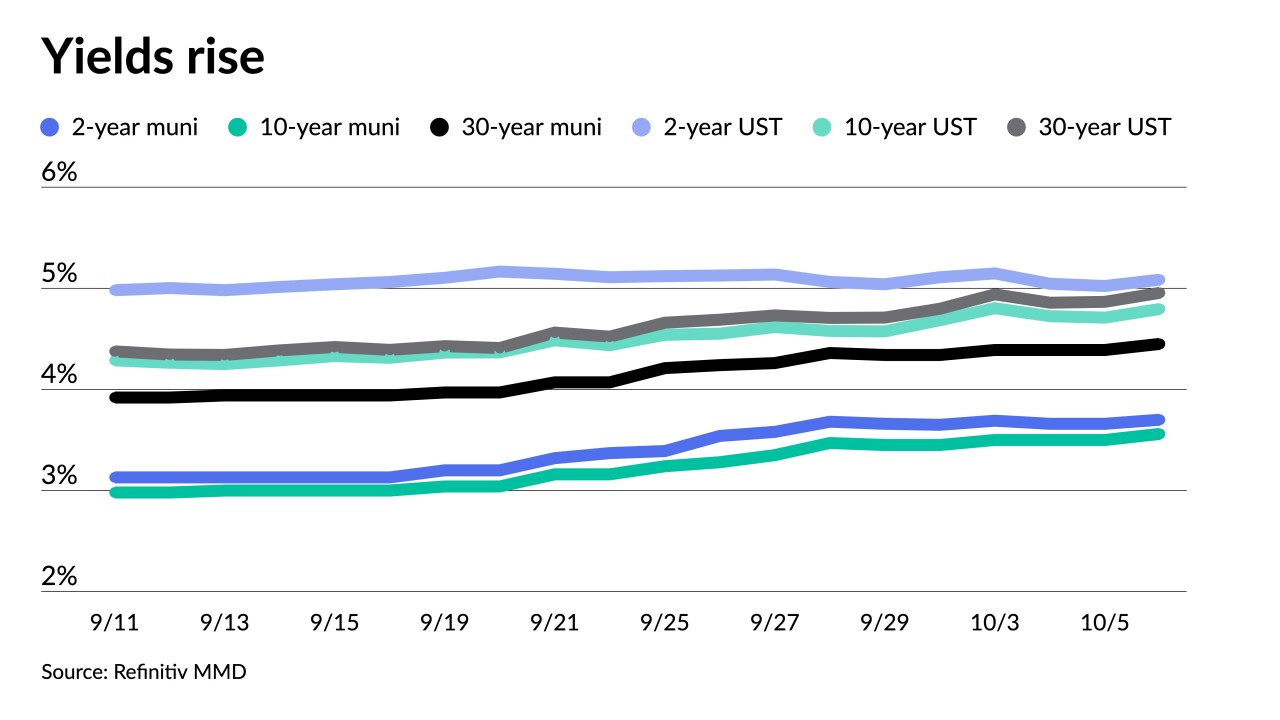

A higher inflation figure sent UST yields higher, complicating Central Bank policymaking and reversing a flight-to-safety bid amid ongoing geopolitical turmoil in Israel.

October 12 -

Minutes from the September Federal Open Market Committee meeting were "not much of a market mover" Wednesday, said Scott Anderson, chief U.S. economist and managing director at BMO Economics.

October 11 -

However, "a long-lasting bond market rally seems unlikely given major structural shifts of higher bond supply and on uncertainty with demand," said Edward Moya, senior market analyst at OANDA.

October 10 -

"Despite the breathtaking selloff in longer rates, Barclays' macro strategists see no clear catalyst to stem the bleeding," Barclays strategists said. "Data are unlikely to weaken quickly or enough to help bonds."

October 6 -

The nature of municipal bonds is to help people, says Peter Hayes, "I really like that it's public purpose."

October 6 -

All eyes will be on Friday's report, though "it seems most leading indicators suggest job growth will remain healthy, which should keep the bond market selloff going strong," said OANDA's Edward Moya.

October 5 -

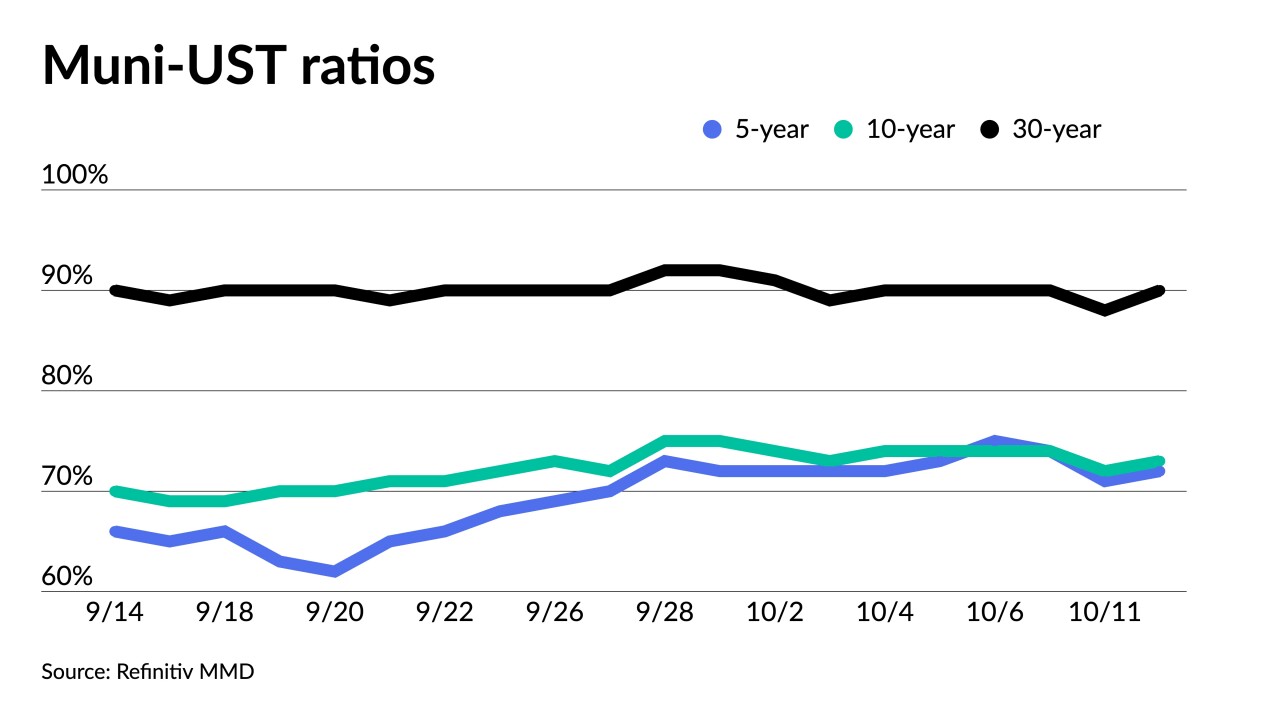

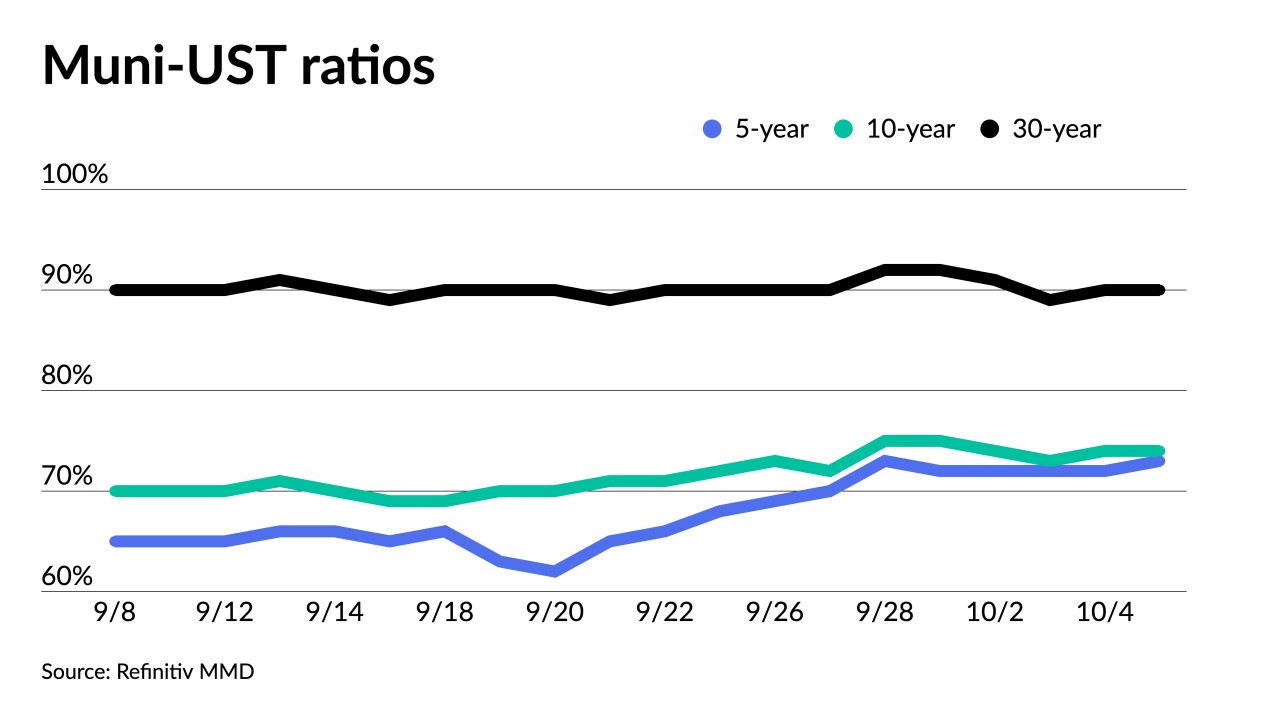

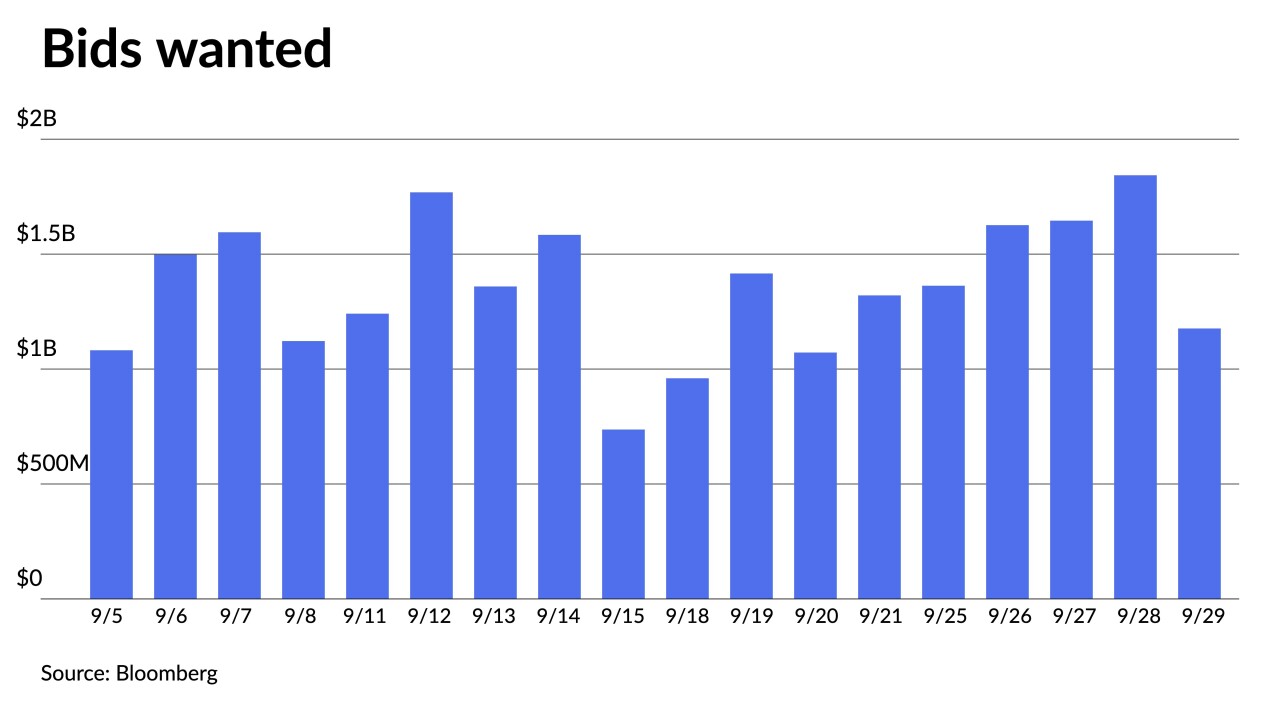

Municipal yields fell up to three basis points, depending on the scale, but underperform a better UST market.

October 4 -

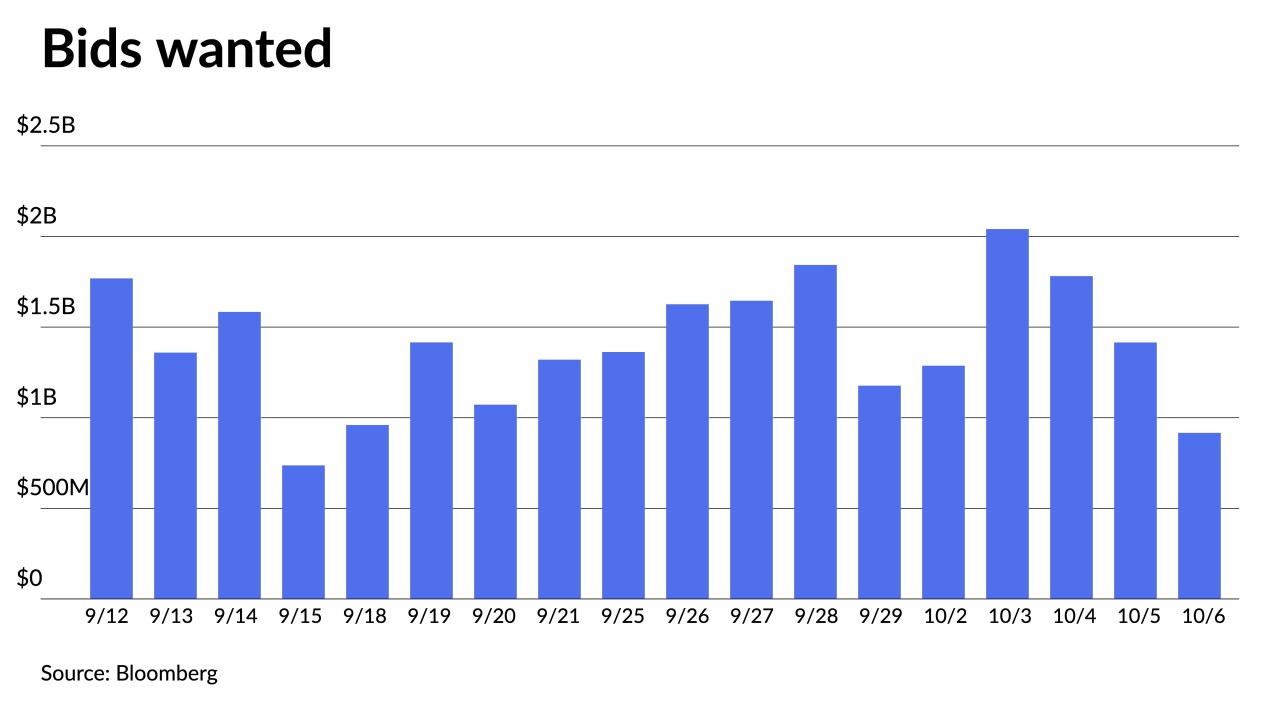

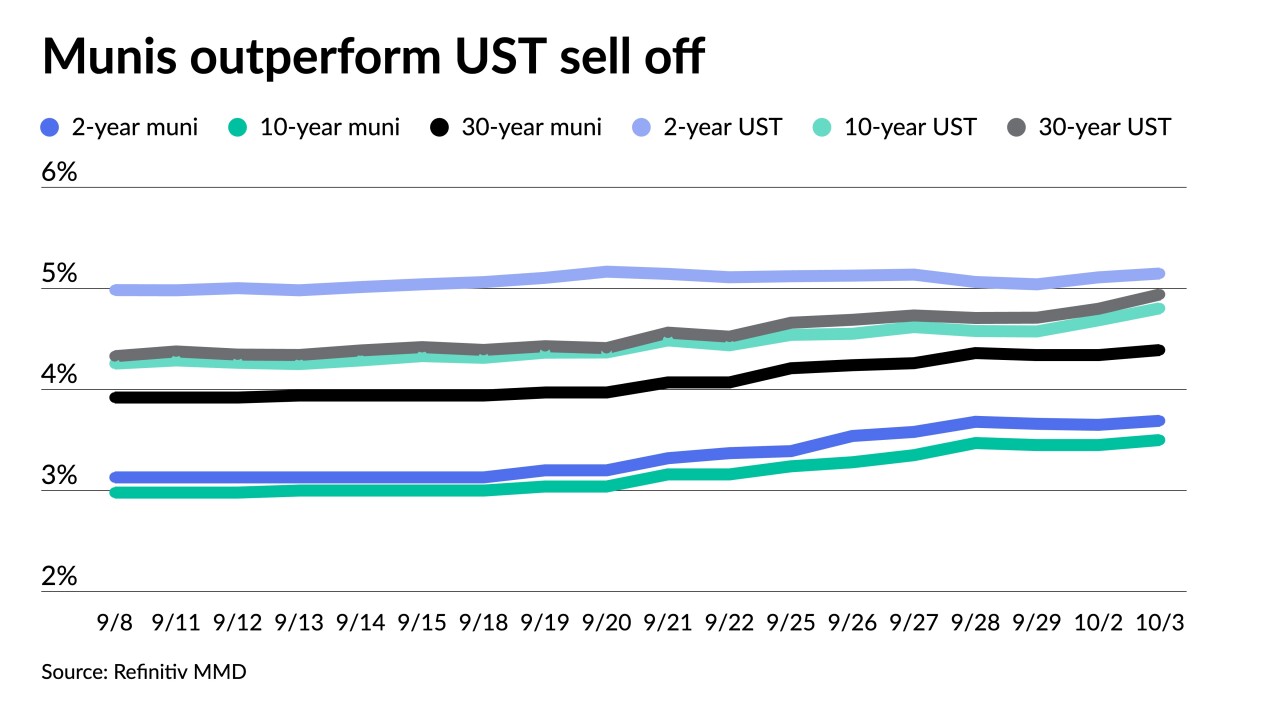

UST rates are driving all things in the muni market, said Jon Mondillo, head of North American Fixed Income at abrdn.

October 3 -

There will be "choppiness in the municipal bond market through the end of the year," said Anders S. Persson, Nuveen's chief investment officer for Global Fixed Income, and Daniel J. Close, Nuveen's head of municipals.

October 2 -

The Bloomberg Municipal Index and High-Yield Index lost 3.3% and 3.9%, respectively, in September.

September 29