-

The new-issue calendar for the holiday-shortened week is $4.98 billion, with $3.633 billion of negotiated deals and $1.347 billion of competitive loans.

February 18 -

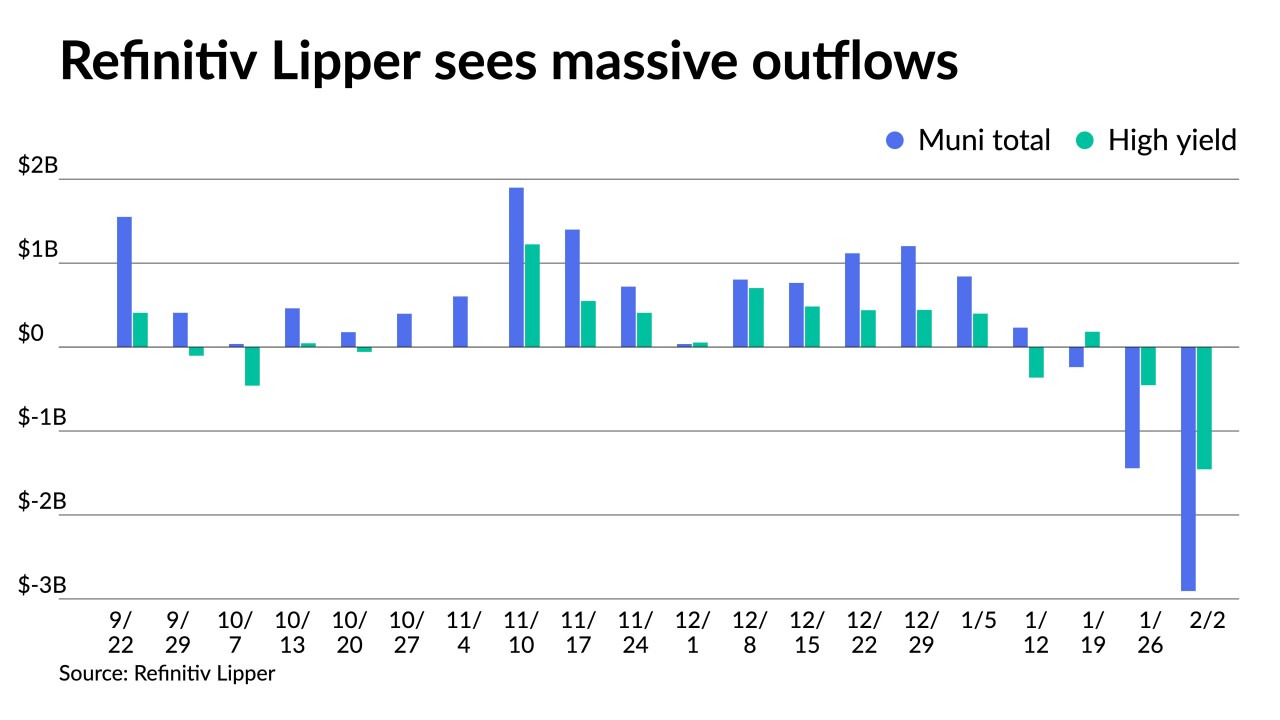

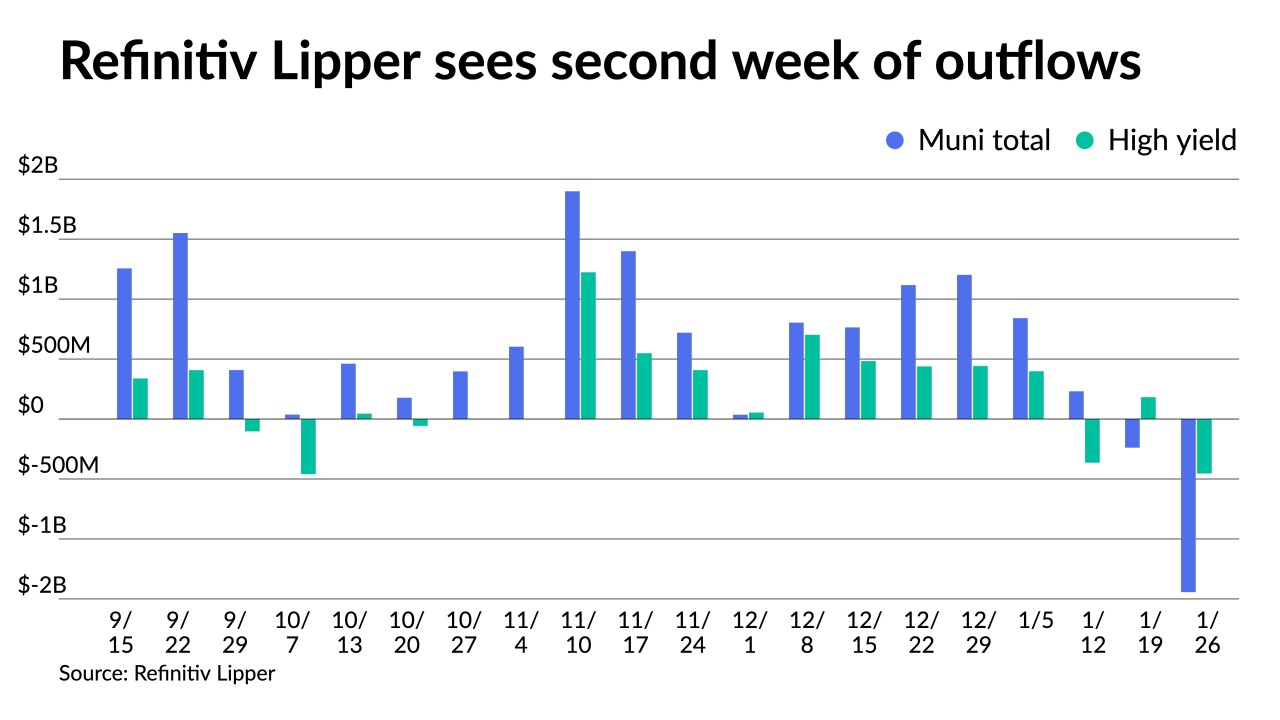

Refinitiv Lipper reported outflows after inflows of $216 million the previous week.

February 17 -

Rates could go up faster than they did in 2015 if predictions for the economy hold, minutes from the FOMC said, but the release offered no hints as to whether a 50 basis point liftoff would be considered.

February 16 -

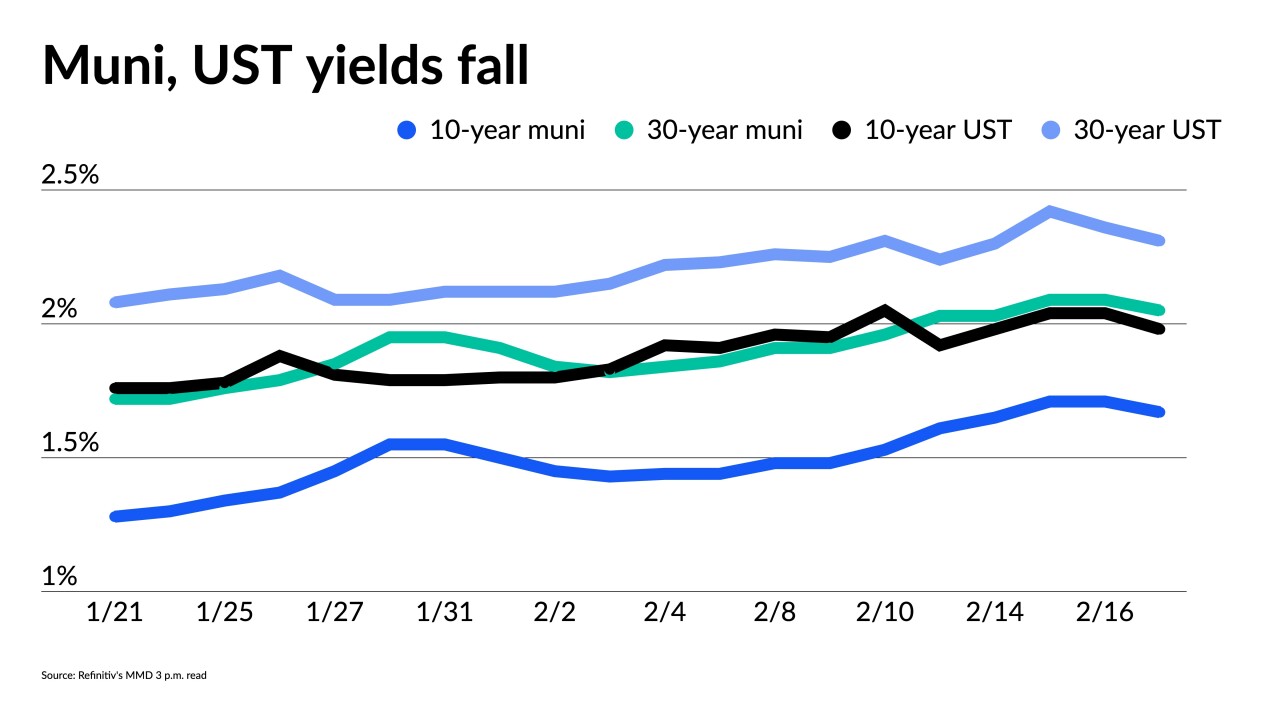

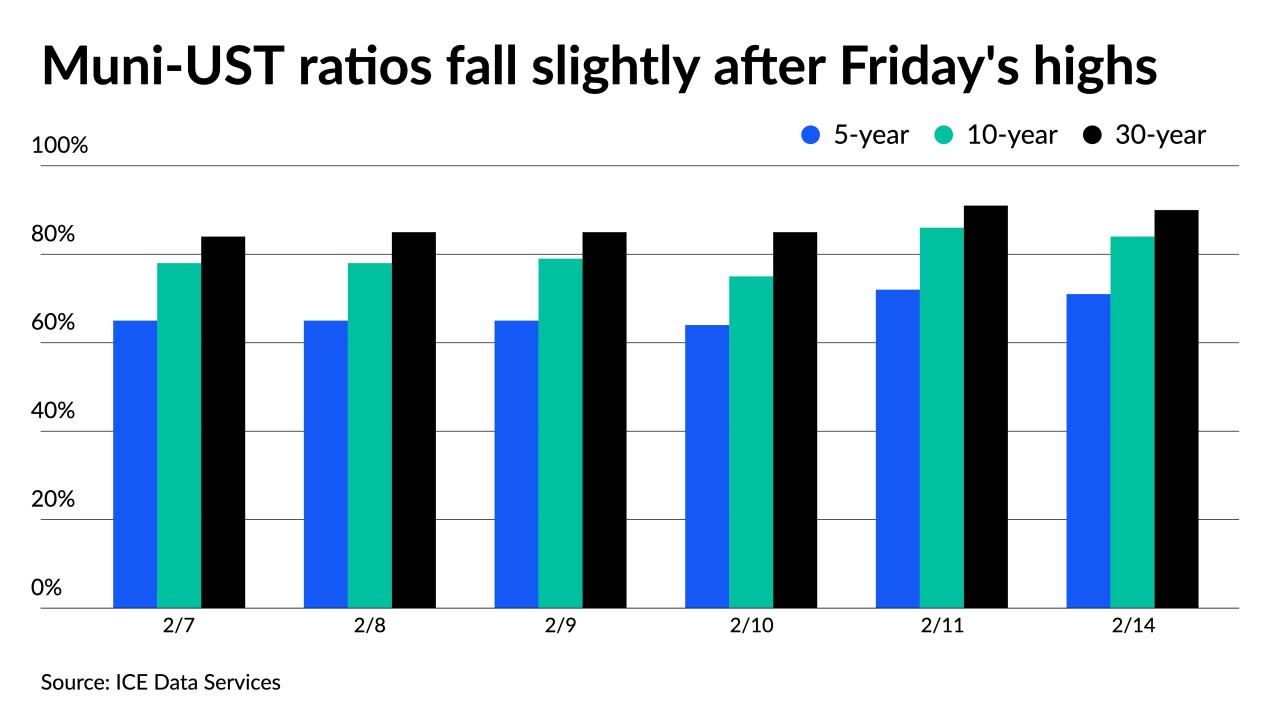

Municipal bonds' relative value has increased dramatically as rates have risen and credit fundamentals have improved, with municipal-to-Treasury ratios now on par with their five-year averages.

February 15 -

Inflation remains under market scrutiny, with Monday’s data suggesting consumers expect price pressures to cool later this year.

February 14 -

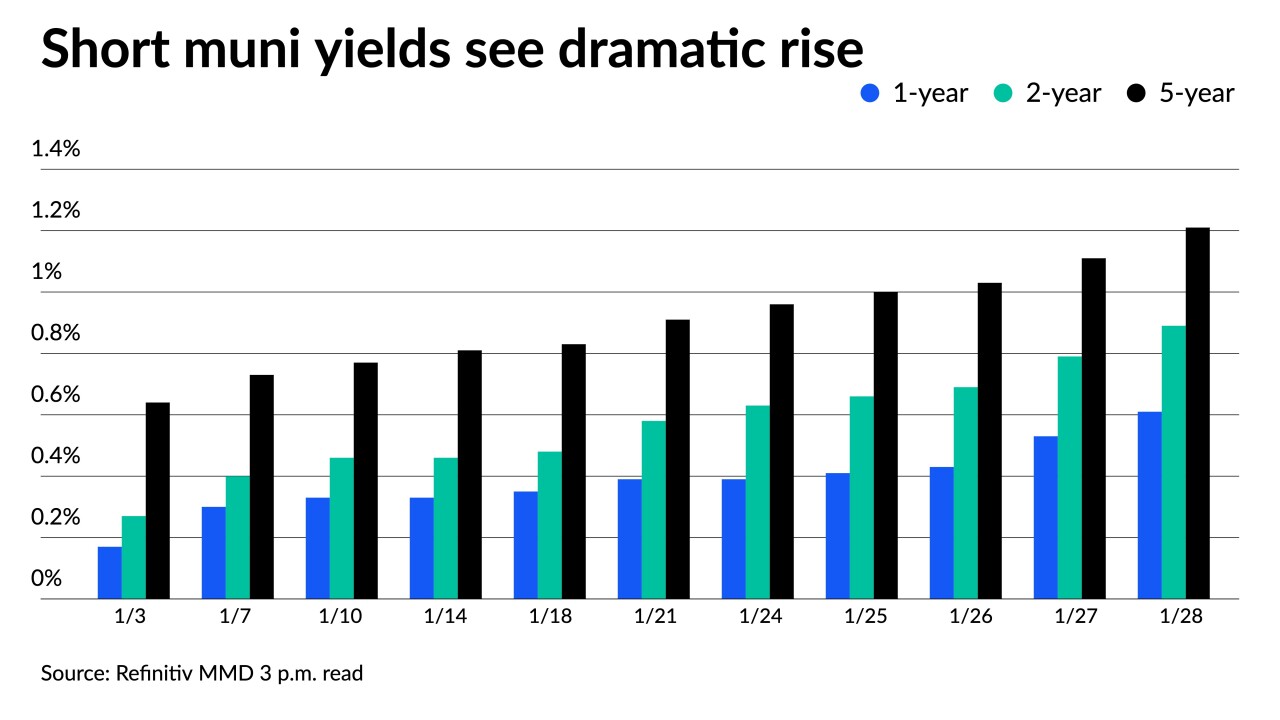

Municipal yields rose up to 10 basis points on the short end, playing catch up to the volatility of Treasuries' moves on Thursday. Rising UST rates will inevitably be more significant for munis until they settle into more stable levels.

February 11 -

Refinitiv Lipper reported the first inflows into municipal bond mutual funds at $216 million after three weeks of large outflows while high-yield saw small outflows. Exchange-traded funds reported $755 million of inflows.

February 10 -

Markets were somewhat comforted by Federal Reserve Bank of Atlanta President Raphael Bostic’s comments suggesting the Fed will not be as aggressive as the markets suspect.

February 9 -

The state of Washington sold $743 million of general obligation bonds in the competitive market at similar spreads to its November sale while some issuers have moved to the day-to-day calendar.

February 8 -

Washington will bring $742 million of general obligation bonds in competitive sales Tuesday, providing guidance for triple-A benchmark yields.

February 7 -

Municipal to UST ratios hit highs earlier in the week, creating entry points for buyers to return to the market even as ratios fell on the week. The primary will see a smaller calendar at $5.4 billion.

February 4 -

Municipals were stronger again on the day, though, and new-issues were repriced to lower yields.

February 3 -

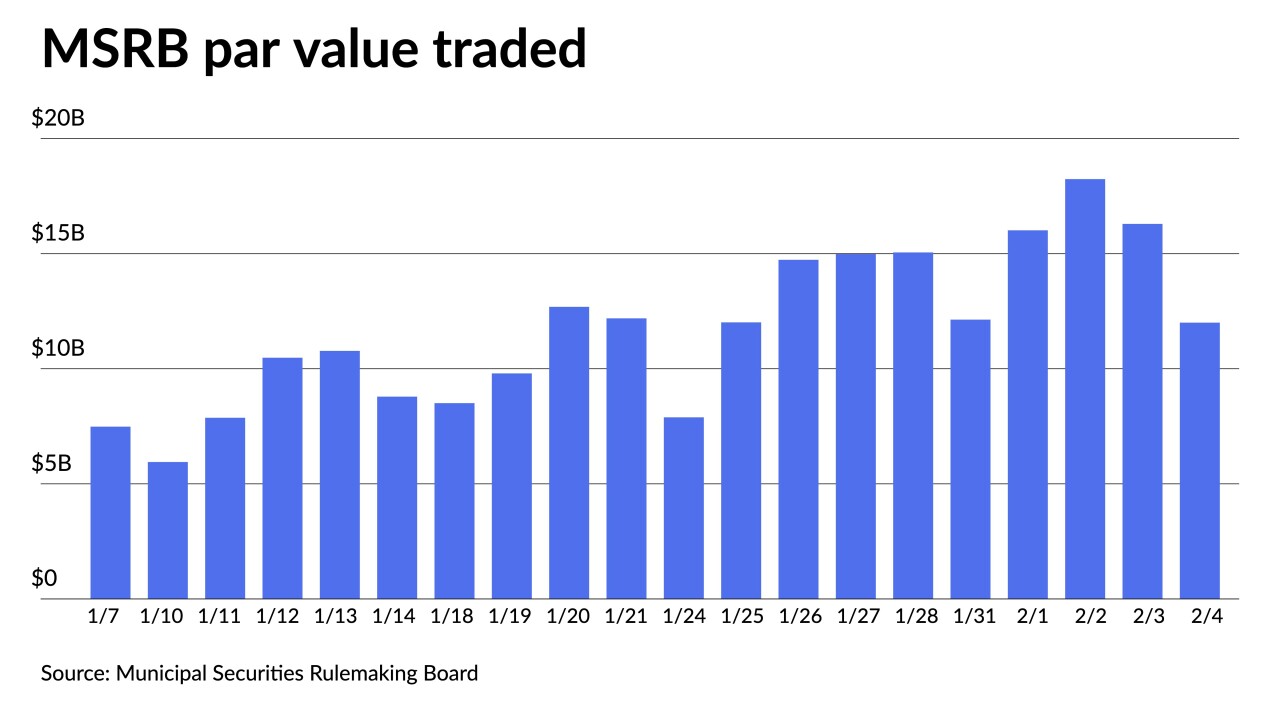

Buyers appeared to return to the market the past two sessions after the January correction moved yields and ratios higher. Secondary trading was up again on Wednesday and new deals were well-received.

February 2 -

Triple-A benchmark curves were bumped two to five basis points outside of five years as markets calmed to start February.

February 1 -

Market volatility has led to munis seeing the worst performance to start the year since 2018 and the biggest monthly losses since March 2020.

January 31 -

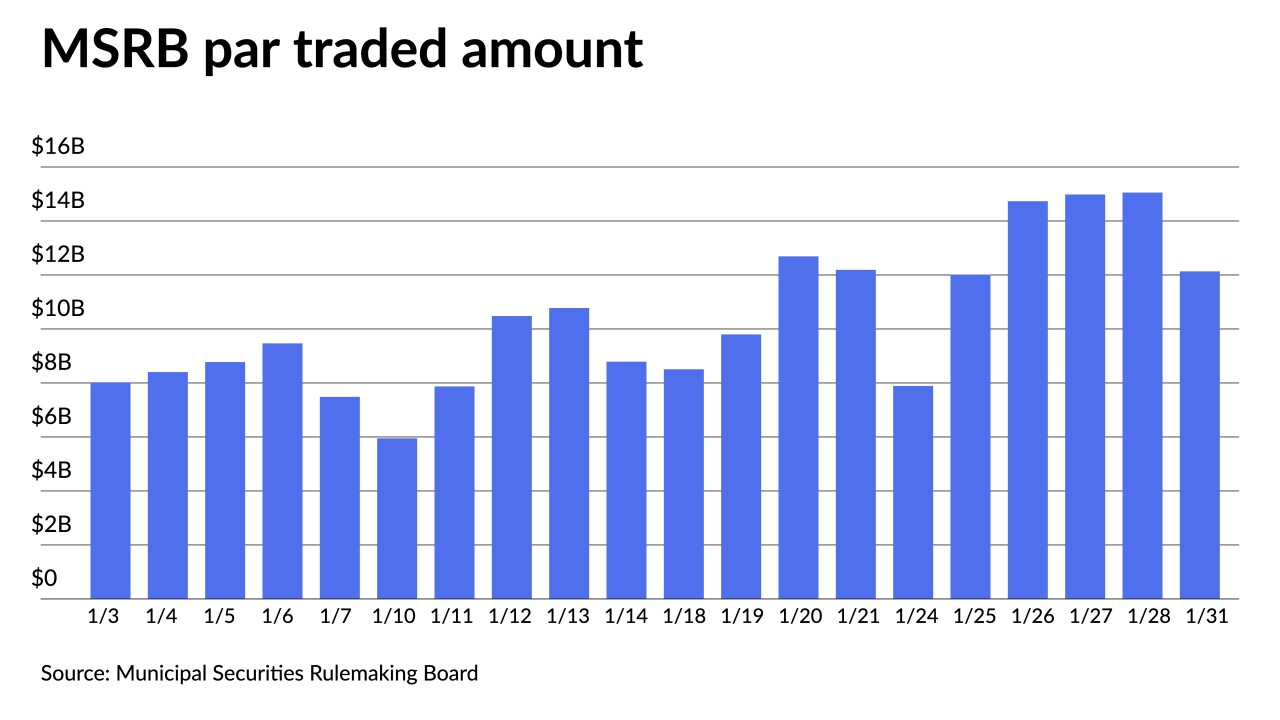

Short-end muni yields have risen more than 30 basis points on some triple-A scales over the past five trading sessions.

January 28 -

Returns are deep in the red with the Bloomberg Municipal Index at negative 1.85%, while high-yield sits at negative 1.81%.

January 27 -

The statement offered no surprises, but Fed Chair jerome Powell's refusal to denounce more hawkish scenarios hurt market sentiment.

January 26 -

Triple-A benchmarks were cut two to six basis points across the curve with the largest moves concentrated again on bonds inside 10 years, underperforming Treasuries once again.

January 25 -

Munis are expected to underperform for another few weeks as markets remain volatile and investors reevaluate allocations.

January 24