-

Returns are deep in the red with the Bloomberg Municipal Index at negative 1.85%, while high-yield sits at negative 1.81%.

January 27 -

The statement offered no surprises, but Fed Chair jerome Powell's refusal to denounce more hawkish scenarios hurt market sentiment.

January 26 -

Triple-A benchmarks were cut two to six basis points across the curve with the largest moves concentrated again on bonds inside 10 years, underperforming Treasuries once again.

January 25 -

Munis are expected to underperform for another few weeks as markets remain volatile and investors reevaluate allocations.

January 24 -

The combination of steady supply, heavy secondary selling and inconsistent demand have moved yields to their highest levels since May 2020.

January 21 -

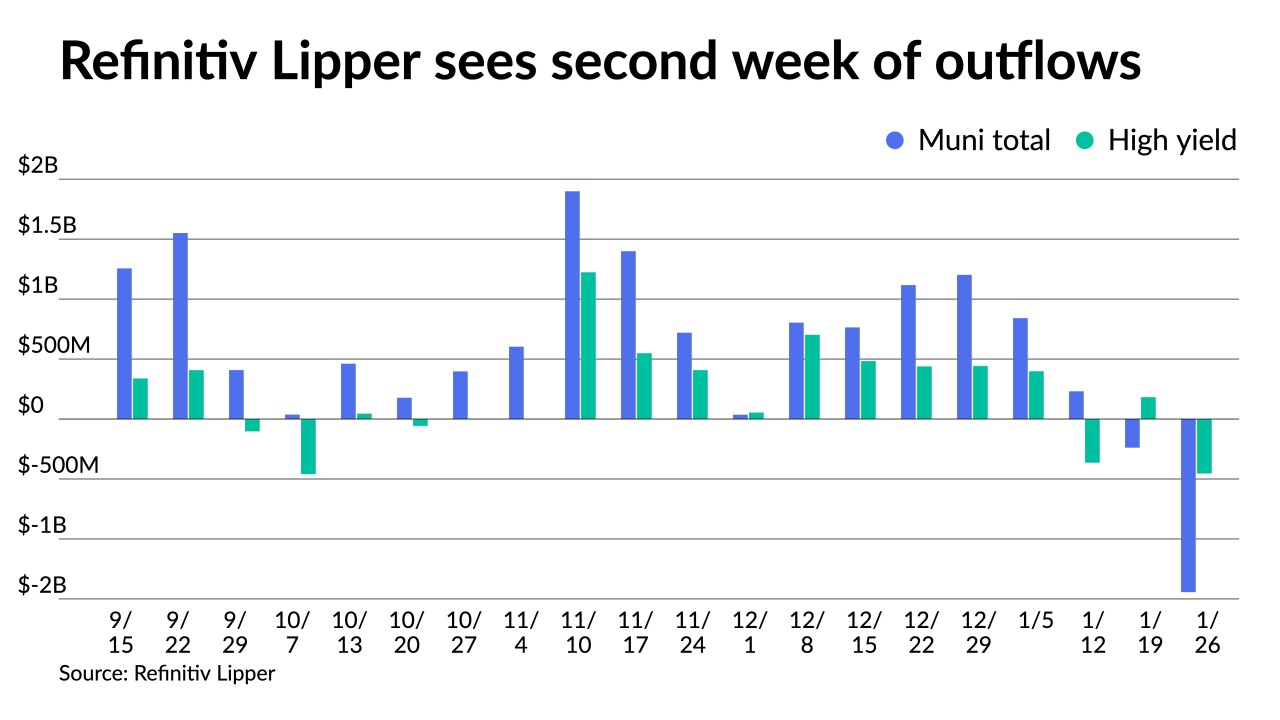

Refinitiv Lipper reported $238.926 million of outflows, but $182.035 million of inflows to high-yield, reversing last week's outflows. New-issues faced concessions.

January 20 -

The Investment Company Institute reported a large drop of inflows into municipal bond mutual funds at $142 million in the week ending Jan. 12, down from $1.413 billion in the previous week.

January 19 -

The 2-, 5- and 10-year UST is higher than before the pandemic began as investors factor in a rate hike as soon as March.

January 18 -

The largest deal of the week comes from the New York City Transitional Finance Authority with $950 million of exempts and $250 million of taxables.

January 14 -

For investors in the municipal bond market, 2021 proved to be a year of hurdles. This is likely to change, particularly for investors in the municipal bond market.

January 14 Cannon Advisors

Cannon Advisors