-

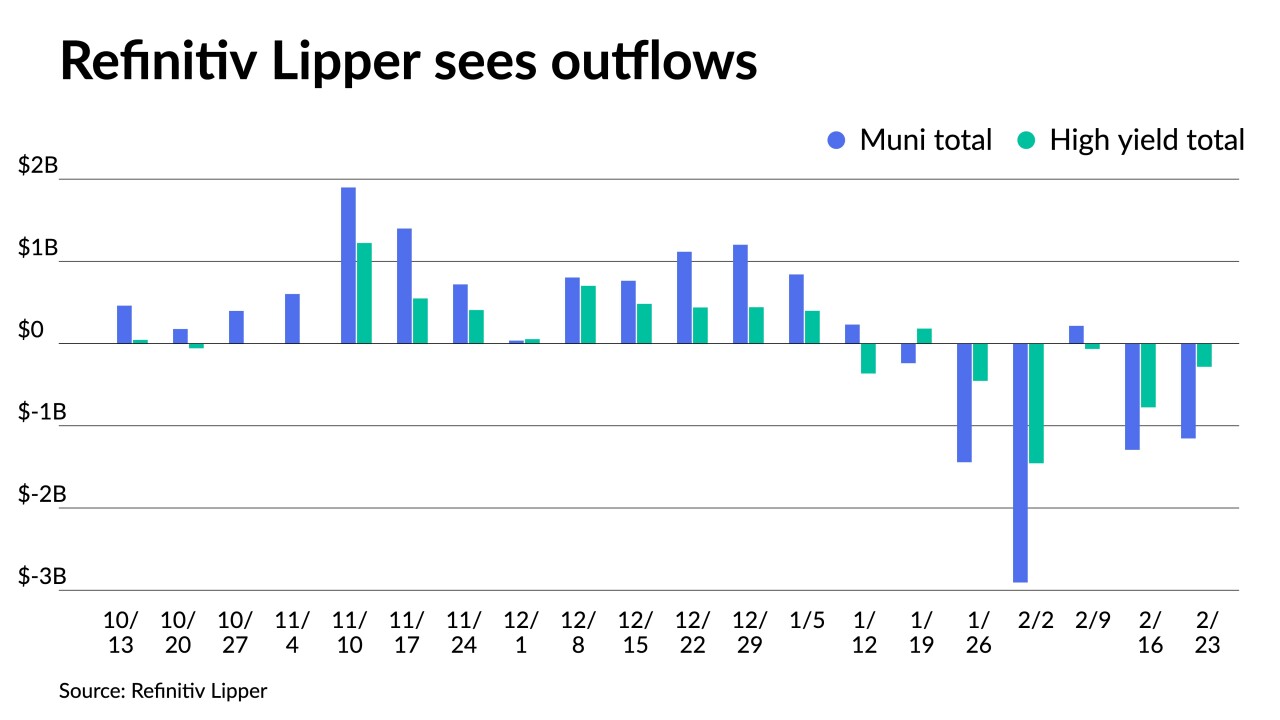

Investors yanked $1.154 billion out of municipal bond mutual funds in the latest week, Refinitiv Lipper reported.

February 24 -

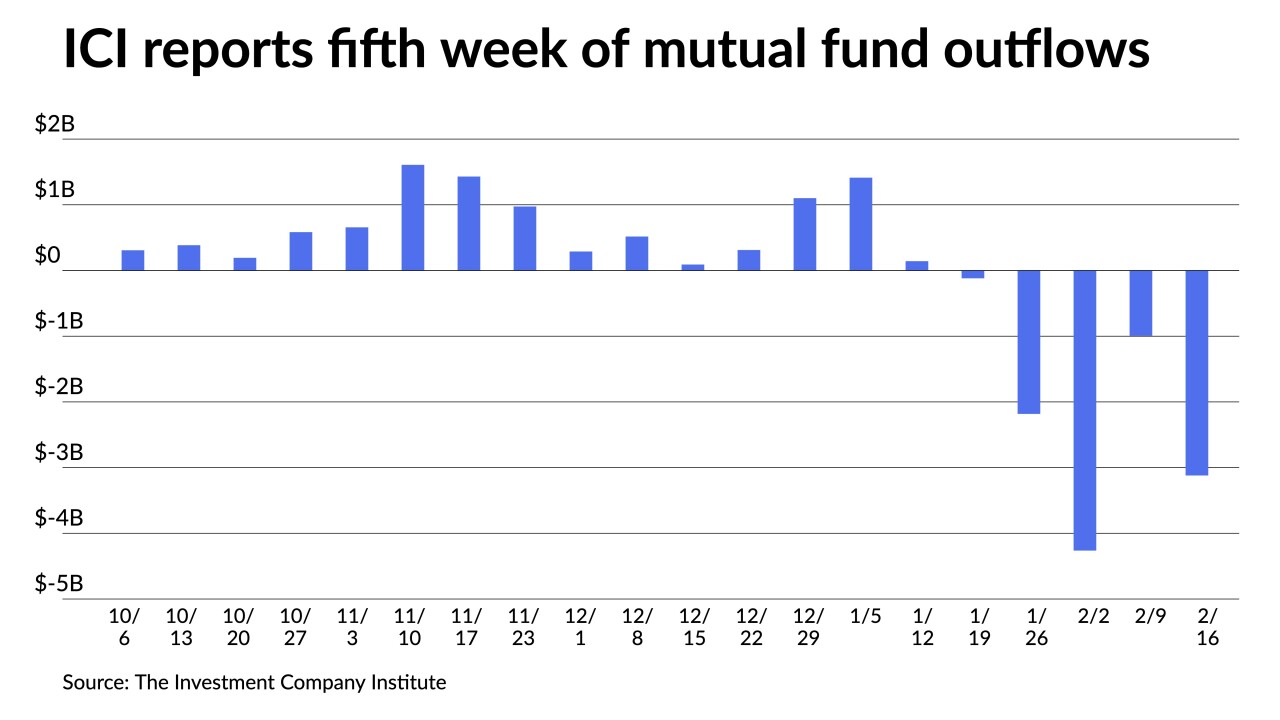

The Investment Company Institute on Wednesday reported $3.120 billion of outflows in the week ending Feb. 16, up from $993 million of outflows in the previous week.

February 23 -

Between the long holiday weekend and investors trying to absorb the Russia-Ukraine developments, it was a slow start to the week in the municipal market.

February 22 -

Municipals have been resilient throughout the pandemic — with the help of federal aid — keeping the Golden Age for public finance alive.

February 22 -

The new-issue calendar for the holiday-shortened week is $4.98 billion, with $3.633 billion of negotiated deals and $1.347 billion of competitive loans.

February 18 -

Refinitiv Lipper reported outflows after inflows of $216 million the previous week.

February 17 -

Rates could go up faster than they did in 2015 if predictions for the economy hold, minutes from the FOMC said, but the release offered no hints as to whether a 50 basis point liftoff would be considered.

February 16 -

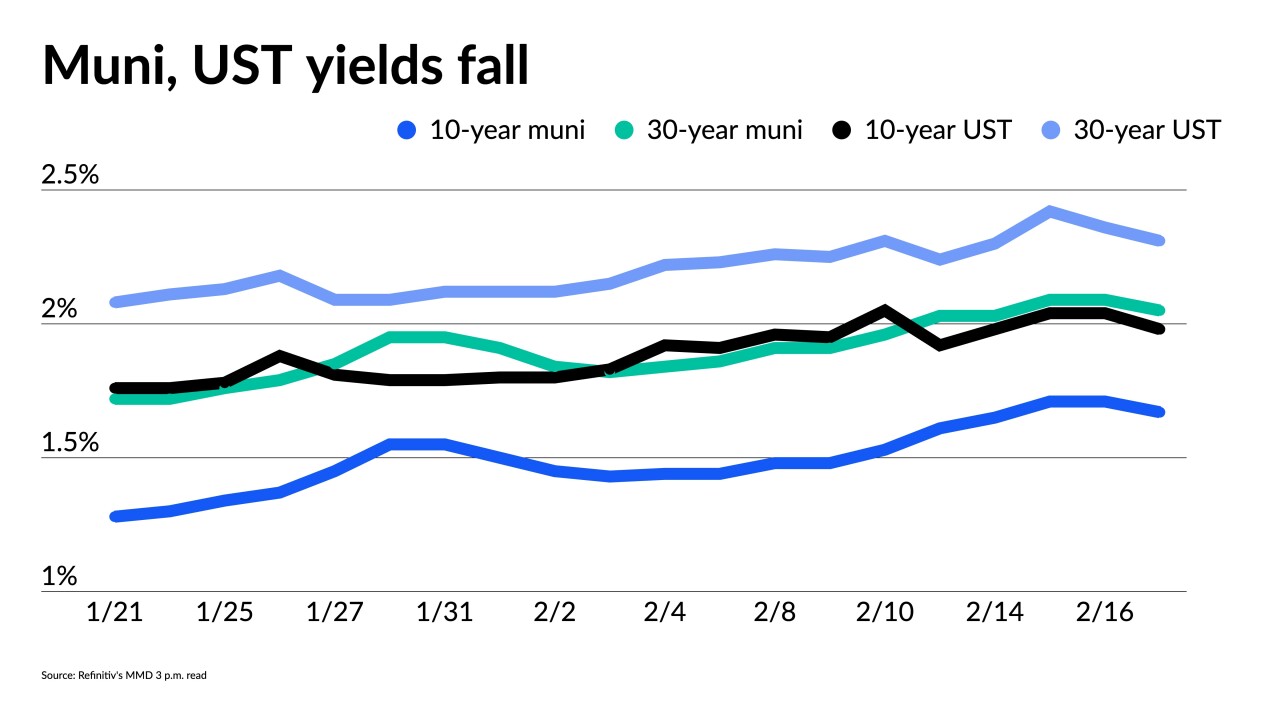

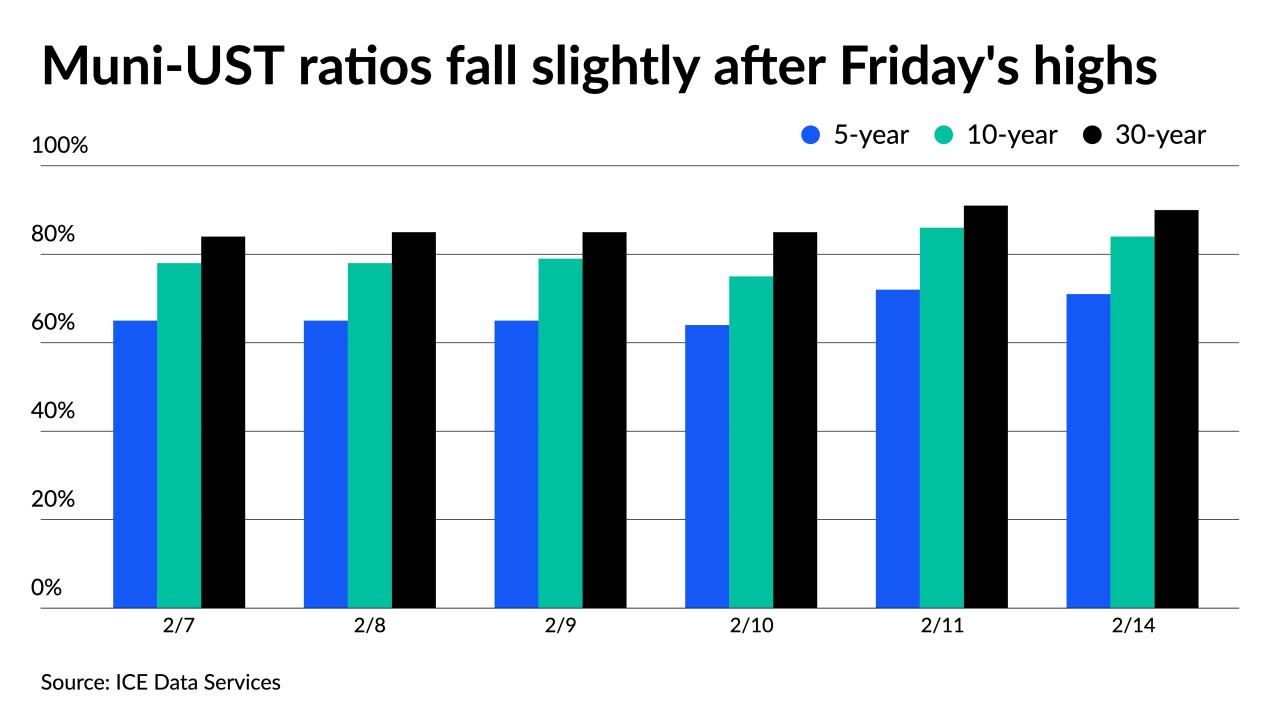

Municipal bonds' relative value has increased dramatically as rates have risen and credit fundamentals have improved, with municipal-to-Treasury ratios now on par with their five-year averages.

February 15 -

Inflation remains under market scrutiny, with Monday’s data suggesting consumers expect price pressures to cool later this year.

February 14 -

Municipal yields rose up to 10 basis points on the short end, playing catch up to the volatility of Treasuries' moves on Thursday. Rising UST rates will inevitably be more significant for munis until they settle into more stable levels.

February 11