-

ICE TMC, part of ICE Bonds, provides market participants access to an all-to-all market for trading munis and other bonds.

November 7 -

Investors will be greeted Monday with a new-issue calendar estimated at $5.268 billion.

November 4 -

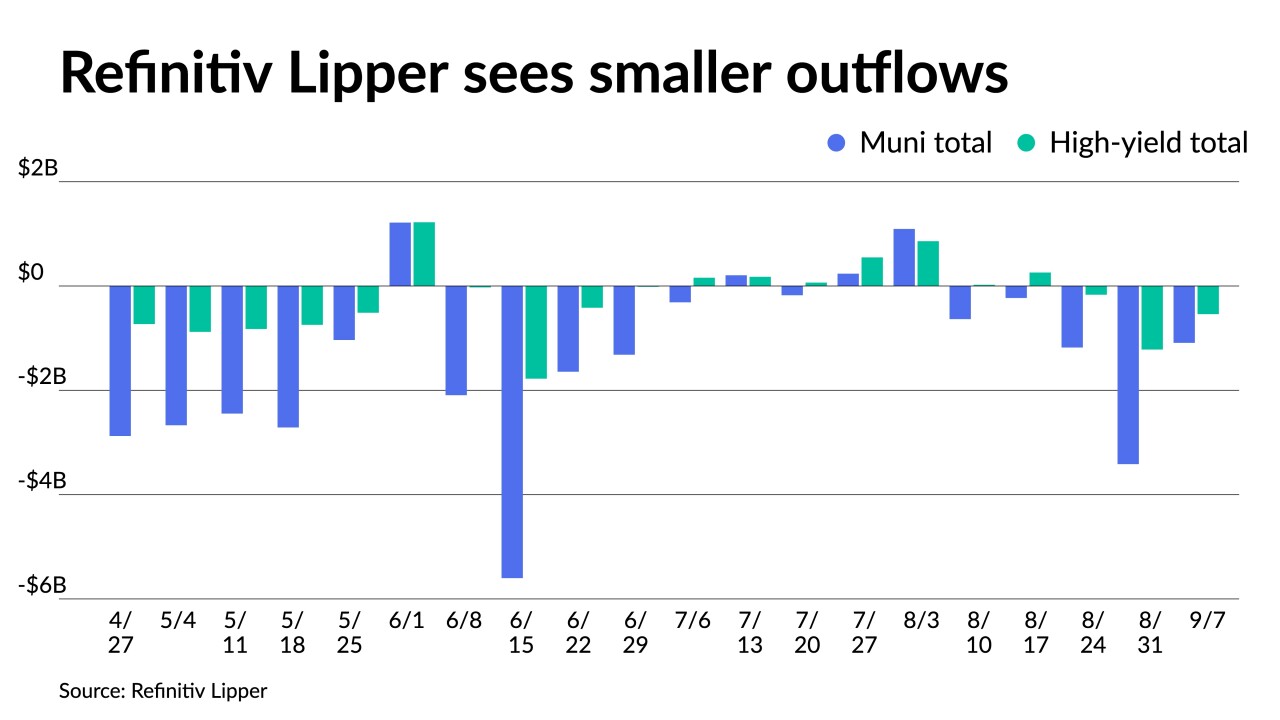

High-yield saw outflows of $867.067 million after $594.497 million of outflows the week prior while exchange-traded funds saw inflows of $736.967 million after $444.544 million of inflows the previous week.

November 3 -

Investors pulled $3.843 billion from mutual funds in the week ending Oct. 26 after $3.876 billion of outflows the previous week, according to ICI.

November 2 -

October returns were in the red with the Bloomberg Municipal Index showing a loss of 0.83% for the month, bringing total losses in 2022 to 12.86%. Only May and July saw positive returns for the asset class.

November 1 -

With the Federal Open Market Committee meeting this week and the next week shortened by the bond market observance of Veterans Day, CreditSights strategists said "investors should be prepared for two weeks of subdued new issuance."

October 31 -

The upcoming Federal Open Market Committee meeting on Tuesday and Wednesday has led to a lighter new-issue calendar with $2.72 billion on tap.

October 28 -

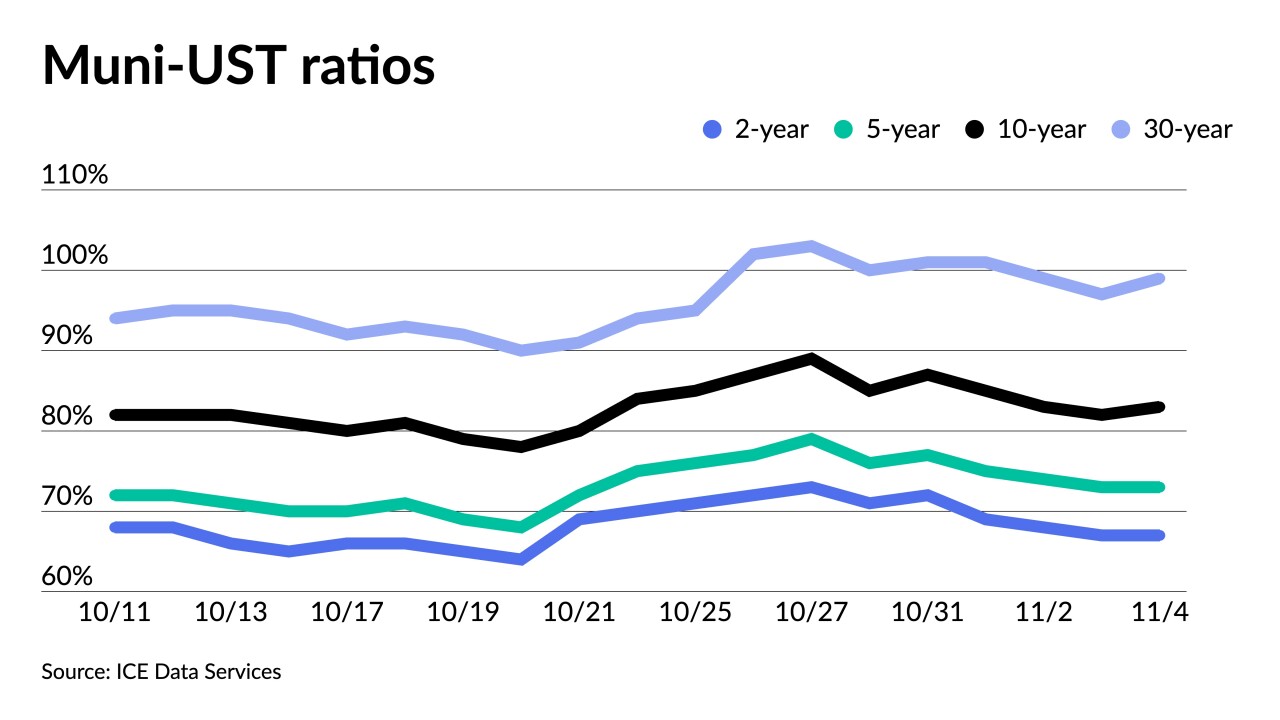

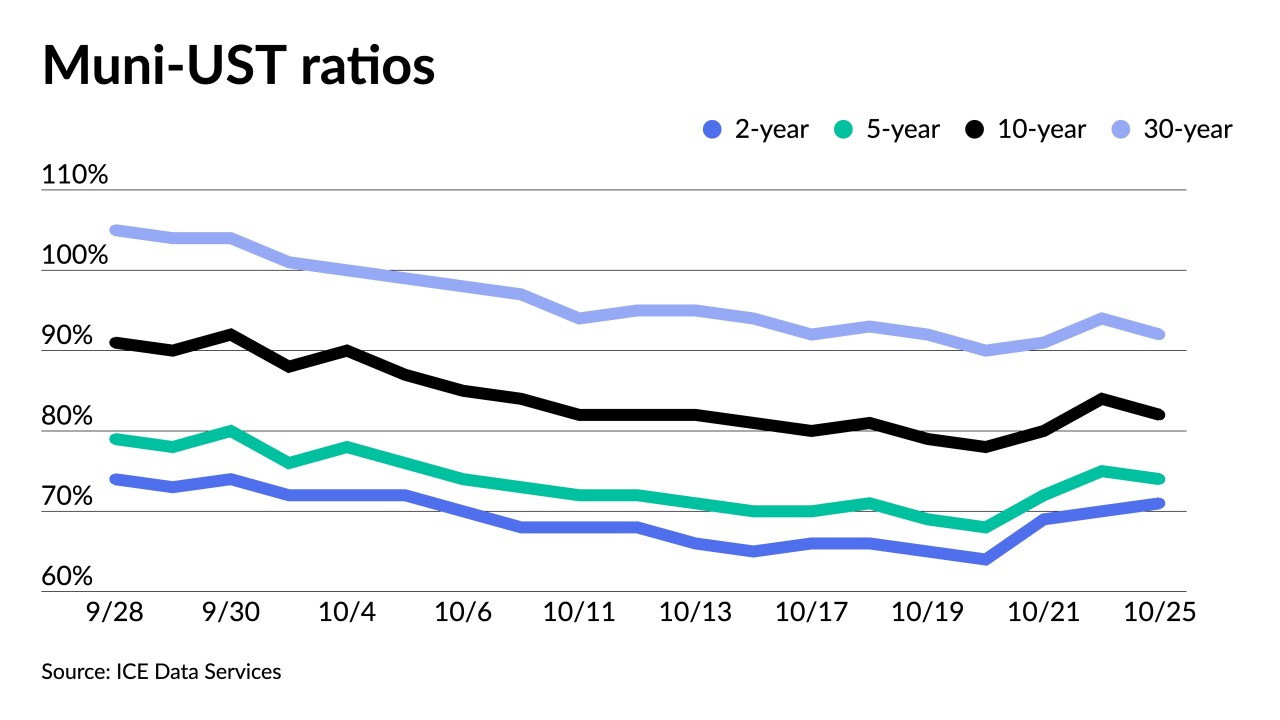

Municipal to UST ratios have risen this week with the 10-year approaching 90% and the 30-year topping 100%.

October 27 -

Outflows continued as investors pulled $3.876 billion from mutual funds in the week ending Oct. 19 after $4.532 billion of outflows the previous week, according to the Investment Company Institute.

October 26 -

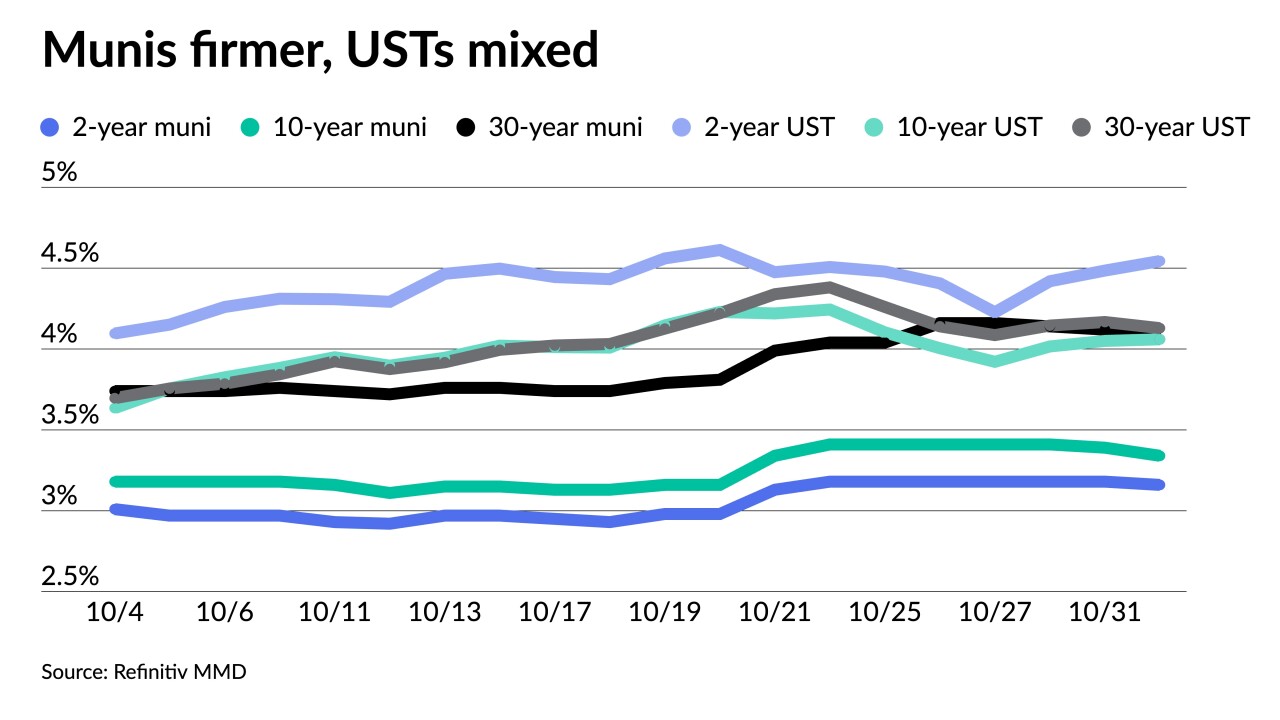

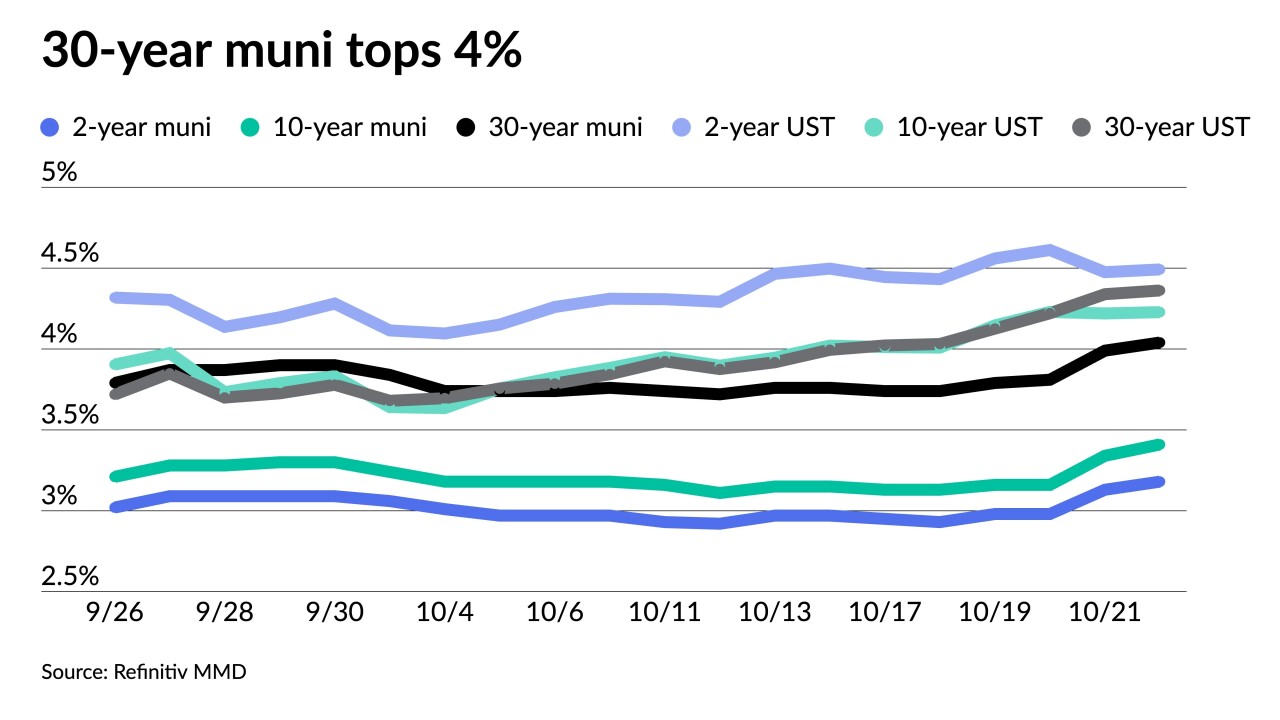

While muni performance has turned negative for October, "the asset class is significantly outperforming UST," said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

October 25 -

"Municipal market performance has improved, but the bumpy road continues as investors remain uncertain about the interest rate environment," said Nuveen's Head of Municipals John Miller.

October 24 -

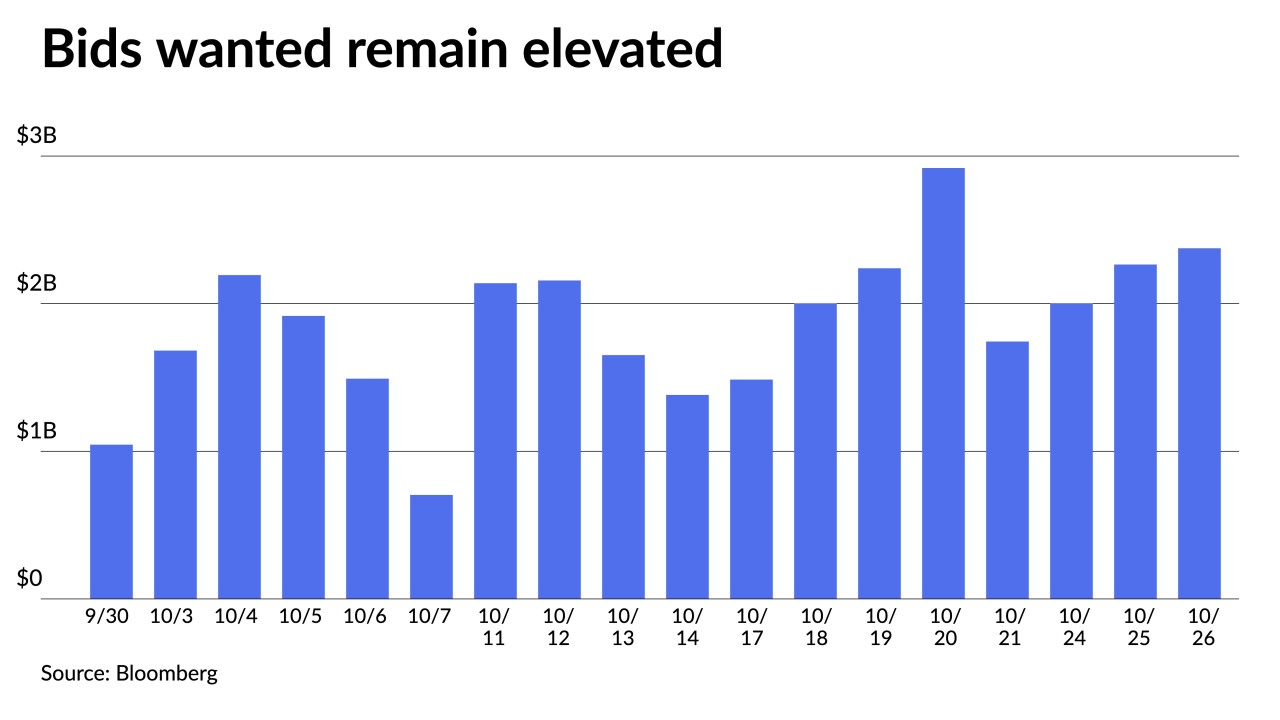

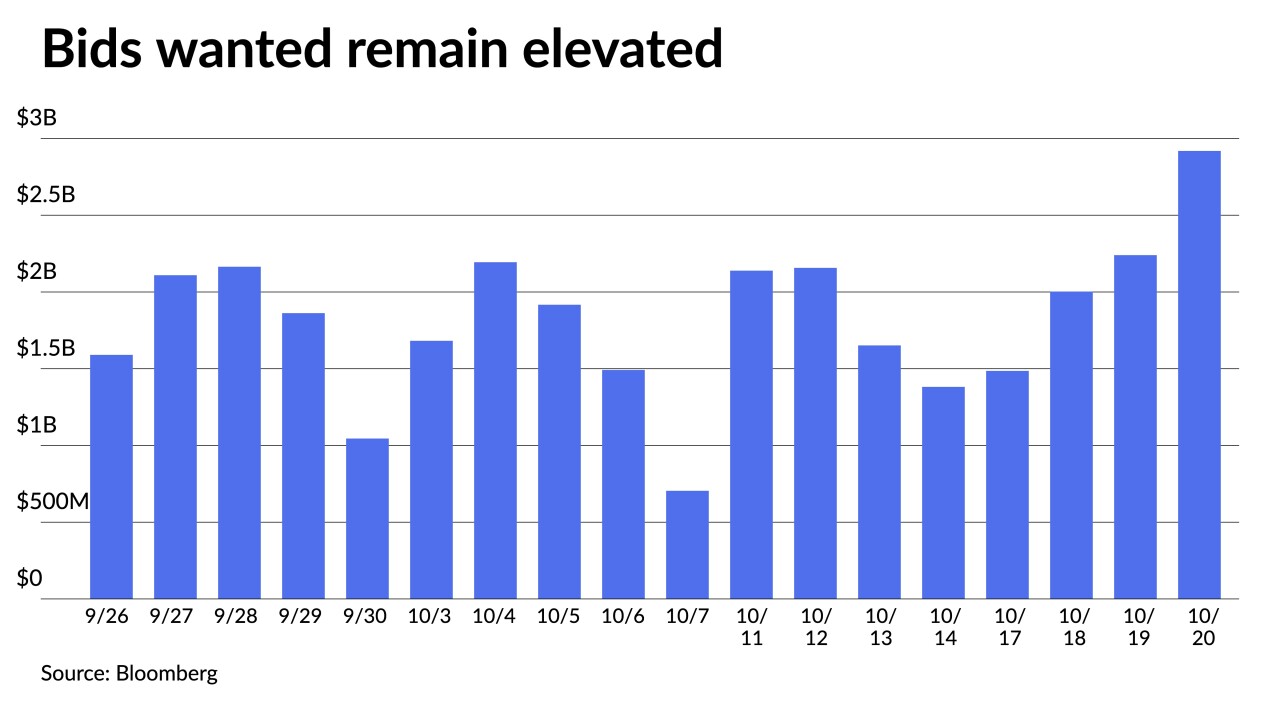

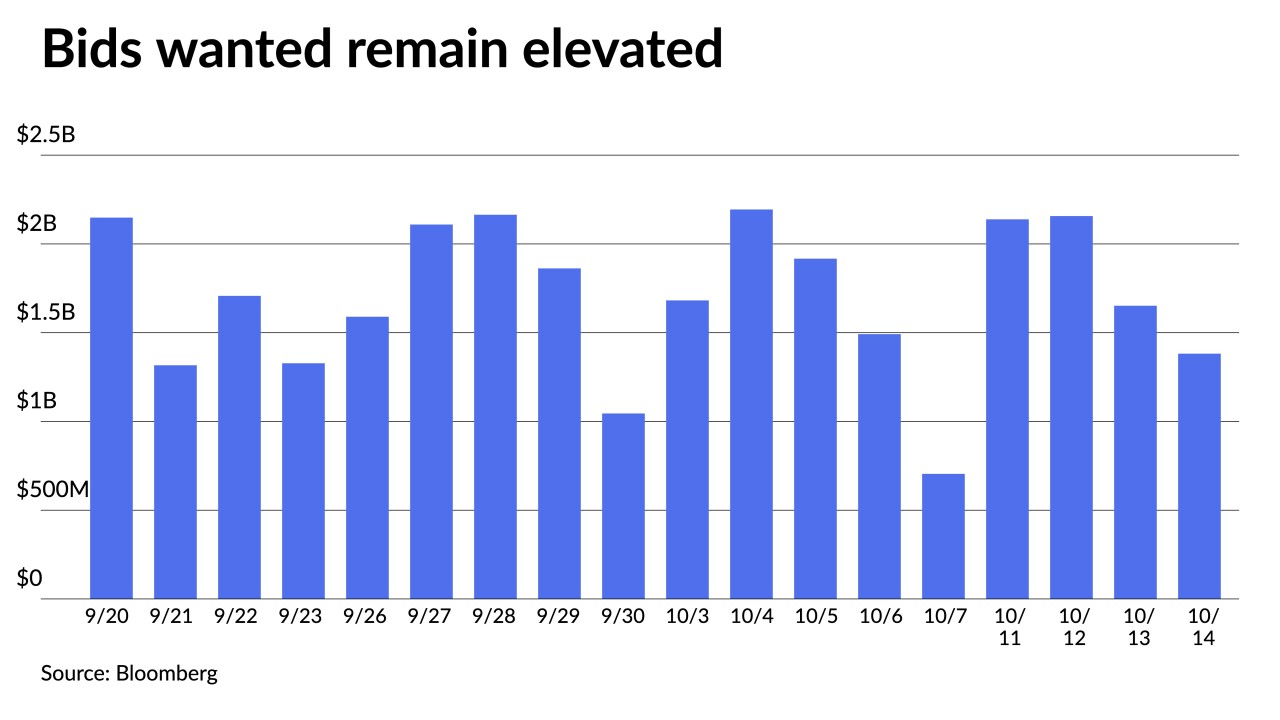

Selling pressure was on the rise again this week. Thursday's $2.919 billion of bonds out for the bid was only surpassed on March 19, 2020, when they hit $4.115 billion. A larger calendar closes out October.

October 21 -

"The curve slope has undergone a massive flattening this year and recent trends suggest demand pockets are developing in specific ranges," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

October 20 -

Outflows continued as investors pulled $4.532 billion from mutual funds in the week ending Oct. 12 after $5.172 billion of outflows the previous week, according to the Investment Company Institute.

October 19 -

Triple-A curves were a touch firmer in spots as secondary trading took a backseat to the larger primary activity with Connecticut and Massachusetts pricing general obligation bonds, a large CommonSpirit healthcare and several competitive issues led by Rhode Island GOs.

October 18 -

Volume rebounds eightfold this week with a new-issue calendar of $8.5 billion, including several billion-dollar deals.

October 17 -

"Despite a pick-up in volatility in the rates market, municipals have been performing relatively well in October," according to Barclays PLC.

October 14 -

Refinitiv Lipper reported $2.262 billion of outflows from municipal bond mutual funds for the week ending Wednesday after $2.057 billion the week prior.

October 13 -

The Investment Company Institute reported $5.128 billion of outflows for the week ending Oct. 5 after $5.374 billion of outflows the previous week.

October 12 -

Munis are in the black so far in October and some participants see signs of continued improvement.

October 11