-

"Munis are poised to continue this rally into December as we can end 2022 on a high note and close out the worst-performing year on record for munis," said Jason Wong, vice president of municipals at AmeriVet Securities.

December 5 -

Investors will be greeted Monday with a new-issue calendar estimated at $5.893 billion.

December 2 -

Munis saw the best performance in November in decades, with the asset class ending in the positive by 4.68%. The MSRB reported that trading volume reached another record in November, with 1.29 million municipal trades.

December 1 -

Powell said smaller interest rate increases are likely ahead — and could start as early as next month.

November 30 -

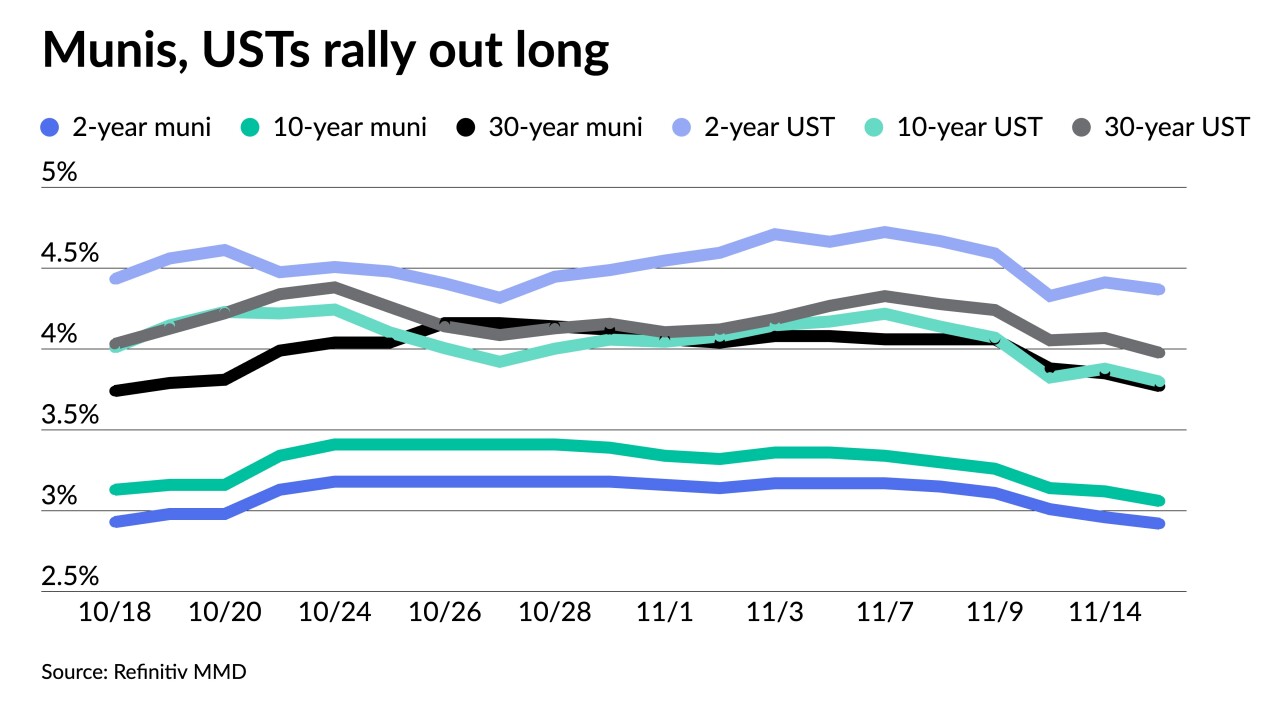

Tax-exempt munis have now regained late September levels, and November's rally has eclipsed October's selloff, MMA notes in a weekly report.

November 29 -

The Bloomberg Municipal Index is at positive 4.06% as of Friday. Bloomberg indices show high-yield returning 4.17%, taxable munis returning 4.38% in November while the Impact Index is at positive 4.66%.

November 28 -

Markets took the news that it will soon be appropriate to increase the Fed funds target rate at a slower pace as good news.

November 23 -

Lower supply in 2022 has somewhat helped the market avoid larger losses, many participants have said.

November 22 -

The negotiated calendar this week is very light due to the Thanksgiving holiday, with only four deals above $100 million.

November 21 -

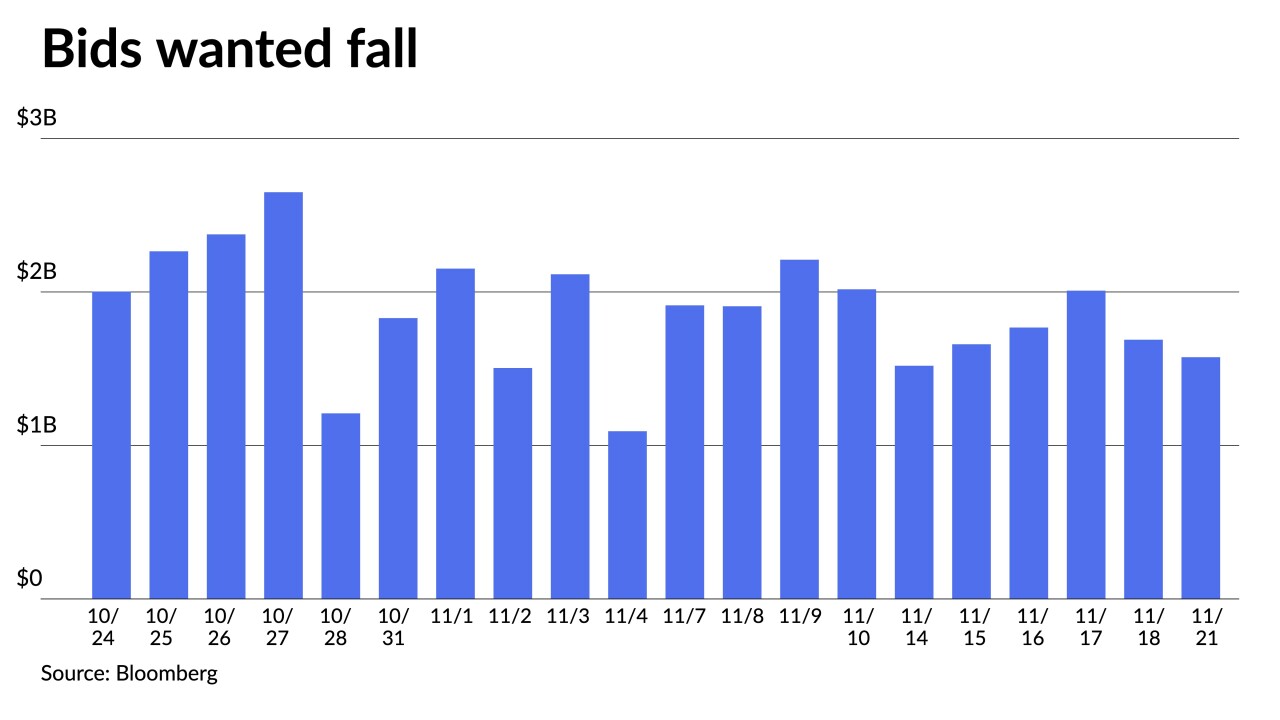

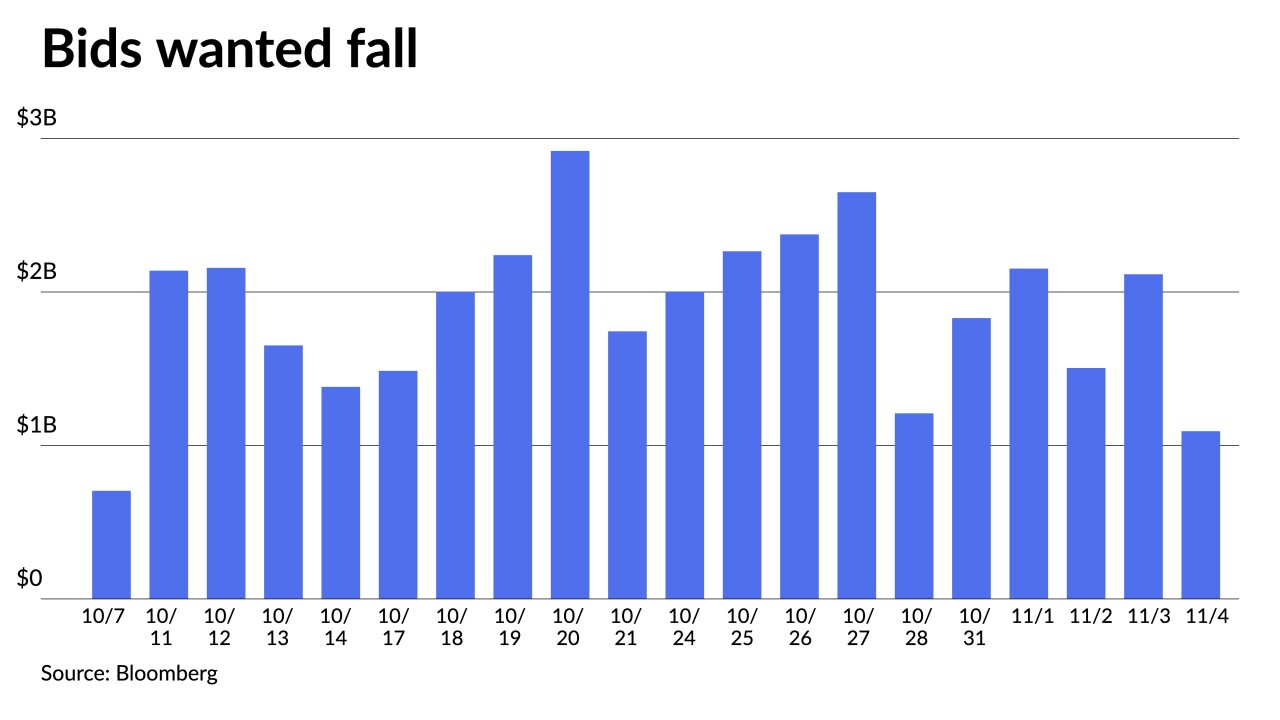

Issuance shrinks to $722 million while Bond Buyer 30-day visible supply sits at little more than $7 billion.

November 18 -

Municipals improved again Thursday, pushing the 10-year yield firmly below 3%, while Refinitiv Lipper reported $604.704 million of inflows into municipal bond mutual funds for the week ending Wednesday.

November 17 -

Investment bank expands with three former Citigroup muni veterans at the helm.

November 17 -

As market participants navigate through the remaining weeks of 2022, Jeff Lipton, managing director of credit research at Oppenheimer Inc., expects munis to maintain their outperformance over USTs

November 16 -

Triple-A yields fell five to eight basis points while UST saw yields fall up to nine out long, moving the 30-year UST below 4% for the first time since mid-October.

November 15 -

Illinois raised its fiscal 2023 revenue estimates by $3.69 billion, giving Gov. J.B. Pritzker enough to propose doubling the state's $1 billion rainy day fund.

November 15 -

Munis were in their own lane while broader markets were mixed Monday as participants digested various Fed officials' comments on inflation and rate hike schedules.

November 14 -

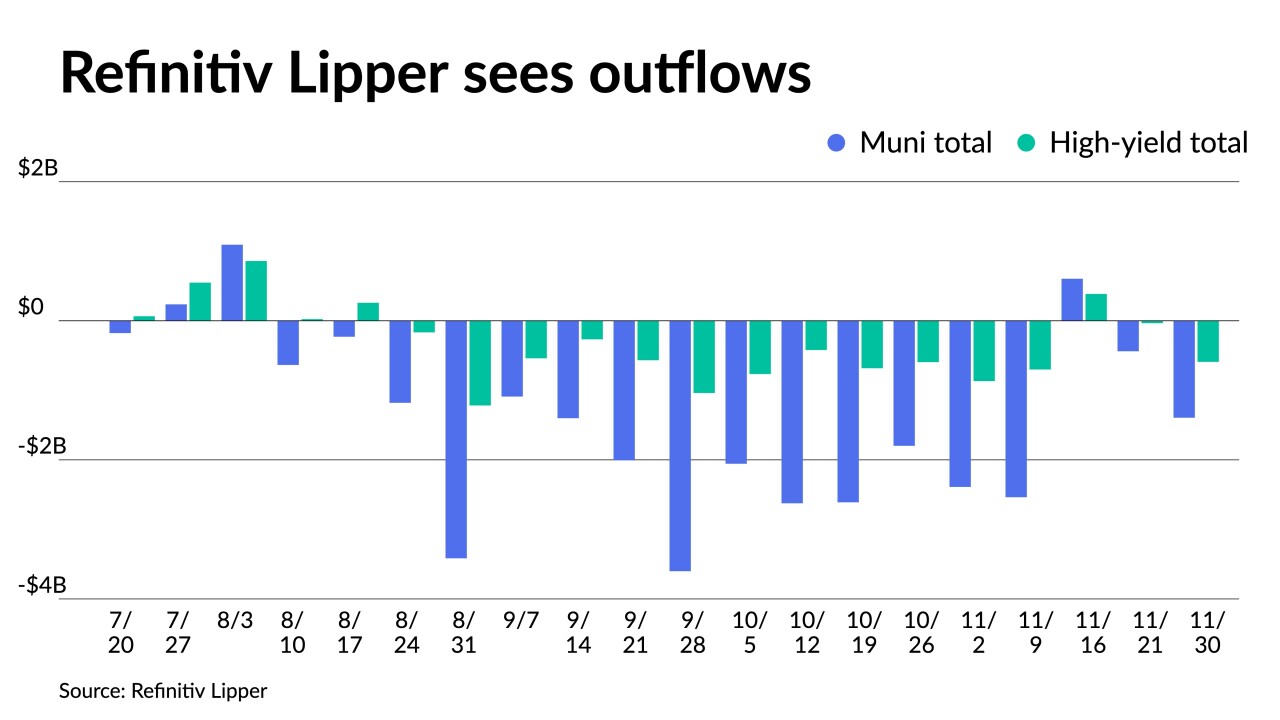

Refinitiv Lipper reported $2.537 billion of outflows from municipal bond mutual funds for the week ending Wednesday after $2.389 billion the week prior.

November 10 -

Municipal bond mutual funds saw more losses on Wednesday with the Investment Company Institute reporting another week of multi-billion-dollar outflows, bringing year-to-date losses to $123.3 billion.

November 9 -

The market has seen outflows for 13 straight weeks, per Refinitiv Lipper, but Nuveen strategists Anders S. Persson and John V. Miller said "selling is due primarily to investors harvesting tax losses."

November 8 -

Voters will decide on more than $60 billion of bond ballot measures Tuesday with New York voters faced with the largest amount at $4.2 billion.

November 7