-

Even after investors received an infusion of $18 billion of matured and called bond proceeds on Sept. 1, muni prices have continued to weaken, note CreditSights strategists Pat Luby and John Ceffalio.

September 12 -

The calendar for the week of Sept. 12 is at $6.6 billion while Bond Buyer 30-day visible supply sits at $14.15 billion.

September 9 -

Outflows from municipal bond mutual funds receded as investors pulled $1.090 billion out of funds in the latest week, versus the $3.416 billion of outflows the prior week, according to Refinitiv Lipper data.

September 8 -

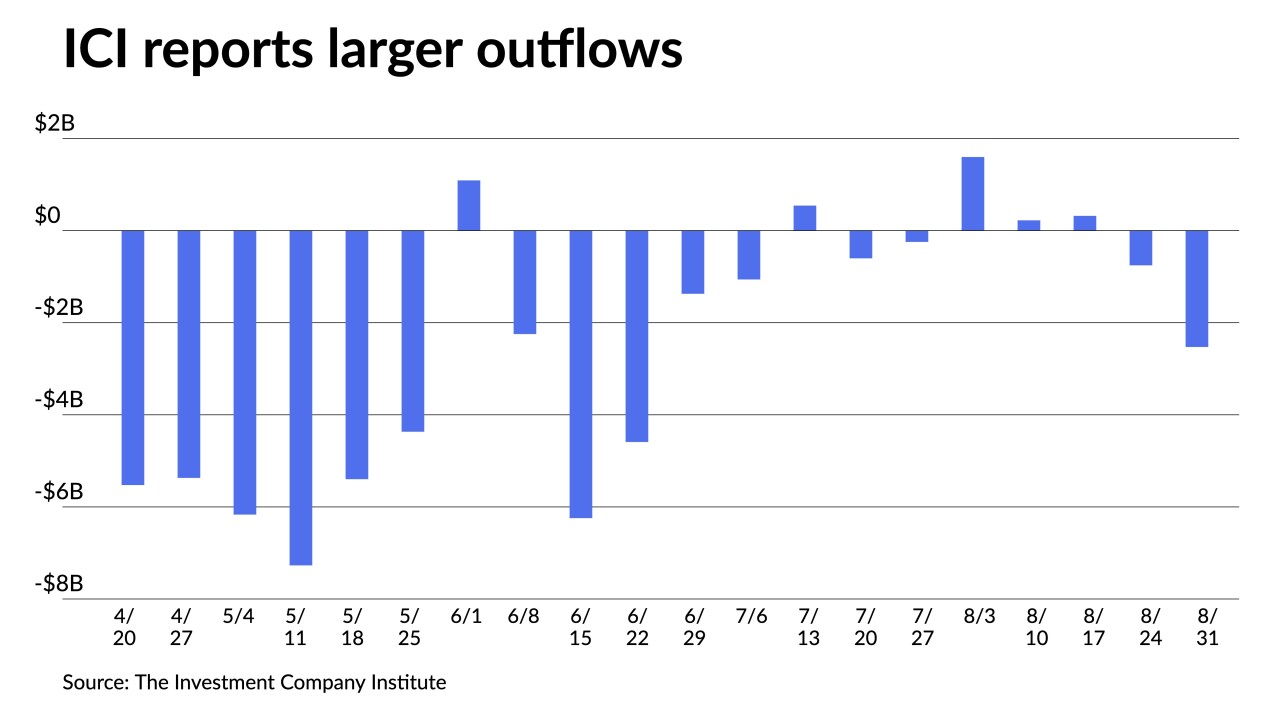

The Investment Company Institute reported $2.527 billion of outflows from muni bond mutual funds in the week ending Aug. 31 compared to $765 million of outflows the previous week.

September 7 -

The muni market may get a temporary boost of support this week as investors received $18 billion of maturing and called bond proceeds on Sept. 1.

September 6 -

Investors will be greeted Tuesday with a larger new-issue calendar, estimated at $6.087 billion, up from total sales of $5.551 billion in the week of Aug. 29.

September 2 -

The Investment Company Institute reported $755 million of outflows from muni bond mutual funds in the week ending August 24 compared to $320 million of inflows the previous week.

August 31 -

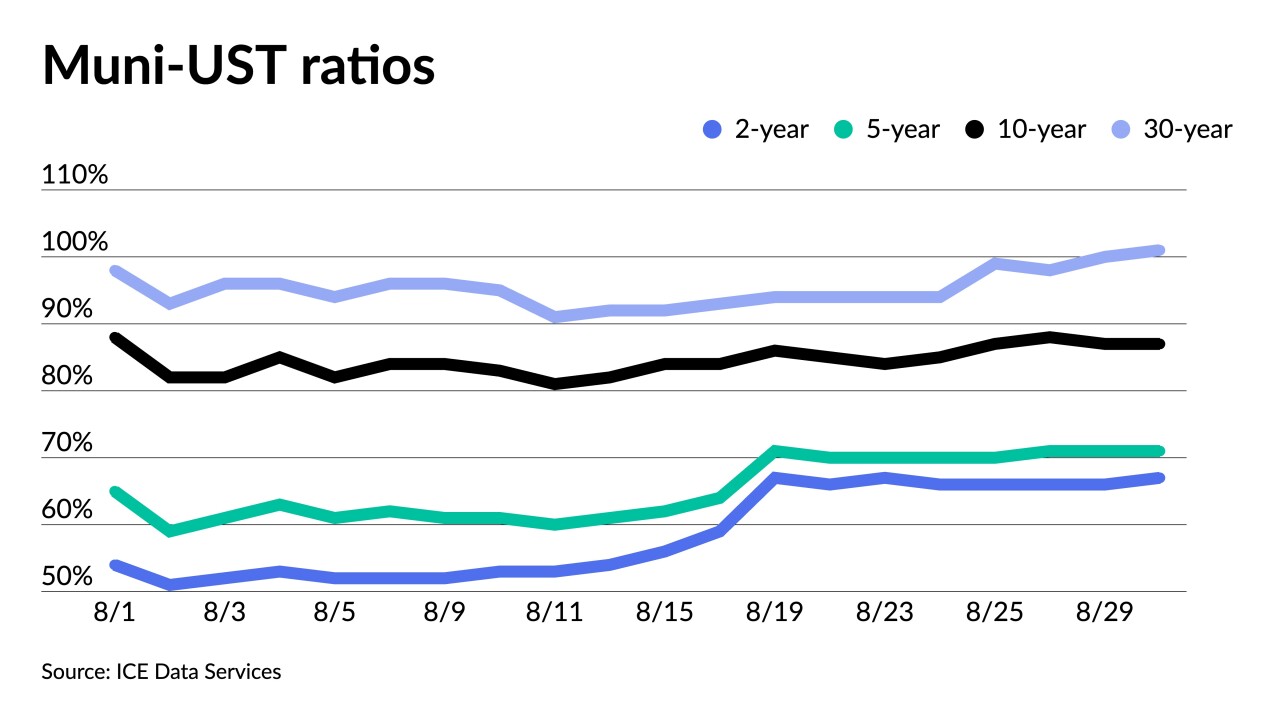

After underperforming USTs last week, "munis have given up their earlier performance advantage for August with both asset classes currently earning virtually the same negative returns," said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

August 30 -

Fed Chair Jerome Powell's message on rates last week combined with seasonal factors to give the market a "weird" vibe this week, one trader said.

August 29 -

Investors will be greeted Monday with decreased supply with the new-issue calendar estimated at $5.882 billion, down from total sales of $6.134 billion in the week of Aug. 22.

August 26