-

Markets took the news that it will soon be appropriate to increase the Fed funds target rate at a slower pace as good news.

November 23 -

Lower supply in 2022 has somewhat helped the market avoid larger losses, many participants have said.

November 22 -

The negotiated calendar this week is very light due to the Thanksgiving holiday, with only four deals above $100 million.

November 21 -

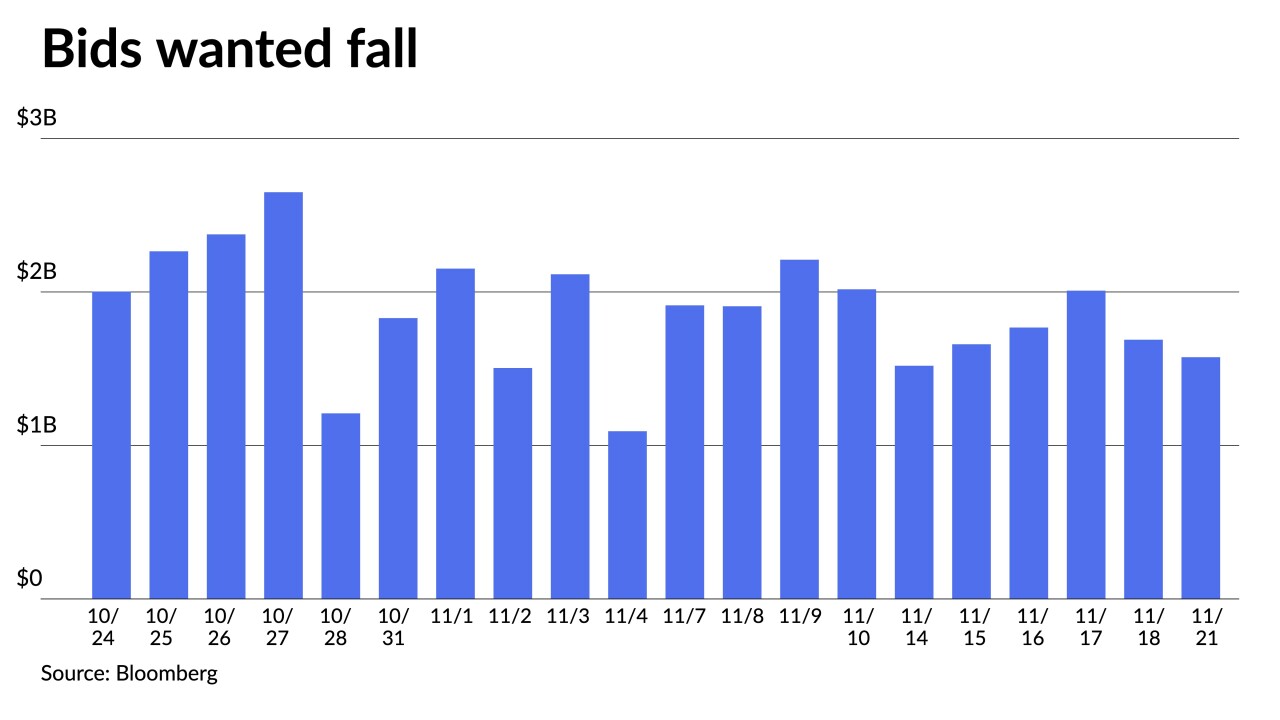

Issuance shrinks to $722 million while Bond Buyer 30-day visible supply sits at little more than $7 billion.

November 18 -

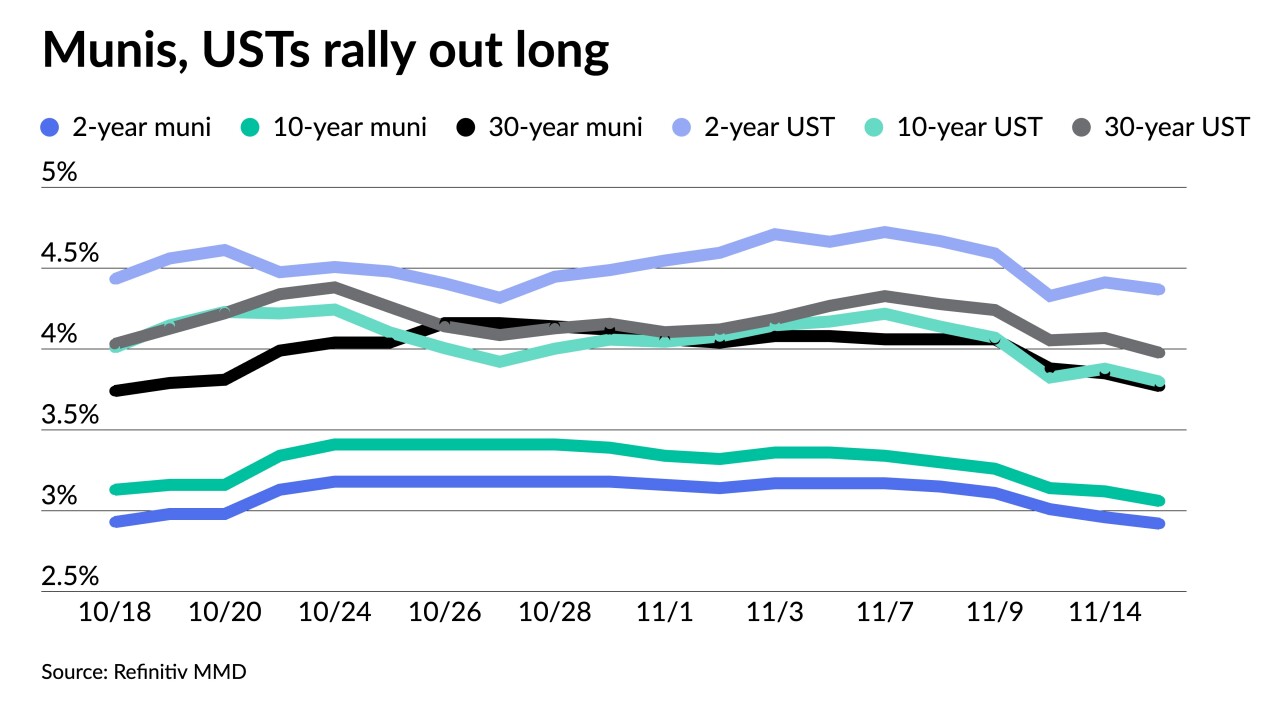

Municipals improved again Thursday, pushing the 10-year yield firmly below 3%, while Refinitiv Lipper reported $604.704 million of inflows into municipal bond mutual funds for the week ending Wednesday.

November 17 -

Investment bank expands with three former Citigroup muni veterans at the helm.

November 17 -

As market participants navigate through the remaining weeks of 2022, Jeff Lipton, managing director of credit research at Oppenheimer Inc., expects munis to maintain their outperformance over USTs

November 16 -

Triple-A yields fell five to eight basis points while UST saw yields fall up to nine out long, moving the 30-year UST below 4% for the first time since mid-October.

November 15 -

Illinois raised its fiscal 2023 revenue estimates by $3.69 billion, giving Gov. J.B. Pritzker enough to propose doubling the state's $1 billion rainy day fund.

November 15 -

Munis were in their own lane while broader markets were mixed Monday as participants digested various Fed officials' comments on inflation and rate hike schedules.

November 14