-

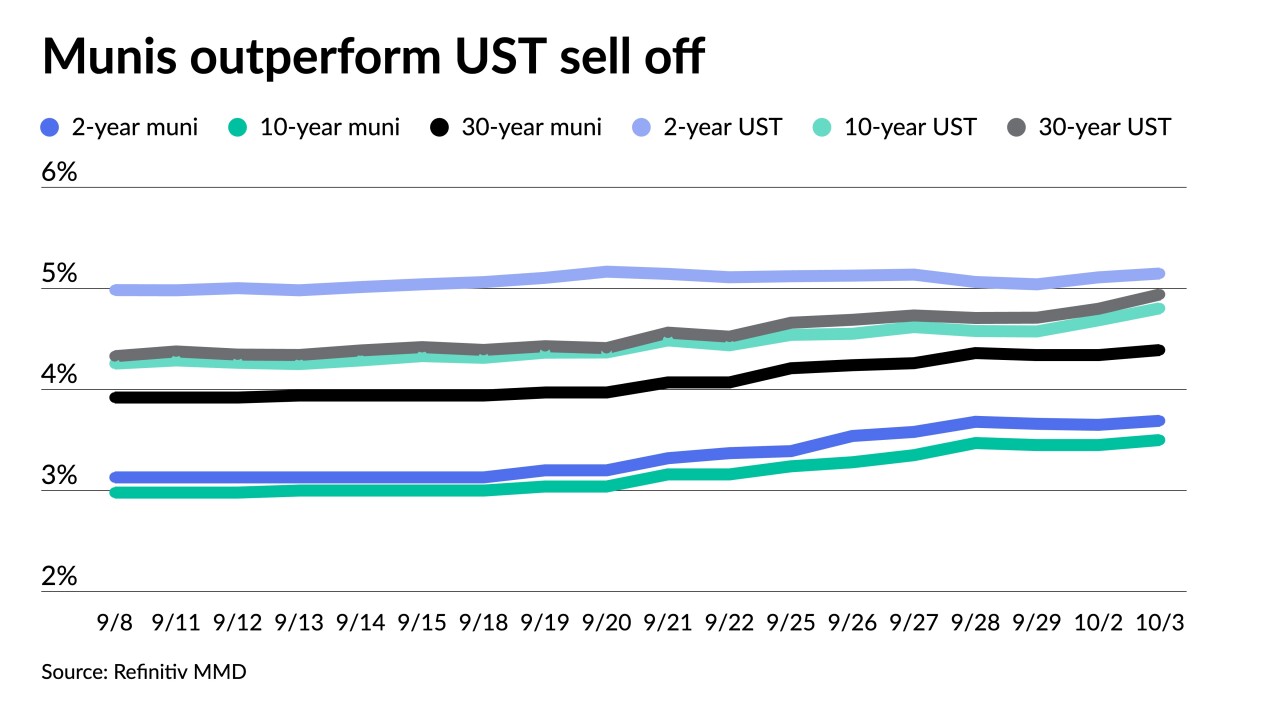

UST rates are driving all things in the muni market, said Jon Mondillo, head of North American Fixed Income at abrdn.

October 3 -

There will be "choppiness in the municipal bond market through the end of the year," said Anders S. Persson, Nuveen's chief investment officer for Global Fixed Income, and Daniel J. Close, Nuveen's head of municipals.

October 2 -

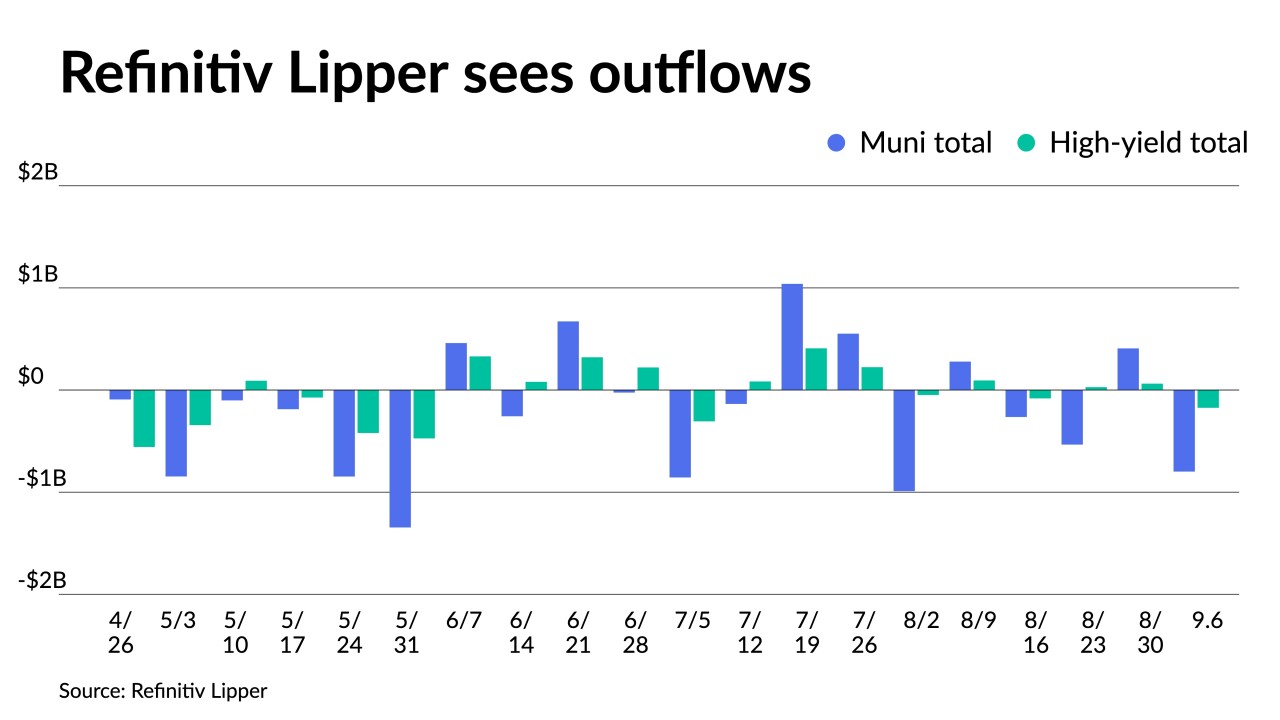

The Bloomberg Municipal Index and High-Yield Index lost 3.3% and 3.9%, respectively, in September.

September 29 -

The last time muni mutual funds saw outflows top $1 billion was the week ending May 31 when they were $1.345 billion.

September 28 -

"The market has taken to heart the [Federal Open Market Committee] actions from last week," said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

September 27 -

Yields have "risen substantially over the last week as the market seeks to find at least a minor level of balance or equilibrium," said Tom Kozlik, managing director and head of public policy and municipal strategy at HilltopSecurities.

September 26 -

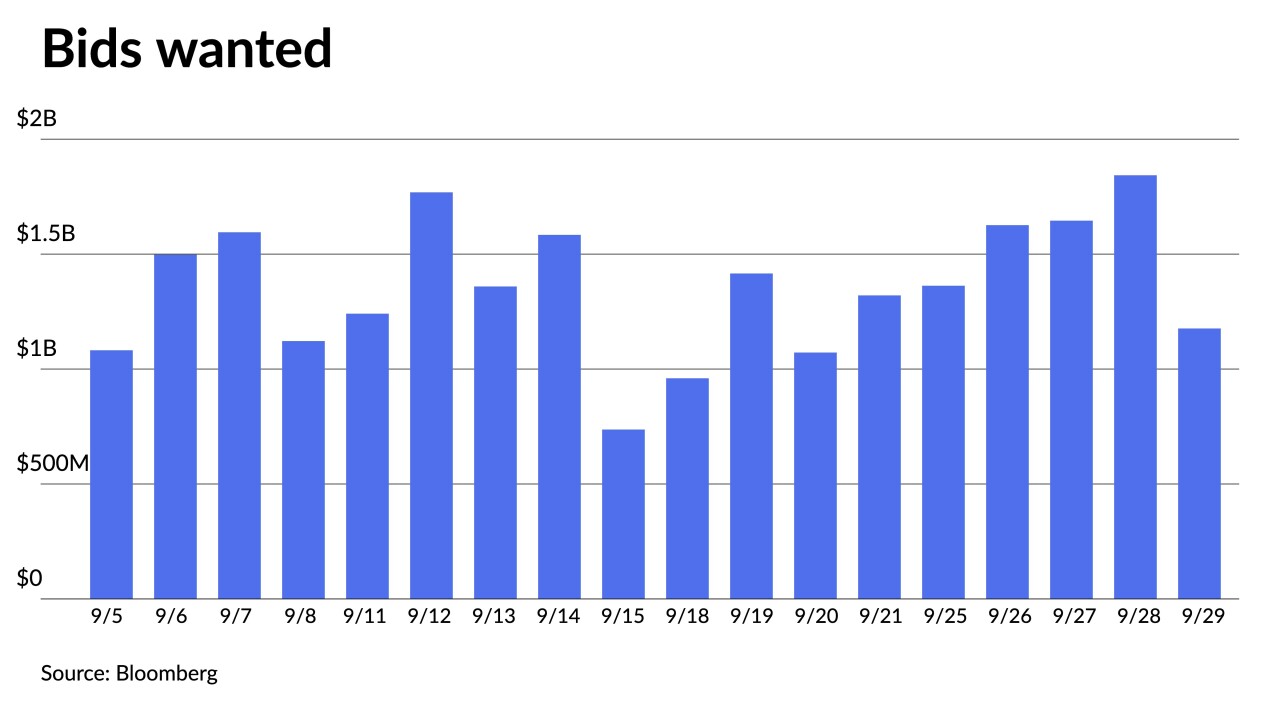

"People are just kind of sitting on their hands and being careful because MMD is raising yields every day and people don't know which way this is heading," said John Farawell of Roosevelt & Cross.

September 25 -

The Texas Water Development Board leads the new-issue calendar with $1 billion of revenue bonds.

September 22 -

The general bias toward muni rates is that they would be a bit higher with technicals "being a little less supportive than they were in August, plus what we heard with from the Fed 'higher for longer,' and potentially another hike," said Jeff MacDonald, head of Fixed Income Strategies at Fiduciary Trust International.

September 21 -

As was expected, the FOMC held rates in a range between 5.25% and 5.50%, but the dot plot in the Summary of Economic Projections showed 12 of 19 members expect another 25-basis-point rate hike this year.

September 20 -

Fund flows "should be moving along a more positive trajectory, but they have yet to do so with munis unable to break free of the Treasury market's tight grip," Oppenheimer's Jeff Lipton said.

September 19 -

With a light new-issue calendar ahead of the FOMC meeting, "secondary flows may benefit from greater attention," said Kim Olsan, senior vice president at FHN Financial.

September 18 -

"We believe investors should take advantage of the current high rates environment: investors should pick and choose bonds selectively in the coming weeks in anticipation of this tightening cycle's end after November," BofA strategists said.

September 15 -

Refinitiv Lipper reported $116.737 million was pulled from municipal bond mutual funds for the week ending Wednesday after $798.474 million of outflows from the funds the previous week.

September 14 -

There hasn't been a huge return of capital in the muni market so far this year, with fund flows being rather anemic, said Chad Farrington, co-head of municipal bond strategy at DWS Group.

September 13 -

While supply this week is "softer," uncertainty and volatility may prevail once more due to "yields still not exciting longer-term investors," said Matt Fabian, a partner at Municipal Market Analytics.

September 12 -

Munis have had a slow start "down roughly 0.25% for the first week of September bringing year-to-date returns to 1.34%," said Jason Wong, vice president of municipals at AmeriVet Securities.

September 11 -

Historically, "September and, to a lesser degree, October have not been kind to municipal investors."

September 8 -

Refinitiv Lipper reported $798.474 million was pulled from municipal bond mutual funds in the week ending Wednesday after $407.976 million of inflows into the funds the previous week.

September 7 -

California and the Port Authority of New York and New Jersey held one-day retail order periods for $1 billion-plus issues.

September 6