-

The topic of issuer disclosure timing has heated up in recent months, and widened a divide between issuers and analysts.

February 6 -

Paul Daley, managing director of BondWave’s Information Lab, talks about how big data can be made more accessible and valuable to users. He details his examination into a Pacific Gas and Electric bond as a way to illustrate how drilling down into this information can help participants in a fast-moving market. Chip Barnett hosts.

February 6 -

The muni market was weaker again on Wednesday with yields on the rise, yet that did not slow down the primary. It did not matter if it was tax-exempt or taxable — they were gone in a flash.

February 5 -

Investors should be aware that a lower coupon rate could become illiquid if interest rates rise, the Municipal Securities Rulemaking Board said.

February 5 -

New muni and taxable muni issuance was easily absorbed as yields rose off of the record lows they landed last week.

February 5 -

The municipal market has been on a tear in terms of fundamentals and technicals that are driving the market and there isn’t much in the near-term likely to stymie that tone.

February 4 -

Municipal bond buyers will see a $7 billion new-issue calendar ahead.

January 31 -

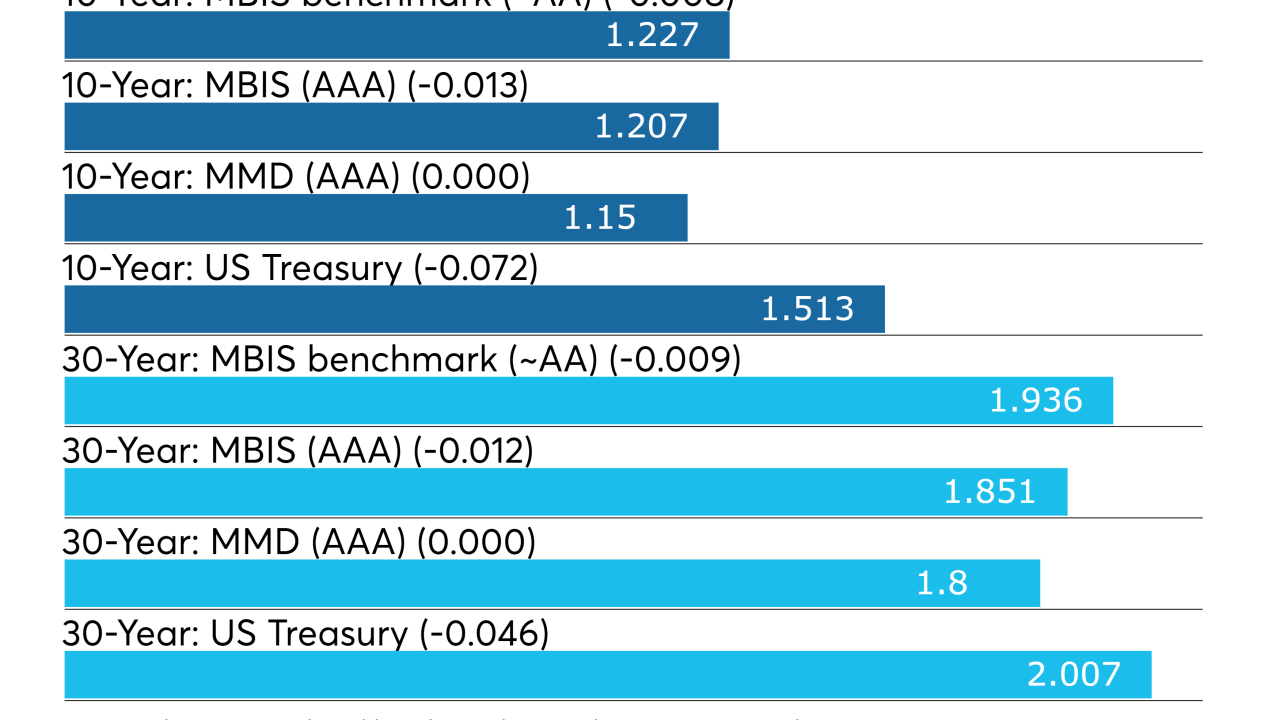

It was a record day in the market in a couple of different ways, as yields descended further to new record lows on both the 10- and 30-year and the market saw the lowest yield ever for a century bond.

January 30 -

Daryl Clements, portfolio manager at AllianceBernstein, breaks down what trends from 2019 will carry into 2020 and those that might emerge in the new year. Hosted by Aaron Weitzman.

January 30 -

Despite tax-exempts being expensive, strong technicals are likely to extend into February.

January 29