-

With each passing day, fears surrounding COVID-19 elevate as the equity sell-off pressed on. The biggest winners have and will continue to be muni issuers, as they are selling into a record low rate market.

February 28 -

Municipal market technicals were already driving performance and so the strong quality bid has deepened the rally across the curve as the asset class really didn’t need to grab the U.S. Treasuries coattails all that tightly.

February 27 -

Chris Mier, CFA of Loop Capital, says fiscal policy needs to achieve more at present and believes we are at a comfortable point in the credit cycle. Despite that conviction, he says the coronavirus will serve to slow growth. John Hallacy hosts.

February 27 -

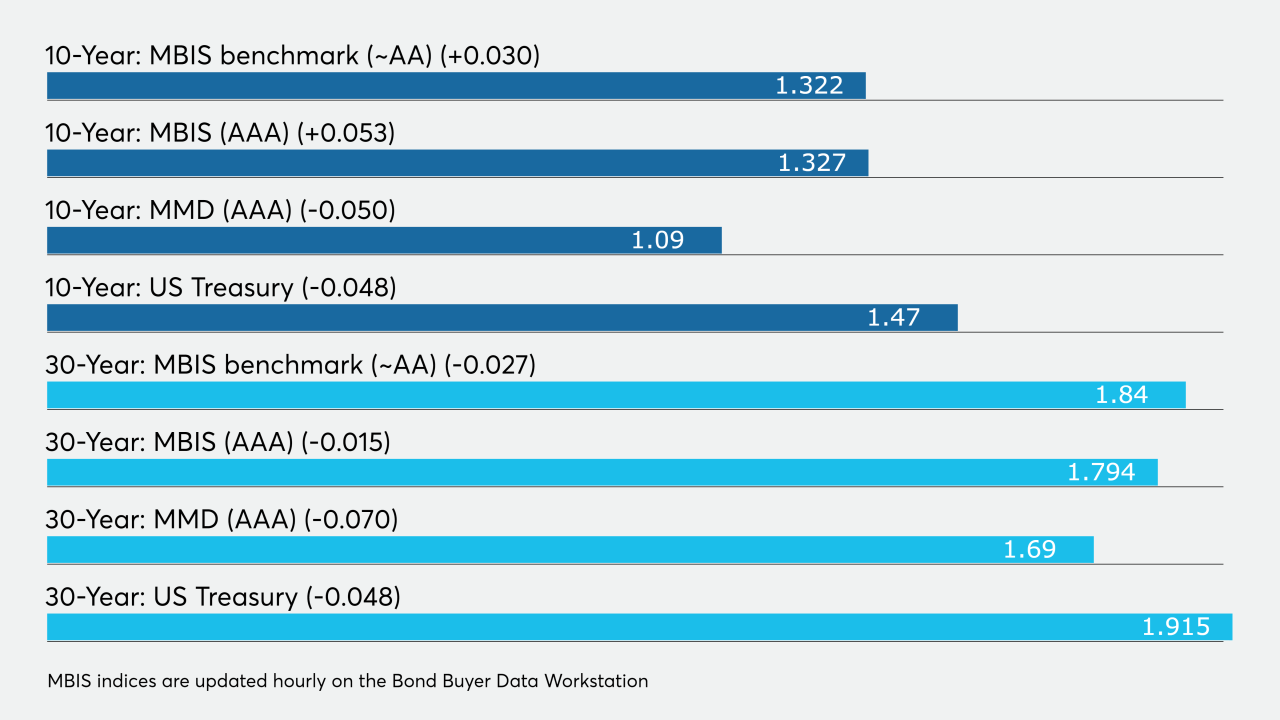

Municipal bond yields were unchanged at record low levels, according to late reads.

February 26 -

As COVID-19 fears run rampant, investors continued to sell off equities, resulting in muni yields again following Treasury yields down to all-time lows.

February 25 -

The Fitch rating on the bonds, issued as part of the Midwestern Disaster Area authorization, remains deep in junk.

February 25 -

Municipal bonds yields continued their descent and once again rewrote the record books, as the flight to safety on fears of COVID-19 that took place Friday picked up right where it left off.

February 24 -

November's progressive income tax referendum looms large over Gov. J.B. Pritzker's proposed fiscal 2021 budget and the state's long-term fiscal prospects.

February 21 -

Bond yields keep grinding lower ahead of the largest issuance week of 2020, clocking in at $13 billion.

February 21 -

The market got technically stronger and the new-issue calendar builds.

February 20