-

Most analysts expect the Federal Open Market Committee will alter its Summary of Economic Projections and perhaps begin to talk about tapering, without offering clues when they'll begin cutting back on asset purchases.

June 14 -

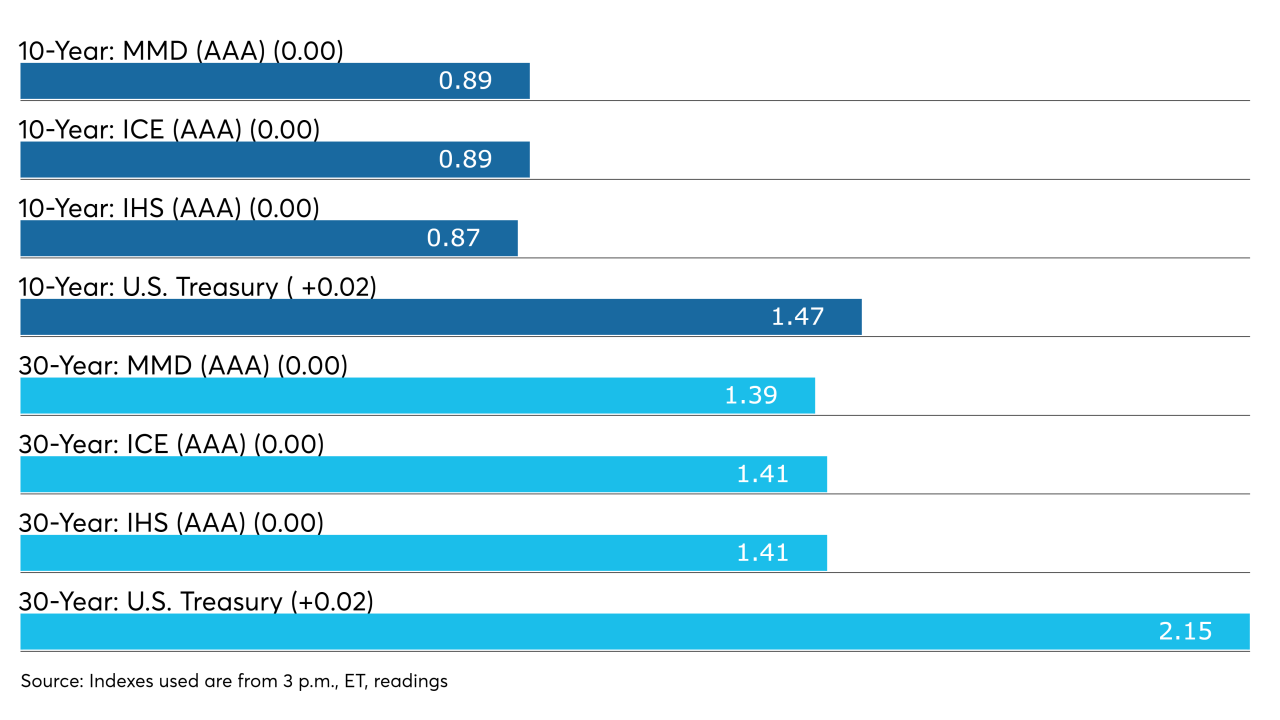

Yields on top-quality munis were flat on the AAA scales Friday; yields were seven to nine basis points lower on the week.

June 11 -

Trading showed firmer prints, with Georgia general obligation bonds, Maryland GOs and Los Angeles Department of Water and Power bonds trading up.

June 10 -

The Investment Company Institute reported $1.089 billion of inflows into municipal bond mutual funds, marking the 13th consecutive week.

June 9 -

The U.S. Treasury 10-year dipped to its lowest yield since March while municipal investors poured money into new deals and secondary trading helped push benchmarks even lower.

June 8 -

The market idled Monday while investors prepare for a $12 billion new-issue onslaught that brings diversity of credits that will help direct benchmark yields. Continued fund flows are needed to sustain current yields.

June 7 -

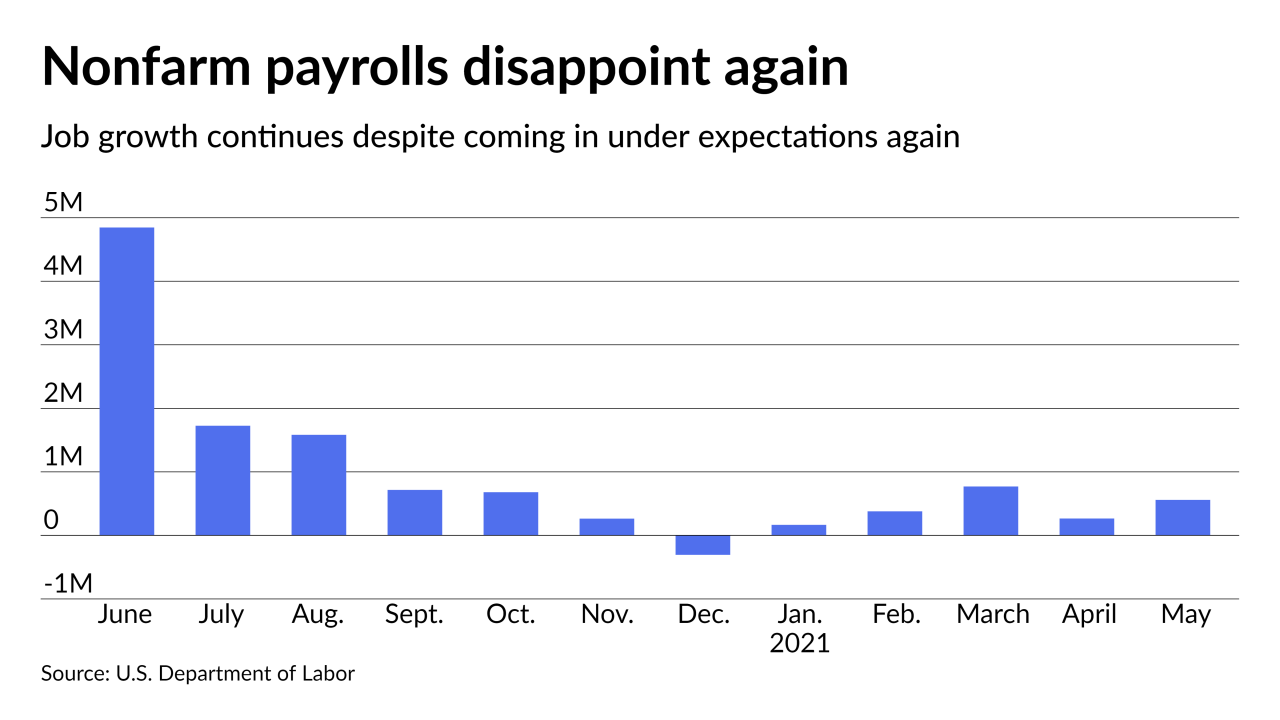

Muni prices were firm Friday after the employment report showed nonfarm payrolls rose 559,000 in May as the jobless rate fell to 5.8%.

June 4 -

As most participants await Friday's jobs report, the municipal market Thursday sustained a firm tone as rates remained on a gradual path of decline.

June 3 -

ICI's report marks the 12th consecutive week of inflows bringing the total for 2021 to more than $40 billion. Lower- and non-rated deals saw 20 to 30 basis point bumps in repricings as any paper with yield is massively oversubscribed.

June 2 -

The revenue sector winners in May included healthcare with +0.53% gains, transportation with +0.42%, each benefiting from "the reach for yield and improving metrics," analysts said.

June 1