-

This week's new-issue supply needs to be "priced to sell to pique investor interest," said noted Nuveen's Daniel Close and Anders S. Persson.

August 22 -

Tracey Manzi, senior investment strategist at Raymond James, talks with Chip Barnett about the fixed income markets today and how munis and Treasuries are doing. She says the number one issue clients are asking about is inflation. (20 minutes)

August 22 -

Continued pressure on the UST market coupled with the end of the summer reinvest may begin to test new issues as investors are able to be more selective.

August 21 -

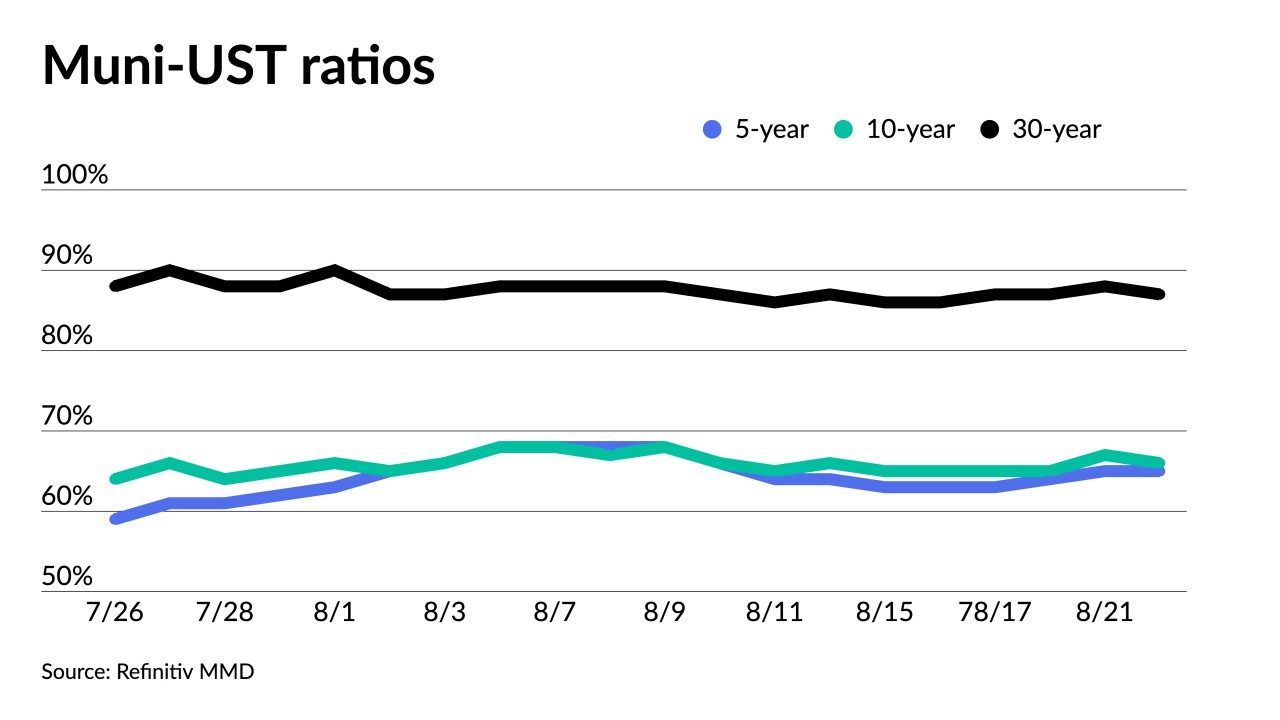

"Bearish Treasury moves have kept some pressure on the muni market and prevented an attempt to rally during the summer season when large redemptions trump issuance," BofA Global Research said in a report.

August 18 -

Refinitiv Lipper reported $264.046 million of outflows from municipal bond mutual funds for the week ending Wednesday after $278.559 million of inflows the previous week.

August 17 -

Municipal CUSIP request volume decreased in July on a year-over-year basis, following an increase in June, according to CUSIP Global Services.

August 16 -

Summer redemption season ends Tuesday when issuers return $9 billion of matured or called bond principal, said CreditSights strategists Pat Luby and Sam Berzok.

August 15 -

The investor-owned utility issues tax-exempt bonds through the Hawaii Department of Budget and Finance.

August 15 -

"The recent outperformance has valuations nearing stretched levels again," Birch Creek Capital said in a weekly report. "If USTs reverse the recent trend higher, we would not be surprised to see munis lag during the rally."

August 14 -

Another day of mixed inflation data led Treasury yields to rise but munis mostly stayed put after underperforming a UST rally earlier in the week. The market is also focused on the $9 billion of redemption flows coming on Tuesday.

August 11 -

Refinitiv Lipper reported $278.559 million of inflows into municipal bond mutual funds for the week ending Wednesday, led by exchange-traded funds.

August 10 -

New York City's $1 billion deal was re-priced to lower yields and a tax-exempt and taxable deal for the NFL's Tennessee Titans new stadium priced.

August 9 -

Municipals followed U.S. Treasuries firmer after markets reacted to the Moody's downgrade of several mid-sized U.S. banks. New issues saw good demand and repriced to lower yields as a result.

August 8 -

While triple-As were little changed the past two sessions, some damage was done last week, leaving market participants generally less optimistic for the final weeks of August.

August 7 -

Late summer is "rarely a good time for our asset class," Barclays strategists said, noting the municipal investment grade index lost money in August three years in a row, and 2023 seems to follow this trend.

August 4 -

Municipal bond mutual fund saw outflows return with Refinitiv Lipper reporting investors pulling $989.852 billion from funds for the week ending Wednesday, led by ETFs and long-end funds.

August 3 -

J.P. Morgan held a one-day retail order for $1.65 billion of revenue bonds from the Dormitory Authority of the State of New York, while Minnesota sold $1.02 billion of GOs in the competitive market in five deals.

August 1 -

This week kicks off a flip of calendar to the final month of the summer reinvestment season and one of the larger new-issue calendars of the year.

July 31 -

For the coming week, investors will be greeted with a larger new-issue calendar led by large New York and Texas ISD issuers, along with gilt-edged Minnesota selling competitively.

July 28 -

Municipal bond mutual fund saw inflows with Refinitiv Lipper on Thursday reporting investors added $552.219 million to funds for the week ending Wednesday following $1.040 billion of outflows the previous week.

July 27