-

Data from the Municipal Securities Rulemaking Board indicates that trade volume may stay high after a consistent third quarter.

October 10 -

With munis establishing "directional footing" in the fourth quarter of this year, the technical backdrop is still the market driver for 2024, said Jeff Lipton, a research analyst and market strategist.

October 9 -

Supply is slightly lower this week at nearly $10 billion but not by much, with the pace of supply suggesting $500 billion of issuance for the year could still happen, said Tripp Kaiser, a managing director at Municipal Market Analytics, Inc.

October 8 -

Muni yields were cut up two to five basis points, depending on the curve, while UST yields rose five to seven basis points, pushing the 10-year UST yields above 4%.

October 7 -

Municipal bond mutual funds saw inflows of $1.879 billion in the latest week, marking the 14th consecutive week of inflows and the highest level of 2024, per LSEG data, reiterating the strong investor support for this market.

October 3 -

The biggest theme within the muni market — and what is responsible for its performance — is the amount of cash on the sidelines, with $6-plus trillion in money market funds and close to $2.5 trillion in certificates of deposits, said Julio Bonilla, a fixed-income portfolio manager at Schroders.

October 2 -

Through the integration, Investortool's clients can calculate analytics based on predictive trade levels, filter the live market based on "what's rich or what's cheap" compared to the predictive price and power automation, said James Morris, senior vice president at Investortools.

October 2 -

The larger supply calendar should be "taken down well given the persistent inflows into our market and investors are still sitting on plenty of cash," said Daryl Clements, a municipal portfolio manager at AllianceBernstein.

October 1 -

With supply ballooning, reinvestment dollars at lows of the year, J.P. Morgan's Peter DeGroot argues the next few weeks could offer the best opportunity to buy bonds of the year – and possibly the rate cycle. DeGroot talks about this, plus potential impacts of shifting investor behavior on market liquidity, and what the upcoming election might mean for tax policy and the muni market. Lynne Funk hosts.

October 1 -

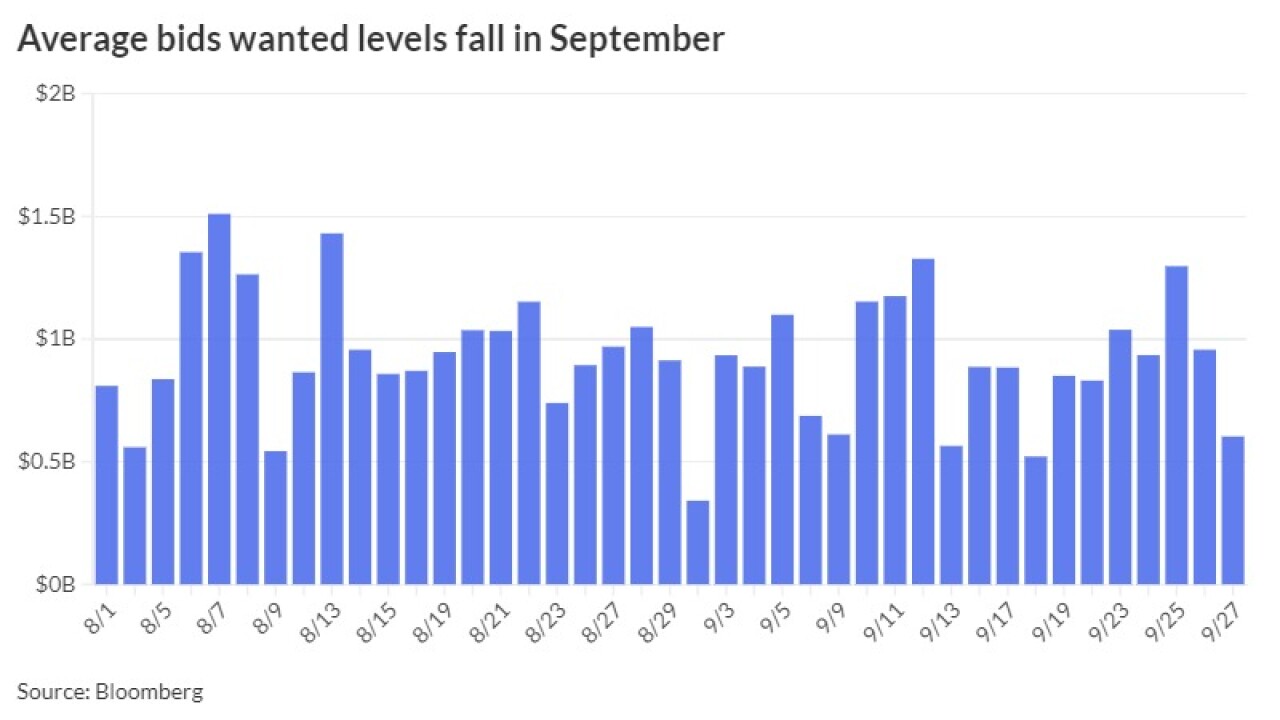

"As September draws to a close, some dynamics may prevail in October but others could undergo a shift," said NewSquare Capital's Kim Olsan. "One aspect that will continue is the level of supply coming to market."

September 30