-

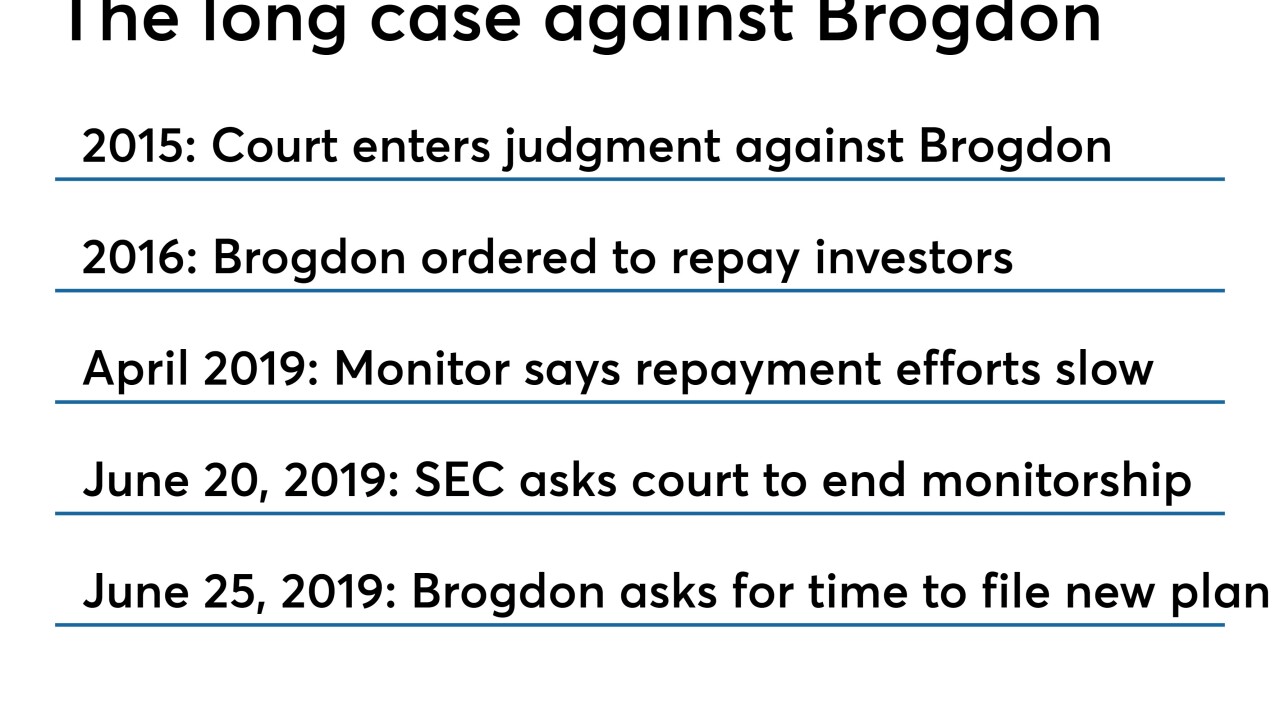

The SEC and Bank of Oklahoma differ in what they want a federal judge to do next in the Christopher Brogdon case, though both claim to have investors' best interests at heart.

August 5 -

GFOA is putting together a working group to address concerns about continuing disclosure in the municipal market, a topic increasingly discussed among stakeholders.

July 26 -

Registered advisory firm Dale Scott & Co. will pay $25,000, and one firm and one individual each will pay $10,000 for acting as unregistered solicitors.

July 16 -

The Long Island township is emerging from the cloud of SEC scrutiny.

July 15 -

The monitorship plan will extend until Sept. 13 for seven assisted living facilities he is trying to liquidate.

July 11 -

Allison Herren Lee is short on direct municipal market experience, but has a well-rounded background as a securities lawyer.

July 9 -

Investors will still lose big as the SEC's case against Dwayne Edwards and Todd Barker is now all but over.

July 1 -

Investor confusion about Harvey, Illinois, and a local library district contributed to a municipal advisor and broker-dealer facing Securities and Exchange Commission charges in a bond offering gone wrong.

June 28 -

Investors are likely to lose millions whether the Atlanta-based financier continues under a court-appointed monitorship or not.

June 26 -

Brogdon's high personal spending and failure to sell his assets spell an end to the usefulness of his repayment plan, the SEC told a federal judge.

June 21 -

The new events became effective in late February, and hundreds of Event 15 disclosures have filed in, with just a handful of Event 16 filings.

June 20 -

The judge ruled for Peter Cannava, who had denied wrongdoing even after Wells Fargo and other defendants settled charges.

June 12 -

The Securities and Exchange Commission agreed to settle with Oyster Bay, New York, and are awaiting a district court judge's approval.

June 10 -

The new money ordered Wednesday comes from the SEC’s settlement with Brogdon Family LLC (BFLLC), a separate legal entity controlled by the former nursing home developer.

June 6 -

On Wednesday, the SEC approved the final rule 3-1, with Commissioner Robert Jackson voting against the rule.

June 5 -

Abonamah will oversee the municipal securities office's strategic initiatives in his new role.

June 4 -

The financier's lawyers disputed a court-appointed monitor who had criticized him for maintaining an expensive lifestyle while his investors faced losses.

May 28 -

J.W. Korth & Co. was found to have charged excessive markups in 38 sales of municipal securities.

May 23 -

“Brogdon's substantial and ongoing failure to comply with the plan and court orders are egregious and ongoing,” a court-appointed monitor reported.

May 6 -

Bond Dealers of America members said they have spent an average of more than $17 million on regulatory costs since the beginning of the 2008 credit crisis.

April 25