-

The $105 million of power project revenue refunding bonds deal for Plum Point Energy Station in Arkansas comes amid tighter emission regulations.

September 18 -

The Franklin County Convention Facilities Authority will issue $138.2 million of lease revenue anticipation refunding bonds to refund or redeem outstanding Build America Bonds.

September 17 -

Illinois will sell up to $1.1 billion of general obligation refunding bonds and $600 million of taxable and tax-exempt GO bonds by the end of September.

September 4 -

The Dallas-Fort Worth region toll highway owner and operator aims to rake in savings from the deal as it expects to cash fund a $2 billion capital plan.

September 3 -

Midwest bond sales ticked 1.8% higher by volume in the first half of 2024, to $34.377 billion as the region missed out on the big gains in volume nationwide.

August 21 -

The state plans to price the bonds in early October.

August 16 -

Detroit-based Wayne State University will return to market with $31.7 million of general revenue refunding bonds, with proceeds refunding outstanding bonds.

August 13 -

When Wisconsin priced $253.755 million of GO refunding bonds on July 23, it was the state's second forward delivery deal in recent months.

August 7 -

The New York City Transitional Finance Authority is set up to refund Build America Bonds as part of a $2.11 billion deal slated to land in the market this week.

July 15 -

In the first half of 2024, winding-down federal aid, a resurgence of Build America Bond refundings and election uncertainty have contributed to the surge in issuance, said James Welch, a portfolio manager at Principal Asset Management.

June 28 -

The authority is refunding its 2014A bonds to gain debt service savings.

May 30 -

The Metropolitan Washington Airports Authority plans to refund about $400 million and sell $429 million of new money for its capital construction program.

May 30 -

Alaska's efforts to manage its cyclical revenues brought an upgrade from S&P Global Ratings and positive outlook from Moody's Ratings.

May 1 -

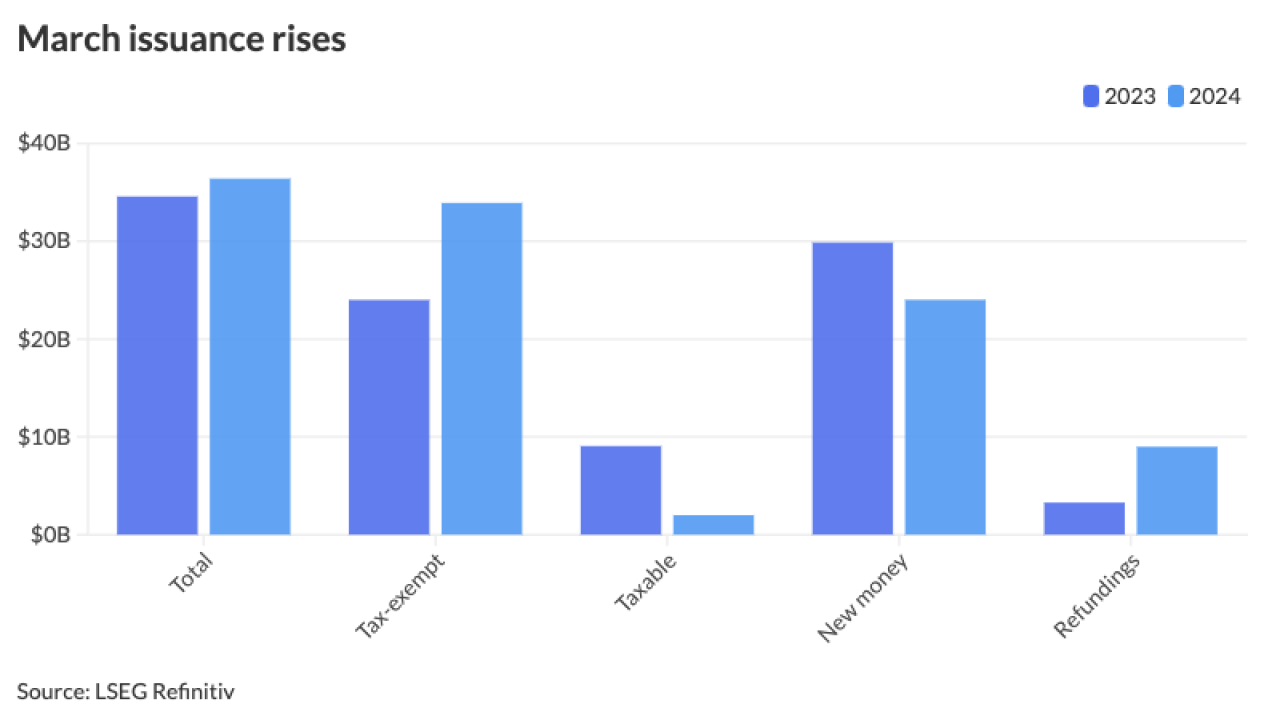

The pace of the issuance and the increase of refundings, surging 59.6% in the first quarter of 2024, have also led some firms to up their overall 2024 issuance projections.

April 11 -

The city gave no reason for the cancellation of its redemption plans or bond issuance, but reserved the right to call the 2010B BABs for redemption in the future.

April 10 -

Two mega deals recently priced with make-whole calls for bonds due in 2034 and shorter where the market does not appear "to be penalizing issuers for including an optional make whole call feature in the short maturity tax-exempt bonds," said Pat Luby, head of Municipal Strategy at CreditSights, in a report.

April 4 -

March issuance came in at $36.405 billion, above the $34.579 billion 10-year average, according to LSEG Refinitiv data.

April 1 -

The UC Regents will close the books on its $1.1 billion refunding deal that included the refunding BABs Wednesday. Investors do not appear to be penalizing the issuer in secondary trading as spreads have stayed at or near the original pricing.

March 26 -

The Washington refunding deal is built on an extraordinary optional redemption of Build America Bonds despite criticism from investors who hold them.

March 22 -

The extraordinary redemptions being used to call Build America Bonds "are based on a creative but flawed legal argument driven by the current change in interest rates," said Kramer Levin partner Amy Caton.

March 21