-

Tax changes sought by the municipal bond industry are likely to be embedded into infrastructure legislation.

October 27 -

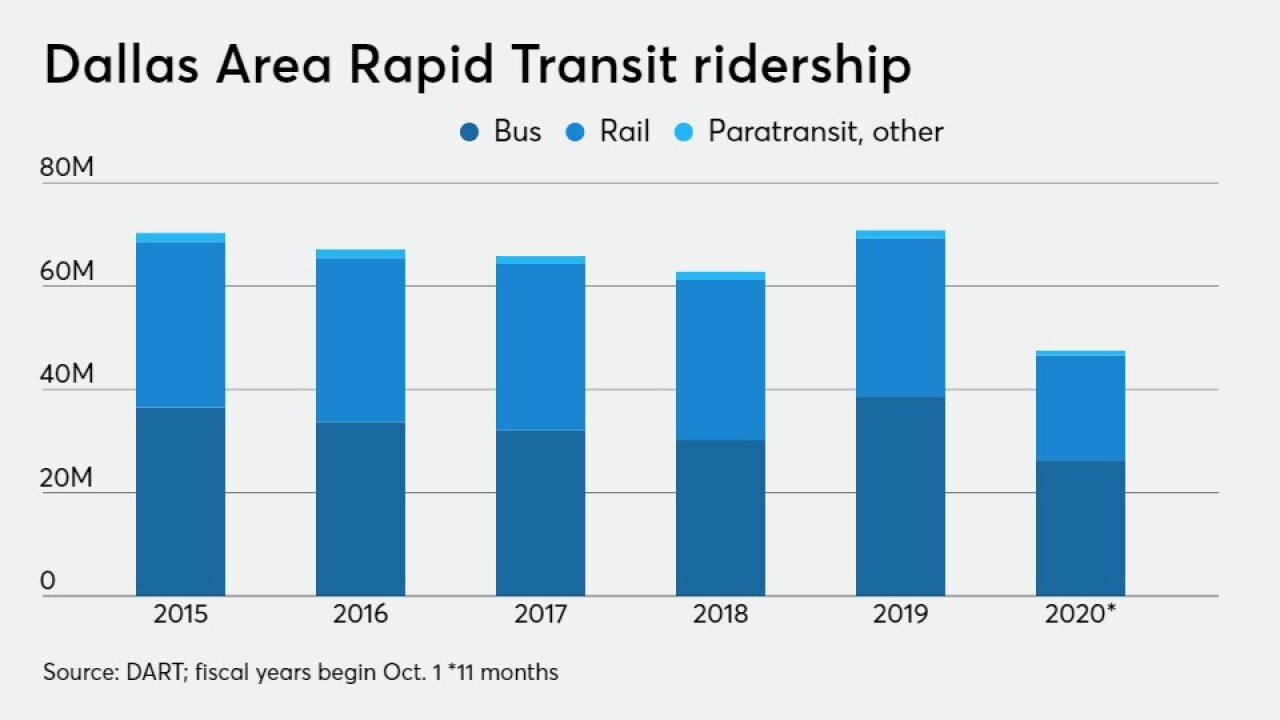

"We have no need for cash-flow relief or restructuring," said the treasurer of Dallas Area Rapid Transit, which continues to expand its rail services.

October 26 -

The Louisiana State Bond Commission will refinance $424 million of variable-rate bonds; the deal isn't expected to include the termination of underwater swaps.

October 15 -

Moody’s Investors Service revised the outlook on its Aa2 rating to negative ahead of the $96 million deal.

October 13 -

Upfront savings from the $371 million deal will improve liquidity for the authority after the coronavirus-caused traffic downturn.

October 9 -

The airport will sell $925 million in a deal structured to lower short-run debt-service outlays as it manages through the coronavirus-driven air travel decline.

October 9 -

Advance refunding, direct-pay bonds, and increased limits on bank-qualified bonds would be among the muni-friendly tax provisions that have a good chance of becoming law if Democrats control both chambers of Congress.

October 8 -

With its credit ratings intact after the economic blow from the pandemic, Dallas will go to market with $293 million of bonds.

October 5 -

The Florida Cabinet approved new money and refunding bonds, some of which may be sold as taxable debt with advance tax-exempt refundings no longer possible.

September 22 -

Facing a revenue disruption over next two years, the Harris County-Houston Sports Authority will ease cash flow pressure with a $100 million refunding.

September 21