-

Officials of the art museum say the effects of Detroit's bankruptcy have impeded their efforts to build the endowment they had envisioned.

November 8 -

Though the market may view Chicago's budget as heading in the right direction, relying on the state is a gamble that's a concern for aldermen, too.

October 29 -

Nearly two in three finance officers in large cities predict a recession in the next year or two.

October 28 -

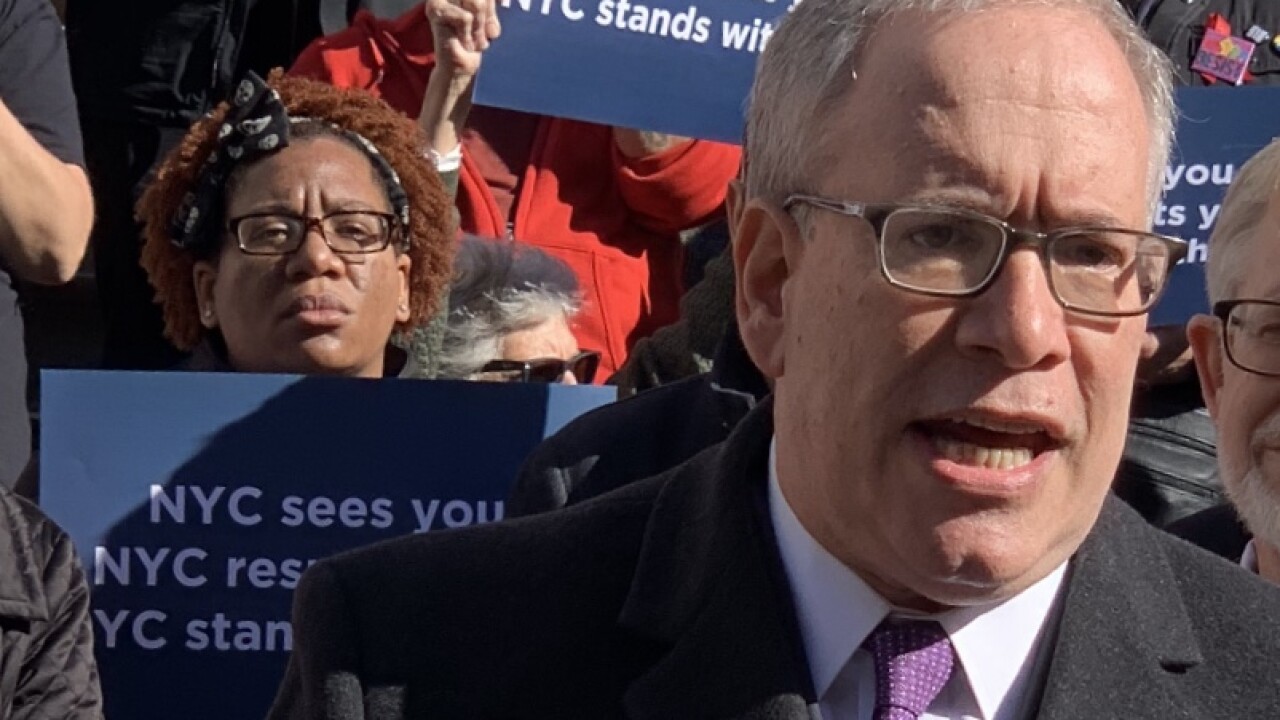

Mismanagement of real-property related taxes may be shortchanging an MTA revenue stream, said city Comptroller Scott Stringer.

September 30 -

The ruling on tax assessments orders Philadelphia to repay $48 million, with $34 million coming from the school district.

July 22 -

The lawsuits were filed a day after 11 Democrats in the Senate and a bipartisan group of 47 House lawmakers announced a long-shot effort to repeal the regulation using the Congressional Review Act.

July 17 -

The IRS regulation is targeted at ending workarounds by state and local governments that have been enacted since the cap was included in the 2017 Tax Cuts and Jobs Act.

July 16 -

Lawmakers are plowing through a pile of trailer bills, including two tax increases, that must pass to avoid blowing a hole in their $214.8 billion budget.

June 20 -

A tighter cap on local property tax rates for some cities and counties will factor negatively into future bond ratings, analysts warn.

June 13 -

Bills to limit the revenue flexibility of local governments and put more state funding toward schools were driven by a desire to limit property taxes.

June 3