-

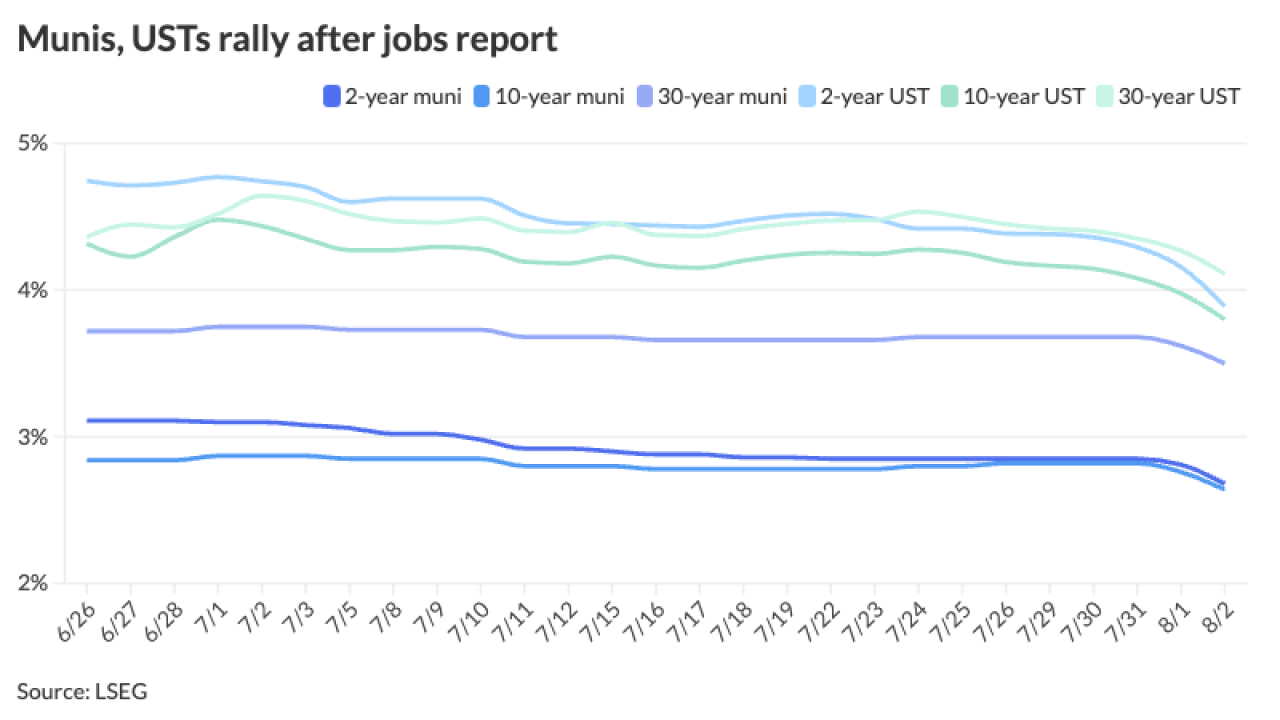

Recent events have been a "roundtrip" for rates, starting with the sentiment shifting from slowing inflation to a softening labor market, said James Pruskowski, chief investment officer at 16Rock Asset Management.

August 7 -

When Wisconsin priced $253.755 million of GO refunding bonds on July 23, it was the state's second forward delivery deal in recent months.

August 7 -

The Omaha City Council approved placing a $333.4 million GO bond deal on the Nov. 5 ballot.

August 7 -

This week's new-issue calendar will be "outsized," said Anders S. Persson, Nuveen's chief investment officer for global fixed-income, and Daniel J. Close, Nuveen's head of municipals.

August 6 -

"Decelerating or slowing economic growth has sparked a classic flight-to-quality trade with short-term Treasuries being the prime beneficiary," said Gary Pzegeo, head of fixed-income at CIBC Private Wealth U.S.

August 5 -

Data shows the average bids per competitive sale is up noticeably over the past few quarters, Justin Marlowe said, rising to 8.5 bids in Q1 2024 from 6.1 bids in Q1 2022.

August 5 -

LIPA's prepares to go to market with new leadership as it prepares to decide on its next power supply management services provider.

August 5 -

All eyes now turn to the September Federal Open Market Committee meeting where the Fed is expected to cut rates, but market participants are mixed on whether it will be a 25- or 50-basis-point cut.

August 2 -

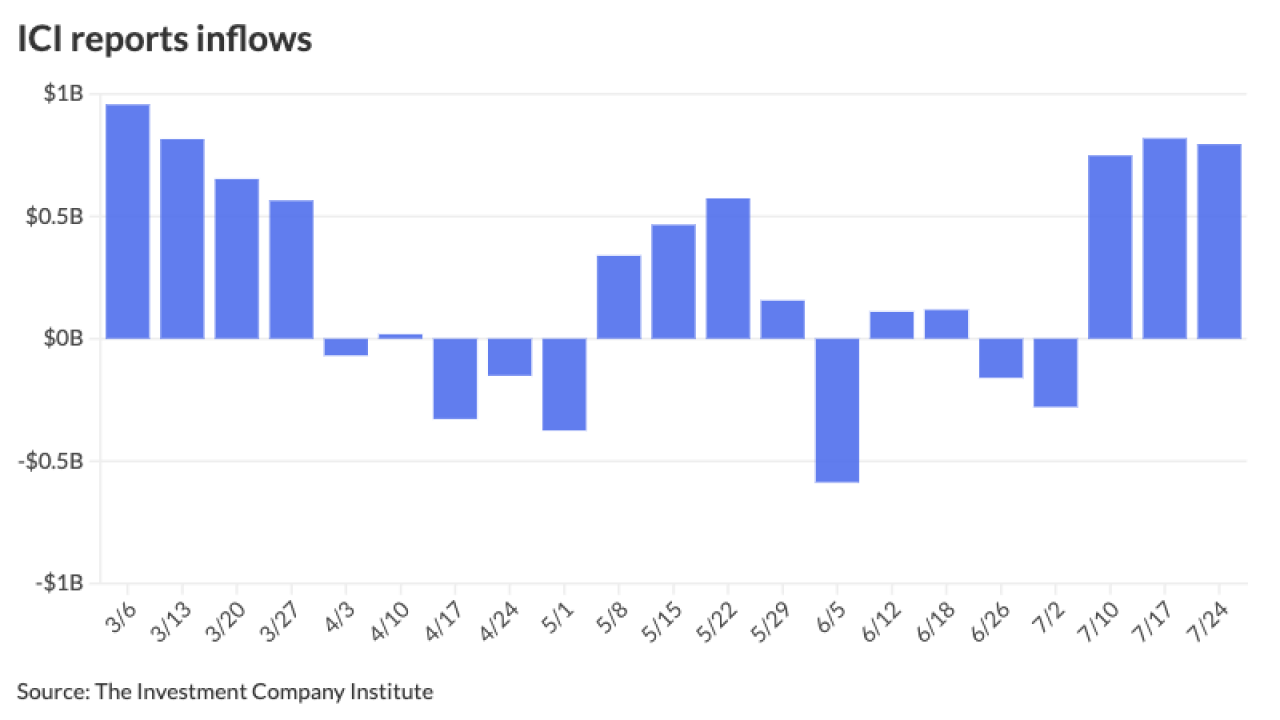

Municipal bond mutual funds saw inflows as investors added $1.112 billion to funds after $892.2 million of inflows the week prior, according to LSEG Lipper.

August 1 -

"The Fed remains data dependent as always, but it now appears that the 'more good data' bar is not as high as it was before, particularly with labor market developments becoming more important," said Michael Gregory, deputy chief economist at BMO Economics.

July 31