-

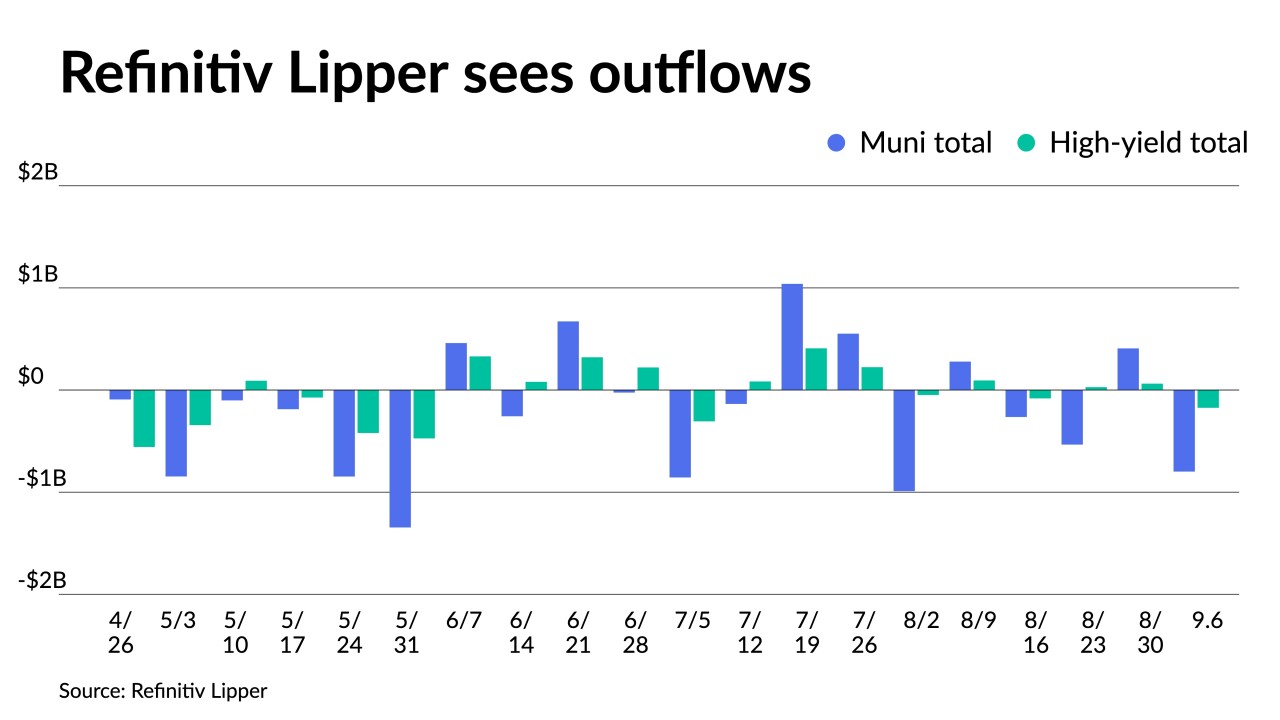

Refinitiv Lipper reported $116.737 million was pulled from municipal bond mutual funds for the week ending Wednesday after $798.474 million of outflows from the funds the previous week.

September 14 -

There hasn't been a huge return of capital in the muni market so far this year, with fund flows being rather anemic, said Chad Farrington, co-head of municipal bond strategy at DWS Group.

September 13 -

While supply this week is "softer," uncertainty and volatility may prevail once more due to "yields still not exciting longer-term investors," said Matt Fabian, a partner at Municipal Market Analytics.

September 12 -

Munis have had a slow start "down roughly 0.25% for the first week of September bringing year-to-date returns to 1.34%," said Jason Wong, vice president of municipals at AmeriVet Securities.

September 11 -

Historically, "September and, to a lesser degree, October have not been kind to municipal investors."

September 8 -

Refinitiv Lipper reported $798.474 million was pulled from municipal bond mutual funds in the week ending Wednesday after $407.976 million of inflows into the funds the previous week.

September 7 -

With around 30% of bonds trading near the de minimis threshold, a new study takes a deep dive into how the rule drives illiquidity as mutual funds dump paper that's approaching the threshold.

September 7 -

California and the Port Authority of New York and New Jersey held one-day retail order periods for $1 billion-plus issues.

September 6 -

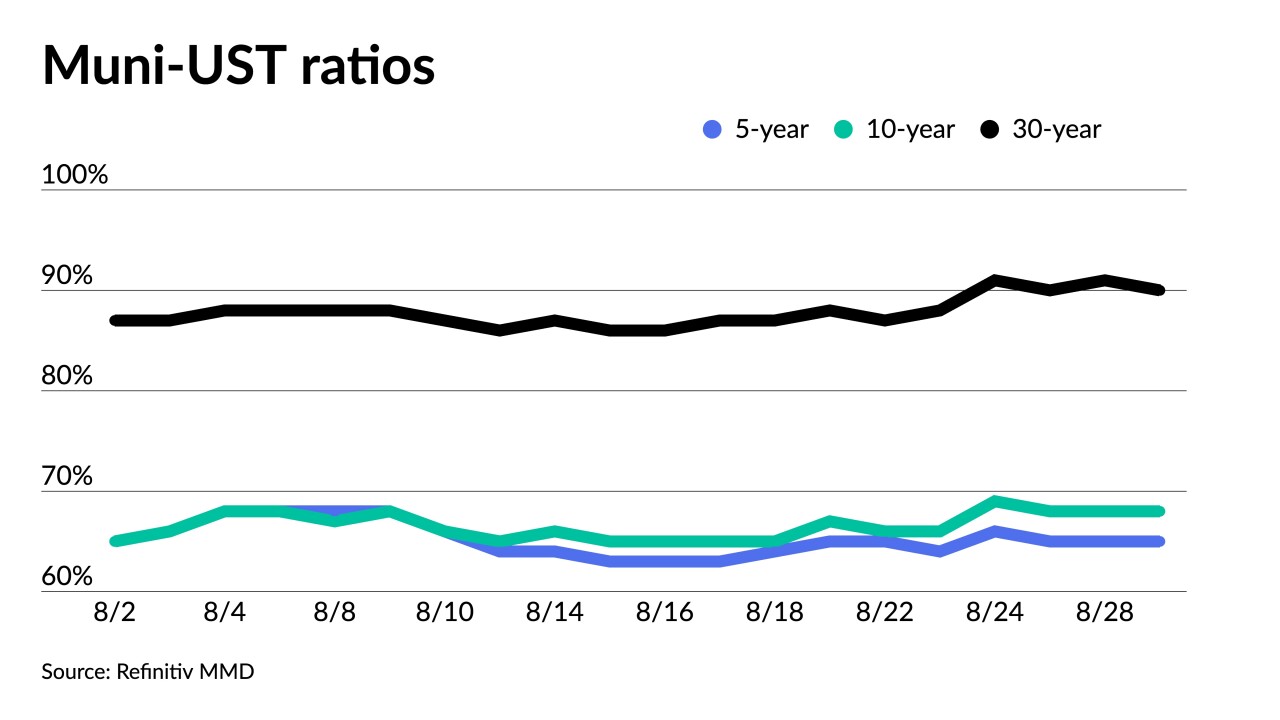

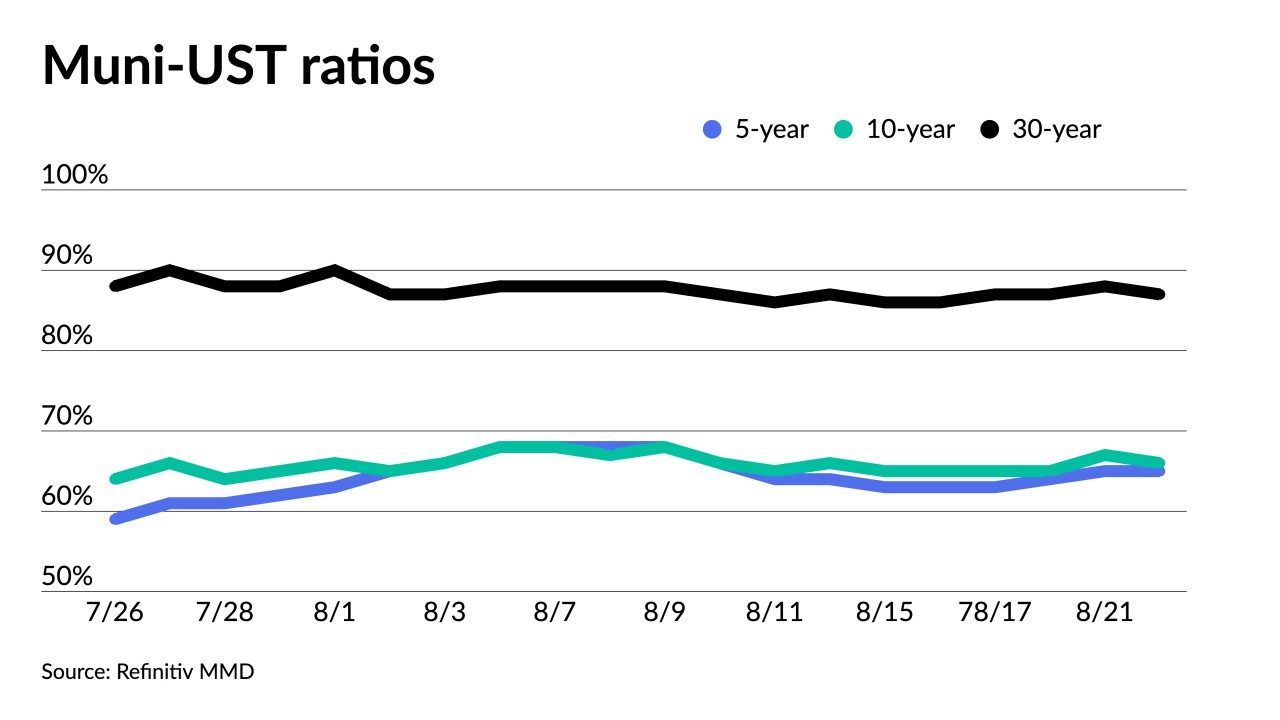

Investors remain hesitant about "jumping back into munis even as rates are nearing multi-year highs as tax-exempts are still not cheap enough with the front-end ratios still yielding under 70% while the historical averages are around 90%," AmeriVet Securities' Jason Wong noted.

September 5 -

The calendar will rebound with an estimated $7.141 billion next week with $6.323 billion of negotiated deals on tap and $817.6 million on the competitive calendar.

September 1 -

Refinitiv Lipper reported $407.976 million of inflows from municipal bond mutual funds for the week ending Wednesday after $534.428 million of outflows into the funds the previous week.

August 31 -

"We've seen more buyer attention at this time of the year versus what we generally would experience as we approach the beginning of September," said Morgan Stanley's Matthew Gastall.

August 30 -

Over the last month or so there's been some volatility in the muni market driven by the Treasury side, said Daryl Clements, municipal portfolio manager at AllianceBernstein.

August 29 -

The muni market "finally succumbed to the month-long rate selloff that had seen valuations test historically rich levels," said Birch Creek Capital strategists in a weekly report.

August 28 -

While muni buyers will see a meager slate of new issues this week, Jacksonville, Florida, heads to market with a sale of over $290 million of revenue and refunding bonds.

August 28 -

The new-issue calendar for the final week of August is estimated at a meager $2.979 billion. Bond Buyer 30-day visible supply sits at $5.76 billion.

August 25 -

Refinitiv Lipper reported $534.428 million of outflows from municipal bond mutual funds for the week ending Wednesday after $264.046 million of outflows into the funds the previous week.

August 24 -

Supply scarcity is helping the market through the Treasury volatility. Bond Buyer 30-day visible supply currently sits at $4.72 billion.

August 23 -

This week's new-issue supply needs to be "priced to sell to pique investor interest," said noted Nuveen's Daniel Close and Anders S. Persson.

August 22 -

The State Trunk Line Fund deal is the latest to fund the state's $3.5 billion bond authorization for highways. After this deal $700 million remains.

August 22