-

The calendar will rebound with an estimated $7.141 billion next week with $6.323 billion of negotiated deals on tap and $817.6 million on the competitive calendar.

September 1 -

Refinitiv Lipper reported $407.976 million of inflows from municipal bond mutual funds for the week ending Wednesday after $534.428 million of outflows into the funds the previous week.

August 31 -

"We've seen more buyer attention at this time of the year versus what we generally would experience as we approach the beginning of September," said Morgan Stanley's Matthew Gastall.

August 30 -

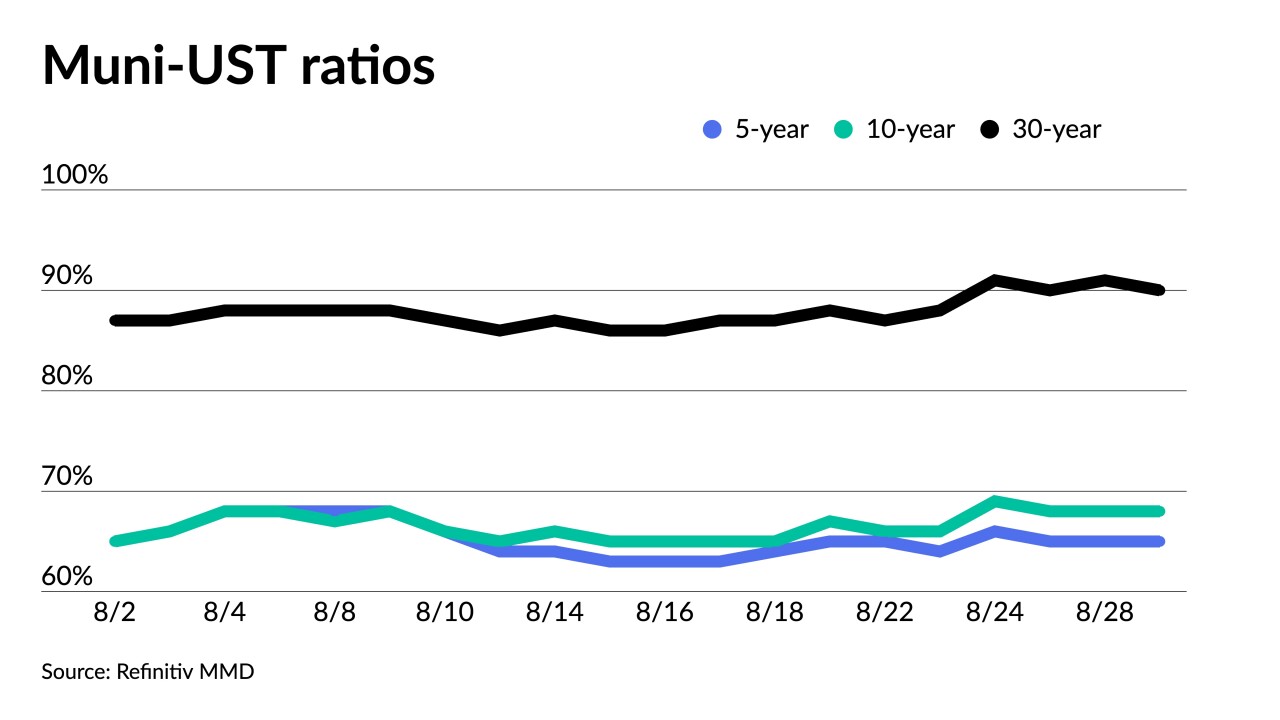

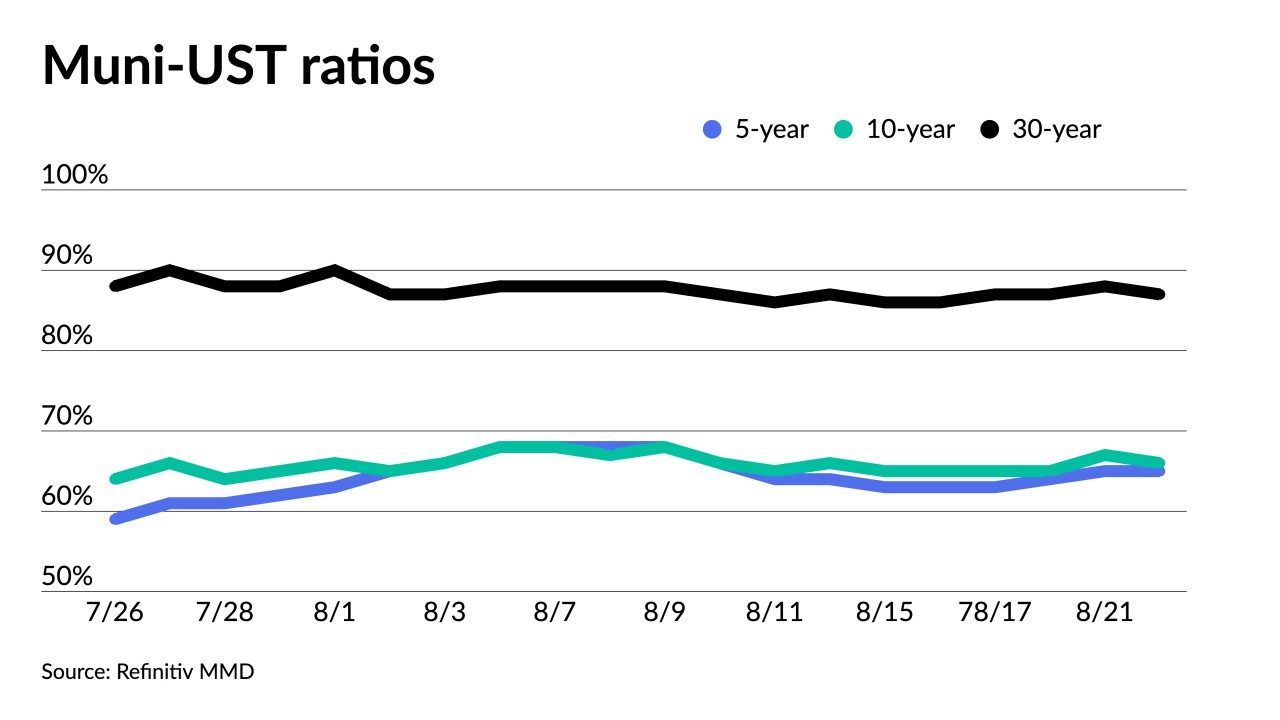

Over the last month or so there's been some volatility in the muni market driven by the Treasury side, said Daryl Clements, municipal portfolio manager at AllianceBernstein.

August 29 -

The muni market "finally succumbed to the month-long rate selloff that had seen valuations test historically rich levels," said Birch Creek Capital strategists in a weekly report.

August 28 -

While muni buyers will see a meager slate of new issues this week, Jacksonville, Florida, heads to market with a sale of over $290 million of revenue and refunding bonds.

August 28 -

The new-issue calendar for the final week of August is estimated at a meager $2.979 billion. Bond Buyer 30-day visible supply sits at $5.76 billion.

August 25 -

Refinitiv Lipper reported $534.428 million of outflows from municipal bond mutual funds for the week ending Wednesday after $264.046 million of outflows into the funds the previous week.

August 24 -

Supply scarcity is helping the market through the Treasury volatility. Bond Buyer 30-day visible supply currently sits at $4.72 billion.

August 23 -

This week's new-issue supply needs to be "priced to sell to pique investor interest," said noted Nuveen's Daniel Close and Anders S. Persson.

August 22