-

Royden Durham and Tony Tanner, portfolio managers at the Aquila group of funds, talk with Chip Barnett about what's special about Kentucky and Arizona -- what's the same and what's different -- within their municipal bond markets. (18 minutes)

October 17 -

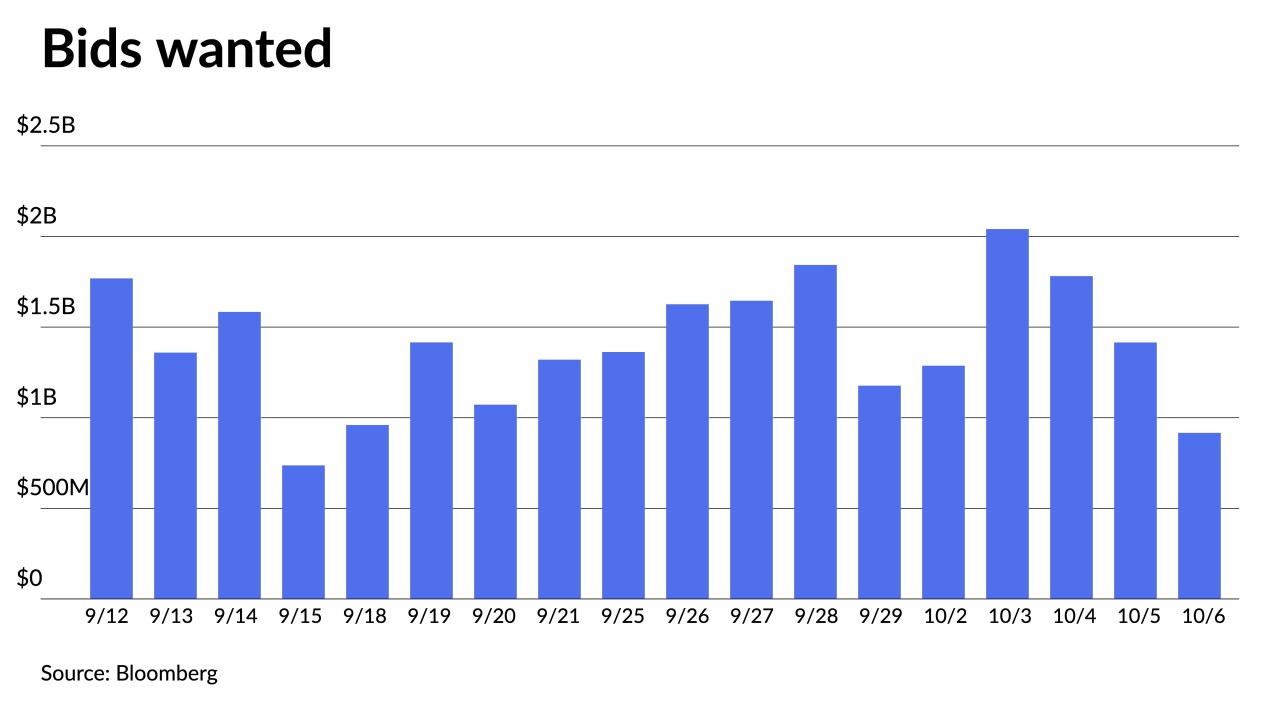

"The combination of higher yields and this week's heavier new-issue calendar will attract attention from income-focused individual investors as well as from institutional investors who are underweight munis," said CreditSights strategists Pat Luby and Sam Berzok.

October 16 -

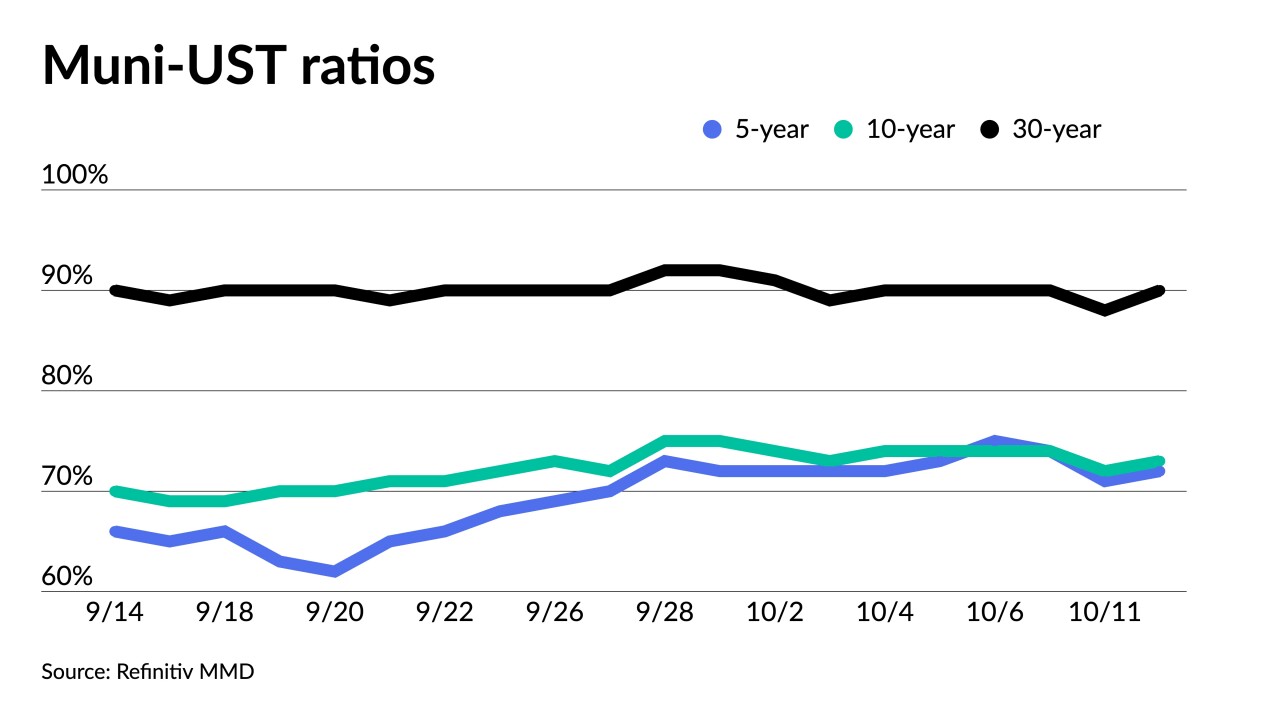

As valuations got richer after muni outperformance this week, Barclays strategists expect munis to be "truly tested in the next several weeks, with supply picking up."

October 13 -

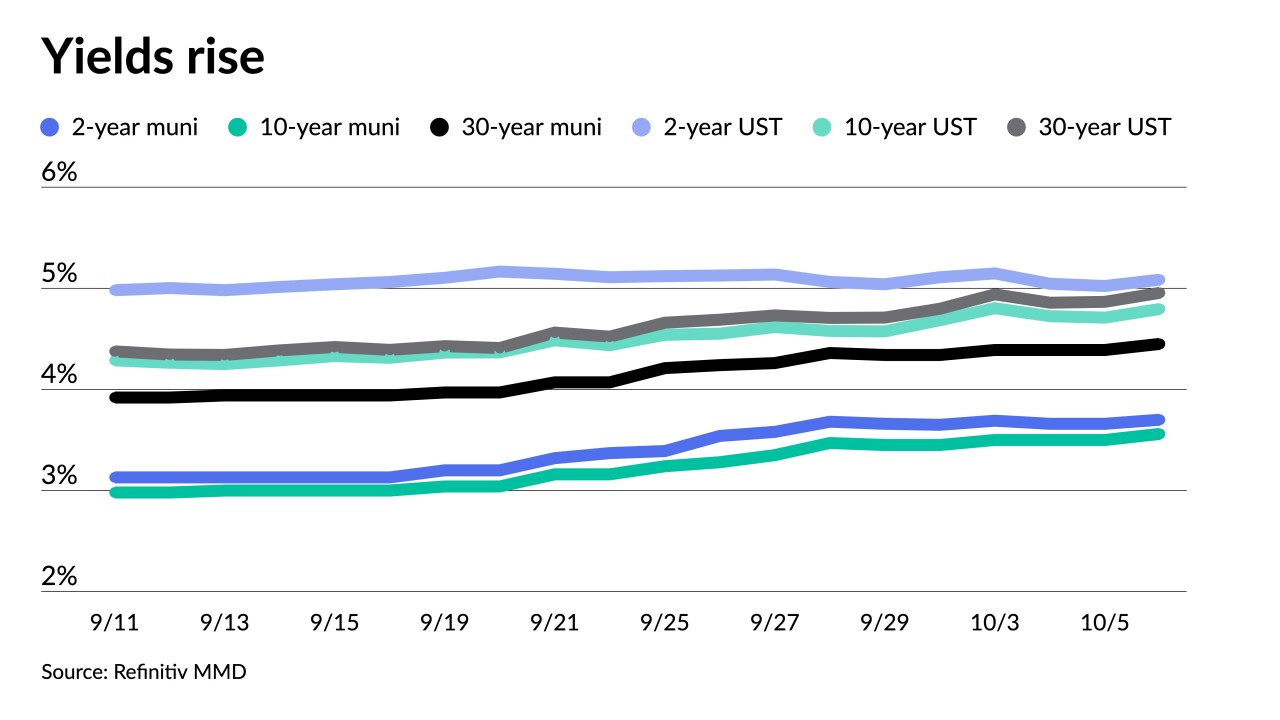

The recent rise in yields has created an opportunity for those investors waiting to "jump into the market," said Roberto Roffo, portfolio manager at SWBC Investment Company.

October 13 -

Despite the sticker shock of rising rates, yields in fact are at average levels for over the last 30 years, panelists said at the GFOA's MiniMuni conference.

October 13 -

A higher inflation figure sent UST yields higher, complicating Central Bank policymaking and reversing a flight-to-safety bid amid ongoing geopolitical turmoil in Israel.

October 12 -

Minutes from the September Federal Open Market Committee meeting were "not much of a market mover" Wednesday, said Scott Anderson, chief U.S. economist and managing director at BMO Economics.

October 11 -

However, "a long-lasting bond market rally seems unlikely given major structural shifts of higher bond supply and on uncertainty with demand," said Edward Moya, senior market analyst at OANDA.

October 10 -

The firm will continue to do business in the competitive market.

October 10 -

"Despite the breathtaking selloff in longer rates, Barclays' macro strategists see no clear catalyst to stem the bleeding," Barclays strategists said. "Data are unlikely to weaken quickly or enough to help bonds."

October 6