-

Bond Buyer Senior Reporter Keeley Webster shares an interview with California Treasurer Fiona Ma on her run for lieutenant governor as a prelude to a fireside chat Wells Fargo Director Julia Kim conducted with the state treasurer at The Bond Buyer's California Public Finance conference.

October 31 -

Another month of muni losses "may spark additional sale pressure as some investors throw in the towel, but we suspect any further weakness would represent a strong entry point for [investment grade] buyers," Birch Creek Capital said in a weekly report.

October 30 -

States use tax proceeds in a way that appeals to voters because recreational marijuana is often legalized through a referendum process.

October 30 -

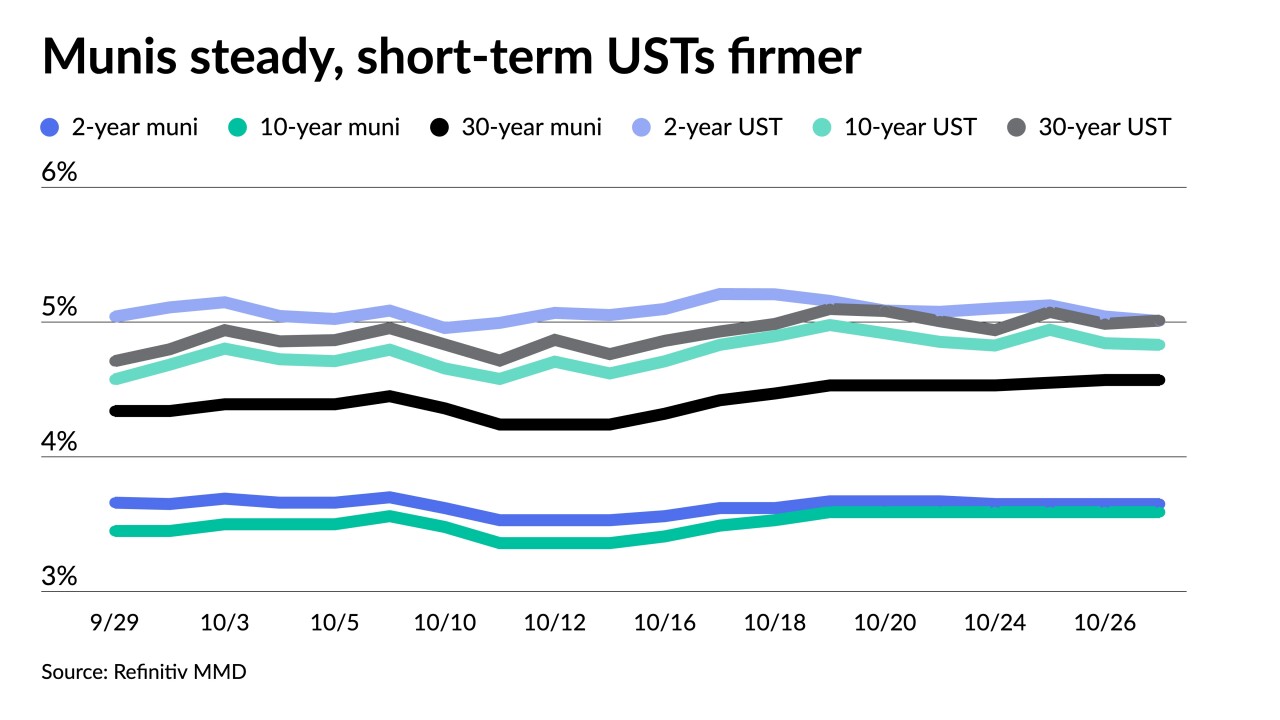

If Treasury rates become "more stabilized," it provides "a good reason to be somewhat constructive on munis for a while," BofA Global Research said in a report.

October 27 -

The Grand River Dam Authority, the state's largest public power utility, is expected to start issuing the debt later this year.

October 27 -

Investors continue to pull money from muni mutual funds with LSEG Lipper reporting $934.7 million of outflows for the week ending Wednesday after $297 million of outflows the week prior.

October 26 -

Municipal mutual fund losses continued last week — but to a lesser extent — as the Investment Company Institute Wednesday reported investors pulled $1.291 billion from the funds in the week ending Oct. 18 after $2.645 million of outflows the previous week.

October 25 -

The biggest challenge to the public finance industry at large remains market volatility, according to respondents in The Bond Buyer's Live Market Survey. Forty-six percent named it their top concern, with a recession or economic downturn coming in second at 33%.

October 25 -

Munis experienced some firmness Tuesday, but "whether or not that's going to be for more than a nanosecond remains to be seen," said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

October 24 -

The Board of Education enters the market with two speculative grade ratings and one investment grade after affirmations from the agencies across the board.

October 24