-

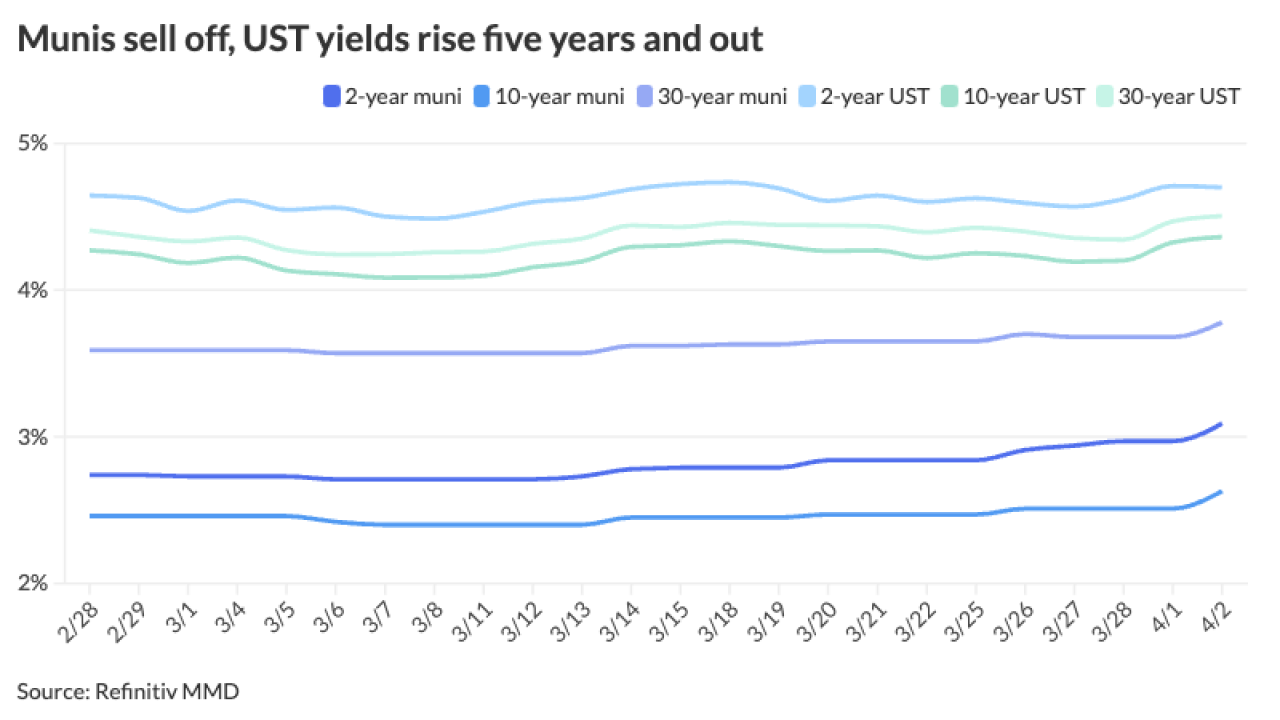

"Most spots on the muni AAA HG curve are at or near year-to-date highs, and the muni HG curve showed significant underperformance across the curve in March, relative to the broader fixed income market, after sizable muni outperformance in February," said J.P. Morgan strategists.

April 3 -

-

Among the items approved by the state Local Government Commission were $750 million of affordable housing bonds, the Turnpike Authority's Thursday sale of $184 million to refund BABs and Wake County's $321 million refunding bonds.

April 3 -

Before Tuesday's selloff, muni yields have been rising over the last several weeks due to "outsized" new-issue supply, said Anders S. Persson, Nuveen's chief investment officer for global fixed income, and Daniel J. Close, Nuveen's head of municipals.

April 2 -

John Hallacy of John Hallacy Consulting and Rich Ciccarone, president emeritus of Merritt Research Services, talk with Chip Barnett about the municipal bond business over the past 40 years. They take a look back at where the industry has been, where it is and where it will be going.

April 2 -

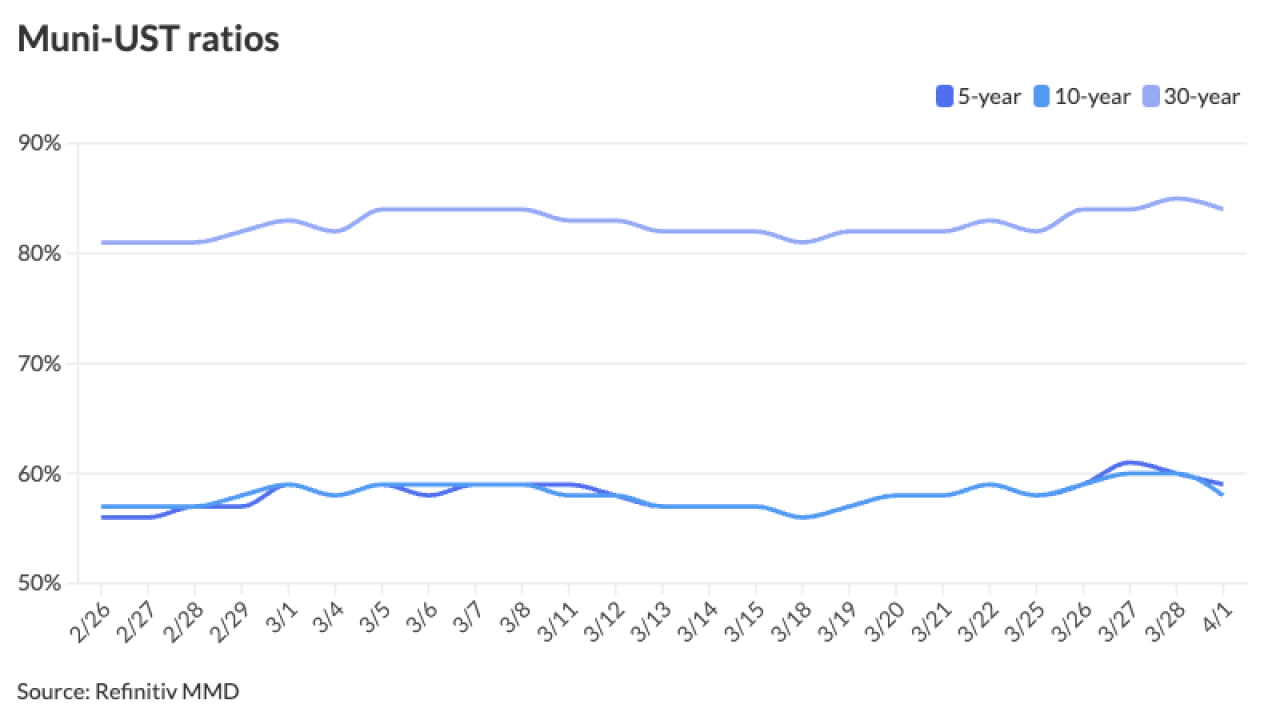

The uptick in supply amid tax season has led to a short-end correction and higher muni to UST short ratios, but the levels are still rather rich from a historical perspective.

April 1 -

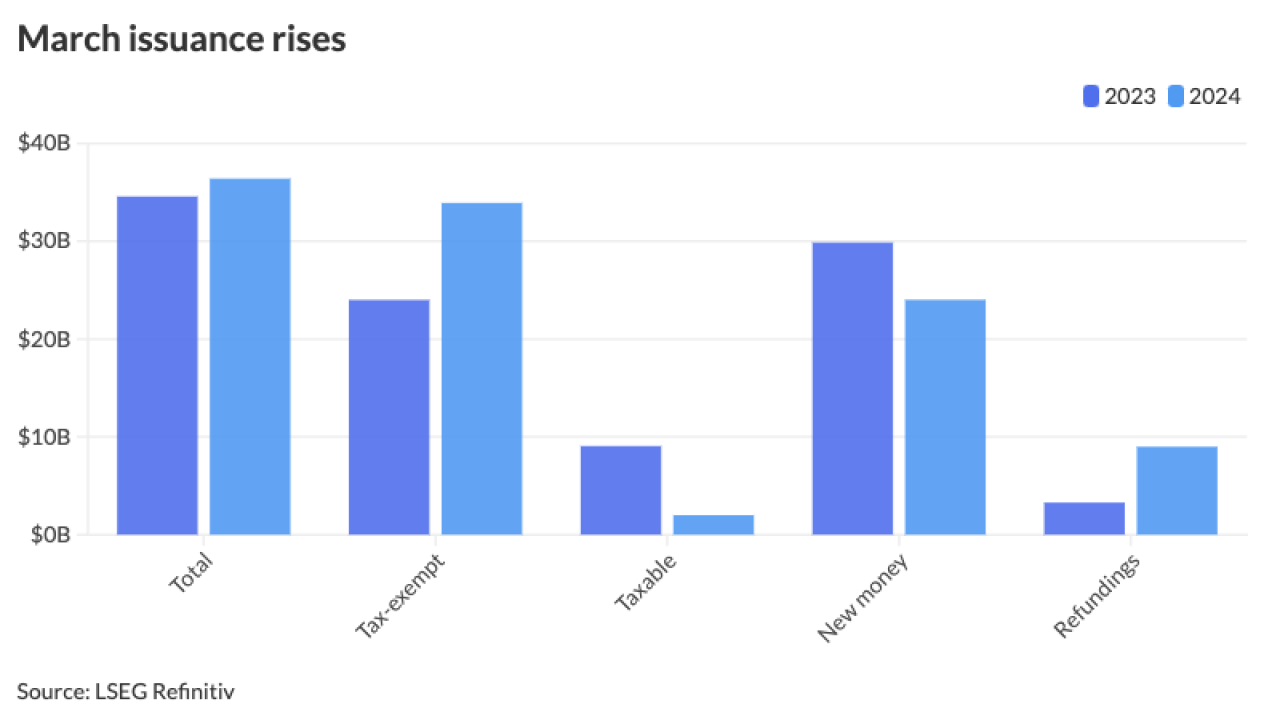

March issuance came in at $36.405 billion, above the $34.579 billion 10-year average, according to LSEG Refinitiv data.

April 1 -

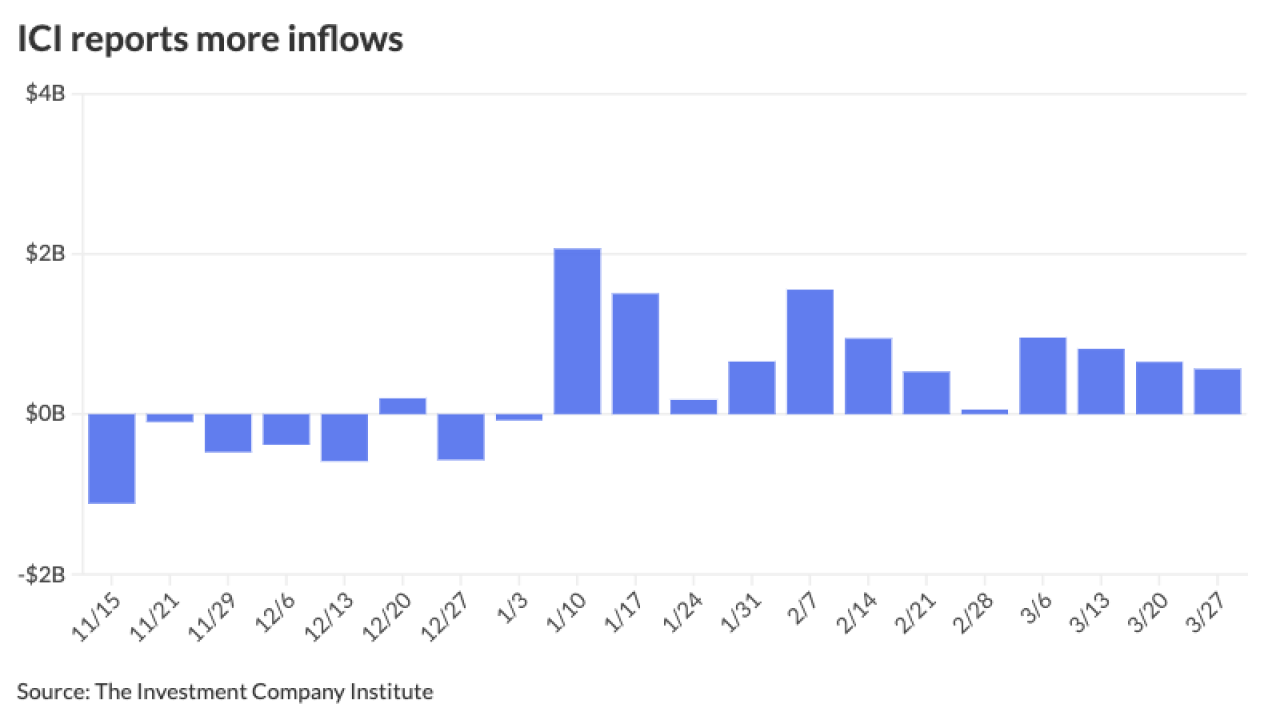

LSEG Lipper reported fund inflows of $447 million while high-yield muni bond funds saw another round of inflows at $246 million, marking the 12th consecutive week of positive flows in that space.

March 28 -

Most of the selling during tax season happens on the front end of the curve, said Wesly Pate, senior portfolio manager at Income Research + Management.

March 28 -

"Now that the first phase of Miami Worldcenter is complete and the second phase is underway, our team is issuing bonds backed by the TIF package, which will help defray the cost of the improvements made in the district," the development team said.

March 28