-

In 2024, variable rate (short put) issuance is up 6.4% increase year-over-year, LSEG data shows. Few expect issuance to return pre-financial crisis levels.

June 26 -

Convention centers in Chicago, Cincinnati and St. Louis are being upgraded, although cost increases after the pandemic added challenges to some financings.

June 26 -

Demand for the increased supply has been "solid" if nearly largely reliant on income-oriented small lot buyers, noted Municipal Market Analytics, Inc. Partner Matt Fabian. Through last week, buyers continued to be separately managed account/retail in size.

June 25 -

Finance officials for the city decided to be the first municipal issuer to use the distributed ledger technology for a $10 million deal, banking on cost savings, better liquidity and more access for retail investors to their bonds. Mayor Tom Koch, CFO Eric Mason and Strategic Asset Manager Rick Coscia say it should be the first of many deals for the industry.

June 25 -

Total volume currently stands at $224.13 billion, up 38.5% from $161.848 billion at this time last year. As the end of the first half approaches, several firms are revisiting their supply projections for the year, given the growth so far this year.

June 25 -

With the "pretty good run" month-to-date, it would not be unexpected to see "the market take a breather, and with a large calendar this coming week, it may again move sideways," said AllianceBernstein strategists in a weekly report.

June 24 -

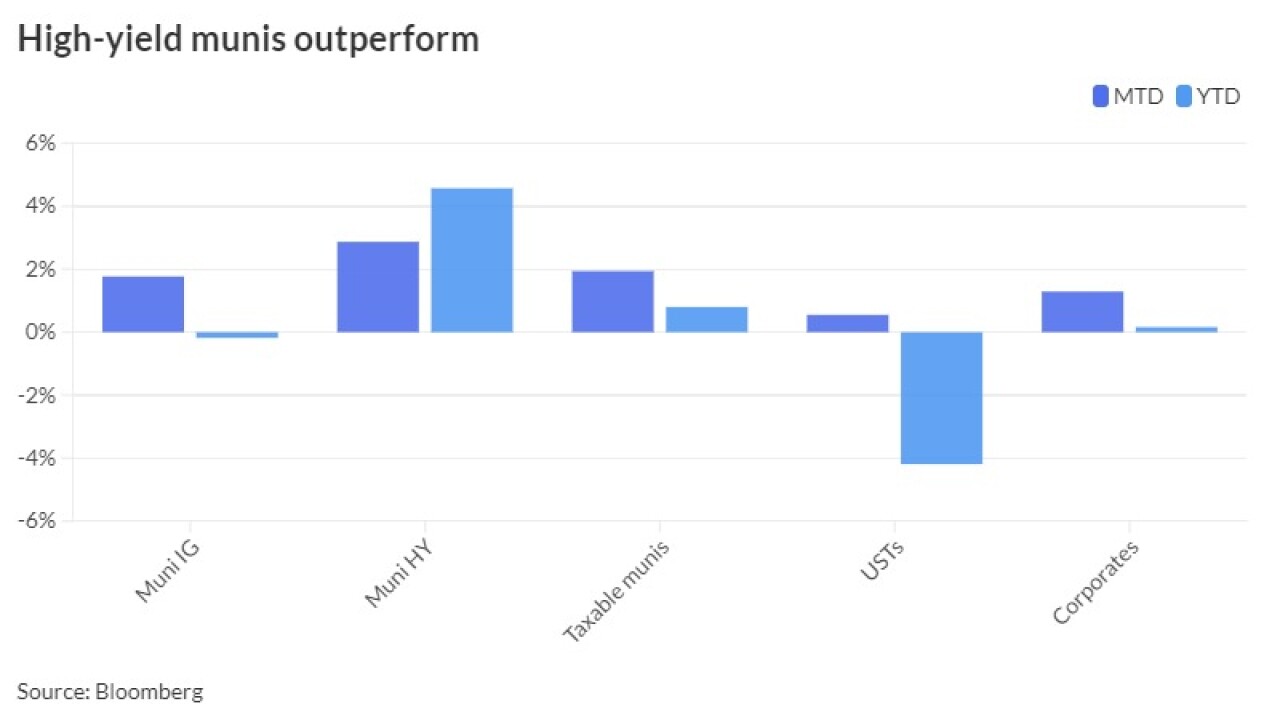

"It is hard to be overly excited about current valuations of tax-exempts relative to Treasuries; however, at tax-adjusted yields (using individual tax brackets), munis look quite attractive compared with other asset classes," noted Barclays PLC.

June 21 -

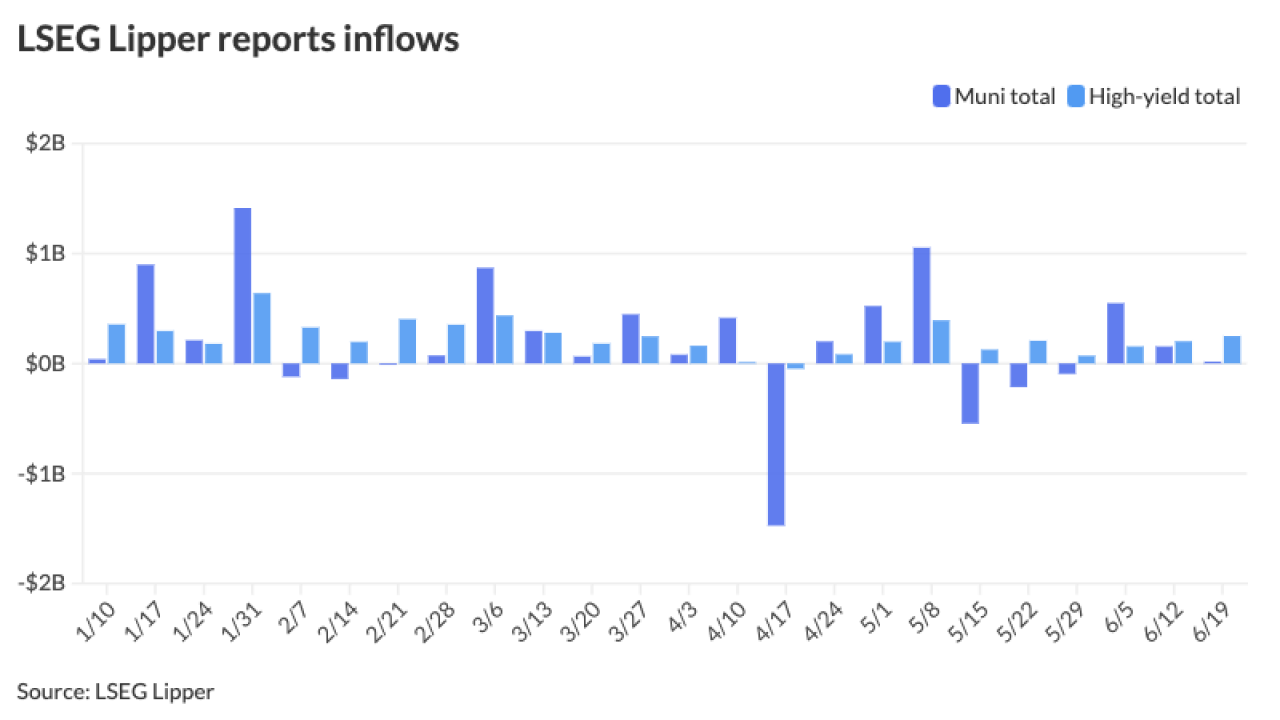

Municipal bond mutual funds saw small inflows as investors added $16.4 million to the funds after $154.4 million of inflows the week prior, according to LSEG Lipper.

June 20 -

The state's new law requires companies like investment banks to provide written verification of their positions, part of a trend among similar bills aimed at preventing Wall Street banks from lying about their positions, said a firearms industry lobbyist.

June 20 -

Issuance this year is "well on its way" to $450 billion, mostly from the tax-exempt supply of new money projects, said Matt Fabian, a partner at Municipal Market Analytics.

June 18