-

Muni mutual funds saw outflows after 23 weeks of inflows as LSEG Lipper reported investors pulled $316.2 million for the week ending Dec. 11. High-yield municipal bond funds, though, saw inflows of $192.3 million.

December 12 -

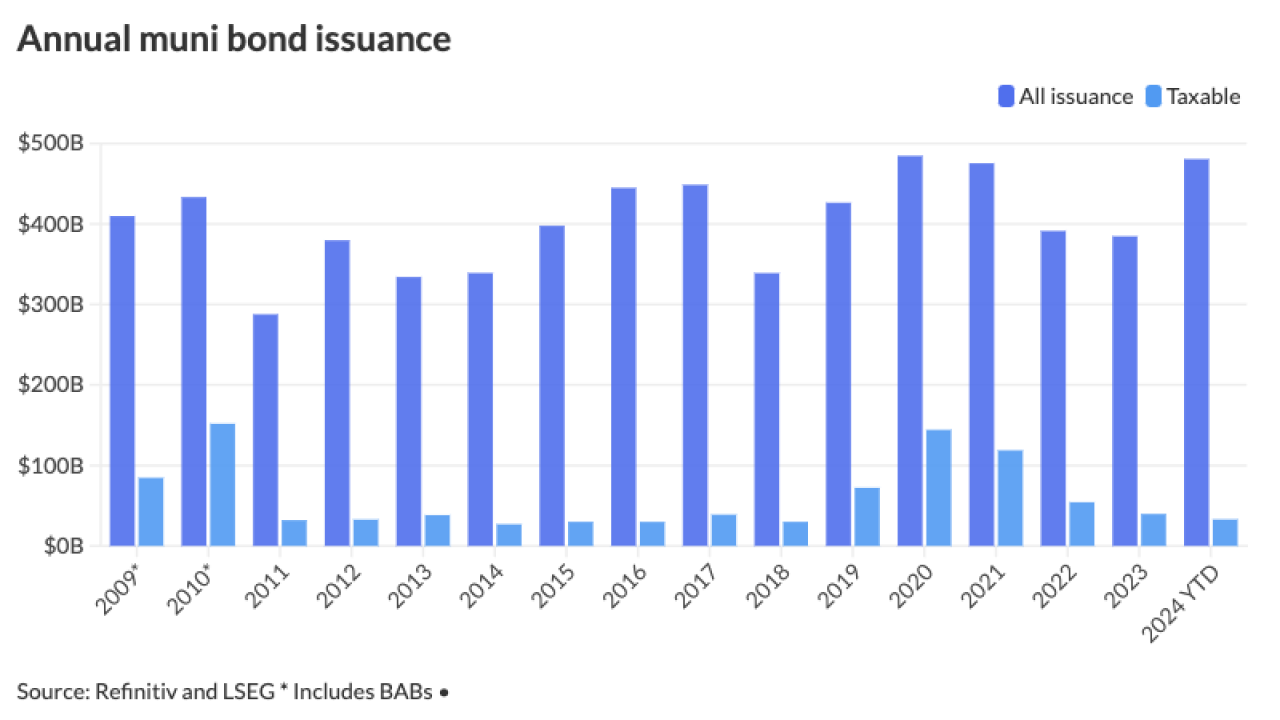

Most on the Street expect issuance to come in around $500 billion, but a few think volume will be much higher, primarily because of potential changes to the tax exemption. Most firms expect refunding volumes to also grow in 2025.

December 12 -

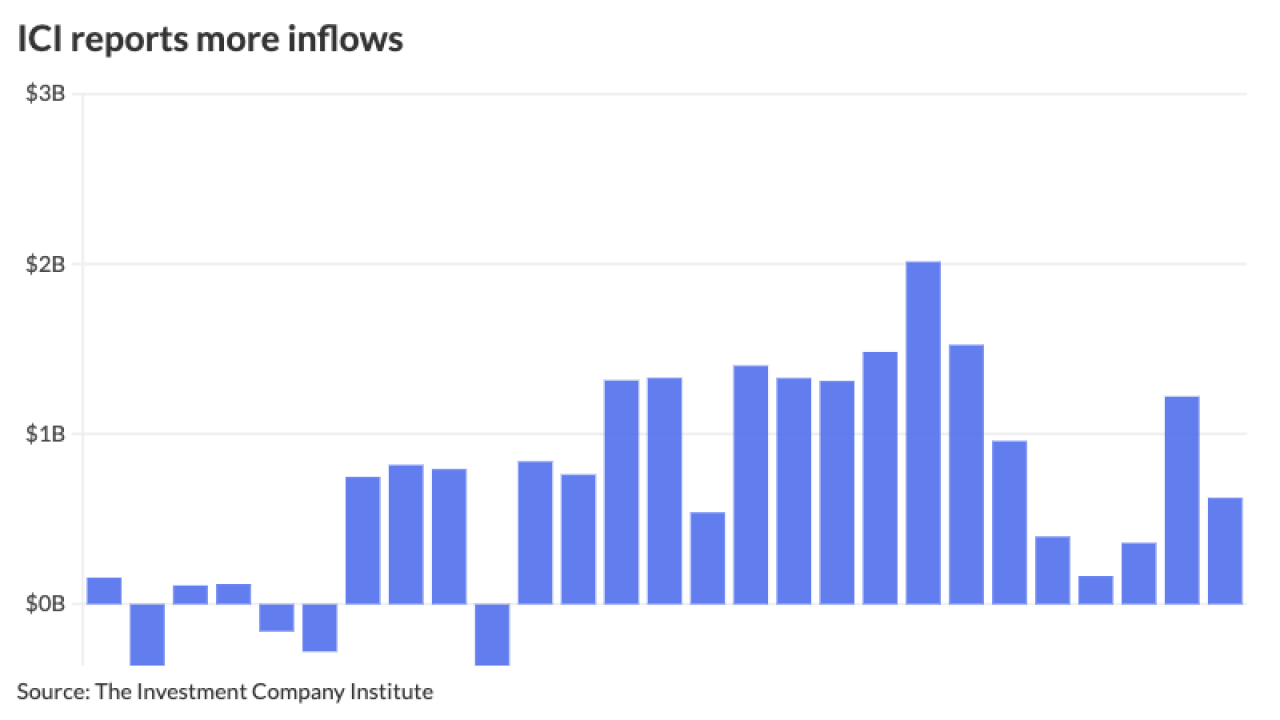

Municipal investors are more focused on the final new-issues coming down the pike and repositioning books as 2024 heads to a close. ICI reported another week of inflows into municipal bond mutual funds.

December 11 -

"With strong demand, rate cuts and favorable technicals, the muni market — outside of an unexpected shock — is set up to perform well over the next couple of months," said Daryl Clements, a municipal portfolio manager at AllianceBernstein.

December 10 -

Bond Buyer senior reporter Keeley Webster hosted a wide-ranging discussion on the state's fall bond slate, housing, and second-term priorities with California Treasurer Fiona Ma and Deputy Treasurer of Public Finance John Sheldon.

December 10 -

Munis are in the black so far this month, with the Bloomberg Municipal Index at +0.33% in December and +2.88% year-to-date, the high-yield index is at +0.27% in December and returning 8.41% in 2024, while taxable munis are returning 0.43% so far this month and 4.58% in 2024.

December 9 -

Connecticut is poised to ramp up transportation borrowing, after years of consistently issuing less debt than it had the capacity and authority to sell.

December 9 -

Investors will be greeted with a diverse new-issue slate the week of Dec. 9, led by bellwether names. If all the deals price, 2024's total should break 2020's record by the end of the week. Despite rich valuations, demand has remained strong as the year winds down.

December 6 -

High-yield municipal bond funds saw inflows of $534.1 million compared to $300.6 million compared the previous week, per LSEG Lipper data.

December 5 -

"This matter is now under active investigation by federal authorities and impacted financial institutions, who are coordinating with the White Lake Township Police Department," said Daniel Keller, chief of police, in a statement.

December 5 -

Technicals could "break down" if there is a potential decline in risk assets or rising unemployment, particularly in white-collar jobs, said Jeff Timlin, a managing partner at Sage Advisory.

December 4 -

Blackstone Inc. is refinancing tax-exempt debt for a 76-story residential tower in downtown Manhattan designed by famed architect Frank Gehry.

December 4 -

Muni investors hope "any move toward higher yields is steady, even dignified, such that it doesn't catalyze an outflow cycle that would countervail year-to-date total returns just before we close out the year," said Vikram Rai, head of municipal strategy at Wells Fargo.

December 3 -

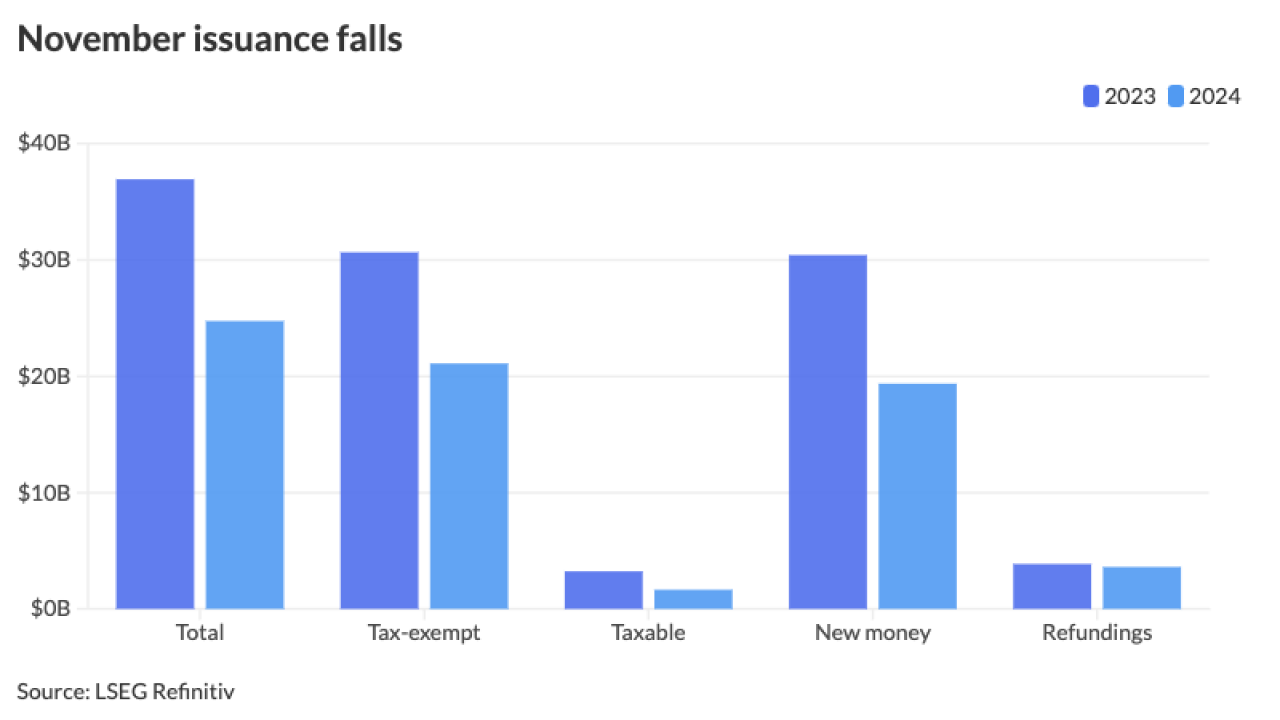

Munis ended November in the black with the asset class seeing gains of 1.73% for the month, pushing year-to-date returns to 2.55%.

December 2 -

The product is designed to compartmentalize information and provide a unified system to monitor bank activities, forecast cash inflows and outflows, and prevent fraud.

December 2 -

With an estimated $13 billion calendar on tap, demand for paper will be bolstered by the $16 billion of redemptions coming Monday while mutual fund inflows, this week at about $560 million and concentrated in the long-end, signal solid investor support. Munis are returning 1.73% in November as of Friday.

November 29 -

The Investment Company Institute reported $1.221 billion of inflows into municipal bond mutual funds for the week ending Nov. 20. Exchange-traded funds saw inflows of $836 million.

November 27 -

November's total is below the 10-year average of $32.278 billion and is the lowest monthly total this year. The year's total is about $25 billion short of $500 billion.

November 27 -

"Earlier this month, Chair [Jerome] Powell noted that there was no 'hurry' to cut rates," noted BMO Senior Economist Priscilla Thiagamoorthy. The minutes, she noted, "confirm a broad support for taking a more cautious approach in easing monetary policy."

November 26 -

Markets could see that "the risks of higher inflation and interest rates are implicit constraints on the Trump policy agenda, with the eventual policy outcomes potentially less inflationary than some investors previously feared," UBS strategists noted.

November 25