-

Municipal investors can expect just shy of $10 billion of new issues from which to choose the first full week of October and the fourth quarter, led by a $1.5 billion taxable general obligation bond offering from New York City. Connecticut is bringing $935 million of general obligation bonds.

October 4 -

Municipal bond mutual funds saw inflows of $1.879 billion in the latest week, marking the 14th consecutive week of inflows and the highest level of 2024, per LSEG data, reiterating the strong investor support for this market.

October 3 -

This surge in demand "is no coincidence — it's the result of weeks of relentless inflows, further amplified by the Federal Reserve's recent rate cut," said 16Rock Asset Management CIO James Pruskowski.

October 3 -

The biggest theme within the muni market — and what is responsible for its performance — is the amount of cash on the sidelines, with $6-plus trillion in money market funds and close to $2.5 trillion in certificates of deposits, said Julio Bonilla, a fixed-income portfolio manager at Schroders.

October 2 -

Speakers at the LGBTQ+ History Month mixer pushed back against attacks on diversity.

October 2 -

The larger supply calendar should be "taken down well given the persistent inflows into our market and investors are still sitting on plenty of cash," said Daryl Clements, a municipal portfolio manager at AllianceBernstein.

October 1 -

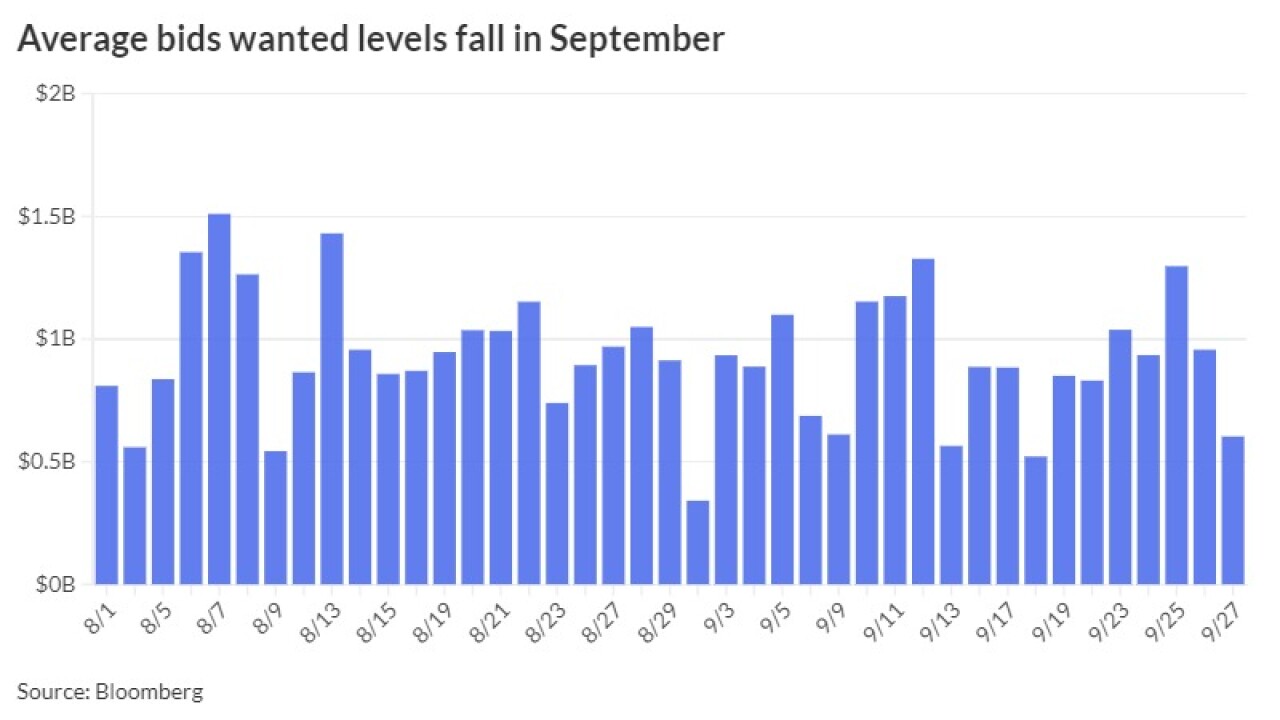

"As September draws to a close, some dynamics may prevail in October but others could undergo a shift," said NewSquare Capital's Kim Olsan. "One aspect that will continue is the level of supply coming to market."

September 30 -

September volume came in over $44 billion leading volume year-to-date to hit more than $380 billion, just shy of 2023's full-year total issuance.

September 30 -

Bonds will finance construction of the South Coast Rail Project, which will restore commuter rail service between Boston and southeastern Massachusetts.

September 30 -

Municipal triple-A yield curves closed out the week with few changes, valuations were little changed, but at attractive levels, and the forward calendar climbs to more than $10 billion to open the fourth quarter.

September 27