-

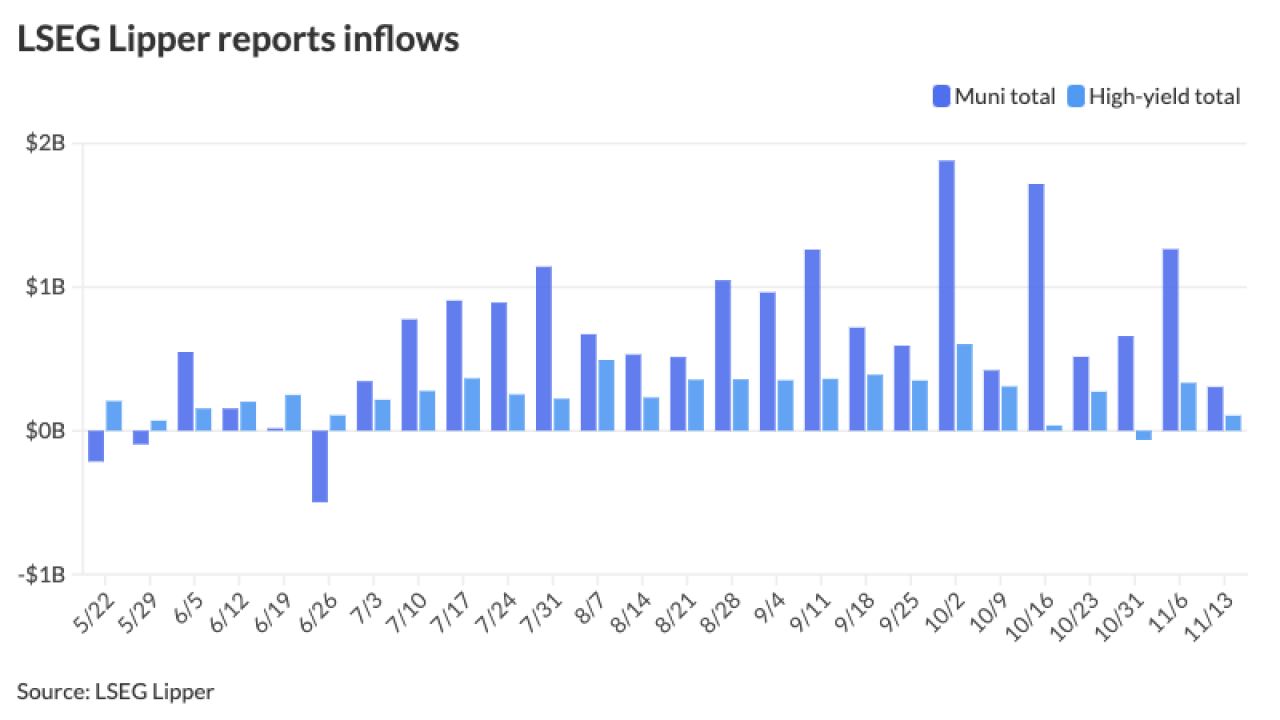

High-yield funds saw $608.9 million of inflows compared with inflows of $150.3 million the week prior.

November 21 -

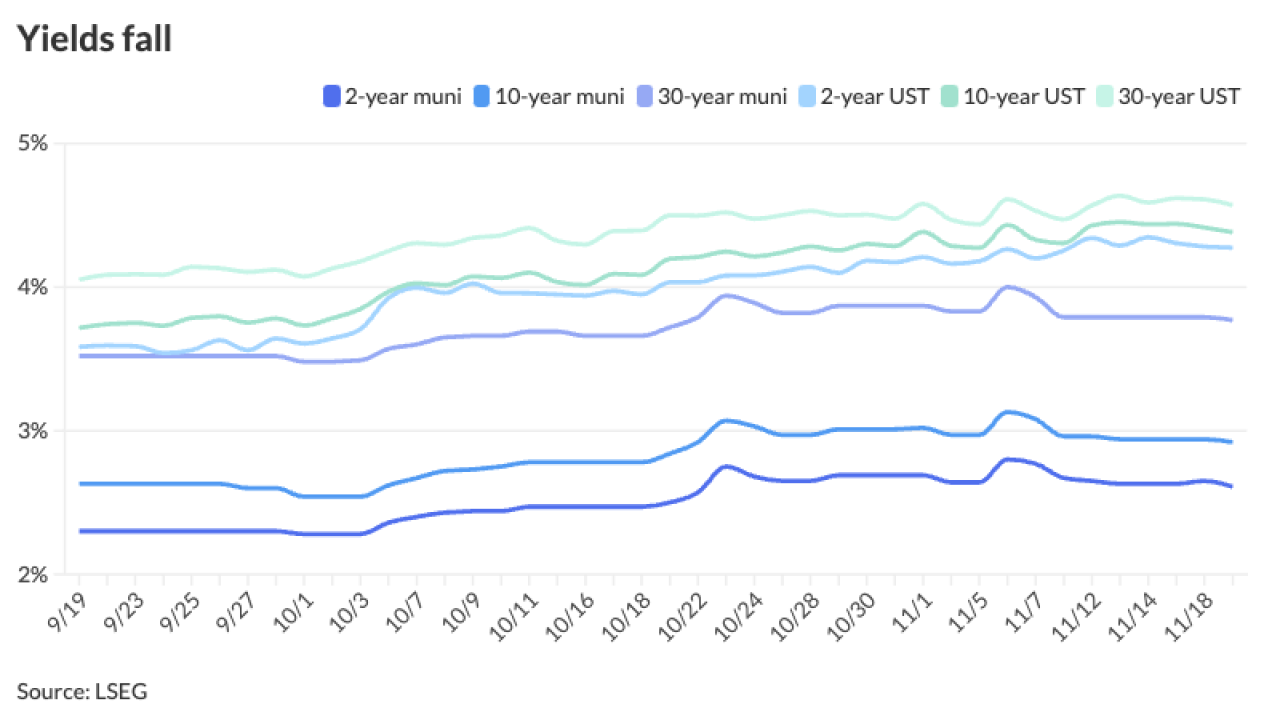

Municipals are outperforming USTs to a large degree this month, with investment grade munis seeing positive 0.81% returns in November and 1.63% year-to-date. USTs are in the red at -0.40% in November with only 0.96% positive returns in 2024.

November 20 -

"This year, with the tax-exemption clearly threatened, primary calendars should (although, of course, might not) be larger, putting a $500 billion full-year supply total in range, with $451 billion already in the books through 46 weeks," said MMA's Matt Fabian.

November 19 -

The low-rated, Phoenix-based university turned to a public debt sale after refinancing maturing outstanding bonds with bridge loans.

November 19 -

The wealthy city is borrowing $124.2 million through its finance authority. The bonds are backed by lease payments the city will pay from its general fund.

November 18 -

Houston is set to price Tuesday $1 billion of United Airlines Terminal Improvement Projects AMT revenue bonds while the Public Finance Authority will bring $125 million of non-rated Million Air Three General Aviation Facilities Project revenue bonds.

November 18 -

As headline risk swirls around the Fed and the transition to the Trump administration, municipals have largely stayed in their own lane. November finds the municipal market "in far better technical shape, with an attractive backdrop through at least year-end," J.P. Morgan's Peter DeGroot said.

November 15 -

The Aloha State received three rating affirmations as it prepares to sell $750 million of taxable general obligation bonds.

November 15 -

This month is experiencing similar volatility as 2016 when generic yields traded higher by 50 to 70 basis points during November of that year, said Kim Olsan, a senior fixed income portfolio manager at NewSquare Capital.

November 14 -

The finance team burned the midnight oil to assemble and market one of the most complex deals in the municipal market this year.

November 14