-

After two weeks of a deluge of issuance, supply drops off "given the FOMC meeting and Juneteenth holiday, so we expect investors will refocus on the secondary market and look to scoop up any value left behind in the wake of the issuance onslaught," said Birch Creek strategists.

June 16 -

Issuance takes a bit of a breather due to the Juneteenth holiday and the Federal Open Market Committee meeting, Barclays strategists said.

June 13 -

BlackRock strategists are "constructive" on munis for multiple reasons and think the current market environment presents itself as a buying opportunity, especially as issuance continues to be elevated and provides "ample ability" to source bonds in the primary market.

June 12 -

The bond panel approved $215 million in public facilities revenue bonds and $125 million in housing bonds.

June 12 -

A "lighter-than-anticipated CPI report" led to UST firmness, as it "quelled fears about tariff-related inflation and boosted enthusiasm that the Fed will cut rates in the next two or three meetings," said José Torres, senior economist at Interactive Brokers.

June 11 -

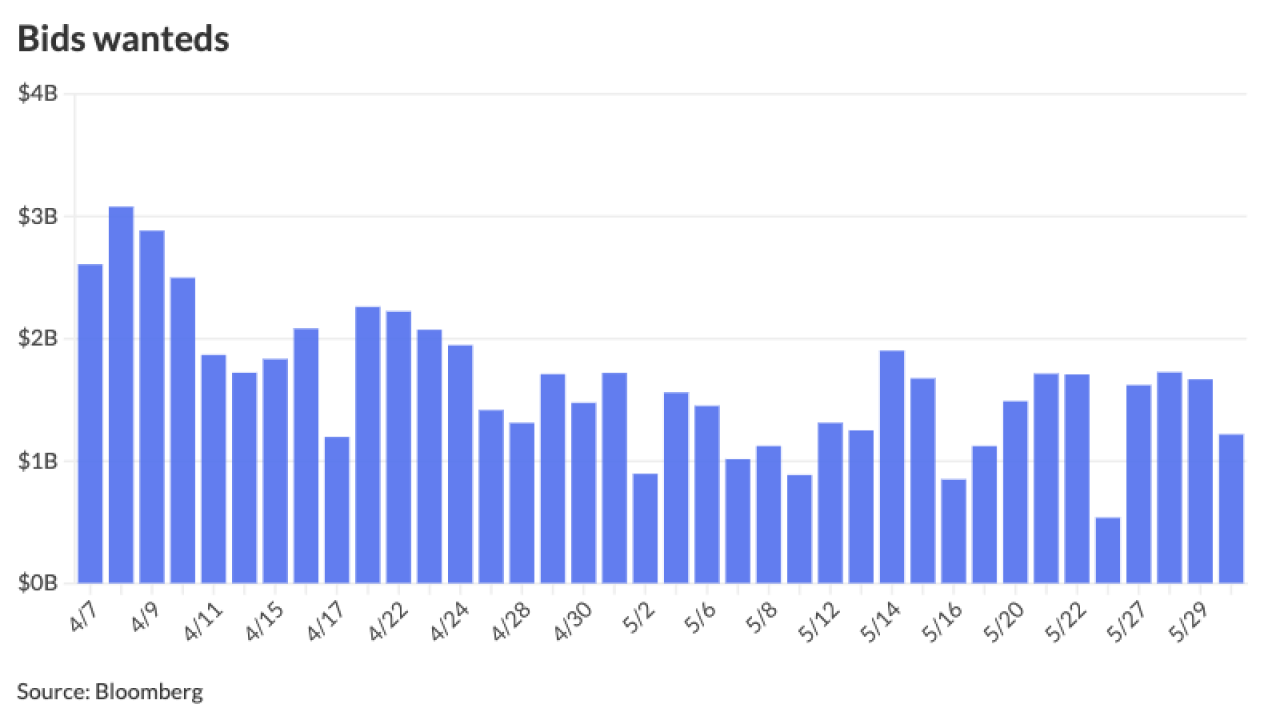

The elevated new-issue market comes on the heels of one of the largest weeks of issuance.

June 10 -

"The broader themes from the demand perspective are that it's choppy and people are not necessarily jumping into high-yield munis with both feet," said First Eagle's John Miller.

June 10 -

However, the new-issue calendar may not be "absorbed as easily, given valuations have grown less compelling after this week's performance," said Birch Creek strategists.

June 9 -

Armed with higher ratings since its last sale four years ago, the city is set to return to the market with a bang.

June 9 -

Chicago is facing myriad headwinds. But its GO bond sale last week was oversubscribed and city officials said that allowed them to lower yields in repricing.

June 9 -

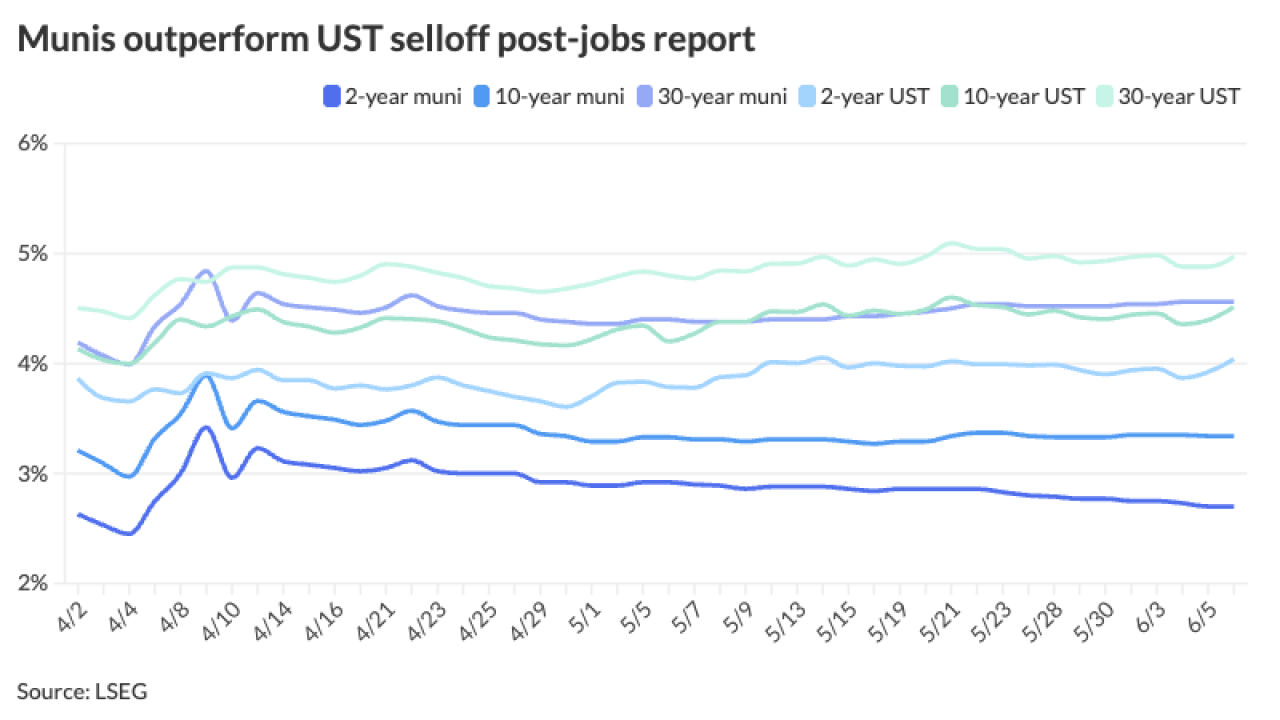

The nonfarm payrolls report shows the economy is "hanging in there," though it is slowing, said Jeff MacDonald of Fiduciary Trust International.

June 6 -

This week the market has performed "exceedingly well" with the tailwind of June 1 reinvestment capital, said J.P. Morgan strategists led by Peter DeGroot.

June 5 -

The utility expects the bonds to have an all-in true interest cost of 4.91%.

June 5 -

There is still a lot of chaos and uncertainty out there, said Jennifer Johnston, director of municipal bond research at Franklin Templeton.

June 4 -

"We're going to get a lot of price discovery with the big deals, a large number of deals, and then a lot of cash to put to work," said Whitney Fitts of Appleton Partners.

June 3 -

The Delta Center hockey and basketball venue will be renovated with proceeds from the $900 million Downtown Revitalization Public Infrastructure District deal.

June 3 -

Issuance this week soars to nearly $17 billion, and investors are "bracing for another hefty serving the following week," said Birch Creek strategists.

June 2 -

The Indiana Financing Authority is the biggest entry on 2025's largest negotiated calendar with $1.5 billion of Indiana University Health system revenue bonds.

May 30 -

With higher yields and ratios, many participants say investors should be taking advantage of current levels.

May 29 -

Chicago goes to market next week with $517.95 million of taxable and tax-exempt general obligation bonds following a downward outlook revision from Fitch.

May 29