-

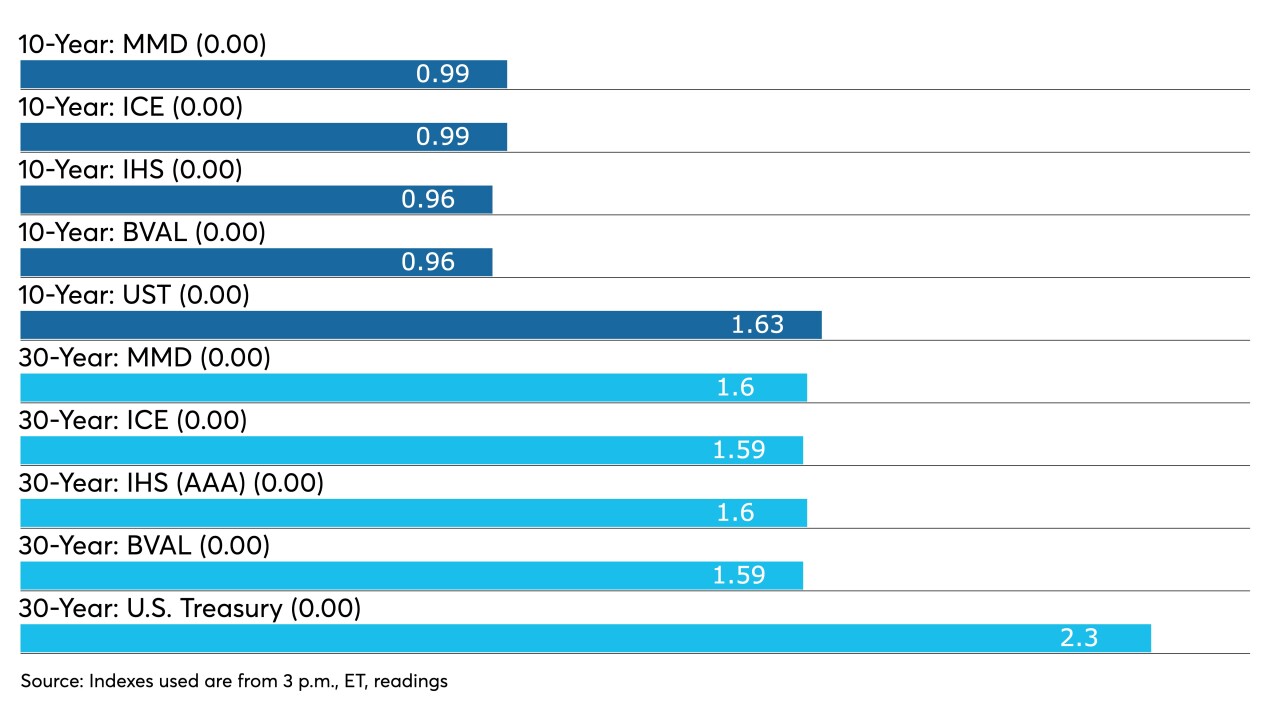

After just one session, the 10-year muni is back below 1% with ICE Data Services and Refinitiv MMD at 0.99% while Bloomberg BVAL is at 0.96% and IHS Markit at 0.95%.

May 4 -

Regina Egea, president of the Garden State Initiative, analyzes New Jersey's fiscal landscape, including the proposed state budget, unfunded pension liability and deficit borrowing. Paul Burton hosts. (20 minutes)

May 4 -

Inflationary pressures remain high while the manufacturing sector continues to deal with supply chain woes that hold it back, analysts said.

May 3 -

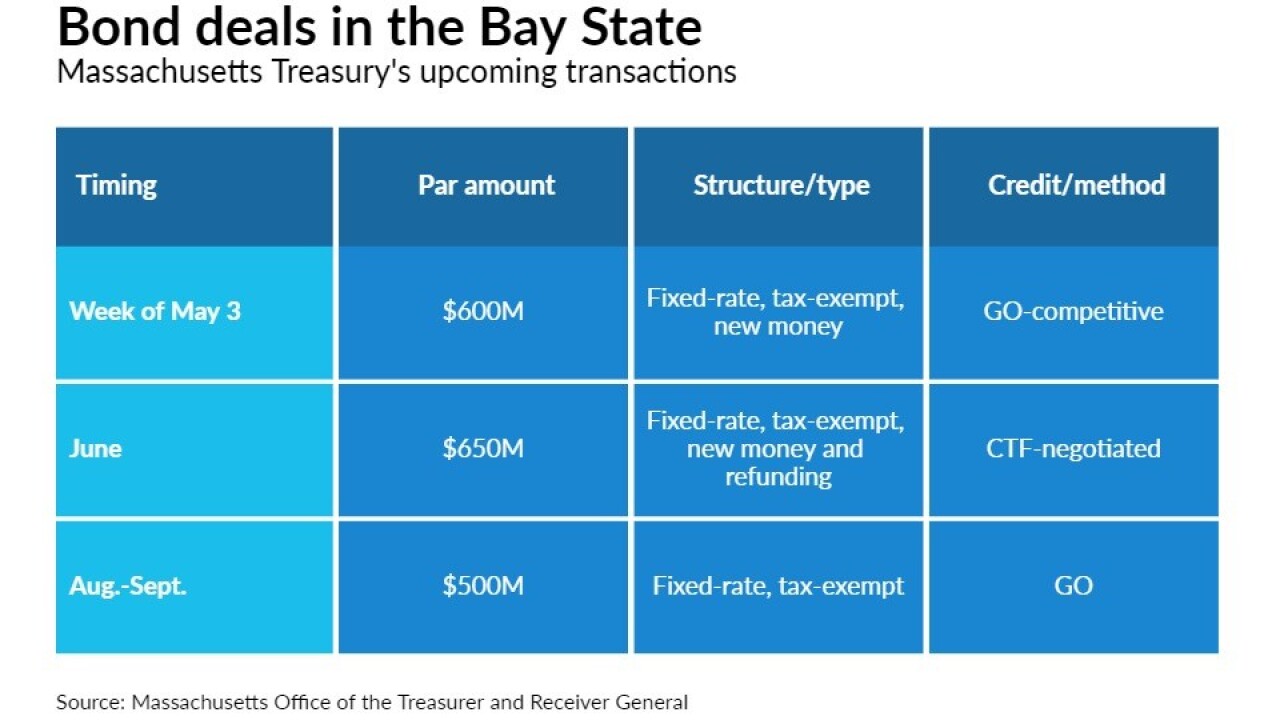

The states intend to come to market with $600 million and $1 billion, respectively, bringing state GO credits in an improving credit environment that has held yields down.

May 3 -

Rates, ratios and credit spreads have munis entering May on solid footing, though some pressures due to tax season and rising U.S. Treasuries remain.

April 30 -

With federal aid rolling out, the municipal credit picture is improving and issuers are coming to market at a faster clip. An infrastructure package could push issuance levels even higher.

April 30 -

The North Texas Tollway Authority will sell a mix of taxable first-tier and tax-exempt second-tier bonds in the refunding transaction.

April 30 -

Refinitiv Lipper reported another week of inflows at $1.64 billion, with $630 million headed into to high-yield. Benchmark yields rose as much as four basis points following weaker U.S. Treasuries, resistance to ultra-low yields.

April 29 -

The municipal market largely ignored the FOMC news that it would hold rates steady. New Jersey was 20 times oversubscribed and ICI reported $2.5 billion of inflows into long-term municipal bond mutual funds.

April 28 -

Data released Tuesday show an improving economy, which continues to stoke fears of impending inflation. Muni investors await New Jersey's $1.57 billion transportation deal.

April 27 -

The dearth of supply will likely hold down rates and keep certain investors out of the muni market. High-yield municipal bonds, still the most in-demand sector, tightened again.

April 26 -

Milwaukee will offer investors its first green-designated bonds under its sewerage credit Tuesday and returns next week with a GO sale.

April 26 -

Refinitiv Lipper reported $1.889 billion of inflows, with $641 million in high-yield. Negotiated deals repriced to lower yields while competitive loan yields were compelling from New Jersey and Los Angeles USD.

April 22 -

High-grade scales were little changed as ICI reports the sixth week in a row of inflows to the tune of $2.29 billion into municipal bond mutual funds.

April 21 -

The Illinois-based health system, with a balance sheet helped by its insurance arm, will sell $600 million of AA-minus rated debt over the next month.

April 21 -

Municipal triple-A benchmarks held steady as the focus was on the primary in which large new issues repriced to lower yields while secondary trading was light.

April 20 -

Municipal bonds have a direct effect on the social and cultural character of cities, metropolitan areas, counties, and states. Munis and the initiatives they support such as public education, housing subsidies, public transit systems, and more, can often be linked to local or regional politics. Join Lynne Funk, Executive Editor at The Bond Buyer and Destin Jenkins, Neubauer Family Assistant Professor of History at the University of Chicago as they explore how municipal bond mismanagement can have contrasting influences on the different ethnic groups in our cities.

-

The municipal market was steady Monday as the investors gear up for three separate billion-dollar deals heading to market from California, New York, and Connecticut issuers.

April 19 -

The state said it would continue to move forward with the new prisons despite Barclays departure amid controversy over the role of private firm CoreCivic.

April 19 -

Transportation infrastructure, sustainability and affordable housing are in play in three different bond deals.

April 19