-

Refinitiv Lipper reported $750 million of inflows into municipal bond mutual funds for the week ending May 12 while high-yield funds saw $487 million of inflows.

May 13 -

While the pressure was on municipal yields, which rose two to four basis points, the Investment Company Institute reported another week of inflows, with $928 million coming into municipal bond mutual funds and another $285 million into ETFs.

May 12 -

First quarter FDIC data show a $10.75 billion-plus jump in U.S. banks’ net purchases of municipal securities, the eighth biggest quarter since 2003, MMA says.

May 11 -

IndyGo's expansion is being financed by a local income tax.

May 11 -

Tighter spreads and richer ratios are likely to continue, particularly as looming tax increases amplify the value of the tax-exemption, but analysts are hesitant to predict how much lower rates can go before investors balk.

May 10 -

A disappointing jobs report gives credence to the Federal Reserve’s concern about slack in the labor market.

May 7 -

“Our net present value savings were $191.5 million or a record-setting 29%," said North Texas Tollway Authority Chief Financial Officer Horatio Porter.

May 6 -

Refinitiv Lipper reported $584 million of inflows, $341 million of which went to high-yield, as investors pull back on reinvesting to pay tax bills with the May 17 tax filing deadline looming.

May 6 -

Pennsylvania's competitive GO deal saw its yields fall further from recent trading while the North Texas Tollway Authority benefited from positive credit news on the transportation sector and repriced 25 basis points lower. ICI reported another round of $2-billion-plus inflows.

May 5 -

Alpha Ledger Technologies, which had already done so in its home state of Washington, helped its first Oregon issuer record a municipal loan on a blockchain platform.

May 5 -

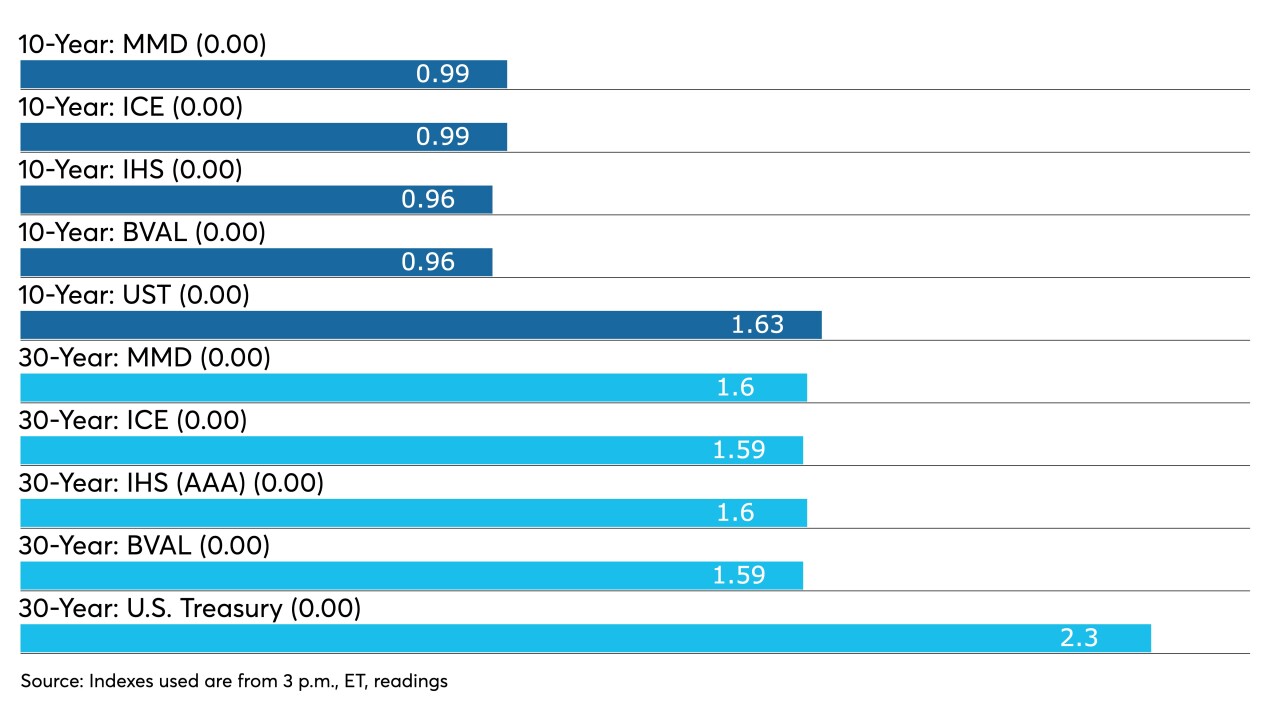

After just one session, the 10-year muni is back below 1% with ICE Data Services and Refinitiv MMD at 0.99% while Bloomberg BVAL is at 0.96% and IHS Markit at 0.95%.

May 4 -

Regina Egea, president of the Garden State Initiative, analyzes New Jersey's fiscal landscape, including the proposed state budget, unfunded pension liability and deficit borrowing. Paul Burton hosts. (20 minutes)

May 4 -

Inflationary pressures remain high while the manufacturing sector continues to deal with supply chain woes that hold it back, analysts said.

May 3 -

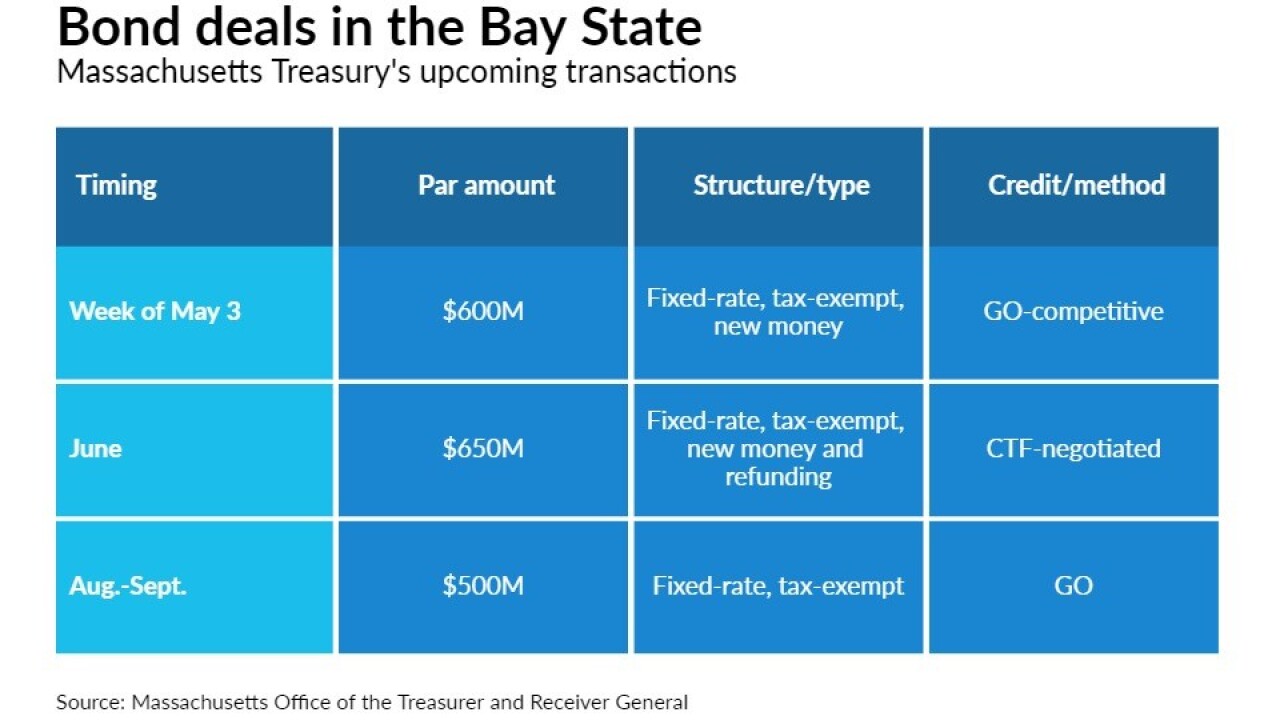

The states intend to come to market with $600 million and $1 billion, respectively, bringing state GO credits in an improving credit environment that has held yields down.

May 3 -

Rates, ratios and credit spreads have munis entering May on solid footing, though some pressures due to tax season and rising U.S. Treasuries remain.

April 30 -

With federal aid rolling out, the municipal credit picture is improving and issuers are coming to market at a faster clip. An infrastructure package could push issuance levels even higher.

April 30 -

The North Texas Tollway Authority will sell a mix of taxable first-tier and tax-exempt second-tier bonds in the refunding transaction.

April 30 -

Refinitiv Lipper reported another week of inflows at $1.64 billion, with $630 million headed into to high-yield. Benchmark yields rose as much as four basis points following weaker U.S. Treasuries, resistance to ultra-low yields.

April 29 -

The municipal market largely ignored the FOMC news that it would hold rates steady. New Jersey was 20 times oversubscribed and ICI reported $2.5 billion of inflows into long-term municipal bond mutual funds.

April 28 -

Data released Tuesday show an improving economy, which continues to stoke fears of impending inflation. Muni investors await New Jersey's $1.57 billion transportation deal.

April 27